Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

[HYPERLIQUID]

Due to its remarkable financial performance, HYPERLIQUID has recently gained widespread attention. Reports indicate that its trading volume and revenue have reached historical highs, with profit margins as high as 97%. The platform is using its revenue to buy back its token HYPE, sparking market discussions about its undervaluation compared to competitors like Circle. Additionally, the launch of new features and collaborations with institutions such as Anchorage Digital (including the launch of HyperEVM) have further fueled its popularity. The community is optimistic about the future growth and innovative potential of the Hyperliquid ecosystem.

[AVAX]

Today, discussions around AVAX are focused on the launch of the Dinari Financial Network. This is a Layer 1 blockchain powered by Avalanche, aimed at tokenizing and facilitating compliant trading of U.S. stocks. This move is seen as a significant step towards the integration of traditional finance and blockchain technology, attracting partnerships from institutions like VanEck, BitGo, and Gemini. Meanwhile, Avalanche's performance data in terms of trading volume growth and collaborations with major entities like Visa and NBA teams also highlights its expanding ecosystem and future potential.

[BNB]

BNB price hits an all-time high (ATH) of $868, with a market cap surpassing $120 billion, making it one of the most valuable assets globally. This surge is attributed to several strategic advancements, including the completion of the "Maxwell" hard fork (which reduced block time to 0.75 seconds) and furthering its application in traditional finance through partnerships with Kraken, Ondo Finance, and others. The BNB Chain ecosystem is also expanding, with increased on-chain activity and more new projects launching, further boosting BNB's value. The community is generally optimistic, expecting its price to soon break the $1,000 mark.

[UNION]

Today, UNION sparked discussions on Twitter due to the launch of its $U token on the Ethereum mainnet, marking a significant milestone for the project. The community is excited about the upcoming token generation event (TGE) and the potential opportunities it may seize in the current ZK trend. Discussions also emphasize the project's focus on cross-chain interoperability, with many looking forward to the subsequent release of a complete roadmap, tokenomics model, and auditing tools. The minting of 1 billion tokens has led to speculation about its future value, and the community eagerly anticipates UNION's performance in driving adoption post-TGE.

Featured Articles

On August 13, ETH surged past $4,700, reaching a four-year high, while SOL struggled to stay around $200 during the same period. In 2024, Pump.fun sparked a meme frenzy across the Solana chain, and at the beginning of the year, Trump launched $TRUMP on it, pushing SOL's price to around $300, leading to calls for "Solana to replace ETH." However, the actual market trend provided a sobering response. Despite both ETH and SOL advancing treasury strategies to accumulate "bullets" for their ecosystems, their performances diverged significantly—SOL/ETH exchange rate plummeted from 0.09 at the beginning of the year to 0.042, maintaining a weak pattern throughout the year. The underlying reasons may not only be price fluctuations but also a comprehensive reflection of narrative heat, ecological structure, and differences in funding expectations.

In June this year, internet brokerage giant Robinhood launched a new service for European users, offering trading opportunities for "stock tokens" of top unlisted unicorns like OpenAI and SpaceX. Robinhood even airdropped a small amount of OpenAI and SpaceX tokens to eligible new users as a promotional tactic. However, this move was immediately opposed by OpenAI. OpenAI's official account clarified on X that "these OpenAI tokens do not represent equity in OpenAI, and we have no partnership with Robinhood." In response to this news, Elon Musk did not directly comment on Robinhood's tokens but retweeted OpenAI's statement, sarcastically remarking, "Your own 'equity' is the fake one." This jab not only mocks OpenAI's capital operations after becoming a profit-driven entity but also highlights the significant resistance unlisted companies have towards losing pricing power over such shares. Despite the skepticism, traditional brokerages' attempts reflect a strong market interest in on-chain Pre-IPO asset trading. The reason is simple: the enormous benefits of the primary market have long been monopolized by a few institutions and high-net-worth individuals, with many star companies experiencing exponential growth in valuation upon listing (or acquisition). For instance, design software company Figma, after failing to complete its acquisition by Adobe due to antitrust issues, went public independently in 2025, with an initial price of $33 per share, soaring to $115.5 on its first day, a staggering 250% increase; this price corresponds to a market cap of nearly $68 billion, far exceeding the $20 billion valuation during previous acquisition discussions with Adobe. Similarly, the recently listed crypto exchange Bullish saw its stock surge 290% after opening. These cases indicate that investing in such companies before they go public could yield several times or even dozens of times returns. However, traditionally, it has been relatively difficult and complex for ordinary investors to participate in such opportunities. The appeal of the on-chain Pre-IPO concept lies in allowing retail investors to share in the appreciation of future public star companies early on.

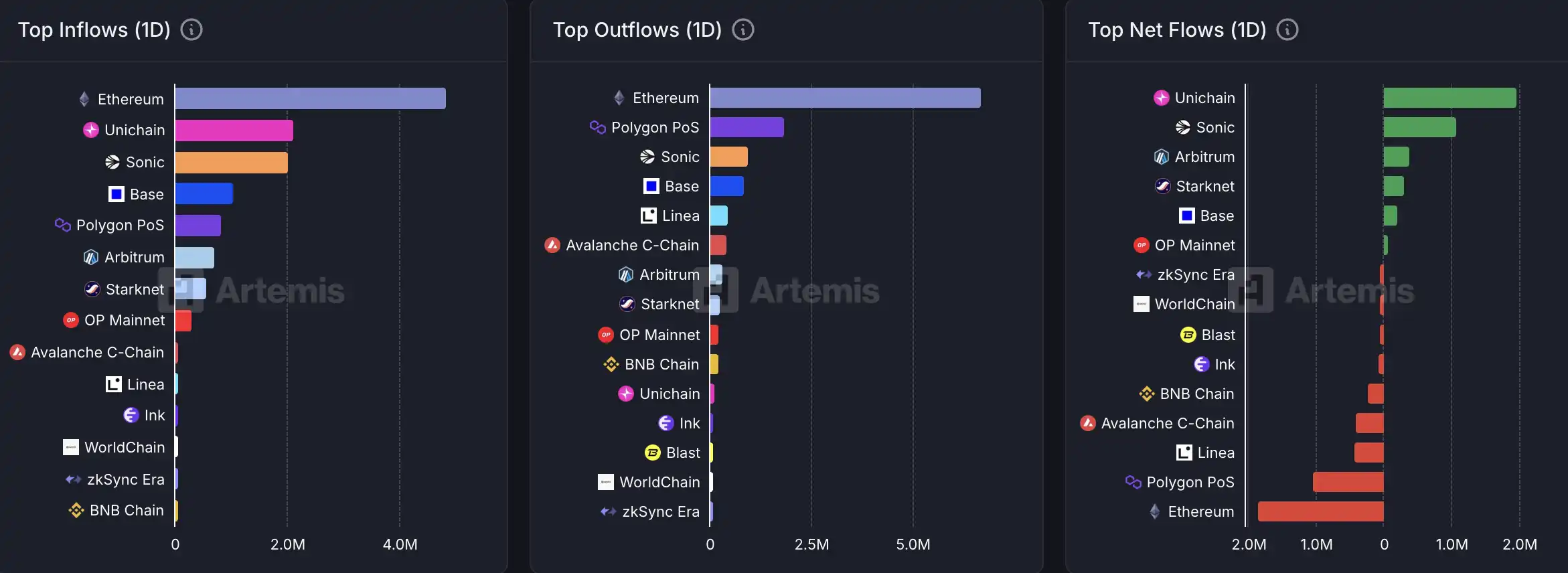

On-Chain Data

On-chain capital flow situation for the week of August 15

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。