Ether ETFs Shatter Records Again With $729 Million Inflow As Bitcoin ETFs Mark 6 Days Green

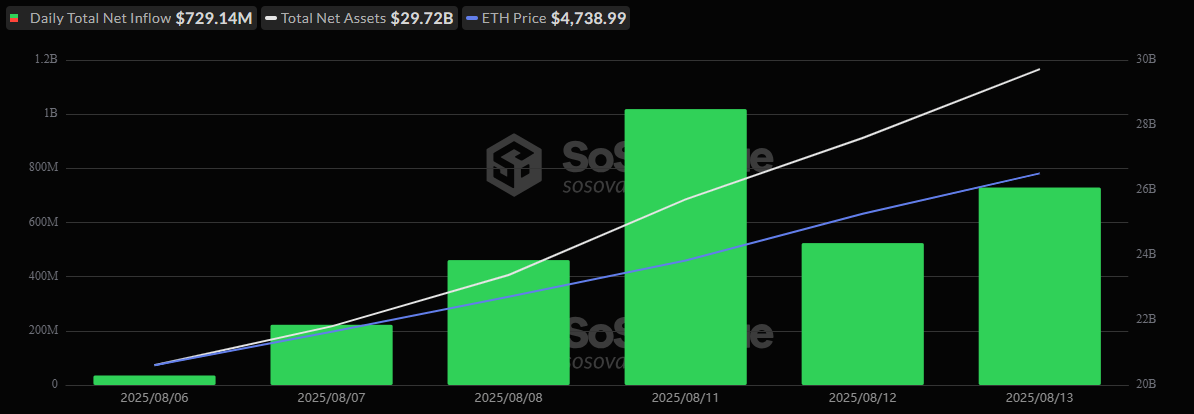

The appetite for crypto ETFs has rarely been this intense. Wednesday, Aug. 13, saw ether ETFs smash past another milestone, raking in $729.14 million, the second-largest single-day haul in their history, while bitcoin ETFs quietly extended their winning streak to six days with $86.91 million in fresh inflows.

For ether ETFs, it was another powerhouse day. Blackrock’s ETHA dominated with $500.85 million, supported by Fidelity’s FETH at $154.69 million. Grayscale’s Ether Mini Trust brought in $51.34 million, ETHE added $7.38 million, while Bitwise’s ETHW and Franklin’s EZET chipped in $10.85 million and $3.59 million, respectively.

No outflows were recorded, with trading volume reaching a record $4.47 billion, and net assets climbed to a new peak of $29.72 billion.

Source: Sosovalue

Interestingly, bitcoin’s surge came without its institutional flagship. Blackrock’s IBIT sat on the sidelines, recording zero flows. Instead, Ark 21shares’ ARKB took the lead with $36.58 million, followed by Fidelity’s FBTC with $26.70 million.

Grayscale’s Bitcoin Mini Trust added $11.42 million, while Bitwise’s BITB and Invesco’s BTCO contributed $7.32 million and $4.90 million, respectively. Not a single bitcoin ETF posted an outflow. Total value traded soared to $4.97 billion, pushing net assets to an all-time high of $158.64 billion.

Two days of historic inflows and record volumes suggest one thing: institutional crypto demand is hitting overdrive, and ETH is firmly in the driver’s seat.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。