Recent ETH Market Performance: Price Surge and On-Chain Activity Driving Growth

Since the beginning of this year, Ethereum (ETH) has shown a strong upward trend, recently entering an accelerated growth phase. In early August, the price of ETH briefly surpassed $4,300, reaching a new high since the end of 2021, with an increase of over 20% in the past week. The rapid rise in mid to late July was even more pronounced, with a nearly 44% increase within two weeks, reflecting strong buying interest in the market.

This surge has been accompanied by a significant increase in on-chain activity. Daily trading volume for ETH reached a near one-year high, and the total amount staked across the network is approaching 30% of the total supply, with more holders choosing to stake their ETH for returns. In July 2025, the Ethereum network processed approximately 46.67 million transactions, with the number of active addresses reaching 683,500, both setting historical records. After U.S. regulators clarified that staked derivatives do not fall under securities, investor confidence has strengthened, leading to a decrease in exchange ETH reserves to 15.35 million coins, the lowest since 2016, indicating that more assets are being locked up long-term or invested in the on-chain ecosystem.

The derivatives market is also signaling bullish trends. The open interest in ETH options has climbed to a historical peak of $13.75 billion, with call options accounting for about 67%, indicating a clear market inclination towards betting on further price increases. The open interest in ETH at the Chicago Mercantile Exchange (CME) has significantly risen, reflecting a large influx of institutional capital. The implied volatility distribution of options also shows a concentration of high strike prices, with the $6,000 call option expiring in December having the largest open interest, suggesting strong mid-term optimism in the market. Overall, ETH price, on-chain data, and derivatives structure all point to a consensus—market confidence in Ethereum's future is high.

Institutional "Hoarding" Battle: ETH Treasury Stock Model Becomes Market Focus

As ETH prices rise, institutional investor interest continues to grow, with the emergence of "ETH treasury stocks" being particularly noteworthy. Two U.S. publicly traded companies—SharpLink Gaming (NASDAQ: SBET) and Bitmine Immersion Technologies (NYSE: BMNR)—which were previously unrelated in business, have recently made significant purchases of ETH, directly transforming themselves into ETH-holding enterprises.

As of now, the combined holdings of SBET and BMNR have surpassed those of the Ethereum Foundation. SBET raised over $400 million through a stock issuance (ATM mechanism) and currently holds approximately 280,000 ETH (valued at over $1 billion). BMNR, chaired by Wall Street veteran strategist Tom Lee, has purchased about 300,000 ETH and has set a goal of ultimately holding 5% of the global ETH supply. This positioning is viewed by outsiders as an "ETH version of a central bank," reminiscent of MicroStrategy's strategy of hoarding Bitcoin.

The logic behind these companies hoarding ETH lies in treating it as a core reserve asset rather than merely a speculative target. By financing the purchase of ETH through capital markets and staking it, they not only lock in long-term potential appreciation but also earn staking rewards, driving balance sheet growth. SBET has even disclosed a "per share ETH held" metric, positioning itself as a bridge between traditional stock markets and decentralized finance.

This treasury stock phenomenon has directly altered the market supply and demand dynamics for ETH. On one hand, the continuous large purchases have tightened market circulation, providing support for ETH prices. On the other hand, the hoarding competition among companies has sparked industry discussions. Ethereum co-founder Joseph Lubin has expressed approval, calling it an "intense competition" and joking that "the game has begun." This competition is seen as an important catalyst for advancing decentralized finance, indicating that private enterprises will play a more active role in the popularization and value discovery of ETH.

From the perspective of investment tools, treasury stocks offer greater flexibility compared to traditional ETFs. Standard Chartered Bank points out that these companies can now match ETFs in terms of holding size, but they have advantages in valuation elasticity, capital operations, and derivatives usage. Recently, the stock prices of SBET and BMNR have seen single-day increases exceeding 10%, indicating strong market interest. It is foreseeable that this trend will have a profound impact on the long-term supply and demand of ETH and institutional participation.

Volatility Premium Releases Opportunities: ETH vs BTC Structured Product Window

Compared to BTC, ETH has maintained a higher price volatility over the long term. In May of this year, the implied volatility of ETH options was twice that of BTC, marking the largest gap in five years. During that month, BTC's short-term volatility fell below an annualized level of 35%, while ETH remained high, causing the 30-day volatility gap between the two to reach a peak not seen since mid-2022. This indicates that the market expects ETH's future price fluctuations to be significantly higher than those of BTC.

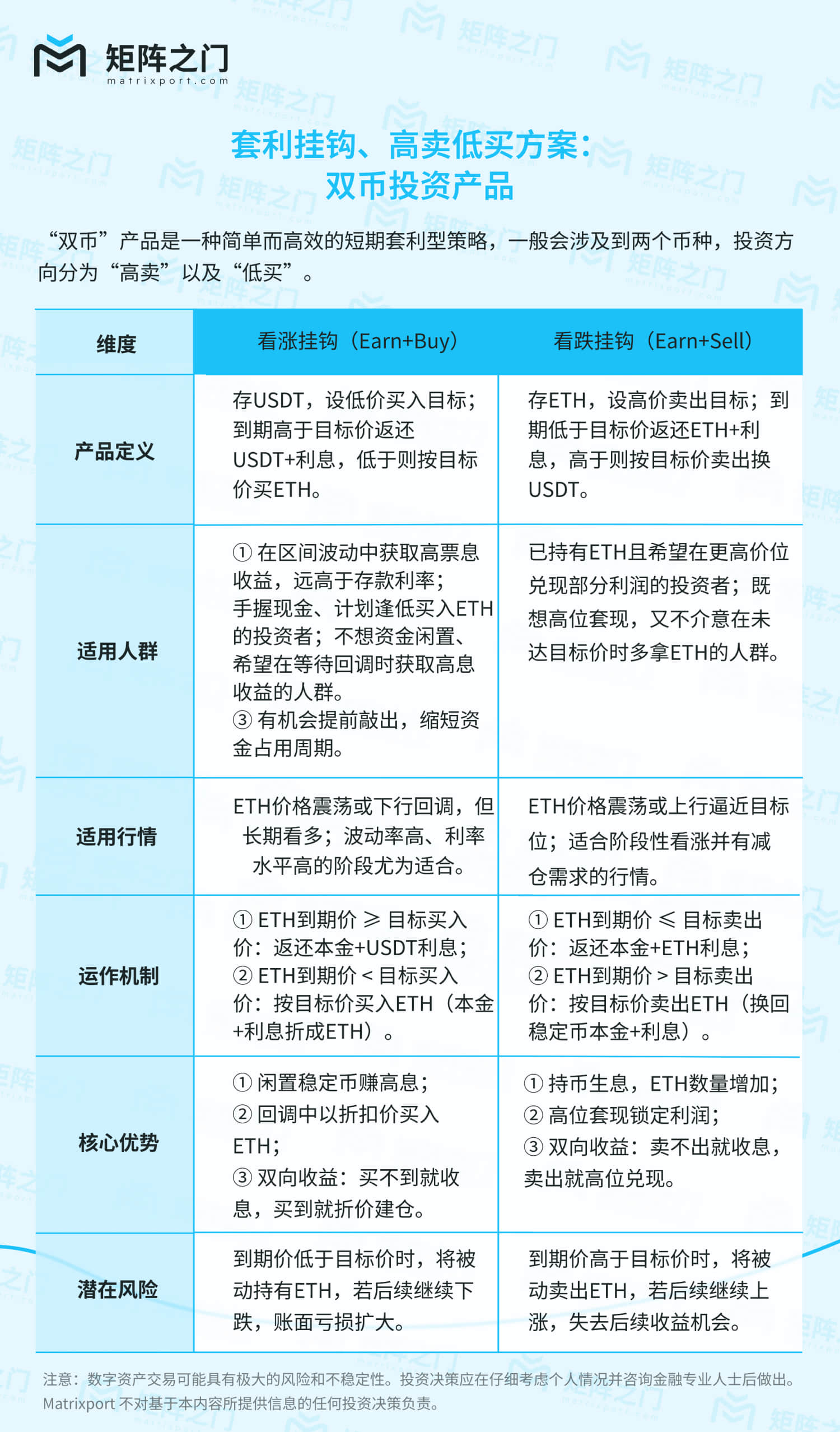

High volatility creates better yield conditions for structured products. For example, in the context of elevated implied volatility for ETH, selling put options can yield higher premiums than BTC. The annualized returns of dual-currency products often exceed those of BTC-linked products under the same conditions, due to the additional returns brought by ETH's volatility premium. This provides an opportunity for investors who are bullish on ETH in the long term and willing to leverage short-term fluctuations to convert high volatility into stable returns.

Of course, high volatility also means that risk management needs to be more cautious. If future volatility decreases and the gap with BTC narrows, the currently issued high-yield products will lock in relatively substantial returns; conversely, in a one-sided market, attention must be paid to the risk buffers and trigger conditions of structured products. Overall, the volatility differences between ETH and BTC provide investors with a dual strategy space of "collecting yields" and "betting on volatility."

ETF Capital Inflow and Corporate Accumulation: ETH Moves Towards Deep Institutionalization

With the expansion of market capitalization and application ecosystem, ETH is entering a more institutionalized phase. Since the beginning of this year, U.S. spot ETH ETFs have attracted over $6.7 billion in net inflows, with nearly $2.4 billion pouring in during just six trading days in late July, far exceeding the $827 million for BTC ETFs during the same period. This reversal in capital flow reflects a change in institutional allocation preferences—ETH is becoming a new mainstream allocation target.

Institutional participation is not only reflected in ETFs. In the past month, several U.S. publicly traded companies have collectively purchased over $1.5 billion in ETH for their reserves, with treasury stocks like SBET and BMNR, along with Grayscale Trust and other funds, occupying a significant proportion of the circulating supply, reducing the amount of ETH available for trading in the market.

The degree of institutionalization in the derivatives market is also increasing. CME's open interest in ETH futures has reached new highs, with annualized premiums exceeding 10%, attracting arbitrage capital from BTC to ETH. Asset management giant ARK Invest has also significantly increased its exposure to ETH-related assets, purchasing 4.4 million shares of BMNR stock through its ETF in July (costing about $116 million), while reducing holdings in Coinbase and further tilting its allocation towards ETH.

The favorable regulatory environment is also boosting institutionalization. The SEC has recently sent positive signals, clarifying that certain staking yield tokens do not constitute securities, leading the market to expect that future spot ETH ETFs will introduce staking dividend features, allowing institutional investors to benefit from both price increases and staking rewards.

With multiple factors at play, many analysts predict that ETH's position in institutional assets will continue to rise, potentially challenging BTC's dominance in certain areas.

Matrixport Structured Product Strategy: Four Plans to Match Different Market Conditions

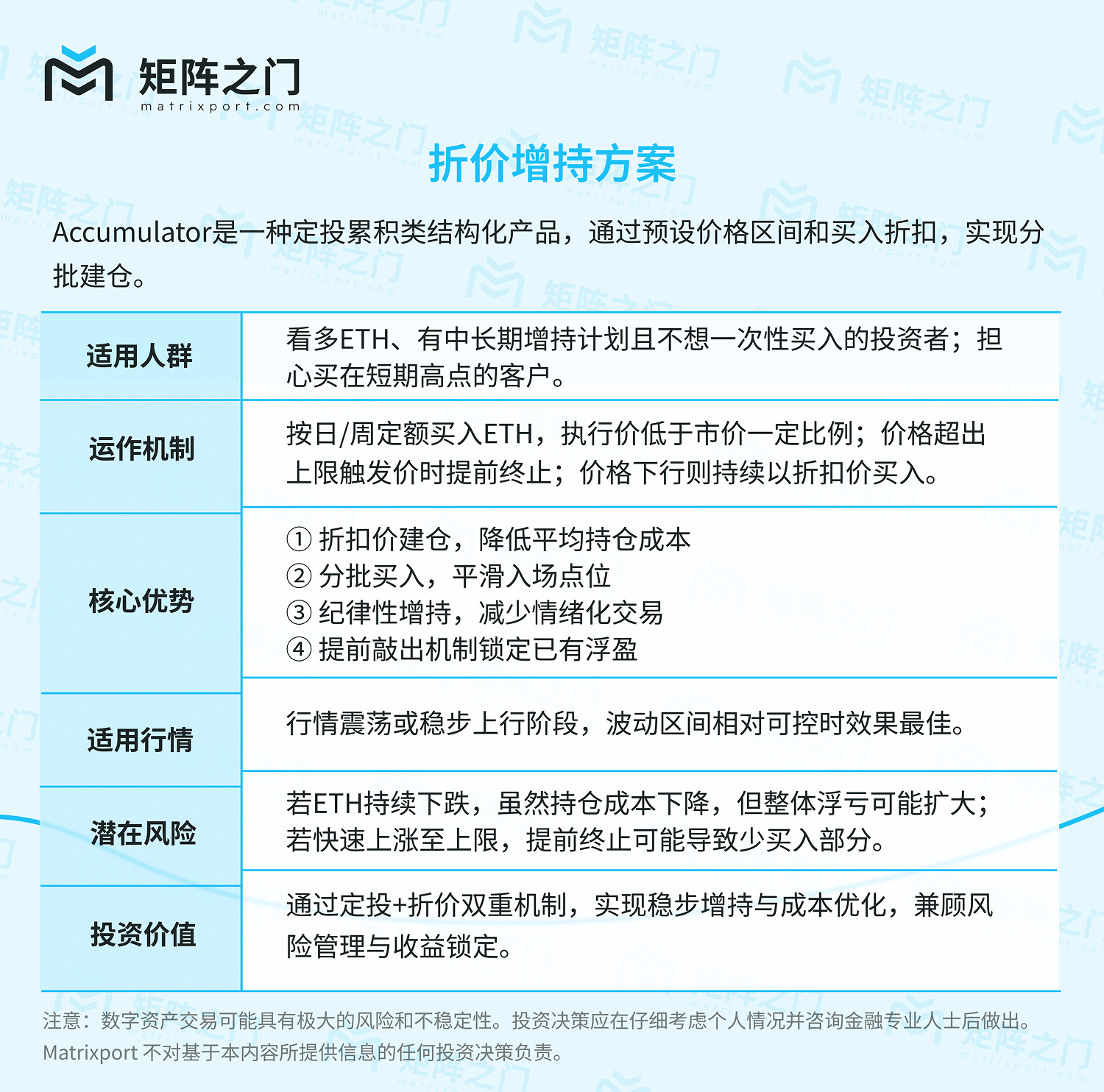

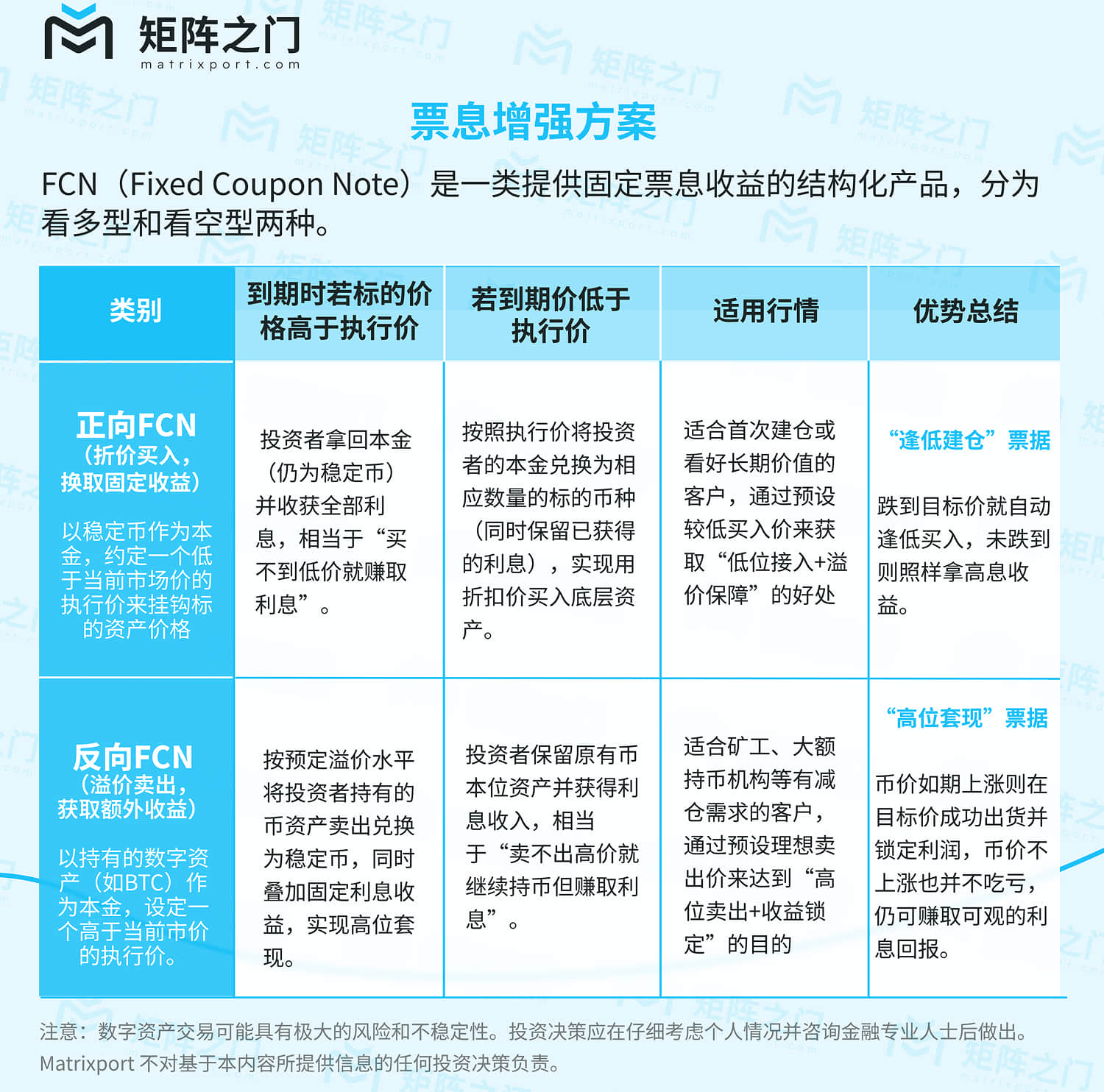

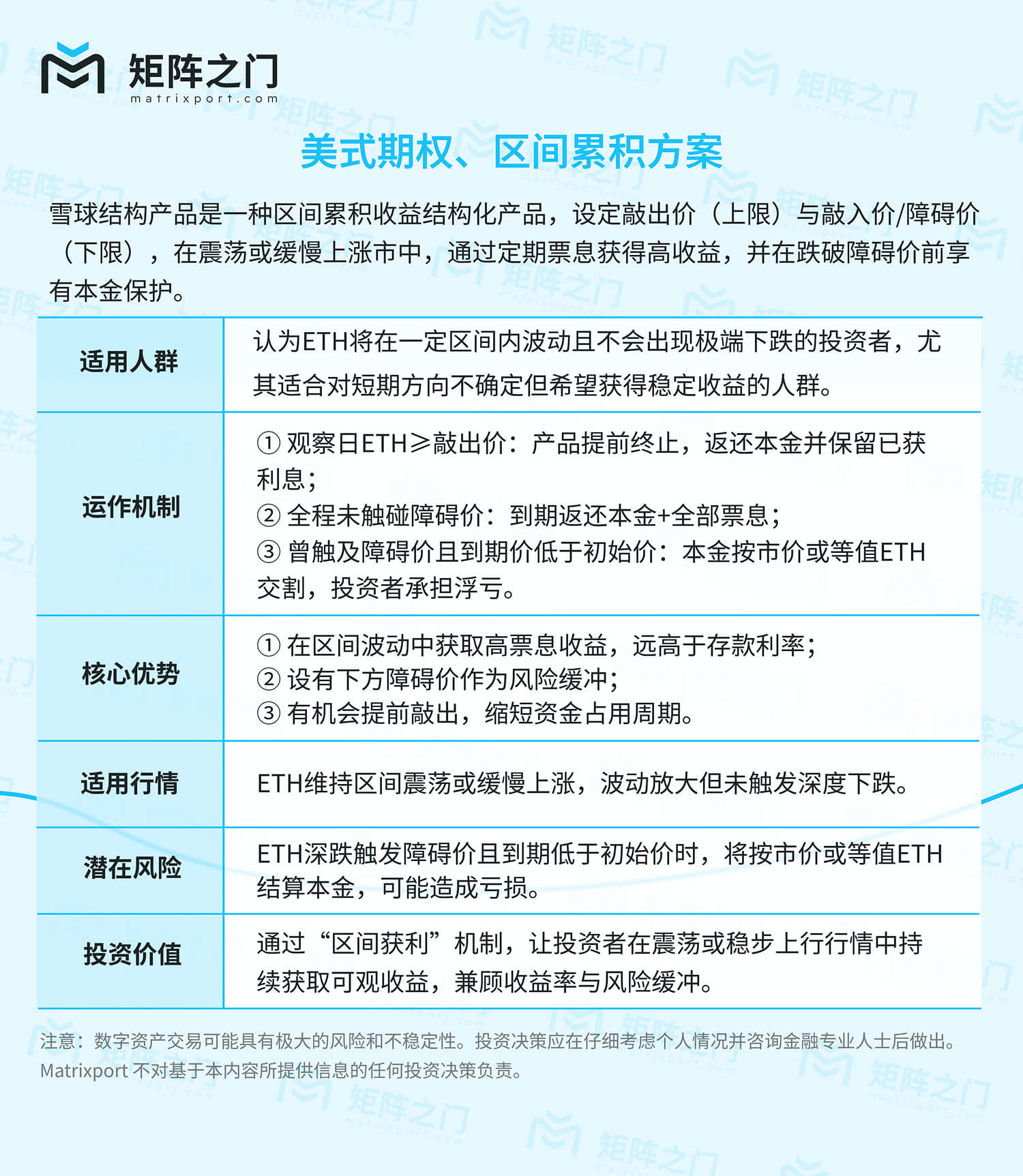

In the context of increased ETH volatility and continued inflow of institutional capital, Matrixport offers a diversified portfolio of structured products for investors with different risk preferences:

Conclusion

In summary, ETH currently presents a favorable situation with strong prices, active on-chain engagement, and increased institutional accumulation. In this optimistic atmosphere, investors should seize the opportunity for price increases while also focusing on risk management. Structured products provide a rich array of strategic tools, helping clients with different risk preferences and needs to participate in the ETH market in a customized manner: they can accumulate at a discount and enhance returns through yield-generating products, or use snowball and dual-currency strategies to achieve stable profits or arbitrage in volatile conditions. For Matrixport clients interested in ETH investments, effectively utilizing the aforementioned products for portfolio configuration can help achieve a balanced approach in a bull market, ensuring steady growth.

Of course, any structured strategy should be based on a clear assessment of one's financial situation and risk tolerance, and executed under the guidance of a professional team. Matrixport is willing to be your long-term partner in exploring ETH investments, helping you navigate volatility steadily and capture opportunities in trends, ensuring that digital assets are not just held but also become a positive engine for wealth growth.

Author: Daniel YU, Head of Asset Management (This article represents the author's personal views only)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。