# Introduction

The year 2025 can be regarded as the inaugural year of the DAT explosion. An increasing number of publicly listed companies are emulating the Strategy model by incorporating cryptocurrencies such as BTC, ETH, SOL, and BNB into their balance sheets as core reserves, continuously increasing their holdings through stock financing. This has led to a resonant rise in both cryptocurrency and stock prices: investors can indirectly gain long-term exposure to cryptocurrencies by purchasing these companies' stocks, while companies leverage stock price premiums to finance further acquisitions of digital assets, creating a self-reinforcing financial flywheel.

This article will analyze from three dimensions: first, systematically sorting out the logical framework and flywheel effect of DAT, explaining why a self-reinforcing cycle of "simultaneous rise of cryptocurrencies and stocks" can be achieved during a bull market; second, showcasing the practical differences and effects of various companies in emerging public chain tokens such as BTC, ETH, SOL, and BNB through case studies, revealing the strategic intentions and financing methods behind institutions; third, discussing the risks and challenges faced by DAT under tightening regulations, increasing market competition, and macroeconomic fluctuations, while looking forward to its potential evolution direction. The article aims to help investors understand how this emerging model affects cryptocurrency prices, stock prices, and capital market interactions, while also revealing the risks hidden behind the flywheel effect. DAT is not just an asset allocation at the corporate level, but a new bridge connecting the cryptocurrency and traditional financial markets, reshaping market narratives, changing the flow of funds, and gradually influencing the macro-level logic of capital allocation.

# DAT Flywheel Effect: The Positive Cycle of Simultaneous Rise of Cryptocurrencies and Stocks

1. Definition and Growth Logic of DAT

DAT (Digital Asset Treasury) refers to publicly listed companies, non-listed enterprises, or investment vehicles that strategically and long-term incorporate cryptocurrencies such as Bitcoin and Ethereum into their balance sheets or equivalent holding vehicles, and amplify the intrinsic cryptocurrency exposure and capital efficiency per share through a closed loop of equity/bond financing → purchasing cryptocurrency spot → information disclosure and valuation reflection. Its essence is an asset allocation framework that connects "company equity" with "on-chain assets."

The core of the DAT model lies in a financial flywheel of "equity financing to purchase on-chain assets," which can self-reinforce during a bull market, achieving a bidirectional push of cryptocurrency and stock prices. This flywheel effect was first validated by Strategy founder Michael Saylor in 2020, with the basic logic as follows:

Holding Cryptocurrency: The company uses the funds raised to buy a large amount of digital assets like BTC and ETH as primary reserves.

Stock Price Premium Rise: Due to providing convenient and compliant cryptocurrency exposure, the company's stock begins to trade at a price higher than its net asset value (NAV). Investors are willing to pay a premium for its stock, effectively recognizing the future appreciation potential of the cryptocurrency assets held by the company.

Utilizing Premium for Further Financing: The rising stock price grants the company further financing capabilities. The company can issue additional shares or low-interest convertible bonds at high prices to raise funds.

Increasing Cryptocurrency Holdings: A significant portion of the newly raised funds is invested in purchasing more cryptocurrencies, expanding the reserve scale.

Reinforcing Narrative Cycle: The continuous increase in cryptocurrency holdings strengthens the market narrative of "cryptocurrency asset proxy stocks," further pushing up stock price premiums and creating conditions for the next round of financing.

2. Performance of the DAT Flywheel Effect

In a bull market, this cycle forms a strong positive feedback loop, known as the "infinite bullet" model: buy cryptocurrency → cryptocurrency price rises → stock price rises → financing → buy cryptocurrency, repeating endlessly. This model allows investors not only to enjoy the benefits of rising cryptocurrency prices but also to leverage their returns through stocks. For example, from 2023 to 2025, the price of Bitcoin rose by approximately 110%, while the stock price of Strategy increased by over 910% during the same period. Capital leverage and stock price premiums make DAT stocks' returns in a bull market far exceed direct cryptocurrency holdings.

Strategy's BTC Treasury Strategy: Since adopting the Bitcoin treasury strategy, Strategy's stock price has skyrocketed by over 2200% in five years. The company's Bitcoin holdings have grown from zero in 2020 to 639,835 BTC, valued at over $73 billion. This has made it the publicly listed company with the largest Bitcoin holdings globally, driving its market value far beyond its original software business value.

BitMine's ETH Treasury Strategy: The U.S. listed company BitMine launched its Ethereum treasury strategy in 2025, and within just one month, its stock price soared by over 110%. Approximately 60% of the increase was attributed to a surge in the number of coins held per share (+330%), 20% from the rise in ETH price (from $2500 to $4300), and another 20% from the expansion of mNAV premium.

DAT has become an important buying force in the cryptocurrency market. According to research data from Coinbase, companies focused on Bitcoin currently hold over 1 million BTC, accounting for about 5% of the circulating supply of Bitcoin; companies focused on Ethereum hold approximately 4.9 million ETH, accounting for about 4% of the circulating supply of ETH. The total value of digital assets held by global DAT companies has exceeded $100 billion. DAT has become an important buying force in the cryptocurrency market. According to research data from Coinbase, companies focused on Bitcoin currently hold over 1 million BTC, accounting for about 5% of the circulating supply of Bitcoin; companies focused on Ethereum hold approximately 4.9 million ETH, accounting for about 4% of the circulating supply of ETH. The total value of digital assets held by global DAT companies has exceeded $100 billion.

# Overview of Typical DAT Strategies: From BTC to Diversified Asset Allocation

As the concept of DAT extends from Bitcoin to other sectors, different companies are developing diversified strategies around various cryptocurrency assets.

1. Bitcoin Treasury Pioneers: The Offensive and Defensive Strategies of "Hodlers"

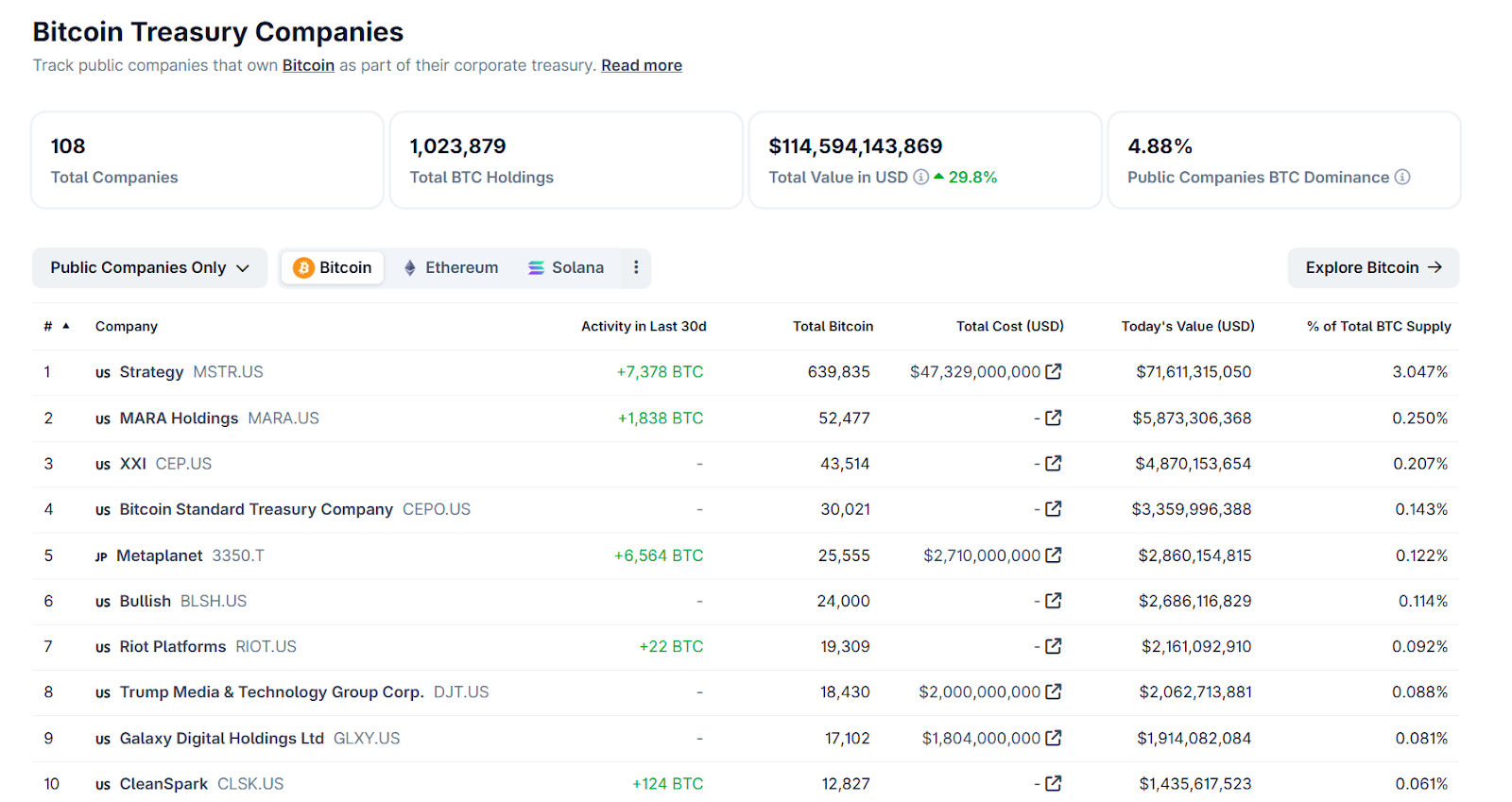

Bitcoin is the first area where DAT has emerged. Strategy's gamble in 2020 laid the foundation for the Bitcoin treasury, and subsequently, many companies joined the ranks of "Hodlers." According to the latest data from CoinGecko, there are currently 108 publicly listed companies holding BTC, with a total holding of over 1 million BTC, accounting for 4.88% of the total BTC supply.

Source: https://www.coingecko.com/en/treasuries/bitcoin/

Strategy: Since August 2020, it has continuously invested revenue and financing into Bitcoin, currently holding nearly 640,000 BTC, accounting for about 3% of the total supply. Strategy has raised funds through multiple rounds of stock/bond financing to buy BTC, achieving exponential growth in stock price and assets during the cryptocurrency bull market. Its success has proven the feasibility of BTC as a corporate reserve asset.

Metaplanet: This Japanese former metaverse technology company transformed into a Bitcoin treasury company in April 2024, using BTC as a core reserve to hedge against risks such as the depreciation of the yen. As of September 25, 2025, Metaplanet holds 25,555 BTC, with an average purchase price of approximately $106,065. Its total cost of buying Bitcoin is about $2.71 billion, and its current market value has slightly appreciated. With its scale of holdings, Metaplanet has become the fifth-largest publicly listed company by BTC reserves globally. This achievement has also led to its stock price rising over 140% since the beginning of the year, elevating the company from a small-cap stock to a mid-cap stock and including it in the FTSE Japan Index.

Mining Companies like MARA and RIOT: U.S. Bitcoin mining companies such as Marathon Digital (MARA) and Riot Platforms (RIOT) are both mining stocks and treasury-like entities. They accumulate BTC through mining and typically prefer to hold BTC rather than sell it all during a bull market. MARA and RIOT hold over 50,000 BTC and 19,000 BTC, respectively. The advantage of mining companies is that they can directly convert operational profits into Bitcoin, effectively using electricity costs to acquire Bitcoin. However, the stock prices of mining companies are also highly correlated with BTC prices, thus essentially becoming a stock tool for investors to gain BTC exposure.

Other Followers: Many small-cap stocks in traditional industries have transformed into "crypto stocks" by purchasing large amounts of cryptocurrency. For example, Hong Kong's Ming Cheng Group (NASDAQ: CREG), originally engaged in construction subcontracting, spent $483 million to purchase BTC in August 2025, announcing that it would incorporate digital assets into its core strategy, leading to a surge in its stock price.

It is noteworthy that as the number of BTC treasury companies surges, the market's "scarcity premium" is declining. The early success of Strategy was due to its rarity, but now the story of "buying BTC to push up stock prices" is no longer novel. Under homogeneous competition, the mNAV premium of some BTC treasury companies relative to their net asset value is gradually converging.

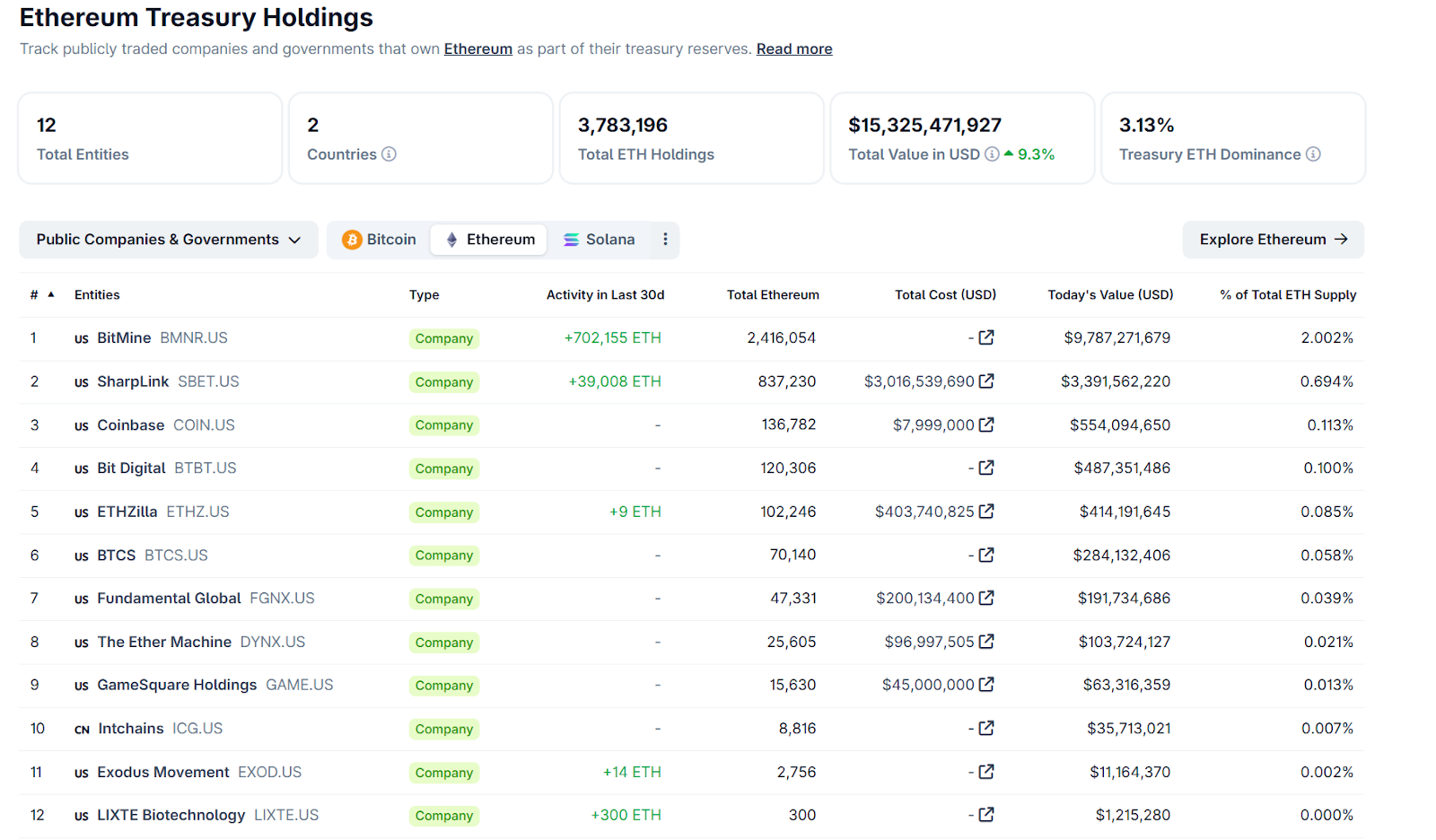

2. The Rise of Ethereum Treasuries: From Reserve Assets to Yield Assets

2025 is regarded as the inaugural year for Ethereum treasuries. Prior to this, companies holding ETH often did so out of business needs rather than strategic reserves. However, this year, several institutions have prominently incorporated ETH into their reserves and innovatively utilized Ethereum's staking yields to achieve a "Hodl and earn" model. According to the latest data from CoinGecko, there are currently 12 publicly listed companies holding ETH, with a total holding of over 3.78 million ETH, accounting for 3.13% of the total ETH supply.

Source: https://www.coingecko.com/en/treasuries/ethereum

BioNexus: In March 2025, BioNexus, headquartered in Southeast Asia, announced that it would adopt ETH as its primary reserve asset, becoming the first publicly listed company to implement an Ethereum treasury strategy. This move is seen as a landmark event, signaling the official entry of ETH into the corporate balance sheet era. Unlike companies like Coinbase that hold ETH out of business necessity, BioNexus clearly positions ETH as a strategic reserve and investment asset, signaling institutional recognition of ETH's value storage status.

BitMine Immersion (BMNR): In mid-2025, BitMine announced a significant investment in ETH, aiming to hold 5% of the global ETH supply long-term. As of September 25, 2025, the company held 2.416 million ETH, accounting for about 2% of the circulating supply. This scale makes it the largest ETH reserve holder globally. BitMine continuously expands its balance sheet through convertible bonds and stock issuances, using a "financing – buying coins – valuation increase – refinancing" flywheel to drive up both stock prices and assets, becoming one of the most notable DATs in 2025. Most of the ETH held by BitMine participates in on-chain staking to earn yields, converting Ethereum's productive attributes into company cash flow.

SharpLink (SBET): SharpLink, a Nasdaq-listed sports betting technology company, actively transformed into an ETH treasury in 2025. SharpLink raises funds almost weekly through an "ATM (at-the-market) small issuance" mechanism and immediately discloses the scale of ETH purchases. It has cumulatively increased its holdings by over 830,000 ETH, with nearly 100% allocated to staking for Staking rewards. This aggressive strategy not only results in substantial unrealized gains on its balance sheet but also generates continuous cash returns. While some worry that its "full staking" increases exposure to risks related to on-chain protocol security and liquidity, supporters argue that this move transforms ETH into a productive asset, representing one of the best practices for DAT to enhance returns.

BTCS Inc: The U.S. blockchain company BTCS launched an "Ethereum Dividend + Loyalty Reward" program, regularly distributing dividends to shareholders from its held ETH, while also setting loyalty reward terms to encourage shareholders to transfer their stocks to a designated registrar and hold them until early 2026 to receive additional ETH rewards. This way, investors not only receive cash and ETH dividends but also gain incentives for long-term holdings. This initiative enhances shareholder stickiness and somewhat suppresses the borrowing and short-selling of stocks. Although the sustainability of "paying dividends with ETH" remains in question, BTCS demonstrates the flexibility and creativity of DAT in financial engineering.

The rise of Ethereum treasuries indicates that the DAT model is evolving from passive coin hoarding to an active value appreciation phase. Companies are no longer simply holding assets; they are beginning to explore staking, DeFi, and other methods to generate yields from on-chain assets, creating greater value for shareholders. For this reason, some analysts believe that ETH treasury companies have a stronger advantage compared to BTC treasuries. During market downturns, the pressure on mNAV decline for ETH treasuries may be less than that for BTC treasuries due to staking yields providing support.

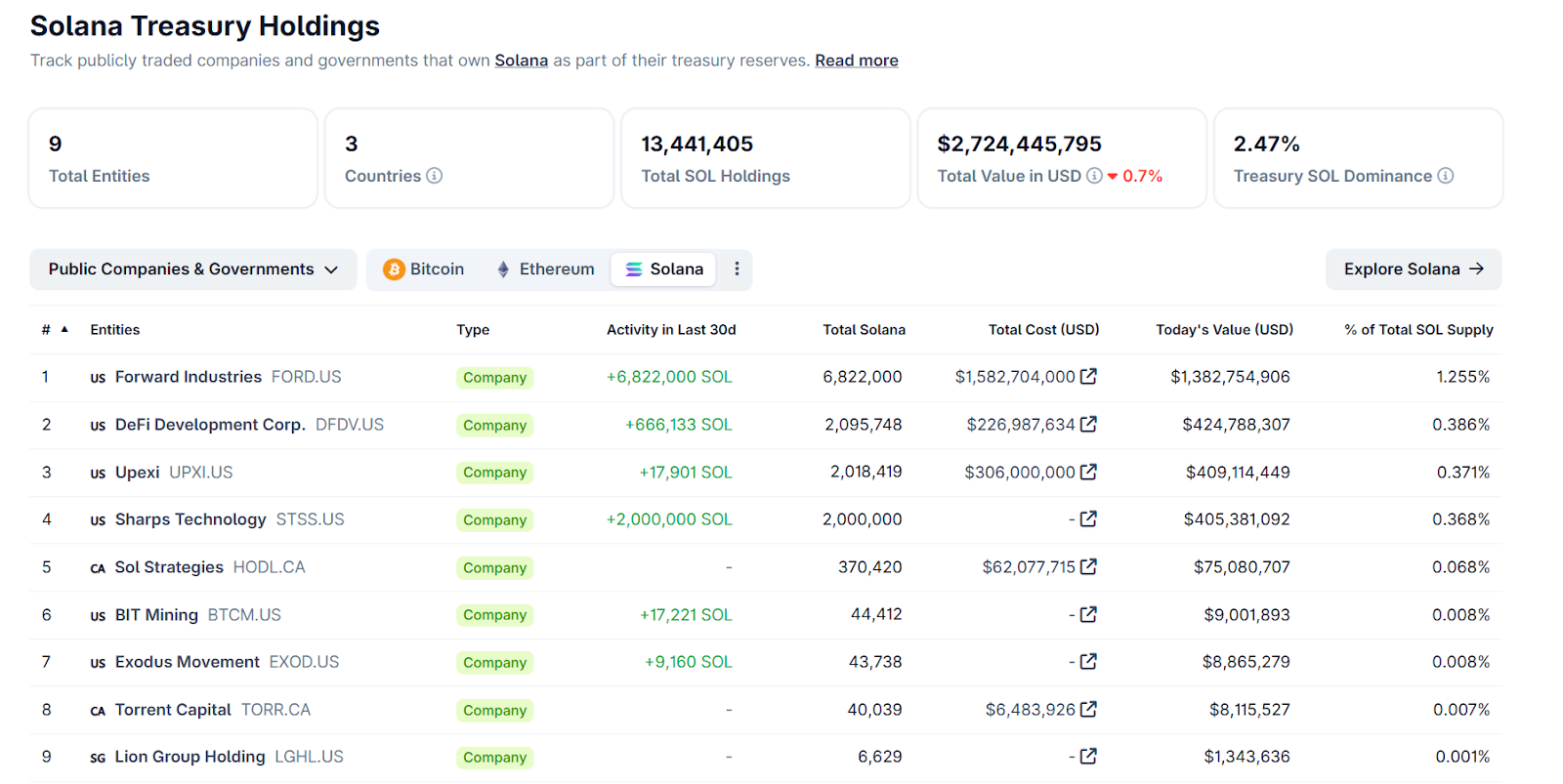

3. The Solana Treasury Boom: A Race Fueled by Massive Investments

In the second half of this year, Solana has become the focus of the DAT field. Following BTC and ETH, SOL is accelerating its entry into the institutional adoption fast lane: currently, nine publicly listed companies have bet on SOL, with a total amount reaching $2.7 billion and total holdings exceeding 2.7 billion SOL, accounting for 2.47% of the total SOL supply.

Source: https://www.coingecko.com/en/treasuries/solana

Forward Industries (FORD): Forward Industries, a long-established company providing design/manufacturing solutions for medical and technology clients, officially switched to a "Solana Treasury Company" narrative in September 2025. Its treasury strategy is supported by a $1.65 billion PIPE fund led by Galaxy Digital, Jump Crypto, and Multicoin, aiming to "build the world's largest Solana treasury" and emphasizing on-chain execution and full staking to earn native yields; the company also disclosed plans to continuously supply ammunition through an ATM (up to $4 billion) and explore tokenizing its stock on Solana.

DeFi Development Corp. (DFDV): DFDV clearly positions SOL as its main treasury asset, using "SPS (SOL per Share)" as the core metric for management and external communication; its strategy includes long-term holding + diversifying staking across multiple validators + building its own Solana validator nodes to earn fees and staking rewards. Recently, it announced that newly purchased SOL would be held long-term and fully participate in staking.

Upexi (NASDAQ: UPXI): Upexi, originally a multi-brand consumer goods company, has transformed into a "SOL Treasury + Asset Management" dual line since 2025: supplementing its ammunition through PIPE/convertible bonds, purchasing large amounts of SOL and almost entirely participating in staking, while also locking up SOL at a discount to enhance intrinsic yields, bringing in industry advisor Arthur Hayes to strengthen institutional communication.

Sharps Technology (STSS): Sharps is a medical device company that announced in September 2025 the completion of its first SOL acquisition and officially adopted a digital asset treasury strategy, with SOL as its main asset, funded by a recent PIPE; the company emphasizes regular disclosures and uses "capital market fundraising → holding SOL → earning on-chain yields" as its main management line.

Sol Strategies (HODLF): Sol Strategies is a Canadian-listed investment and infrastructure company focused on the Solana ecosystem, concentrating on increasing SOL holdings and operating validators while disposing of non-core crypto assets, further aligning its positions towards SOL to match long-term strategies and node operations.

The Solana treasury boom reflects that institutional capital is turning its attention to more diverse public chain assets. SOL is becoming the third most favored asset by DAT companies after BTC and ETH. Compared to BTC and ETH, Solana's underlying technology performance is outstanding, and it has an active ecosystem, leading institutions to bet on its future growth potential and ecosystem expansion. In the short term, massive capital inflows have caused SOL prices to surge above $250 in August and September 2025. However, Solana treasury companies currently have a small base and lack validation, so their future performance remains to be observed. The success or failure of Solana treasuries may directly impact whether this chain can enter the ranks of truly mainstream assets.

4. Emerging Asset Treasuries: BNB, TRON, SUI, ENA, etc.

BNB has also begun to show signs of corporate treasury formation. On August 10, BNB Network Company (BNC) announced an investment of approximately $160 million to purchase 200,000 BNB tokens, becoming the largest corporate holder of BNB globally. Since then, it has made multiple purchases of BNB, aiming to hold 1% of the total BNB supply by the end of 2025, aspiring to become the "Strategy of BNB." Its total holdings have now increased to 418,888 BNB, worth about $368 million. The company's CEO David Namdar (former partner at Galaxy Digital) stated that BNC positions itself as the world's largest corporate holder of BNB and aims to deepen its participation in the Binance Smart Chain ecosystem through this move. BNC's stock price has also risen several times driven by this news, leading to an increase in its market capitalization.

Some emerging public chain tokens and protocol tokens are also beginning to see the emergence of treasury companies. Most of them are supported by project parties and top venture capital, entering the public market through "reverse mergers" or other means, and then engaging in large-scale token accumulation: In June, the TRON Group achieved a listing channel in the U.S. stock market through a reverse merger with Nasdaq small-cap stock SRM Entertainment, subsequently renaming itself Tron Inc., providing funding sources and compliance vehicles for its future TRX treasury strategy. Mill City Ventures (MCVT) announced in July that it would conduct a $450 million private financing deal, with 98% of the raised funds used to purchase SUI tokens, transforming into a company with SUI as its main reserve asset. StablecoinX made significant purchases of ENA tokens in September, leading the community to suspect it is an "ENA treasury company."

In summary, the DAT model is evolving from Bitcoin's solo dominance to a vibrant competition among multiple chains and tokens. BTC treasuries remain dominant, ETH treasuries are catching up, SOL treasuries are expanding rapidly, and BNB and others are joining the fray. It is foreseeable that more crypto assets will be endowed with "treasury stories" in the future. For each asset, long-term locking by institutions undoubtedly enhances market confidence and the scarcity of chips; conversely, the asset's own prospects also determine how far the treasury strategy can go. If the underlying asset lacks intrinsic value or ecological support, mere hoarding is unlikely to sustain investor recognition.

# Risks and Challenges of the DAT Model

Although the DAT flywheel is powerful in a bull market, the cyclical risks and external challenges hidden behind this model cannot be ignored. The current development of DAT has entered a competitive phase, and the industry's elimination race has quietly begun. Major risk points include:

1. Regulatory Scrutiny Tightens Financing Constraints: In early September 2025, the Nasdaq exchange suddenly strengthened its regulation of "coin-buying listed companies." The new rules require that if a listed company wishes to issue new shares to fund the purchase of cryptocurrencies, it must first submit the proposal for shareholder voting approval. This move aims to curb the frequent use of capital increases by some companies to hoard coins and inflate stock prices. Regulators are concerned that DAT could be used as a regulatory arbitrage tool, as the listing threshold for DAT is lower than that for ETFs while achieving similar effects. Nasdaq's new regulations and the attention from agencies like the SEC mean that the DAT model will be more standardized in the future, but the short-term decline in financing efficiency may slow down the flywheel.

2. mNAV Discount and Sell-off Risks: The market value to net asset value ratio (mNAV) of DAT companies is an indicator of their stock price relative to the net value of their held coins. In a bull market, most DATs have an mNAV significantly above 1, indicating that investors are willing to pay a premium for future growth. However, once the market reverses or investor confidence wavers, mNAV may quickly fall below 1, meaning the stock price is lower than the value of the on-balance sheet cryptocurrency, leading to discounted trading. Since September, many DAT stock prices have significantly retreated, and mNAV has collapsed in tandem, leading the market to question whether these companies can continue to issue shares to buy coins. When a company trades at a long-term discount, management often faces immense pressure and may be inclined to sell underlying coin assets to repurchase stock, attempting to push the stock price back toward net value. If multiple DATs simultaneously engage in a sell-off, it could exert downward pressure on coin prices, leading to a larger negative feedback loop.

3. Leverage and Debt Risks: To pursue rapid balance sheet expansion, DAT companies commonly use high-leverage financing tools such as convertible bonds, short-term credit, and reverse mergers. In a bull market, these leverages amplify profits without issue; however, during a sharp decline in cryptocurrency prices, leverage can backfire and trigger a chain crisis. If the prices of underlying assets plummet, debt repayment and margin call clauses may be triggered, forcing companies to passively liquidate assets to repay debts or avoid default. The scenarios of some crypto companies facing liquidation in 2022 could replay within DAT. This is especially true for DAT companies that went public through SPACs or reverse mergers, which rely entirely on subsequent financing; once the market financing window closes, cash flow will quickly dry up.

4. Homogeneous Competition and Marginal Coin Risks: The surge of DAT companies this year has led to signs of market saturation. As similar companies flood in and the "scarcity premium" diminishes, DAT companies are beginning to face different fates. Those lacking strength and following similar strategies will struggle to maintain high valuations and may even face elimination. This is particularly true for DATs focusing on niche altcoins, which may find no buyers once more compliant products like institutional ETFs emerge. The future performance of different types of DATs will depend on three major factors: financing ability, holding scale, and yield levels. Companies that struggle to secure financing, are smaller in scale, and lack staking yields may become targets for acquisition. In summary, the DAT sector is transitioning from wild growth to a survival of the fittest. Companies without differentiated strategies and precise execution will find it difficult to survive in PvP competition.

5. Macroeconomic and Liquidity Shocks: The DAT model connects traditional equity markets and the crypto spot market, but in extreme scenarios, it may also lead to a "double whammy." If macro shocks occur, such as global liquidity tightening or simultaneous declines in stocks and bonds, the stock prices of DAT companies and the prices of their held crypto assets may fall in tandem, amplifying each other. This is because investors tend to sell off risk assets, including stocks and cryptocurrencies, during panic, putting DAT companies under dual selling pressure. Furthermore, if multiple DATs concentrate their holdings and face tight cash flows, concentrated sell-offs can easily trigger a stampede, leading to severe volatility in the crypto market. As nodes of cross-market capital flow, DATs may exacerbate liquidity tensions during crises.

In conclusion, the DAT model inherently carries characteristics of high leverage and strong cyclical tendencies, soaring like a rocket in bull markets and free-falling in bear markets. The year 2025 will be a critical testing period for the DAT narrative, transitioning from boom to stability. If the first half of the year was still immersed in the myth of the flywheel, the second half will see regulations and the market pushing this narrative back to reality—only those DAT companies with healthy financing structures, robust asset allocations, diversified operations, and compliance awareness will be able to navigate through cycles.

## Opportunities and Future Outlook for DAT Development

Despite facing numerous challenges, digital asset treasuries, as an innovative vehicle connecting traditional finance and the crypto economy, still hold promising prospects in the industry. After regulated development and the survival of the fittest, the DAT model is expected to bring new opportunities and profoundly impact the crypto market landscape:

1. A New Bridge for Traditional Capital Entry: DAT provides a regulated and convenient alternative channel for many traditional institutional investors who cannot directly hold cryptocurrencies. For example, some pension funds, insurance companies, and family offices are restricted by their charters from buying coins but can invest in NYSE/Nasdaq stocks. DAT companies allow them to indirectly gain exposure to crypto assets. With the advancement of cryptocurrency ETFs, the channels for institutions to enter the crypto market are becoming increasingly diverse, but DAT still possesses unique appeal: active management + potential yield enhancement. ETFs passively hold coins, while DAT management can pursue returns exceeding mere coin holding through strategies like leverage and staking. This may lead some aggressive capital to prefer allocating to quality DAT stocks. In the long run, DAT may coexist with ETFs and trusts, collectively expanding the proportion of institutional capital allocated to crypto assets.

2. From Passive Hoarding to Active Management: Currently, most DATs still primarily adopt a "buy and hold" strategy. However, looking ahead, these companies may evolve into more proactive digital asset managers. For example: engaging in on-chain staking, lending, and market-making to increase asset yields; participating in DeFi and node operations to enhance ecological influence; or even venturing into the RWA space, mapping real-world assets onto the blockchain to enrich asset portfolios. In the future, we may see DAT companies issuing their own structured products, deeply binding with DeFi protocols, or even becoming the embryonic form of "on-chain banks."

3. Market Impact: Accelerated Financialization and Institutionalization of Crypto Assets: The DAT boom has directly driven up the prices of mainstream cryptocurrencies. One of the key drivers of BTC and ETH prices this year has been the spot buying from DAT companies. On the other hand, DAT has also facilitated the financialization of the crypto market: stock market investors gain exposure to crypto through DAT, and on-chain assets become scarcer and more dispersed among institutions due to the treasury effect, potentially reducing volatility. Additionally, the interaction between DAT and the derivatives market is also strengthening, with hedge funds specifically using the premium and discount of DAT stocks for arbitrage trading or buying DAT stocks while bullish on crypto and selling futures for hedging. This has led traditional financial capital to become more deeply involved in the trading logic of the crypto market.

4. Long-term Issues and Possible Development Directions: Of course, for DAT to achieve long-lasting success, there are still some long-term issues that need to be addressed: how to effectively manage private keys and the security of on-chain assets; how to balance coin holding with the development of core business; how to maintain investor confidence during downturns in the crypto market; and whether future central bank digital currencies (CBDCs) and sovereign funds will hold coins in a manner similar to DAT, among others. The answers to these questions will gradually emerge in the coming years. If the industry enters a consolidation phase, it may give rise to a "crypto Berkshire" type of holding group, holding various coins and related businesses. In such a landscape, the DAT sector will become more mature and stable, and its impact on the market will be even more profound.

Looking ahead, as a number of quality DAT companies emerge, we will see a closer connection between the crypto world and traditional finance. The price fluctuations of crypto assets will be partially influenced by the financial reports and shareholder actions of listed companies; conversely, a "crypto asset concept stock" sector will emerge in the traditional stock market, closely tied to the trends in the crypto space. Investor education and market awareness will also improve due to DAT; a direct example is that many stock investors have come to understand and recognize the value of Bitcoin through investing in strategies. It can be said that DAT companies, to some extent, serve as evangelists and value discoverers for crypto assets.

In 2025, DAT will transition from early experimentation to a competitive landscape, with the opportunities and risks brought by the flywheel continuously intertwining. Looking to the future, only those participants who understand the essence of finance, strictly control risks, and embrace compliance will succeed in this new paradigm competition, leading the industry into the next stage. Regardless, the emergence of DAT has already signaled mainstream recognition of cryptocurrencies: from corporate financial reports to investment portfolios, crypto assets are increasingly integrating into the economic landscape of the real world. The concept of crypto assets as corporate reserves has taken root, and the DAT model is progressing through twists and turns, with its long-term impact being irreversible.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-depth Research Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。