In a stunning fiscal surge, U.S. tariff revenue skyrocketed by over 300% in July alone, reaching an unprecedented $29.6 billion in a single month. The record-breaking figure lends strong support to President Donald Trump’s long-held claim that imposing tariffs on imports can serve as a powerful revenue-generating tool for the federal government.

With this latest windfall, total tariff income since March has now exceeded $100 billion, marking a significant milestone in the administration’s trade strategy. According to a post on X from The Kobeissi Letter, the Trump administration is projected to raise $40 billion in August, putting it on course to raise $350 billion per year.

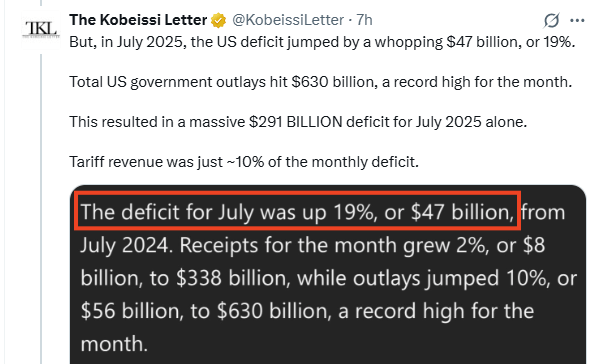

Despite this milestone, the U.S. deficit soared by $47 billion, reaching a massive $291 billion in July. While a key election promise of the Trump administration was to reduce the deficit, the 19% increase indicates the administration is no closer to achieving this goal than it was more than five months ago.

Meanwhile, The Kobeissi Letter post asserts that the ballooning deficit bodes well for alternative assets like gold and bitcoin ( BTC).

“Gold and Bitcoin are surging. We have a combination of sustained tariffs, elevated deficit spending, and rising rate cut expectations. As we have been saying for 12-plus months, this is the best possible fundamental backdrop for both Gold and Bitcoin,” the post explained.

Both gold and BTC have experienced significant gains in 2025, rising by approximately 24% and 30% year-to-date, respectively, with both assets setting new all-time highs this year. At the time of writing, BTC was closing in on its all-time high, while the gold price appeared to have stabilized within the $3,300-to-$3,400 per ounce range.

In a pointed critique, The Kobeissi Letter urged the Trump administration to curb its escalating government spending, arguing that without meaningful fiscal restraint, the substantial revenue generated from tariffs would fall short of playing a transformative role in reducing the national deficit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。