The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and I refuse any market smoke screens!

With the release of a wave of CPI, as we wished, the probability of interest rate cuts in September has directly reached over 90%, and the official statements are extremely stabilizing for the market. Due to the heat of the interest rate cuts overshadowing a very important piece of news, that is, Trump plans to expand the candidates for the Federal Reserve Chairman. Before this, he had already expanded the candidates for the interest rate cut decision. This series of chain reactions is all based on the previous data falsification issues. If this matter can be achieved, and it is accomplished during Trump's term, it is likely that the scale and frequency of interest rate cuts next year or even at the end of this year will increase again. This is also why all dollar-related markets surged yesterday; Trump has always held extreme views on interest rate cut strategies. The main reason is that he is a businessman, and it is understandable for businessmen to seek profit. Moreover, his children have already deeply engaged in the cryptocurrency industry, and this action constantly reminds us that there is a high possibility of two interest rate cuts this year, so everyone should definitely hold onto their spot positions.

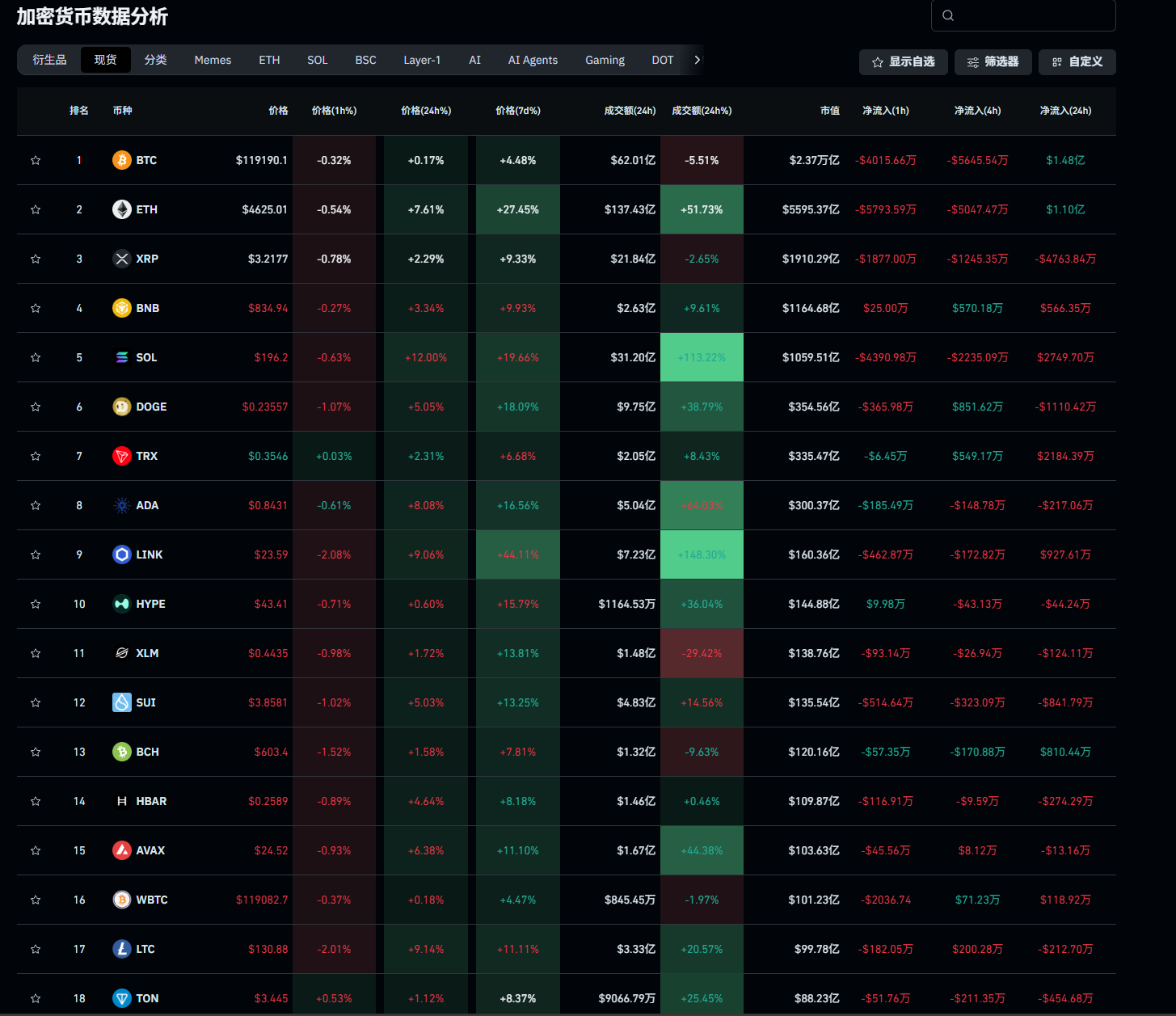

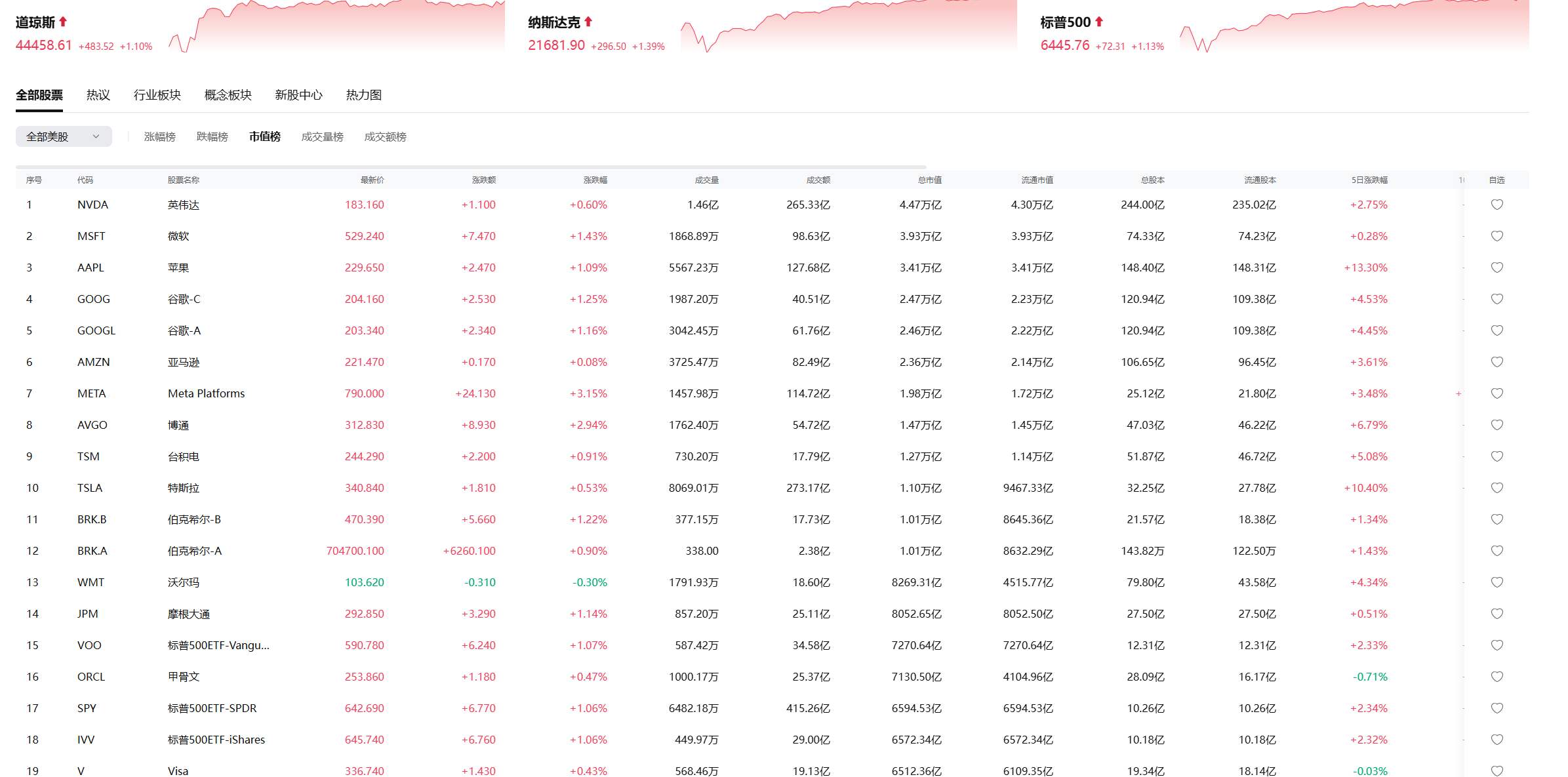

Let's start with the cryptocurrency market. Ethereum is charging towards its historical high. We planned to start a bull market after mid-August, and with the rise of many small coins, we can almost declare that the bull market has arrived. The S&P 500 and Nasdaq indices have both reached new highs during the same period, seemingly indicating that the entire financial market has regained momentum, all thanks to Trump's tariffs, and the upward trend will continue. Vietnam has also begun preparing for a cryptocurrency exchange, and Norway's investment bank indirectly holds 7,161 bitcoins, symbolizing that global officials have begun to pay attention to the cryptocurrency market. Currently, the cryptocurrency market is filled with positive news. The SEC's preparations for the cryptocurrency market have also begun to integrate traditional and digital currency financial systems, and this will soon become a hot topic. What everyone needs to worry about now is the correction around the interest rate cuts, which will also be within a controllable range, but there will definitely be a correction. As long as we avoid the area around the interest rate cuts, the trend will not change.

Regarding the Ethereum average price around 2400 that I advised everyone to layout at the beginning of the year, the estimated take-profit was around 4500-5000. Recently, some users have been asking me whether to continue executing this plan. The layout at that time was almost entirely based on considerations before the interest rate cuts; the current interest rate cuts have not yet arrived, and we have already reached the take-profit target. My thought is to hold until after the interest rate cuts. The only thing that is beyond control is the issuance of stablecoins using Ethereum's public chain, which is the biggest positive news for Ethereum since its listing. My original estimate was based on the BN public chain or the SOL public chain, so regarding SOL, I hope not to have too high expectations; a 2-3 times exit is the best expectation. Especially with the advancement of the compliance process, it will squeeze the market for the SOL public chain. Previously, many small coins borrowed the SOL channel, and it will be very difficult to issue small coins afterward. The coins that were changed for issuance were basically completed last year, so I hope not to have too high expectations.

The take-profit point for Ethereum currently needs to look at breaking the historical new high, which is 4877 from 2021. As long as it breaks the historical new high, it is likely that 5K will not hinder the growth pace. Everyone's take-profit point must continue to rise; at this stage, I do not consider exiting. Including those who are synchronized with me on SOL, the average price is still around 165, and the take-profit target is at least the historical new high. I emphasize again that the bull market for SOL has not truly erupted. The basis for judging the eruption is that it must maintain a continuous growth of at least 10% or more daily. Today can be considered the first step for SOL; we will see if it can break 230 this week. Once it breaks, our take-profit target will not exceed a month. The market after the interest rate cuts needs to be recalculated, considering both the capital volume brought by the interest rate cuts and the entry of large listed companies. This is a very complex process, but it must be remembered that the growth prospects for SOL in this round are far greater than for Ethereum. How Ethereum is currently being pulled, SOL is at least more than double that.

As for other coins, TRX, XRP, BNB, and other coins that I previously recommended have all made new breakthroughs in the short term, and most have maintained historical new highs. The take-profit for these types of coins depends on your thoughts. Currently, I cannot accept this kind of surge; the estimates for small coins are definitely higher than for Ethereum, so for these users, the plan is to consider exiting after the interest rate cuts. If Trump's changes to the Federal Reserve achieve the expected results, and if it really succeeds, there could be at least 4 interest rate cuts this year and next, exceeding 100 basis points. If this effect occurs, the growth will likely not be limited to the cryptocurrency market; the linkage effect with the US stock market will also be very prominent. For those who want to choose other markets, it is advisable to prioritize the technology sector. Among all the coins I have recommended, they all have the potential to double. Excluding BTC, the high point of BTC is actually controllable; pushing the growth of BTC requires massive capital, and at this stage, I do not hold an optimistic view on the upper limit of BTC's growth. Even with the relief from interest rate cuts, it will at most stay around 13-15.

Only two successful interest rate cuts could potentially push it above 15, and it also requires the listing of small coins, which must be maintained around October. Otherwise, exceeding October may absorb the capital volume of BTC. Meanwhile, the heat of stablecoins has not dissipated. Currently, there has been no relevant news from Hong Kong. Once domestic capital can also step into the cryptocurrency market, the help in market value will be particularly significant, and there will also be a certain effect on prices. Here, I want to emphasize one point: when the bull market arrives, I hope everyone does not pay too much attention to when the market will turn. The market that needs to turn back is not something we can grasp; this is a question for the market makers to consider. My trading logic is not to pursue the highest position to exit, but rather to focus on the correction space after the highest position, which is the point where you should exit. I cannot predict the highest position at this stage, and even BlackRock cannot provide you with an answer; just follow the trend.

In summary, regarding the trend, there is no need to say much; just be bullish. In this summary, what I want to convey is logic. At this stage, the entry points are not very important; you must have your own set of trading logic. Including the thoughts mentioned above, they may not all be correct; only after the market has completed can we review the overall gains. If you can develop your own trading habits and clearly understand your earning goals, the current market is providing you with the results of your efforts, and the results are very important. If you cannot profit from this kind of market, it only proves that there are problems in your process. What I need to do is to find and solve this problem. So in your communication with me, you can speak directly; there is no need to hide anything for the sake of face. Clear goals combined with strict execution make it very simple to profit in this trend. Looking at the current market trend, if extended to the end of the year, it is still considered a low position. If you want to enter the market, just stabilize your goals. For those trading contracts, consider going long on Bitcoin and do not consider small coins; I cannot grasp the fluctuations of small coins. Remember, you must seize this opportunity in the bull market because no one knows what the future holds; this bull market may be the historical high point.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and strategizes for the big picture, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。