Oracle service Chainlink's (LINK) native token surged 10% on Tuesday to a fresh seven-month high amid new traditional finance partnership and a recent token buyback initiative.

The token topped $24 for the first time since February, extending its rally to 42% in a week. That's the biggest gain during among the top 50 tokens by market capitalization, CoinDesk data shows.

Among the catalysts was a fresh collaboration between Chainlink and Intercontinental Exchange, the parent company of the New York Stock Exchange, to bring foreign exchange and precious metals pricing data on-chain. The partnership underscores the network’s expanding role as a bridge between traditional finance and blockchain rails.

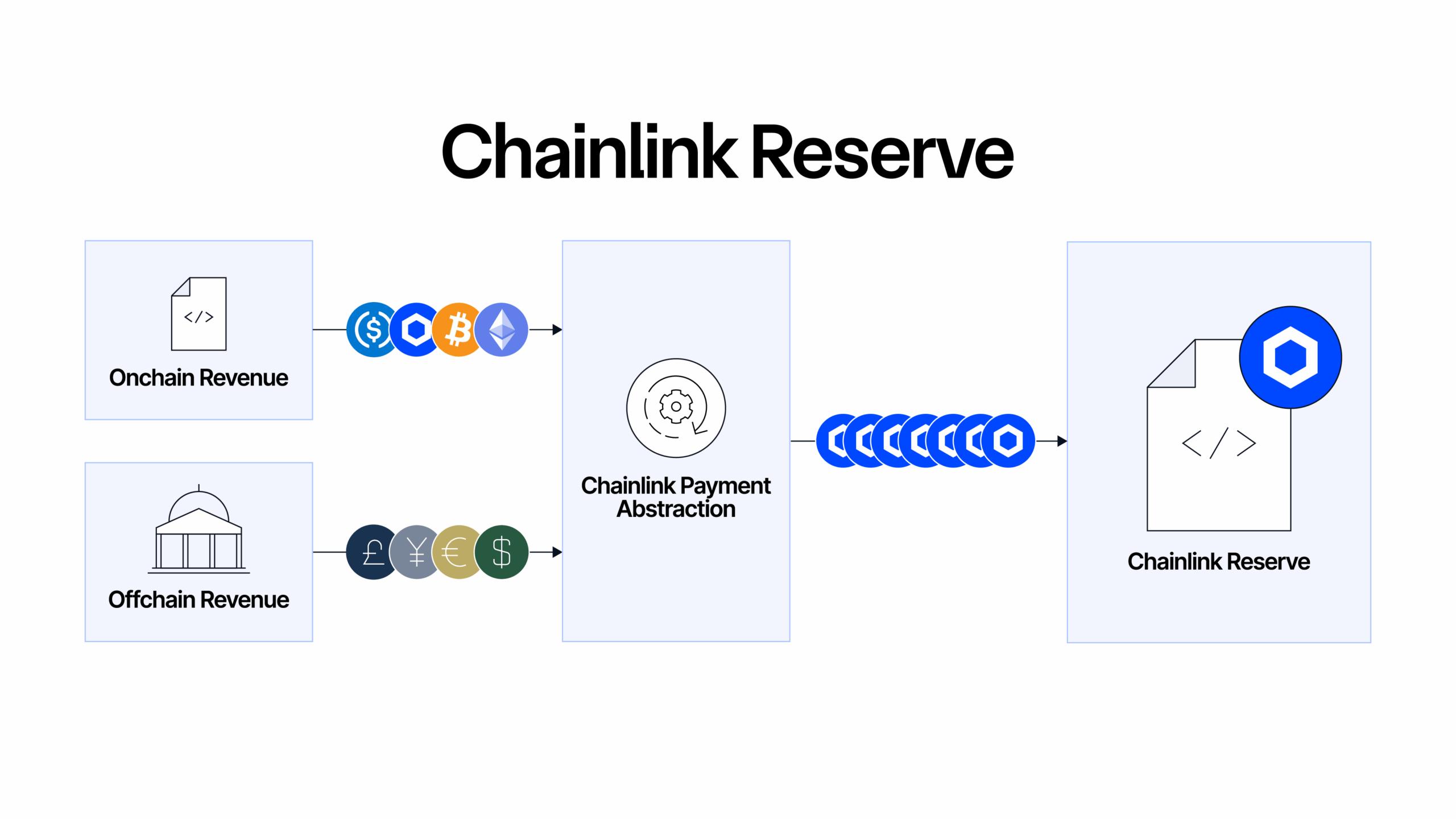

A token purchase program dubbed the Chainlink Reserve, announced last week in a blog post, aims to convert revenue from Chainlink's services and enterprise integrations into LINK tokens, establishing persistent buying momentum.

Technical Indicators Signal Continued Upside

- LINK now trades above its 50-day and 200-day moving averages, validating bullish momentum, CoinDesk's market analysis model showed.

- Near-term resistance emerged near $24, with support around $21.00–$21.30.

- Relative strength index (RSI) measurements approach overbought conditions at 72.72, indicating potential for near-term consolidation.

- A conclusive breakthrough above the $24.10-$24.13 resistance zone could trigger the subsequent rally phase.

Read more

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。