Written by: BUBBLE

"The White House is preparing to issue an executive order to penalize banks that discriminate against crypto companies." This news has been making waves in social circles recently, and those who have been in the cryptocurrency industry for over two years might find themselves rubbing their eyes in disbelief, exclaiming, "It feels like a different era."

However, it has only been a little over a year since March 2023, when "Operation Choke Point 2.0" was fully implemented. During the Biden administration, a joint statement was issued through the Federal Reserve, FDIC, OCC, and other agencies, categorizing cryptocurrency businesses as "high-risk" sectors and requiring banks to strictly assess the risk exposure of crypto clients. Regulatory agencies exerted informal pressure, forcing crypto-friendly banks like Signature Bank and Silvergate Bank to shut down core operations and restrict new client access. Builders of payment and trading platforms must have felt this acutely, while publicly traded crypto companies like Coinbase were caught in the middle, compelled to invest hundreds of millions to establish independent banking relationships. Meanwhile, many small and medium-sized crypto startups registered offshore due to their inability to meet KYC/AML requirements.

In the past month, policy directions have rapidly reshaped almost all types of crypto assets, including stablecoins, DeFi, ETFs, LSTs, and more. The accelerated entry of traditional financial institutions and the prevalence of crypto stock companies have created a strong sense of disconnection. But aside from signaling a starting line for "institutions," what opportunities can we find within these developments?

Four Statements, Three Bills, Two Executive Orders

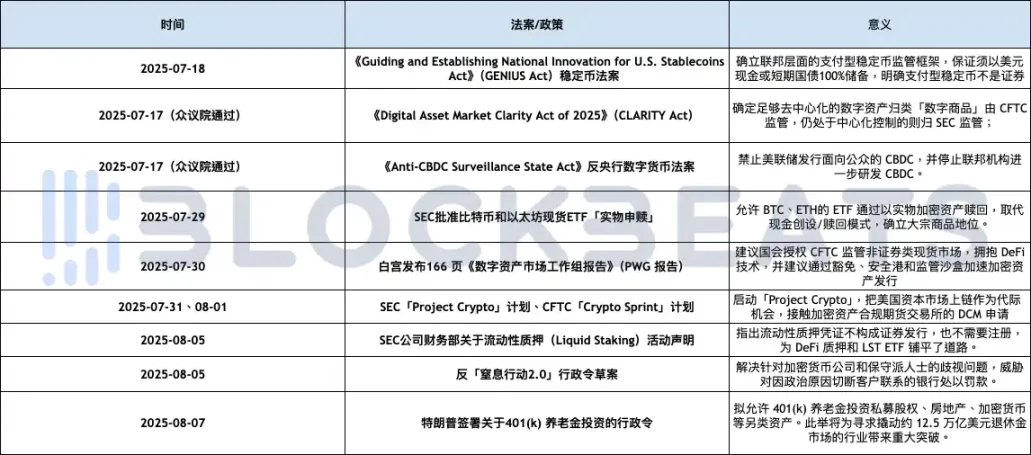

Before delving into the analysis, let's first review the various initiatives launched by the U.S. government and regulatory agencies from July to August. Their dense and fragmented emergence has pieced together the current regulatory blueprint for crypto in the U.S.:

July 18: Trump Signs the GENIUS Act

This bill establishes the first federal-level regulatory framework for stablecoins, which includes:

- Requiring payment stablecoins to be 100% backed by liquid assets such as U.S. dollars or short-term government bonds, with monthly disclosures.

- Stablecoin issuers must obtain "federal qualified issuer" or "state qualified issuer" licenses.

- The bill prohibits issuers from paying interest to holders and requires priority protection for stablecoin holders in bankruptcy.

- The bill clearly defines payment stablecoins as not being securities or commodities.

July 17: House Passes the CLARITY Act

This bill aims to establish a market structure for crypto assets, including:

- Clearly allocating jurisdiction to the CFTC (regulating digital commodities) and SEC (regulating restricted digital assets).

- Allowing projects to temporarily register to transition from securities to digital commodities once the network matures, providing a safe harbor for decentralized participants like developers and validators. The CLARITY Act creates a Section 4(a)(8) exemption under the Securities Act, with a financing cap of $50 million every 12 months, using "mature blockchain systems" to determine if a network is free from control by any individual or team.

July 17: House Passes the Anti-CBDC Surveillance State Act

The House passed this bill to prohibit the Federal Reserve from issuing central bank digital currency (CBDC) to the public and to ban federal agencies from researching or developing CBDCs. Congressman Tom Emmer explained that CBDCs could become "tools for government surveillance," and the bill codifies the president's executive order prohibiting the development of CBDCs to protect citizens' privacy and freedom.

July 29: SEC Approves Bitcoin and Ethereum Spot ETFs for "Physical Redemption"

The commission approved trading products for crypto assets like Bitcoin and Ethereum, allowing shares to be created and redeemed in physical crypto assets rather than cash, meaning Bitcoin and Ethereum receive treatment similar to commodities like gold.

July 30: White House Releases 166-Page "Digital Asset Market Working Group Report" (PWG Report)

The White House's digital asset working group released a 166-page report proposing a comprehensive crypto policy blueprint, which includes:

- Emphasizing the establishment of a digital asset classification system to distinguish between security tokens, commodity tokens, and commercial/consumer tokens.

- Requiring Congress to empower the CFTC to regulate the spot market for non-security digital assets based on the CLARITY Act and to embrace DeFi technology.

- Suggesting that the SEC/CFTC quickly allow crypto asset issuance and trading through exemptions, safe harbors, and regulatory sandboxes.

- Proposing to restart crypto innovation in the banking sector, allowing banks to custody stablecoins and clarifying the process for obtaining Federal Reserve accounts.

July 31 - August 1: SEC's "Project Crypto" and CFTC's "Crypto Sprint" Initiatives

In a speech by SEC Chair Gary Gensler, the "Project Crypto" initiative was launched to modernize securities rules and bring U.S. capital markets on-chain. The SEC will establish clear rules for crypto asset issuance, custody, and trading, ensuring that traditional rules do not hinder innovation through interpretations and exemptions until the rules are refined. Specific contents include:

- Guiding crypto asset issuance back to the U.S. and establishing clear standards to differentiate between digital commodities, stablecoins, collectibles, etc.

- Revising custody regulations to emphasize citizens' rights to self-custody digital wallets and allowing registered intermediaries to provide crypto custody services.

- Promoting "super apps" that enable broker-dealers to trade both securities and non-securities crypto assets on a single platform while providing services like staking and lending.

- Updating rules to create space for decentralized finance (DeFi) and on-chain software systems, clarifying the distinction between pure software publishers and intermediary services, and exploring innovative exemptions to allow new business models to enter the market quickly under "light compliance."

Subsequently, on August 1, the CFTC officially launched the "Crypto Sprint" regulatory initiative in coordination with Project Crypto, and four days later, on August 5, further proposed to include spot crypto assets in CFTC-registered designated contract markets (DCM) for compliant trading, meaning that entities like Coinbase or on-chain derivatives protocols could obtain compliant operating licenses through DCM registration.

August 5: SEC's Division of Corporation Finance Statement on Liquid Staking Activities

The SEC's Division of Corporation Finance issued a statement analyzing liquid staking scenarios, concluding that liquid staking activities do not involve securities trading. Liquid staking receipts (Staking Receipt Tokens) are not considered securities, as their value represents ownership of the staked crypto assets rather than being based on third-party entrepreneurial or managerial efforts. This statement clarifies that liquid staking does not constitute an investment contract, providing clearer compliance space for DeFi staking services.

August 5: Draft Executive Order Against "Operation Choke Point 2.0"

The order aims to address discrimination against cryptocurrency companies and conservatives, threatening fines against banks that sever customer relationships for political reasons and implementing consent orders or other disciplinary measures. Reports indicate that this executive order also directs regulatory agencies to investigate whether any financial institutions have violated the Equal Credit Opportunity Act, antitrust laws, or consumer financial protection laws.

August 7: Trump Signs Executive Order on 401(k) Pension Investments

This order aims to allow 401(k) pension plans to invest in alternative assets such as private equity, real estate, and cryptocurrencies. This move will bring significant breakthroughs for industries seeking to tap into the approximately $12.5 trillion retirement market.

In the Era of Super Apps with Everything On-Chain, Which Crypto Tracks Can Benefit from Policy Dividends?

At this point, the compliance framework for the crypto sector in the U.S. has been established. The Trump administration has solidified the foundational status of "stablecoins" through the stablecoin bill and the anti-CBDC bill, linking them to U.S. Treasury bonds and global liquidity, thus allowing stablecoins to be extended into various crypto fields without hesitation. The CLARITY Act genius bill has defined the jurisdictional boundaries between the SEC and CFTC. The four statements issued between July 29 and August 5, all within a week, are closely related to on-chain developments, from opening up BTC and ETH ETFs for "physical redemption" to information about liquid staking receipts, all aimed at connecting "old money" channels to on-chain before expanding the financial system on-chain using "DeFi yields." The two executive orders issued in recent days are concrete steps to inject "bank" and "pension" money into the crypto sector. This series of coordinated actions has brought about the first true "policy bull market" in crypto history.

Regarding Atkins' mention of a key concept, "Super-App," during the launch of Project Crypto, it refers to the "horizontal integration" of product services. In his vision, a single application in the future could provide customers with comprehensive financial services. Atkins stated, "Broker-dealers with alternative trading systems should be able to simultaneously offer trading in non-securities crypto assets, crypto asset securities, and traditional securities, as well as provide crypto asset staking, lending, and other services without needing to obtain licenses from over 50 states or multiple federal licenses."

When discussing the hottest candidates for Super Apps this year, traditional broker Robinhood and the earliest "compliant" trading platform Coinbase are undoubtedly at the forefront. While Robinhood has acquired Bitstamp this year, launched tokenized equity, and partnered with Aave to bring its services on-chain (allowing for both platform and on-chain trading), Coinbase has further integrated its Base chain ecosystem with the Coinbase exchange and upgraded the Base wallet to combine social and off-chain application layer services into a unified app. However, the real explosion lies in the RWA (Real World Assets) across various fields under the backdrop of super apps.

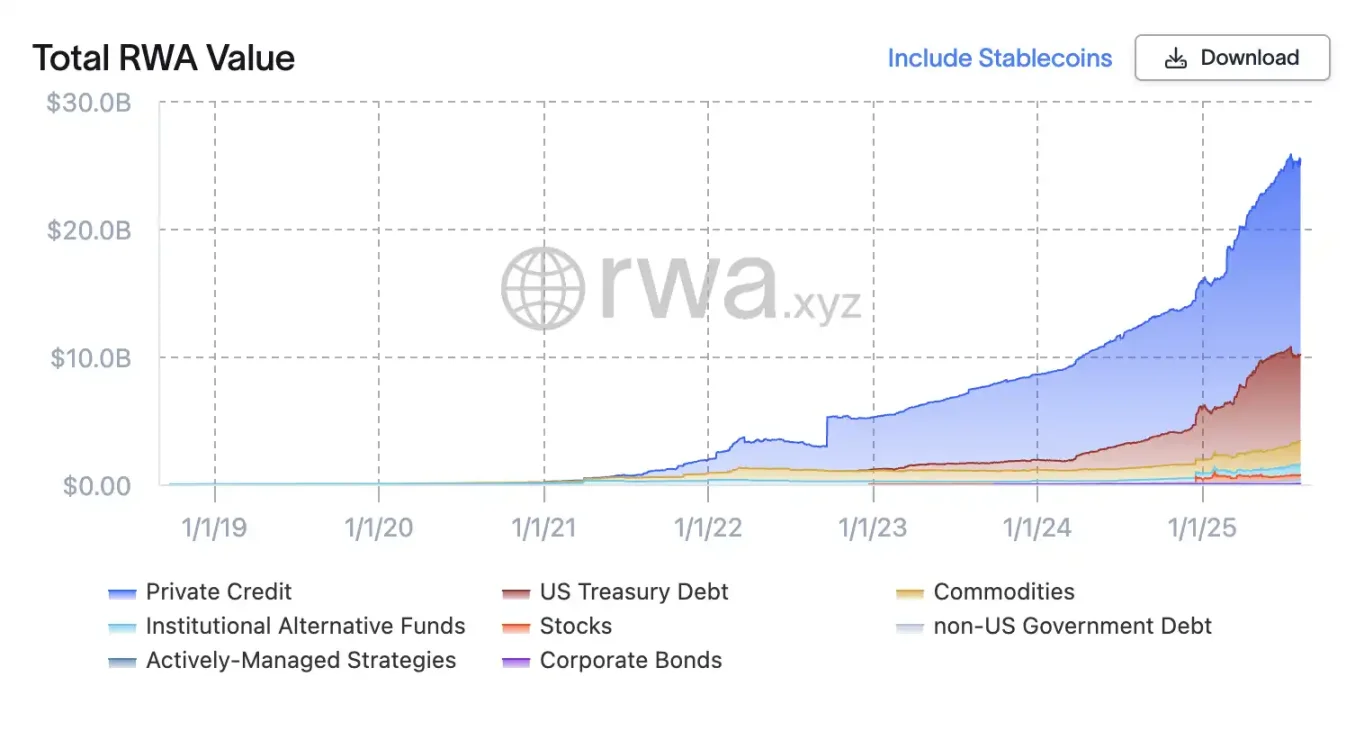

With policies encouraging the on-chain transition of traditional assets, Ethereum bonds, stock tokenization, and short-term government bond tokenization will gradually enter compliant pathways. According to data from RWA.xyz, the global RWA market is expected to grow from approximately $5 billion in 2022 to about $24 billion by June 2025. However, rather than calling this RWA, it might be more appropriate to refer to them as Fintech, as the goal is to make financial services more efficient from both institutional and technological perspectives. From the emergence of Real Estate Investment Trusts (REITs) in the 1960s, E-gold, to the later introduction of ETFs, it has taken numerous experiments, both failures and successes, with decentralized ledgers, colored BTC, algorithmic stablecoins, and more for them to evolve into RWA.

And now, with the recognition from the policy system, it has become the most reliable endorsement, and its market will be enormous. The Boston Consulting Group believes that by 2030, 10% of global GDP (approximately $16 trillion) could be tokenized, while Standard Chartered estimates that tokenized assets will reach $30 trillion by 2034. Tokenization opens exciting new doors for institutional companies by reducing costs, streamlining underwriting, and enhancing capital liquidity. It also helps improve returns for investors willing to take on more risk.

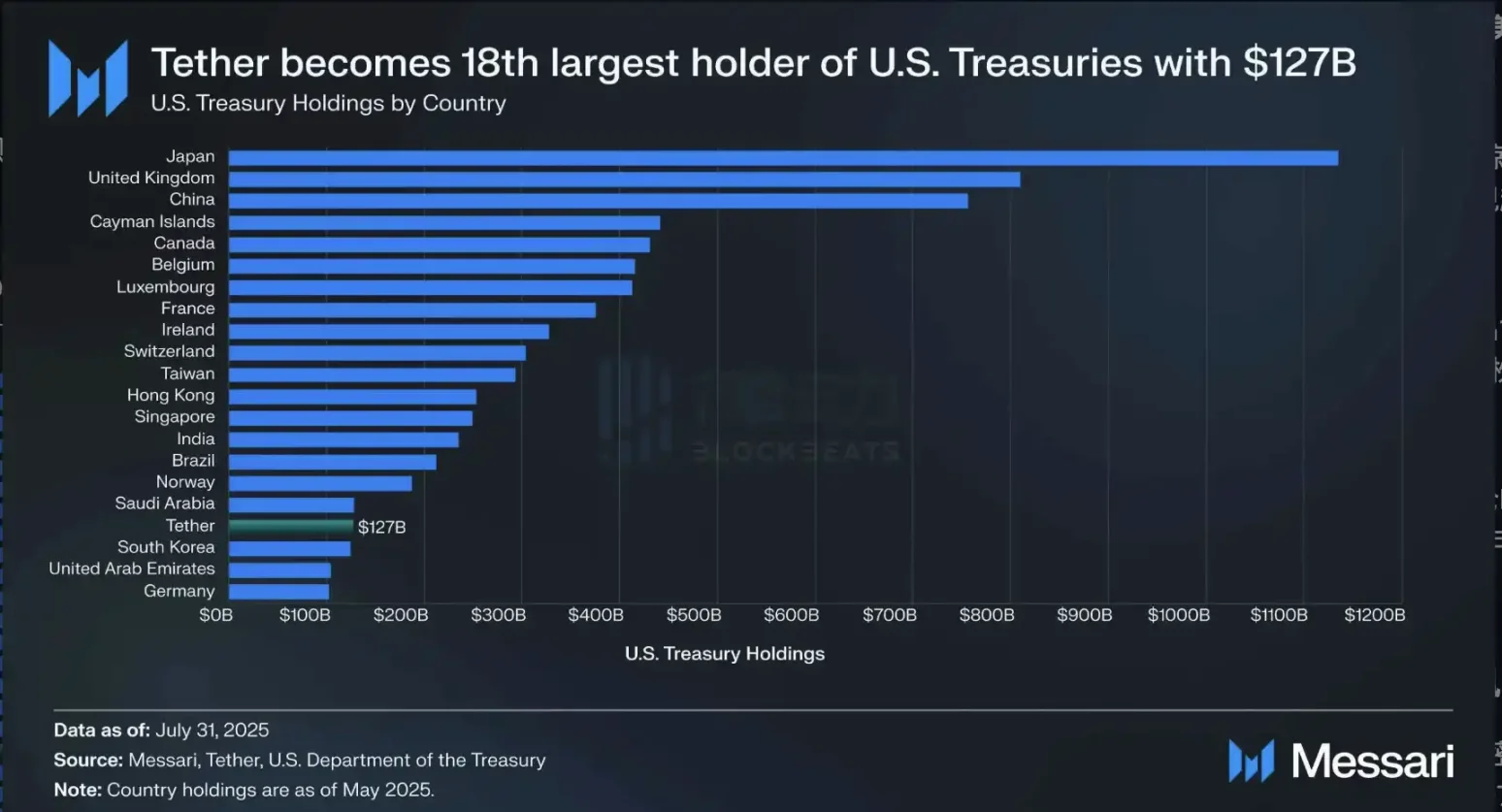

The Essence of Stablecoins: On-Chain Treasury Bonds

When discussing RWAs in cryptocurrency, dollar assets, especially dollar currency and U.S. Treasury bonds, always take center stage. This is the result of nearly 80 years of economic history, with the Bretton Woods system established in 1944 making the dollar a pillar of global finance. Central banks around the world hold most of their reserves in dollar-denominated assets, with approximately 58% of official foreign exchange reserves held in dollars, the majority of which are invested in U.S. Treasury bonds. The U.S. Treasury bond market is the largest bond market in the world, with about $28.8 trillion in outstanding debt and unparalleled liquidity. Foreign governments and investors alone hold about $9 trillion of this debt.

Historically, there have been few assets that match the depth, stability, and credit quality of U.S. Treasury bonds. High-quality government bonds are the cornerstone of institutional portfolios, used for safe capital storage and as collateral for other investments. The crypto world leverages these same fundamentals, and since stablecoins have become the largest "gateway" to crypto, the relationship between the two has deepened more than ever.

While on one hand, cryptocurrencies have not fulfilled Satoshi Nakamoto's expectation of "establishing an alternative to the dollar system," they have instead become a more effective infrastructure for a dollar-based financial system. This has become a necessary condition for the U.S. government to "fully accept their existence," and in fact, the U.S. government may need them more than ever.

With the recent addition of countries like Saudi Arabia, the UAE, Egypt, Iran, and Ethiopia, the total GDP of the BRICS group is expected to reach $29.8 trillion in 2024, surpassing the U.S. GDP of $29.2 trillion, meaning the U.S. is no longer the largest economic group in the world by GDP. Over the past two decades, the growth rate of BRICS economies has significantly outpaced that of the G7.

As of May 15, 2025, U.S. Treasury data shows that Tether's holdings of U.S. Treasury bonds exceed those of South Korea, Source: Messari

Stablecoins, which are strongly correlated with this, hold a unique position in the global financial landscape. They are the most liquid, efficient, and user-friendly wrappers for short-term U.S. Treasury bonds, effectively addressing two barriers related to de-dollarization: maintaining the dollar's dominance in global transactions while ensuring continued demand for U.S. Treasury bonds.

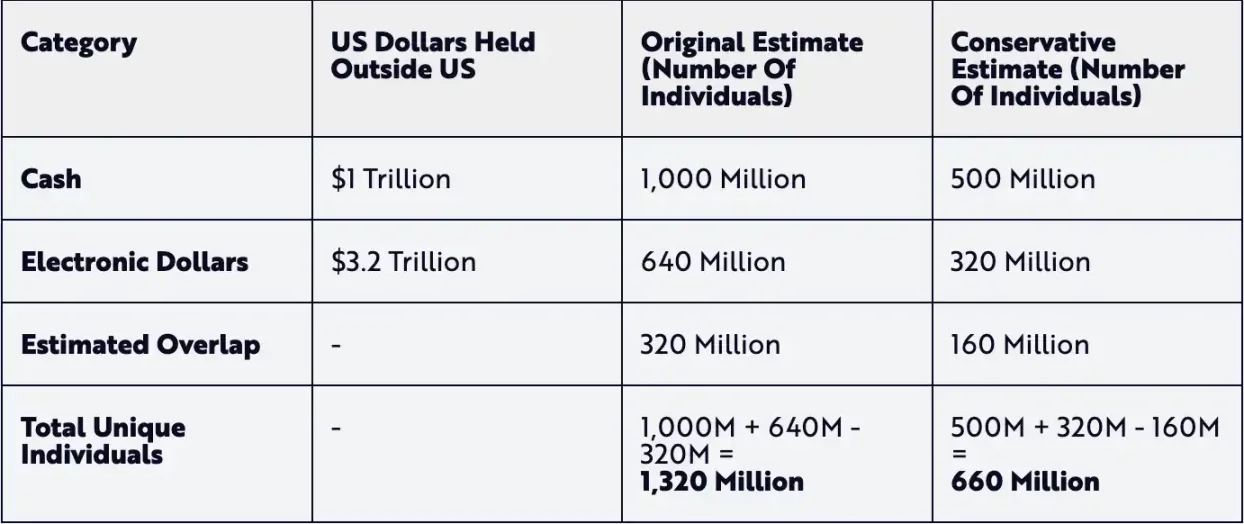

As of December 31, 2024, data on dollar holders shows that stablecoin holders have reached 15% to 30% of the total traditional dollar development over five years, Source: Ark Investment

Dollar stablecoins like USDC and USDT provide traders with a stable trading currency, supported by the same bank deposits and short-term Treasury bonds relied upon by traditional institutions. However, the income from these Treasury bond-backed stablecoins is not owned by the holding users, but there are more on-chain financial products that incorporate the concept of U.S. Treasury bonds. Currently, there are two main methods to build tokenized Treasury bonds on-chain: yield-generating mechanisms and basis-changing mechanisms.

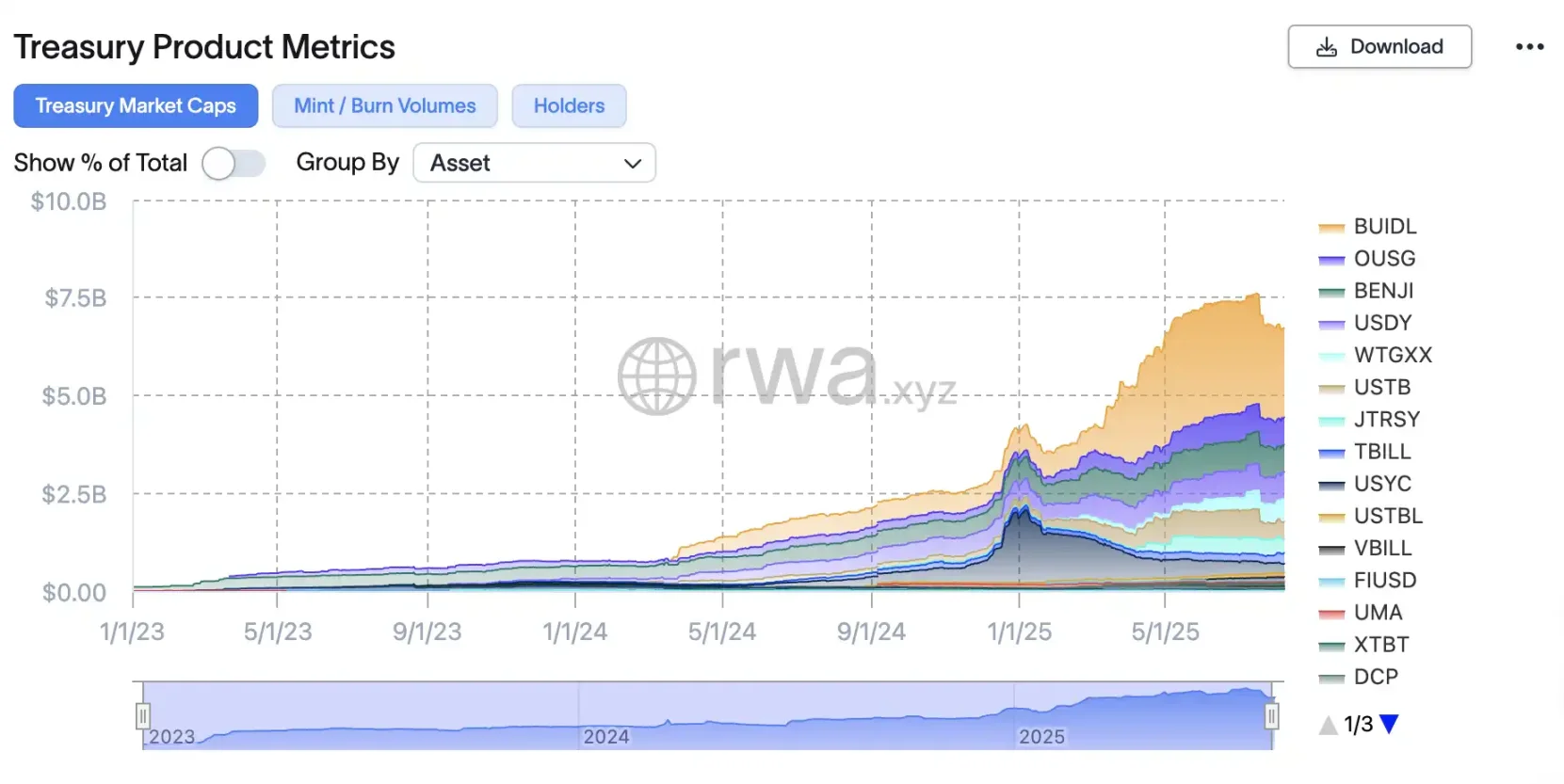

For example, yield tokens like Ondo's USDY and Circle's USYC accumulate underlying yields by enhancing asset pricing through various mechanisms. In this model, due to accumulated yield rates, the price of USDY will be higher six months later than it is today. Conversely, basis-changing tokens like BlackRock's BUIDL and Franklin Templeton's BENJI or Ondo's OUSG maintain dollar parity by distributing yields through newly issued tokens at predefined intervals.

Whether it is "yield-bearing stablecoins" or "Treasury bond tokenization," similar to the adoption of fund portfolios in TradeFi, on-chain financial products use on-chain U.S. Treasury bonds as a component of stable returns, becoming an alternative to high-risk DeFi, allowing crypto investors to achieve stable annual returns of 4-5% with minimal risk.

The Easiest Money-Making Field: On-Chain Credit

The traditional lending industry is one of the core profit sectors of the financial system. According to research by Magistral Consulting, the global credit market is expected to reach $11.3 trillion in 2024 and $12.2 trillion in 2025. In contrast, the entire crypto lending market is still less than $30 billion, but the yields are generally around 9-10%, significantly higher than traditional finance. If regulations are no longer restrictive, it will unleash enormous growth potential.

In March 2023, a research team led by Giulio Cornelli at the University of Zurich published a paper in the Journal of Banking and Finance on the importance of loans from large tech companies. The study showed that a clear fintech regulatory framework could double the growth of new lending activities (some studies indicate that FinTech lending volumes grow by 103% when there is clear regulation). The same logic applies to crypto lending: clear policies attract capital.

Size of the lending market, Source: Magistral Consulting

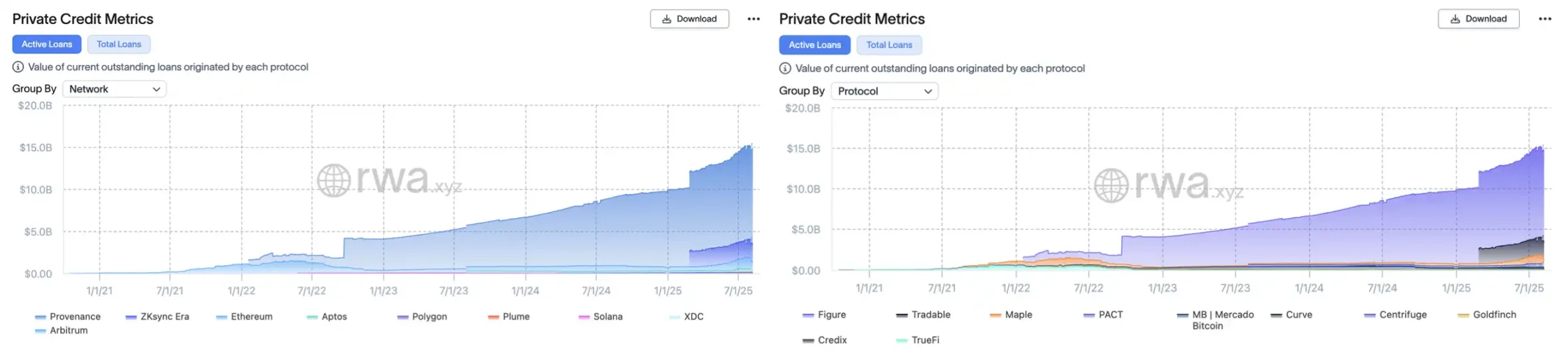

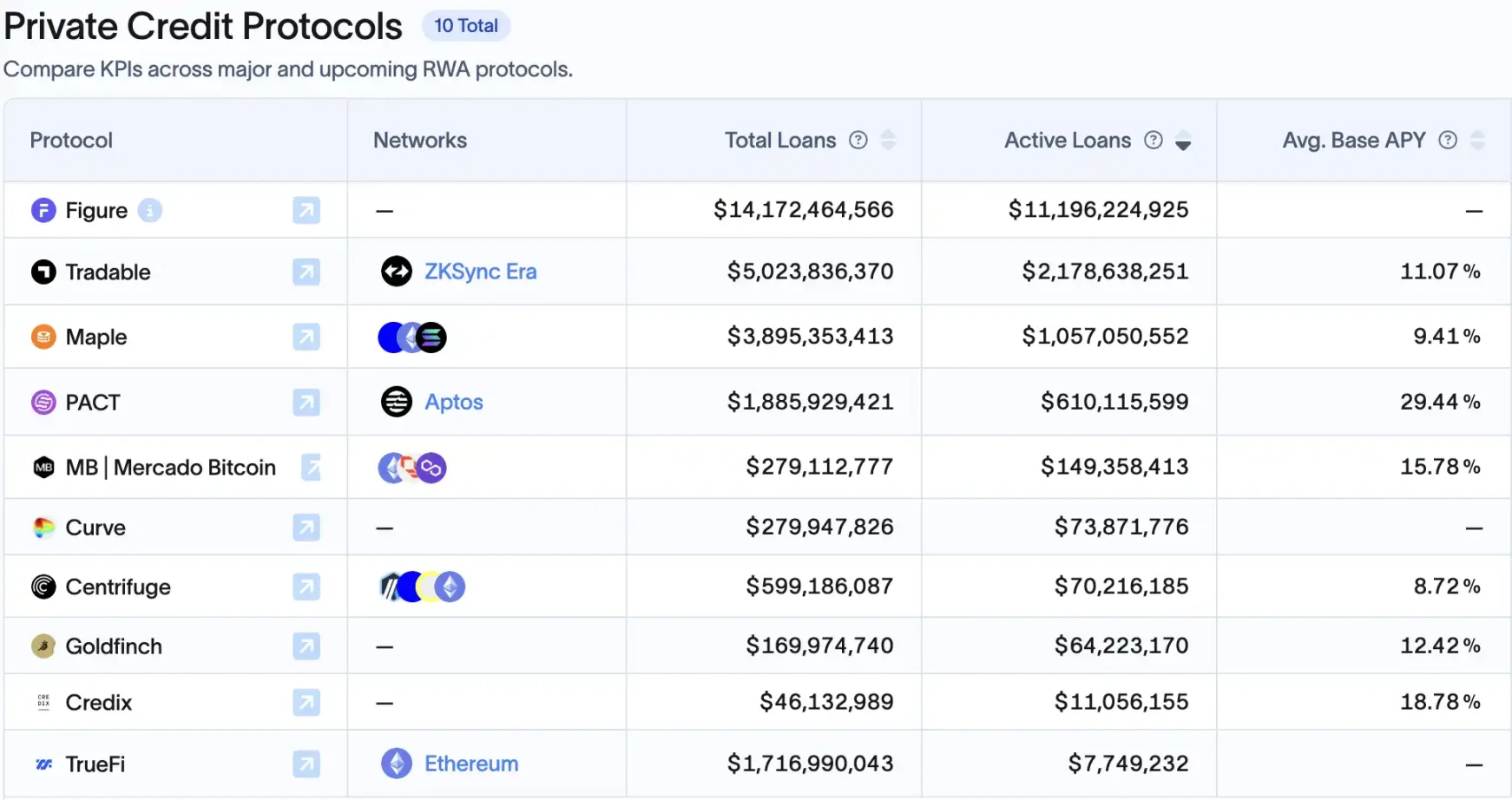

Therefore, in an era where more and more assets are being tokenized in the RWA space, one of the biggest beneficiaries after compliance may be the on-chain lending industry. Currently, the crypto sector lacks the "government credit scoring" system's big data support found in traditional finance, so it can only focus on "collateral assets." Using DeFi to enter the secondary debt market helps to diversify risks. Currently, private credit assets account for about 60% of on-chain RWAs, approximately $14 billion.

Behind this wave is the deep involvement of traditional institutions, with the largest being Figure, which is currently discussing going public. It has launched the Provenance chain, designed specifically for asset securitization and loan financial scenarios within the Cosmos ecosystem. As of August 10, 2025, it has hosted approximately $11 billion in private credit assets, accounting for 75% of this sector. Its founder, Mike Cagney, a former SoFi founder and a "serial entrepreneur" in the lending field, has made it adept in blockchain lending, with the platform connecting the entire chain from loan initiation to tokenization and secondary trading.

The second is Tradable, which has partnered with Janus Henderson, a $330 billion asset management company. Earlier this year, they tokenized $1.7 billion in private credit on Zksync (making Zksync the second-largest "lending chain"), while the third is Ethereum, the "world computer," but its market share in this field is only 1/10th that of Provenance.

Left: Market capitalization of "credit public chains," Right: Market capitalization of credit projects, Source: RWAxyz

DeFi-native platforms are also entering the RWA lending market. For example, Maple Finance has facilitated over $3.3 billion in loans, with current active loans of about $777 million, some targeting real receivables. MakerDAO has also begun to allocate real assets like Treasury bonds and commercial loans, while platforms like Goldfinch and TrueFi have made early moves.

All of this was suppressed under regulatory hostility, but now "policy warming" may completely activate this sector.

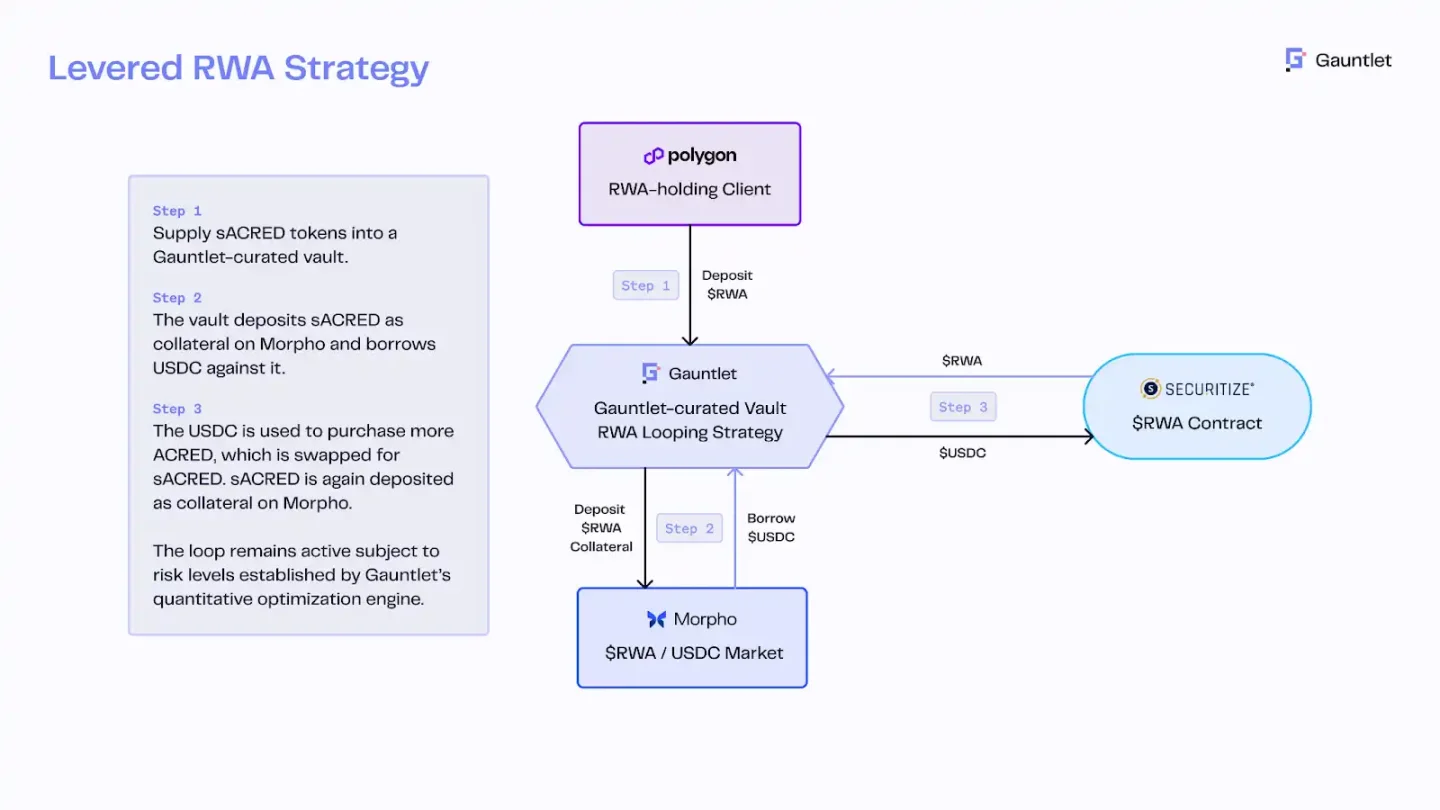

For instance, Apollo has launched its flagship credit fund, ACRED, as a tokenized fund, allowing investors to mint sACRED tokens through Securitize to represent their shares, which can then be used for lending arbitrage on DeFi platforms (like Morpho on Polygon). By using the RedStone price oracle and Gauntlet risk control engine, sACRED is collateralized to borrow stablecoins, which are then leveraged to repurchase ACRED, thus leveraging a base yield of 5-11% to an annualized rate of 16%. This innovation combines institutional credit funds with DeFi leverage.

sACRED circular lending structure, Source: Redstone

Looking further ahead, 401(k) reforms will indirectly benefit on-chain credit. Jake Ostrovskis, an over-the-counter trader at Wintermute, stated that the impact of this move cannot be underestimated. "Just a 2% allocation to Bitcoin and Ethereum would be equivalent to 1.5 times the cumulative ETF inflow to date, while a 3% allocation would more than double the total market inflow. The key is that these buyers are mostly price-insensitive; they focus on meeting allocation benchmarks rather than engaging in tactical trading." The yield demands of traditional pensions are expected to generate interest in investing in stable, high-yield DeFi products. For example, tokenized assets based on real estate debt, small business loans, and private credit pools, if packaged properly for compliance, could become a new choice for pensions.

Current market share of the top 10 on-chain lending projects, Source: RWAxyz

Under the premise of clear regulations, these institutional-level "DeFi credit funds" may replicate rapidly. After all, most large institutions (Apollo, BlackRock, JPMorgan) have viewed tokenization as a key tool for enhancing market liquidity and yield. After 2025, as more assets (such as real estate, trade finance, and even mortgages) are tokenized on-chain, on-chain credit is expected to become a market worth trillions of dollars.

Transforming "American Value" of 56.5 Hours into "On-Chain U.S. Stocks" for the World to Play 724 Hours

The U.S. stock market is one of the largest capital markets in the world. As of mid-2025, the total market capitalization of the U.S. stock market is approximately $50–55 trillion (USD), accounting for 40%–45% of the total global stock market capitalization. However, this enormous "American value" has long been limited to trading within a window of about 6.5 hours a day, five days a week, with clear regional and time restrictions. This situation is now being rewritten, as on-chain U.S. stocks allow global investors to participate in the U.S. stock market 24/7.

On-chain U.S. stocks refer to the digitization of shares of U.S. listed companies into tokens on the blockchain, with prices anchored to real stocks and supported by actual stocks or derivatives. The biggest advantage of tokenized stocks is that trading time is no longer restricted: traditional U.S. stock exchanges are only open for about 6.5 hours on business days, while blockchain-based stock tokens can trade continuously around the clock. Currently, the tokenization of U.S. stocks is primarily achieved through three approaches: third-party compliant issuance + multi-platform access model, licensed brokers' self-issuance + closed-loop on-chain trading, and contract for difference (CFD) model.

Various projects related to the tokenization of U.S. stocks have already emerged in the market, from Republic's "Pre IPO" mirror coins to Ventuals on Hyperliquid, which allows shorting and going long on "Pre IPO," to Robinhood, which has caused a dual shock in both the TradeFi and crypto circles, xStocks with multiple institutional collaborations that can receive stock dividends, and StableStock, which is about to launch a dual-track approach combining brokers and on-chain tokens with DeFi.

This trend is driven by the rapid clarification of the regulatory environment and the entry of traditional giants. The Nasdaq Stock Exchange has proposed creating a digital asset version of ATS (Alternative Trading System), allowing tokenized securities and commodity tokens to be listed and traded together to enhance market liquidity and efficiency. SEC Commissioner Paul Atkins has even compared the on-chain transformation of traditional securities to the digital revolution of music carriers: just as digital music has disrupted the music industry, the on-chain transformation of securities is expected to achieve a new model of issuance, custody, and trading, reshaping all aspects of capital markets. However, this field is still in its early stages; compared to other RWA sectors that can easily reach tens of billions of dollars, the growth potential of the U.S. stock tokenization track seems even greater, as the total market capitalization of on-chain stocks is currently less than $400 million, with monthly trading volume only around $300 million.

The reasons for this include unresolved practical issues, such as the compliance path not being fully opened, complex regulations for institutional entry, and significant friction in the deposit process. However, for most users, the primary issue to resolve is actually insufficient liquidity. Tech investor Zheng Di stated that high OTC costs lead to a division between those trading U.S. stocks and those playing on-chain: "If you deposit through OTC, you have to bear costs of over a thousand dollars, and if you use a licensed exchange like Coinbase in Singapore, you also have to add about 1% in fees and 9% in consumption tax. Therefore, the money in the crypto world and the money in traditional brokerage accounts are essentially two separate systems, and they hardly interact, which is like fighting on two battlefields."

Because of this, on-chain U.S. stocks currently resemble a scenario where one side has to "educate" this group of Degen players to accept basic knowledge of U.S. stocks while the other side is shouting to those accustomed to traditional brokers that this place is "open 7*24." ZiXI, the founder of StableStock, categorized users of on-chain U.S. stocks into three types in an interview and analyzed why on-chain U.S. stocks are "needed" in these users' scenarios:

Novice Users: Mainly distributed in countries with strict foreign exchange controls, such as China, Indonesia, Vietnam, the Philippines, and Nigeria. They hold stablecoins but, due to various restrictions, cannot open bank accounts overseas and cannot smoothly purchase traditional U.S. stocks.

Professional Users: They have stablecoins and overseas bank accounts, but the leverage offered by traditional brokers is too low; for example, Tiger's leverage ratio is only 2.5 times. On-chain, by setting a higher LTV (loan-to-value ratio), high leverage can be achieved; for instance, with an LTV of 90%, one can achieve 9 times leverage trading.

High-Net-Worth Users: They hold U.S. stock assets long-term and may earn interest, dividends, or benefit from stock price increases through margin trading in traditional brokerage accounts. After their stocks are tokenized, they can engage in LP, lending, or even cross-chain operations on-chain.

From the Robinhood launch event to Coinbase submitting a pilot application to the SEC to become one of the first licensed institutions to offer "on-chain U.S. stocks" services in the U.S., along with the SEC's favorable statement on liquid staking, it is foreseeable that as the policy bull market progresses, on-chain U.S. stocks will gradually integrate into the DeFi system, thereby building relatively deep liquidity pools. The once-limited U.S. value of 5×7 hours is accelerating its transformation into an on-chain equity market that global investors can participate in at any time, regardless of time zones. This not only greatly expands the asset landscape for crypto investors but also introduces all-weather liquidity to the traditional stock market, marking Wall Street's move towards the "Super-App era" of on-chain capital markets.

The Renaming of Staked Assets: The Rise of DeFi

In this wave of regulatory favor, one of the biggest winners is undoubtedly the DeFi derivative protocols, as the SEC's recognition of liquid staking has paved the way for them, which is also one of the most relevant benefits for "Crypto Native" players. Previously, the SEC held a hostile attitude towards centralized staking services, forcing exchanges to delist staking services and raising concerns about whether Lido's stETH and Rocket Pool's rETH were unregistered securities. However, in August 2025, the SEC's corporate finance department issued a statement clarifying that "as long as the underlying assets are not securities, then LSTs are also not securities." This clear policy signal is hailed by the industry as a watershed moment for the renaming of staking.

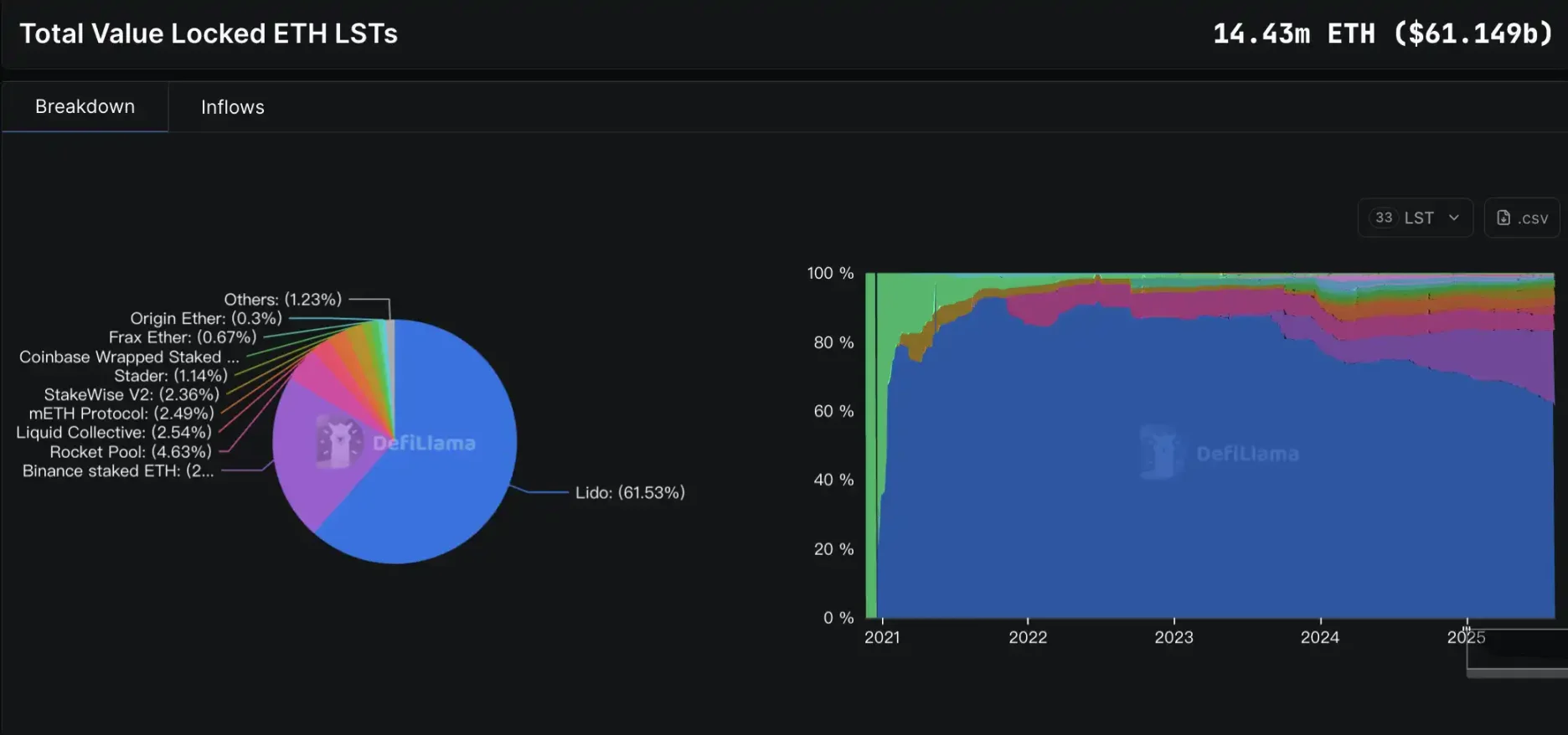

This not only benefits staking itself but also activates a whole set of DeFi ecosystems based on staking: from LST collateralized lending, yield aggregation, and re-staking mechanisms to yield derivatives built on staking. More importantly, the clarity of U.S. regulations means that institutions can legally participate in staking and related product configurations. Currently, approximately 14.4 million ETH is locked in liquid staking, and the growth is accelerating. According to Defillama data, from April to August 2025, the TVL of locked LSTs surged from $20 billion to $61 billion, returning to historical highs.

The SosoValue DeFi index sector has outperformed the recently strong ETH over the past month, Source: SosoValue

From a certain point in time, it seems that these DeFi protocols have formed some consensus and have begun deep cooperation with each other. They not only connect their institutional resources but also collaborate on yield structures, gradually forming systematic "yield flywheels."

For example, the new integrated feature launched by d Ethena and Aave allows users to gain leveraged exposure to sUSDe rates while maintaining better liquidity for their overall positions (without cooling-off period restrictions) by holding USDe. A week after its launch, the Liquid Leverage product has attracted over $1.5 billion in inflows. Pendle splits yield assets into principal (PT) and yield (YT), forming a "yield trading market." Users can purchase YT with smaller amounts to seek high yields, while PT locks in fixed returns, suitable for conservative investors. PT is used as collateral on platforms like Aave and Morpho, forming the infrastructure for the yield capital market. Coupled with Pendle's new plan "Project Boros," which just reached a partnership with Ethena, it expands the trading market to the funding rate of perpetual contracts, allowing institutions to hedge against Binance contract rate risks on-chain.

DeFi player JaceHoiX stated, "Ethena, Pendle, and Aave are forming a triangular relationship of bubble TVL," where users can cycle loans 10x using 1 USDT through minting USDe -> minting PT -> depositing PT -> borrowing USDT -> minting USDe. At the same time, this $10 deposit exists in the TVL of these three protocols, turning $1 into $30 in deposits across these three protocols.

Many institutions have already entered this field early in recent years through various means, such as JP Morgan's lending platform Kinexys, as well as BlackRock, Cantor Fitzgerald, Franklin Templeton, and others. The clarification of policies will facilitate the acceleration of DeFi protocols' integration with TradFi, ultimately extending the narrative of "selling apples in the village" where $1 becomes $30 into a longer version.

U.S. Public Chains and the World Computer

U.S.-based public chain projects are now welcoming favorable policies. The "CLARITY Act," passed in July, proposed standards for "mature blockchain systems," allowing crypto projects to transition from securities to digital commodity assets after their networks have matured in decentralization. This means that public chains with high degrees of decentralization and teams that comply with regulatory paths are expected to gain commodity attributes, subject to regulation by the Commodity Futures Trading Commission (CFTC) rather than the SEC.

KOL @Rocky_Bitcoin believes that the advantages of the U.S. financial center are beginning to shift towards the crypto space. "With clear divisions between the CFTC and SEC, the U.S. aims not only for large trading volumes in the next bull market but also to become a hub for project incubation." This is a significant boon for U.S.-based public chains like Solana, Base, Sui, and Sei. If these chains can natively adapt to compliance logic, they may become the main networks for the next USDC or ETF.

For example, asset management giant VanEck has applied for a Solana spot ETF, stating that SOL functions similarly to Bitcoin and Ethereum and should therefore be regarded as a commodity. Coinbase also launched CFTC-regulated Solana futures contracts in February 2025, accelerating institutional participation in SOL and paving the way for a future SOL spot ETF. This series of initiatives indicates that under the new regulatory mindset, certain "U.S. public chains" are gaining commodity-like status and legitimacy, becoming important bridges for traditional capital to move on-chain, allowing established institutions to confidently transfer value to public chains.

At the same time, Ethereum, the "world computer" of the crypto world, has also benefited significantly from the policy shift, as new regulations restrict "insider trading and quick token cash-outs," favoring mainstream coins with actual construction and stable liquidity. As the most decentralized public chain globally, with the most developers and one of the few that has never gone down, Ethereum has long supported the throughput of the vast majority of stablecoins and DeFi applications.

Now, U.S. regulators have basically recognized Ethereum's non-security status. In August 2025, the SEC issued a statement clarifying that as long as the underlying asset, such as ETH, is not a security, then the liquid staking tokens anchored to it also do not constitute securities. Additionally, the SEC has previously approved spot ETFs for Bitcoin and Ethereum, which indirectly confirms Ethereum's status as a commodity.

With regulatory backing, institutional investors can participate more boldly in the Ethereum ecosystem, whether issuing on-chain government bonds, stocks, or other RWA assets, or using Ethereum as a clearing and settlement layer to connect with TradFi businesses. It is foreseeable that while "U.S. public chains" compete to expand compliance, Ethereum, the "world computer," will remain a cornerstone of global on-chain finance. This is not only due to its first-mover advantage and network effects but also because this round of policy dividends has opened a new door for deep integration with traditional finance.

Has Policy Really Brought a Bull Market?

Whether it is the "Stablecoin Act" establishing the compliant status of dollar-pegged assets or the "Project Crypto" outlining the blueprint for on-chain capital markets, this top-down policy shift has indeed brought unprecedented institutional space to the crypto industry. However, historical experience shows that regulatory friendliness does not equate to unlimited openness; the standards, thresholds, and execution details during the policy trial period will still directly determine the life and death of various tracks.

From RWA, on-chain credit to staking derivatives and on-chain U.S. stocks, almost every track can find its place within the new framework, but their real test may be whether they can maintain the efficiency and innovation inherent to crypto while achieving compliance. The true integration of the global influence of U.S. capital markets with the decentralized characteristics of blockchain will depend on the long-term game between regulatory agencies, traditional finance, and the crypto industry. The direction of policy has shifted; how to grasp the rhythm and control risks will be key to determining how far this "policy bull market" can go.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。