欢迎来到《Web 3 风向标》系列专题,这是十四君对近期 Web 3 行业新技术、协议与产品的集中分析解读。

起因是 AI 翻倍了我平时研究新项目的速度,我想未来人的价值更多侧重到思考、判断与灵感。

所以,本系列会从行业背景→技术原理 → 潜在影响三个角度,帮你在最短时间内抓住核心变化,并判断它们可能引发的趋势。

笔者观点多数带有悲观主义色彩,不作为任何投资交易,也并非针对任意项目方。

Jito BAM|Solana 上的“区块排序 + 插件化的区块构建市场”

他是什么:

简单说,BAM 是一套在 Solana 的"区块构建"的平台,和以太坊 builder net 做 PBS(区块构建者与验证者分离)的目标类似,都是为了更秩序化交易顺序,抗击 MEV,防止中心化作恶风险的目标

由谁、怎样的背景推出:

主导方是 Jito 阵营,Solana 上最大的交易拍卖平台,占据 9 成的验证者客户端市场,具有强大的领导影响力,笔者之前有过详细的调研可参考:万字研报:Solana 上 MEV 的格局演进与是非功过

参与方阵容也非常强大 Triton One、SOL Strategies、Figment、Helius, Drift、Pyth、DFlow 等,显然,这是一套 Solana 官方以及主流项目的联合动作。

而这样的动机,其实很好理解:一边是 Solana 面对 Hyperliquid 这种“原生订单簿链”爆发性发展的压力,而 Hyperliquid 其实核心价值是非常利于做市商操作,但是 Solana 本身的开发性导致了他其实很难做针对性优化这点,但如果整个区块的交易本身都可以被定制,那就可以破局源于 Solana 线性出块的局限性,从而利于多种 Defi 场景的优化。

官方部署计划则是:初期由 Jito Labs 运行节点,少量验证者参与;中期扩展到更多节点运营商,目标覆盖 30%+ 网络质押;最终代码开源并去中心化治理。

再加上行业对“可验证的公平”的叙事趋势,BAM 这个方向很容易获得验证者与协议方的支持,所以笔者认为,他更多是立足在追求 TEE + PBS 这些公平性优化的理念上的,为背景推出的。

怎样的原理实现:

另外,要理解他的价值,还需要了解 Solana 本身的 POH 算法的一个特性。

即他的的出块其实是逐步的线性的(一个 slot 400 ms 下有 64 个 tips 时间段,每个时间段到了,就把当前的交易发出去,且除非回滚不再变更),和以太坊“排好整个区块,先共识,再同步”的模式不一样。

那通过这 BAM 套系统,作为 jito 其实可以轻易升级大量验证者的客户端,从而提升 BAM 系统被验证者接受的占比。

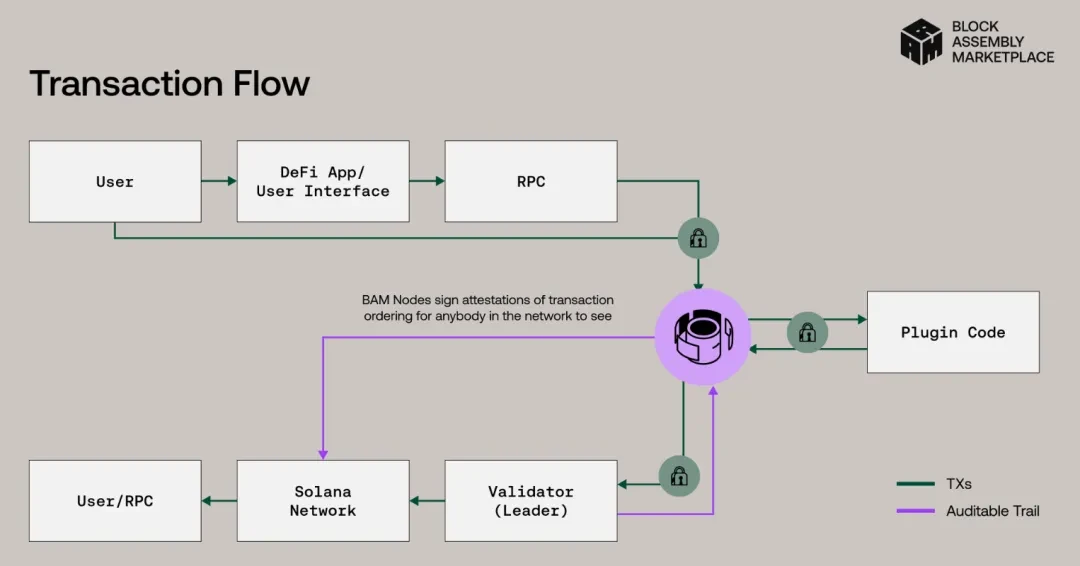

再看 BAM 的系统结构如下图,中间紫色的部分,以及右侧 Plugin code 的部分就是 BAM 了

他就会让 Solana 上的交易就不是一笔一笔地往 Leader 塞,而是先在 TEE (可信计算环境)里把“这一整个区块”的交易顺序排好(结合 Plugin code 实现的固定的一些排序规则),再一次性交给验证者。

而验证者也要最终给到 TEE 证明,说明了他确实把区块的空间(排他性)都给到这个订单流市场里。

这里,比较有特色的是插件功能,能把规则“写死”到 Tee 的交易订单排序里。其实很有实际应用意义:

比如:预言机的平台是有需求要把的价格更新固定排在一个区块的第一笔,这样可以减少更新链上价格的交易的随机性,也就避免了因为价格更新不及时导致的问题。又比如对于 dex,可以写个插件,去识别高概率失败的交易直接在 Tee 内就不打包,然后逐渐等待交易过期,从而减少失败产生的手续费。

他与现有 Solana 出块流程的系统,可以做到并存:依旧是普通订单流、Jito bundle、BAM 三套并行。BAM 是“在某个区块里只收 BAM 的整块”。

如何评价他:

笔者认为:这是“阵容强、叙事强、场景聚焦”的一条路,但要它成为主流市场路径,我不乐观。

与以太坊上的 Builder net 以及呼声很高的 mev share 也一样发展多年难以前进的理由类似。

因为现实,TEE 成本高、QPS 上限也就千级(2013 年时候,Tee 才 128 M 内存,现在已经是发展很多了,但也只能 QPS 千级),虽然如今以太坊上已经有 40%的区块由 TEE 构建。

然而 Solana 数据和计算的吞吐量在那里摆着,你得堆很多 TEE 才能兜住量,外加容灾、内存、带宽全套运维。如果这套项目没有持续的经济激励,这事儿很难跑出正收益。

其实 Jito 的收益并不高(对比链上高收益的协议而言),比如仅在 2025 年第二季度,Jito 就通过 tips 也只赚取了 22,391.31 SOL(约合 400 万美元)。一旦 Solana 巨大的交易规模迁移过去,Tee 的宕机也就必然,并且 Tee 还有内存宕机即存储清空等诸多特性,会加大宕机的风险,带来大面积交易消失的风险。

但它有“杀手级高价卖点的可能”:比如预言机定序、失败免付,都是“能看得见”的体验红利。做市商、企业级交易端会买单。而且参与其中也有 Solana 官方在理念上的配合,是个赚声量的好路子。

最后:BAM 本身的定位也不是 7 x 24 全天候吞吐那个量,它是“给关键区块做确定性保障”的工具,但是很多确定性保障,依赖于绝对确定性,而不是 30%的的确定性,不是 100%的情况下,即使是 99%,也是 0%,这就是最终 web 3 大项目方决策的关键。

BRC 2.0|“映射 EVM”:由 BTC 驱动的可编程能力

他是什么:

2025 年的 9 月 2 号会激活,我理解为这是一个“BTC 驱动、EVM 执行”的双链影子系统。注意,他不是 BRC 20,而是 BRC 第二代的意思,关于 BRC 20 的背景可以参考:解读比特币 Oridinals 协议与 BRC 20 标准 原理创新与局限

而 2.0 的核心是,你在 BTC 上用 inscription 或者 commit-reveal 写“指令”,在索引器里跑一个“魔改版 EVM”去执行对应的部署与调用。EVM 里不收 gas(参数留着但不计价),手续费用算在 BTC 交易上。

基本和 Alkanes 协议(甲烷)类似,甲烷是基于 btc 的 op-return 字段写入交易指令,跑在 WASN 虚拟机里,而他则是跑在 EVM 里。

由谁、怎样的背景推出:

发起方背景是:在 btc 铭文时代火起来的 bestinslot 平台,延续 BRC-20 的思路:不动 BTC 共识,尽量把“可编程性”叠上去。

行业背景是:这两年(其实是前两年) BTC 可编程/L 2 的叙事火,大家都在找能跑通的工程路径,但是市场的风口和开发的进度中间的 gap 实在太大了,导致到今年才有 brc 2.0 以及 alkanes 这样的任意变成的模式出现。

市场声量有些局限,因为 btc 的舞台一直都是没有聚合性的一股力量去引导,并且很多协议都可以在其他协议上衍生,所以其实 brc 2.0 很有可能和 brc 20,这两者没有实际的关系。

怎样的原理实现:

他是在索引器里,并不是 BTC 链上也不是单独一条链,去运作 EVM 的逻辑,注意他不算是个链,因为没有共识。

用户要控制的 EVM 上的地址,则是通过把用户本身的 BTC 地址做哈希,再映射成“虚拟的 EVM 地址”。

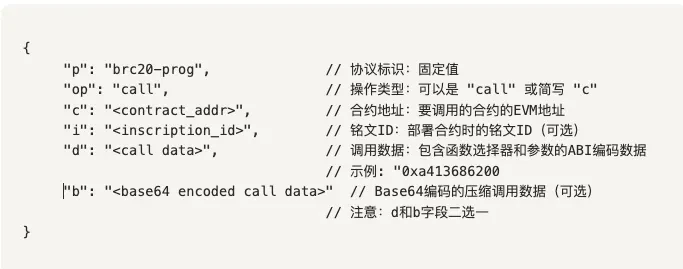

要操作这套系统,其实和 BRC 20 做资产控制的逻辑很相似的,都是一个 json 字符串而已,brc 2.0 里 ,定义如下:

可以看出来,就是你在 BTC 上编码进指令,有各种字节码/调用数据带上去,它在 EVM 里被重放执行。

而且签名与 Gas 也改了:让 EVM 层 gasPrice=0,仅作资源上限;实际手续费在 BTC 交易费中体现。

其实这样是很有风险的,我当时专门让 AI 从他们节点代码里找了一遍,发现没看到“调用深度/步数限制”的保护。所以理论上一个“无限递归/自调用”的合约,可能把这台 VM 拖到宕机(当然,这个保护并不难补:设置最大深度就好)。

如何评价他:

首先,他还是懂得取名字的,起码 brc 2.0 的声量上,会比新造一个协议名词更好,这也是最近 RGB 再次有声音了一样。

其次他也不算和 brc 20 完全无关,毕竟他的协议设计理念,字段模式,基本一样,但是这也不算什么版权。不过并没有看到 brc 20 的原作者站台,所以关联应该也不大。

最后,一切探索出可编程性的平台,可能都想要分享这份世界级共识的价值,然而笔者认为,其实 BTC 并不应该去追求可编程性这件事,因为怎么追求一定是赶不上各种高速链在功能、体验上的优化了。

而且,一旦可编程性哪怕是内置在 btc 本身上,那将会反而打破他估值陷阱,一个能被实际应用的项目,就能基于 PE 做估值,但是现在的 BTC 强就是强在他是限量供需模型,限量供需则无法被估值,所以有价格,再伴随价格有共识,所以也正是 BTC 本身的局限性反而成就了 BTC 本身。

EIP-7999 | 以太坊多维费用市场提案

他是什么:

由 Vitalik 牵头提出的提案,那必然是值得一看了,另外,在最新的 EIP 中,已经从 EIP-0000 被改名为 EIP-7999,所以本文先保持两者均可。

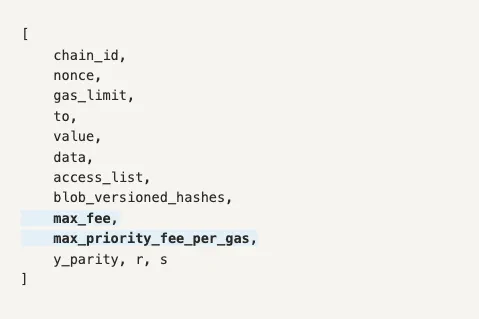

这是一个针对在 EIP-4844 之后,引发“交易费用分裂”(即一笔交易中 blob 有 blob 的价、calldata 有它的价、执行还有 eip-1559 的价格)背景下,提出的一套“总价上限 + 多资源价格向量”的新交易类型。

你可以理解为:一次性把所有资源的报价打包,统一语义地出价,目的是解决链上定价维度太多的问题。

由谁、怎样的背景推出:

方向由 Vitalik 多次文章推动。此前还有“4 个 0”的 EIP 后来编号改到了 7999 的段落里,名字没有那么惊艳了,并且这个方向也是 Vitalik 多次发文的思考,从 2022、2024 年的帖子都看到他思考的变迁。

为什么现在提?

因为钱包、路由、拍价器已经明显感受到“多价格体系”的割裂体验:每个区块只有 6 个 blob,所以要使用 blob 的交易,则需要竞价;而交易本身还在 eip-1559 里;还有从 2015 年开始的 calldata 还有 0/非 0 字节不同的单价……L 2 的开发同学已经被逼到墙角了,因为他们必须为每个资源维度设置独立的费用上限,任何一个维度设置过低都会导致整个交易失败,即使用户的总费用预算充足,也可能因为某个资源的基础费用突然上涨而无法执行交易。

怎样的原理实现:

该提案计划通过引入统一的多维费用市场,核心设计是让用户只需设置一个单一的 max_fee 参数(取代不同字段上多个 max_fee_per_gas),而 EVM 执行过程中会自动将这笔费用在不同资源(EVM gas、blob gas、calldata gas)之间进行动态分配。

要实现这点,肯定不容易,他计划是引入一个新的交易类型,其字段如下:

显然,这个设计还是好一些的,毕竟笔者见识了 ERC-4337 的 Gas 费设计后,对不下来那可太复杂了。

详情可见:从 4337 到 7702:深入解读以太坊账号抽象赛道的过去与未来

如何评价他:

笔者认为,这个方向没问题,而且是有统一费用意义,对于往后做 L 2/L 3 的时候会轻松很多,非常符合现在 L 2 的以太坊大战略方向。

但复杂度会明显上来,工程推进也需要更稳的节奏。因为这套提案会把 区块头、RLP 编码、limit 等都会相应变化,这不只是硬分叉级别的改动,还要引发全链路其他平台的适配,尤其一堆的钱包。

虽然他们可以不支持这种交易类型,但是得解析这种交易的状态。

所以短期肯定不会落地,至少 1-2 个大硬分叉之后才有可能,不过 Vitalik 讲费用市场的两篇文章是非常深刻的经济学方面的思考,值得细看。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。