Ethereum’s transaction volume has been overall on an upward trajectory, closing in its all time high of 1.9 million transactions in a single day in January 2024.

The latest surge is drawing attention from both retail traders and institutional observers, as it reflects a confluence of technical improvements, favorable market sentiment, and a renewed appetite for on-chain activity.

According to data from Etherscan, daily transaction counts have been consistently trending higher over the past several weeks. Other data shows seven-day averages of daily transactions have already surpassed their previous records.

Analysts suggest that this momentum is being fueled by a combination of factors: a recent increase in network capacity, rising ether prices, and a reduction in transaction costs, particularly for decentralized finance (DeFi) protocols and stablecoin transfers.

One of the biggest enablers of the current spike has been a substantial capacity boost on Ethereum’s mainnet. The Fidelity Digital Assets Research Team told CoinDesk that “Ethereum’s Layer 1 is seeing a surge in transactions largely due to a 50% increase in the gas limit since March, which allows more transactions to fit into each block.” This upgrade has significantly increased throughput, enabling more efficient settlement and reducing congestion. As a result, stablecoin transfer costs have fallen consistently below a dollar, making DeFi activity and peer-to-peer payments far more affordable. Fidelity notes that DeFi currently tops the charts for ETH burns, underlining its central role in driving network activity.

Another major driver is ether’s recent price rally, which has rekindled speculative interest across the crypto market. “The surge in Ethereum transactions is largely the result of a sharp price increase over a relatively short period of time,” said Ray Youssef, CEO of crypto app NoOnes. He compared the mood to the early stages of “alt-season,” a period when traders flock to alternative cryptocurrencies, often creating a feedback loop of rising activity and prices. The mid-year gains, which saw ETH cross $4,200 over the weekend, have sparked a surge in speculative trades, liquidity provision, and strategic token movements across decentralized platforms.

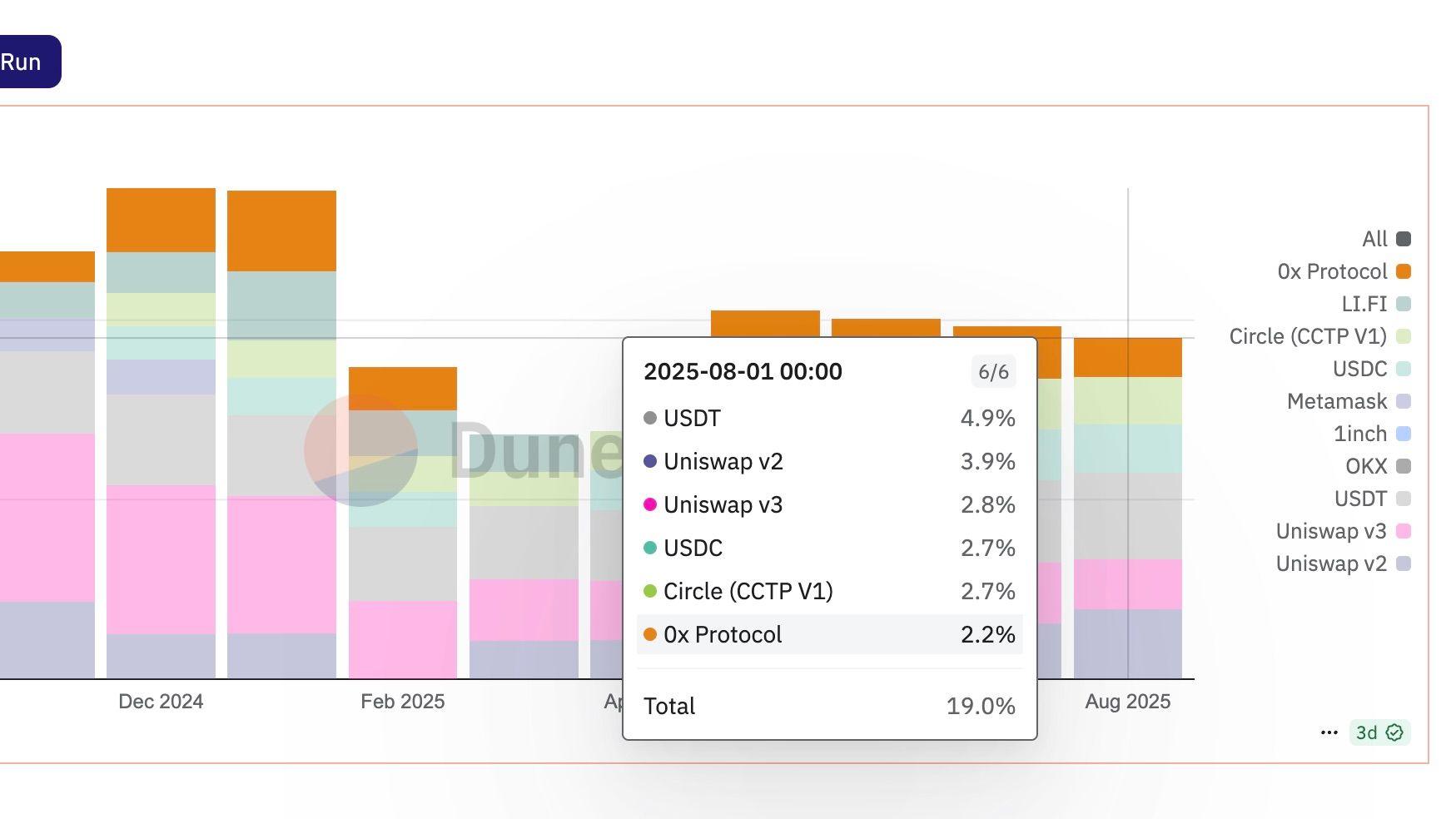

Messari’s Jake Koch-Gallup pointed out that Uniswap swaps, as well as USDT and USDC transfers, remain consistently among the top five gas consumers on the network. This underscores that decentralized exchanges (DEXs) and stablecoin usage continue to be the main engines of demand. “Rising prices tend to pull more participants on-chain, driven by speculative trading, renewed incentive programs, increased L2 usage, and deeper liquidity. These dynamics all contribute to higher Layer 1 transaction volume, both directly and through settlement,” Koch-Gallup told CoinDesk.

Beyond traders and DeFi users, corporate participation is also helping shape the current landscape. “Seeing a green light from regulators, companies are eager to jump on what they see as the ‘last car of the crypto train,’” Youssef said. He suggested that this corporate inflow is providing a more stable foundation for Ethereum’s financial and transactional ecosystem, even if the alt-season effect fades over time. While corporate ETH accumulation adds to long-term demand, Koch-Gallup cautioned that it has little direct impact on immediate transaction counts.

The network’s present momentum suggests Ethereum could be on track to continue to set new all-time highs in daily transactions in the coming weeks. Fidelity observed that the rise in activity demonstrates that demand for block space is keeping pace with the increased supply, an encouraging sign for the ecosystem’s health. However, sustaining this trend will likely require more than just favorable market sentiment.

Koch-Gallup also offered a note of caution. “With blob fees near zero and lower demand for Layer 1 execution, ETH burn has slowed and net supply has periodically turned inflationary,” he said. “Sustaining this trend likely depends on either a resurgence in fee-generating mainnet activity or better mechanisms for L2s to feed value back to Ethereum.” This issue, how the protocol can capture more of the value generated by the activity it secures, is central to ongoing discussions about Ethereum’s evolution.

As the network continues to mature, stakeholders from DeFi innovators to institutional investors are watching closely to see whether this surge will mark the beginning of a sustained growth phase, or a temporary peak driven by speculative heat.

Looking ahead, Ethereum’s roadmap includes further scaling proposals such as PeerDAS and improved Layer 2 integration, which could help alleviate bottlenecks and create a more sustainable environment for high transaction volumes.

For now, the data is telling: transaction counts are climbing, fees for everyday DeFi use are down, and participation across both retail and corporate segments is strong. Whether Ethereum can translate this momentum into lasting adoption and ecosystem resilience may well define its trajectory for the coming months.

Read more: Ethereum Transactions Hit Record High as Staking, SEC Clarity Fuel ETH Rally

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。