On Aug. 8, 2025, ethereum’s (ETH) market capitalization stands at $470.8 billion, representing 12.2% of the $3.87 trillion crypto economy. Over the past 24 hours, $32.5 billion in ETH trades have been recorded, with the intraday range spanning $3,806 to $3,972. The rally also triggered heavy derivatives liquidations, totaling $103.10 million in ETH positions — $76.15 million of which were short bets — leading the broader crypto market’s $284.58 million in liquidations.

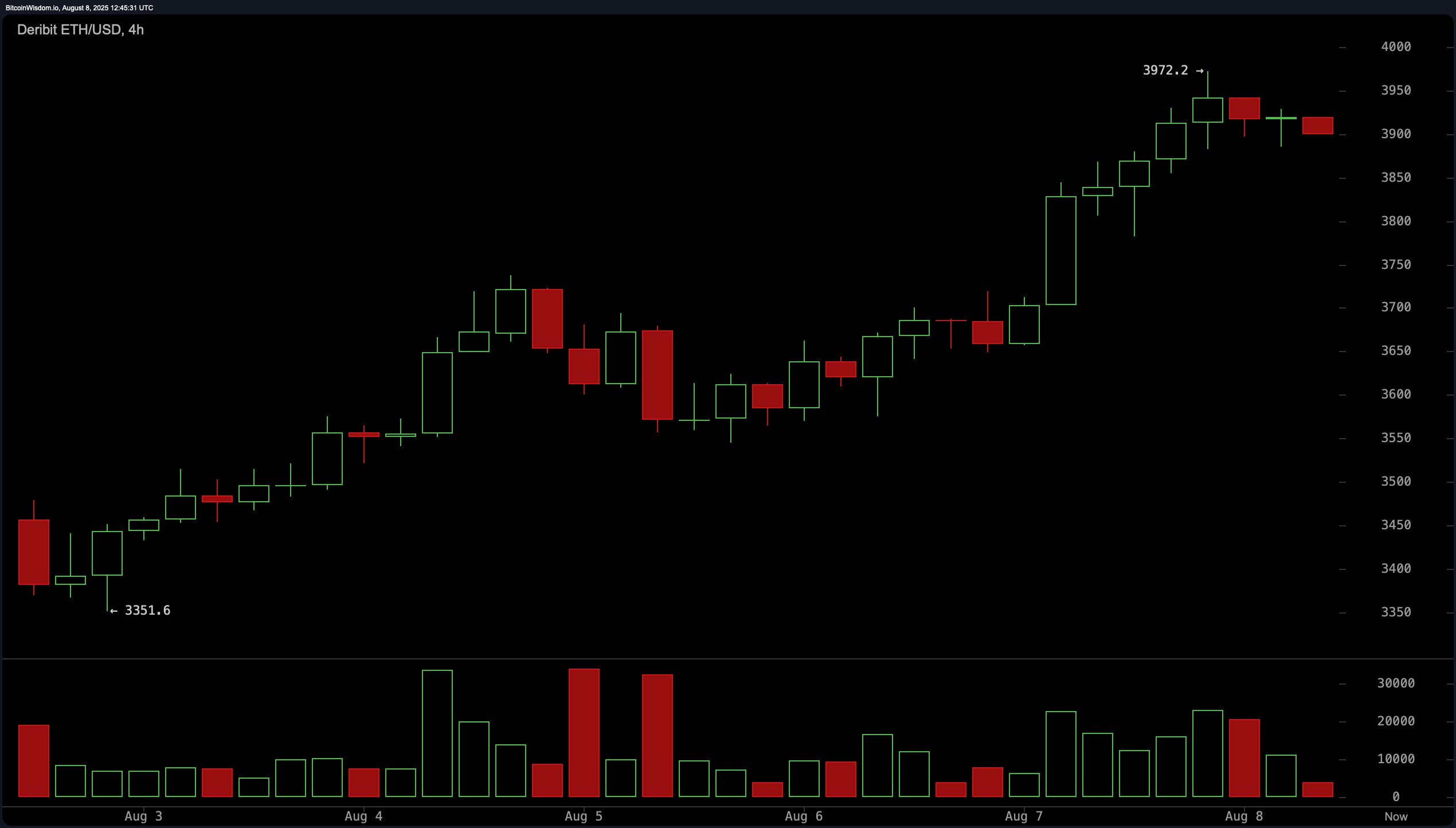

The 4-hour chart shows ethereum rebounding from $3,351 on Aug. 3 to near $3,972 earlier today, marking a steady upward grind with several high-volume breakout candles. Consolidation is now occurring near the highs. On the daily chart, ETH has climbed from $2,475 in late July, pausing at minor resistance levels before accelerating toward the $4,000 mark.

ETH/USD via Deribit on Aug. 8, 2025, 4-hour chart.

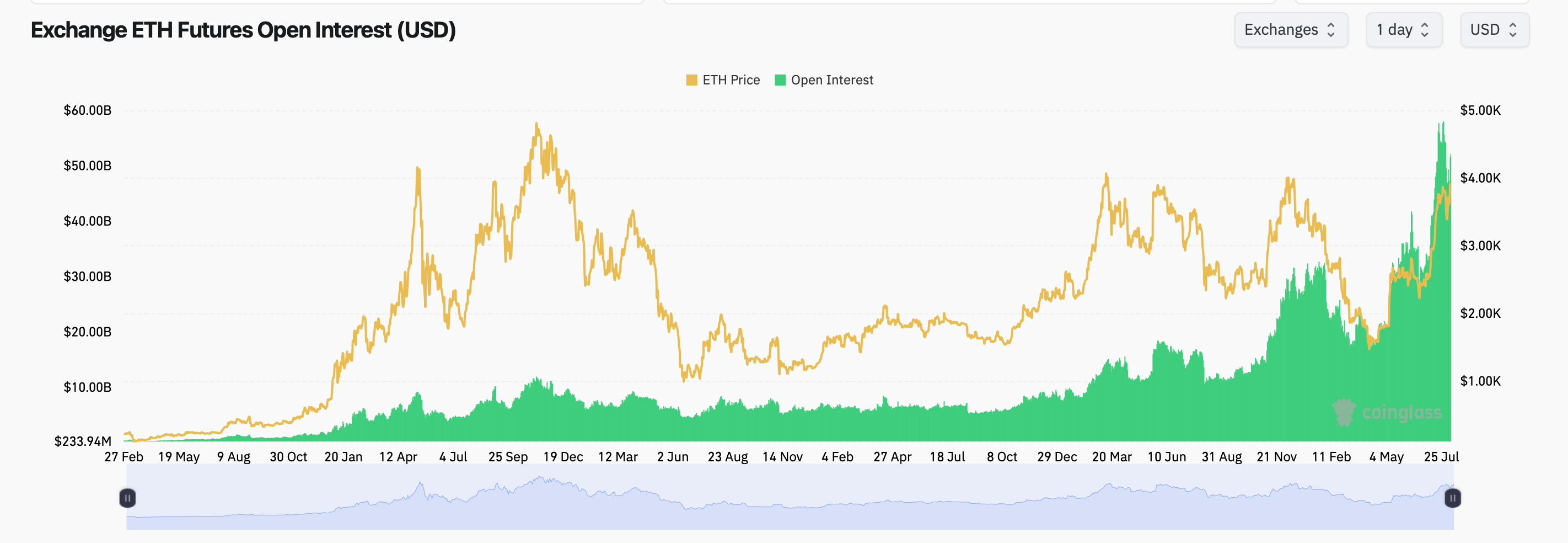

ETH futures open interest has reached $52.19 billion (13.38 million ETH), with the largest concentrations on CME, Binance, and Bybit. CME holds 1.63 million ETH in OI ($6.35 billion), Binance 2.64 million ETH ($10.30 billion), and Bybit 1.23 million ETH ($4.78 billion). Other top exchanges include OKX, Gate, Bitget, WhiteBIT, Kucoin, BingX, and MEXC.

Open interest changes over the last 24 hours show gains for CME (+6.71%), Binance (+1.87%), and Bybit (+3.42%), while OKX, Gate, and KuCoin posted declines. The OI-to-volume ratio is highest on CME at 1.6627, reflecting deep institutional positioning.

In ETH options, total open interest is skewed toward calls at 67.46% (2.045 million ETH) versus 32.54% in puts (986,253 ETH). Over the last day, calls accounted for 57.11% of trading volume (288,565 ETH), while puts comprised 42.89% (216,753 ETH).

Top ETH options by open interest include the Dec. 26, 2025, $6,000 calls (60,644 ETH) and Sept. 26, 2025, $4,000 calls (54,738 ETH). The most actively traded options in the past 24 hours were the Dec. 26, 2025, $4,000 calls (25,626 ETH) and the Sept. 26, 2025, $3,200 calls (20,004 ETH).

With both futures and options markets showing concentrated call interest, the derivatives structure suggests a bullish bias heading into the year’s final quarter. However, high open interest and elevated liquidation activity could amplify volatility if price momentum shifts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。