Dissecting Head Lending Agreements + ETH/SOL Staking Leaders' Financial Statements, Revealing the Truth Behind Project Operations from a Data Perspective.

Written by: @chingchalong02

TL;DR

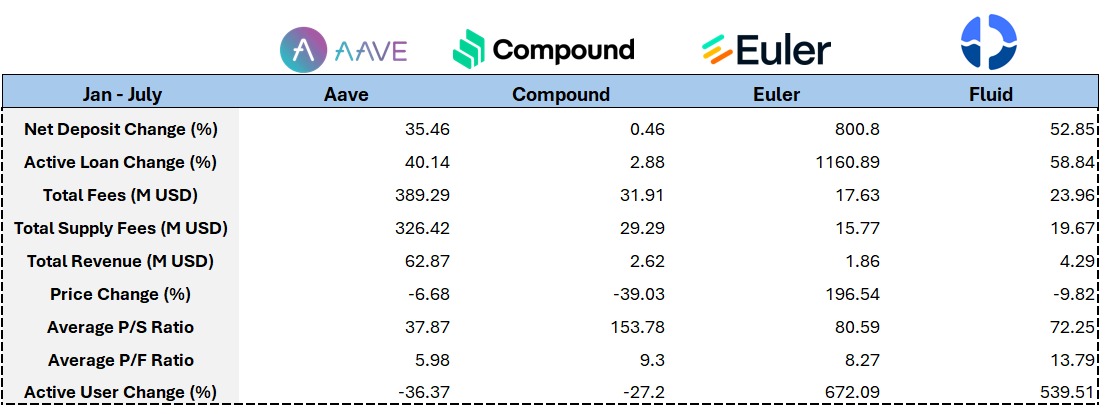

- Circular lending has become a mainstream DeFi play, driving the fundamentals of underlying lending facility platforms and eliminating lending agreements that cannot keep up with trends.

- Euler Finance has surged with its EVK framework allowing anyone to deploy lending vaults, leading to a significant increase in fundamentals and token price; future deployment of RWA asset lending will serve as another catalyst.

- Aave has benefited from the launch of USDe + PT-USDe, the Umbrella mechanism, and GHO cross-chain issuance, with various metrics showing steady growth in the first half of the year.

- Lido Finance's revenue model gives the project a seemingly prosperous appearance, while future prospects are opened up by Wall Street's demand for ETH staking yields.

- Jito, with its MEV infrastructure capabilities, the leading position of jitoSOL, and the future development of re-staking applications on Jito, is expected to perform strongly starting Q2 2025.

Where do lending protocols derive their fees?

Generally, fees come from the total interest paid on all loan positions, whether they are open, closed, or liquidated. This interest income will be distributed proportionally between liquidity providers and the DAO treasury.

Additionally, when a borrowing position exceeds its set LTV limit, the lending protocol allows liquidators to execute liquidation on that position. Each type of asset corresponds to specific liquidation penalties, and the protocol obtains the collateralized assets for auction or the "liquidation" mechanism of Fluid.

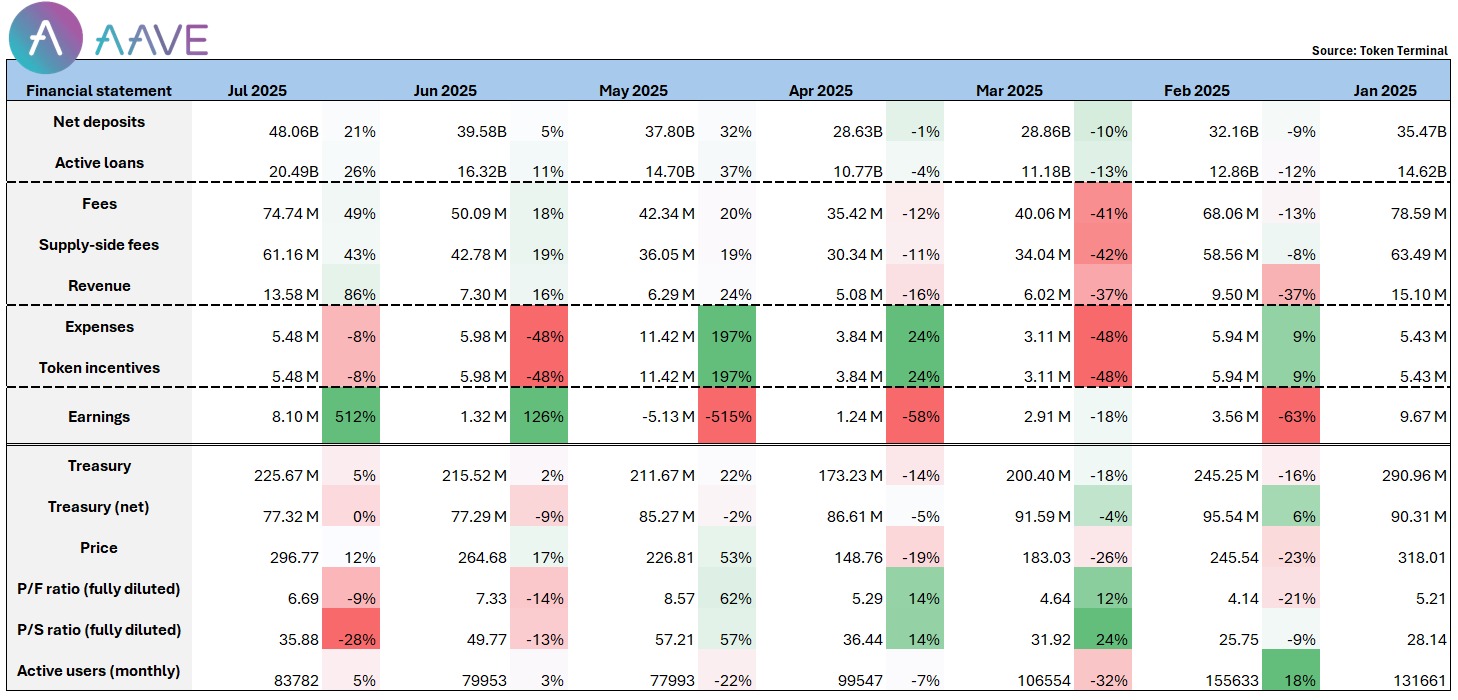

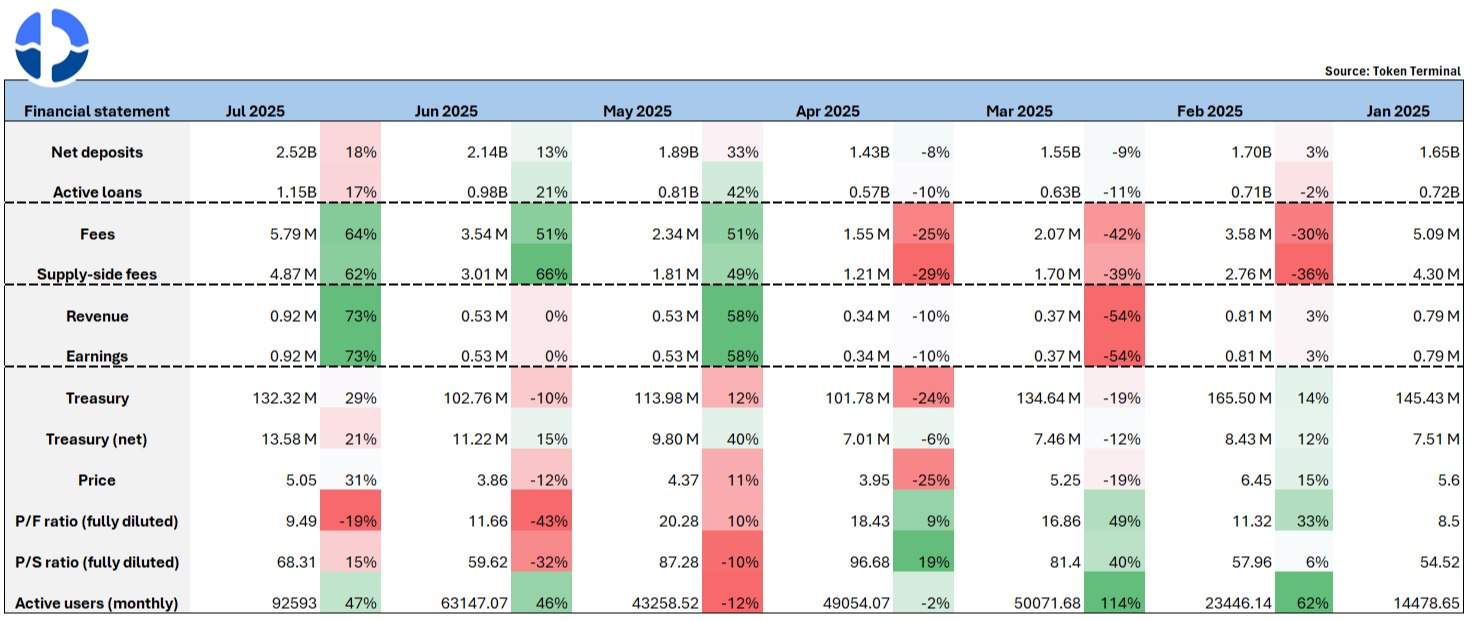

What can we see from Aave's financial statements?

@aave's protocol fees and revenue peaked at the beginning of the year, then gradually declined alongside the market correction. I believe the rebound in data after May is mainly due to the launch of USDe + PT-USDe, as the most significant circular lending demand in this round is driven by Pendle's PT assets and the stablecoin launched by Ethena.

Data shows that nearly $100 million in supply was quickly deposited into the Aave market at the early stage of PT-sUSDe's launch.

Moreover, the Umbrella mechanism was officially activated in June, attracting approximately $300M in funds for deposit protection. At the same time, the cross-chain issuance scale of Aave's native stablecoin GHO continues to grow (current circulation ~$200M), and its multi-chain application scenarios are constantly expanding.

With multiple favorable factors, Aave experienced a comprehensive breakthrough in July:

- Net deposits surpassed $4.8 billion, ranking first across the network;

- The protocol's net profit surged nearly 5 times month-on-month in June, reaching ~$8M;

- Based on price-to-sales and price-to-earnings ratios, Aave remains an undervalued project in the sector.

Given the current growth trend and product maturity, it is expected that more traditional institutions will choose Aave as their DeFi platform. In terms of fee income, TVL, and protocol profitability, Aave is likely to continue setting new highs, solidifying its position as a DeFi leader.

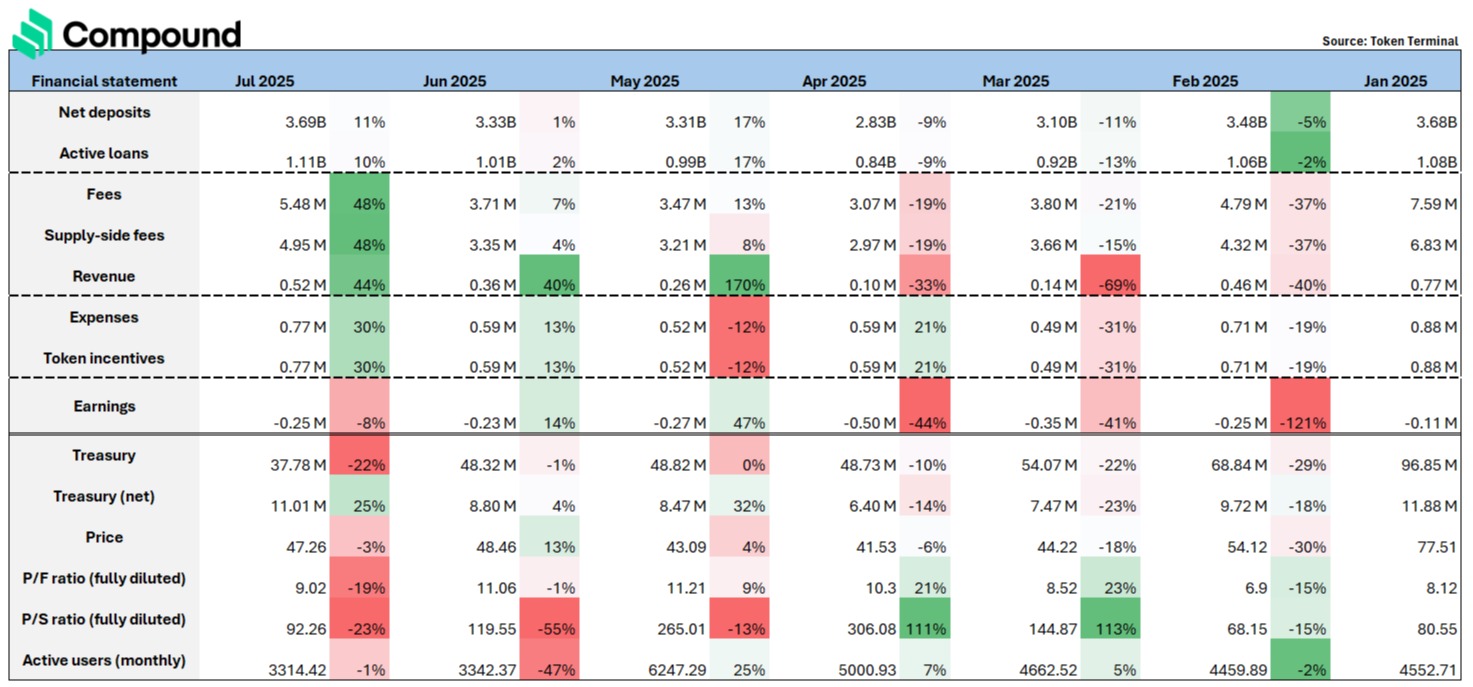

Are there signs of decline in Compound's financial statements?

@compoundfinance, while also an established lending protocol, is clearly less flexible than Aave in terms of asset diversity and market sensitivity. Aave closely follows market trends and has launched various re-staked ETH (such as rETH, ETHx, cbETH), staked BTC (such as lBTC, tBTC), and Pendle's PT assets, none of which are supported on Compound.

Due to the limitations in asset support, Compound's lending play is relatively singular, lacking the application scenarios and combination strategies of circular lending, resulting in low user stickiness and capital utilization. From a financial performance perspective, Compound has recorded continuous losses from the beginning of 2025 to the present, with net earnings maintaining in the range of -$0.11M to -$0.25M, while its token price has also cumulatively dropped by about 40%.

In the current DeFi ecosystem, circular lending has become a foundational application, giving rise to underlying lending protocols focused on supporting complex leverage structures and combination strategies, such as @EulerFinance, @MorphoLabs, and @SiloFinance. The lack of support for such use cases means that Compound is gradually losing a segment of mainstream circular lending users.

Financial statements also show that Compound's TVL has only slightly increased over the past six months (+0.46%), and the protocol's revenue has not shown significant improvement, with the overall growth gap between it and @Aave continuing to widen. This reflects its lagging issues in product evolution and ecosystem integration; if it cannot accelerate its pace in asset support and functional expansion, it may further marginalize itself in the mainstream DeFi lending space.

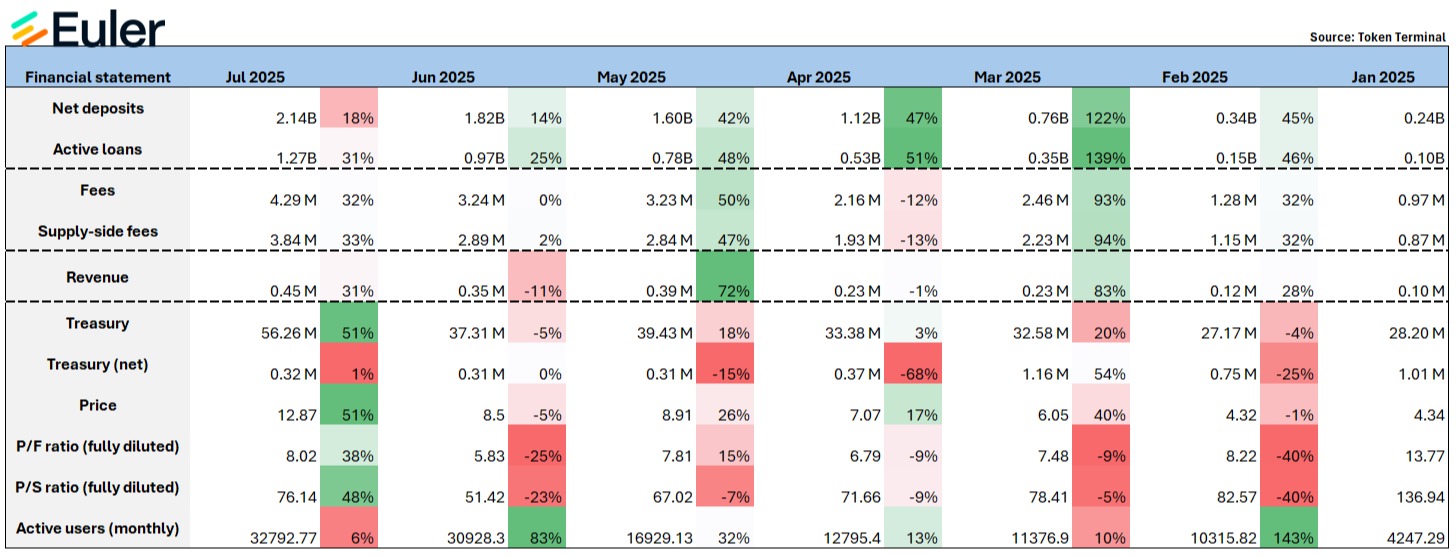

Euler's TVL/Revenue/Coin Price All Show Significant Increases

@eulerfinance's standout feature is that it allows any developer or protocol to build their own vault based on the EVK (Euler Vault Kit) and integrate into the Euler credit ecosystem. This capability aligns perfectly with the mainstream play of the circular lending market, allowing various long-tail assets to be deployed on Euler for lending, significantly increasing the project's revenue sources and enhancing user engagement in lending.

Similar to Aave, after launching the largest circular lending asset PT-USDe in April this year, Euler's monthly revenue and TVL recorded approximately 72% and 42% growth, respectively, demonstrating strong performance.

From the overall performance in the first half of the year, Euler is one of the fastest-growing protocols in terms of TVL and active lending, with TVL increasing by as much as 800% and active lending volume achieving a staggering 1160% growth, making a strong breakout in the lending sector.

The project is also actively collaborating with projects and incentive platforms that have airdrop activities (such as @TurtleDotXYZ, @Merkl_XYZ), closely aligning with another important trend in this cycle—points and airdrop economic models, further enhancing users' willingness to deposit and lend on the platform through incentive mechanisms.

This strategy has proven effective: protocol fees increased from $0.1M to $0.45M, and the token price also achieved approximately 200% growth during the same period.

As a modular, composable, and permissionless credit infrastructure, the potential of EVK goes far beyond the current stage. If the team can successfully introduce another market hotspot—RWA assets—into the Euler lending framework, its TVL growth space is expected to exhibit geometric expansion.

Fluid's Technical Barriers Bring Optimism for Fundamental Growth

@0xFluid is currently the emerging protocol with the second-fastest growth rate in the lending field, with TVL increasing by approximately 53% from the beginning of the year, and its current locked scale is nearly on par with Euler. Its rapid rise as a dark horse is primarily due to its innovative lending mechanism design and superior capital efficiency.

Smart collateral & smart debt are the project's biggest technical barriers, allowing users to directly collateralize LP assets (such as ETH/wstETH, USDT/USDC), and the debt borrowed is not a single asset but constructed as an automatically adjusting pair of LP assets. After borrowing, the debt will be deployed to liquidity markets for trading, bringing returns to users (reducing actual borrowing costs).

This design further optimizes borrowers' interest expenses, with lending rates generally lower than traditional models. Additionally, Fluid's average supported LTV limit is higher than Aave's, and the liquidation penalty is only 3% (compared to Aave's 5%), with overall capital efficiency performance close to Aave's e-mode.

Furthermore, Fluid naturally supports "one-click circular lending," with this feature already built into the front end, suitable for collateralizing ETH to borrow stablecoins and re-collateralization operations; due to relatively attractive deposit rates, even large users choose to deposit substantial funds long-term, seeking stable annualized returns.

Aave also participated in Fluid's token investment early on, purchasing FUID tokens with $4M and promoting the integration of its stablecoin GHO into the Fluid protocol pool. This move not only recognizes Fluid's product model but also represents its competitors' positive bets on its growth potential.

The protocol's revenue increased slightly from $790K to $930K in the first half of the year, with financial conditions steadily improving; however, the token price slightly declined during the same period, mainly due to a lack of significant token economic empowerment and a clear buyback mechanism. Despite the protocol's impressive performance, the token's value capture ability still needs enhancement.

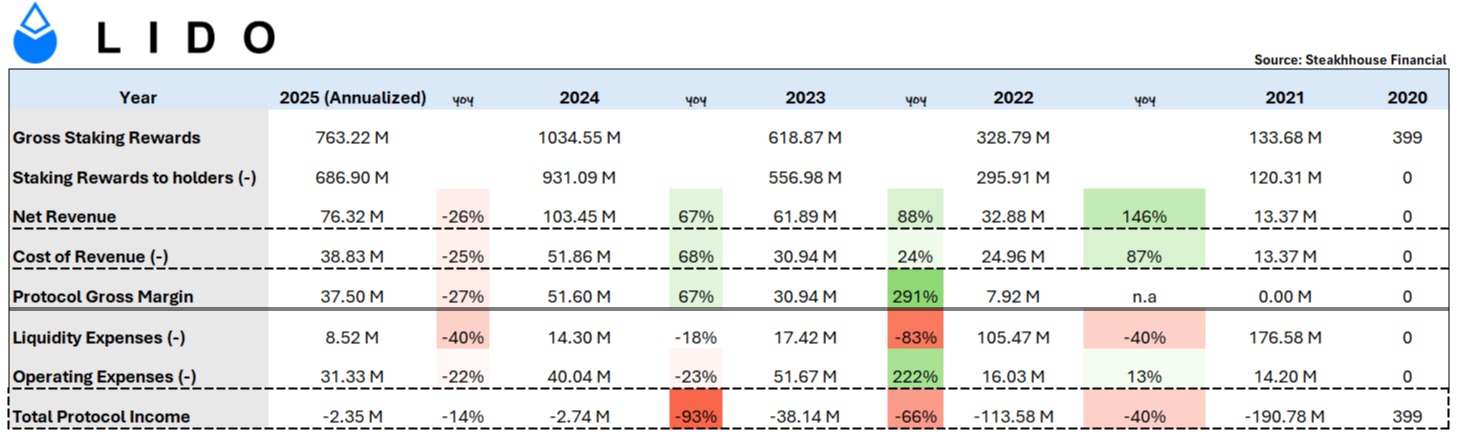

How does Lido's financial statement, dubbed ETH Beta, perform?

@LidoFinance currently has approximately 8.8M ETH staked in the protocol, valued at ~$33B, accounting for about 25% of total ETH staked and 7% of the entire ETH network. It is essentially the project with the largest "holding" of ETH in the industry (sharplink: ~440K ETH; bitmine ~833K ETH).

As the "leader in the ETH staking sector" - this narrative is inevitably seen as ETH Beta, but the project has faced a significant issue since its inception - it has never been profitable in its five-year history.

To dissect the reasons, we must start with the detailed lines of the financial statements.

Staking Rewards to holders: Lido's role is merely to aggregate retail investors' ETH and set up validation nodes, subsequently distributing staking rewards to retail investors proportionally.

In other words, a significant portion of Lido's rewards is not held by itself. For example, in 2024, Lido earned $1.034B in staking rewards for the entire year, of which $931M was essentially distributed to stakers, in accordance with Lido's protocol fee terms - stakers (90%), node operators (5%), and Lido DAO treasury (5%).

Cost of Revenue: This refers to node rewards + slashing rewards, as the cost of slashing is borne by Lido.

Liquidity Expense: The wash fees incurred from LP contributions.

Operational Expense: LEGO Grant + TRP (Token Rewards Plan) are two funding and incentive frameworks for the ecosystem. The former is an external funding program supporting community or developer proposals that benefit Lido; the latter is an internal token incentive program used to reward core contributors to the DAO.

The positive aspect is that Lido has improved in controlling costs in recent years, with Liquidity Expense decreasing annually to about $8.5M in 2025, and Operating Expense also decreasing by approximately 20% year-on-year since 2023. Therefore, with significant revenue growth in 2023/2024 (88%/67%) and reduced costs, the project's income loss has drastically decreased (-66%/-93%), resulting in a loss of only about $2M this year.

What is Lido's future trend?

If we say that the income level of the "leader in the ETH staking sector" still falls short, it may be too harsh, but costs are indeed decreasing year by year. What exactly is causing the continued losses? Firstly, the 10% fee is an industry standard and is unlikely to change.

The only variable is the scale of the sector - the amount of ETH staked. It is worth noting that the staking ratio of ETH compared to Solana/Sui/Avax/ADA is still relatively low. A catalyst in the broader environment - Wall Street's demand for ETH staking yields will be key, as evidenced by Blackrock's application to add staking functionality to its iShares ETH ETF.

Once there is a precedent, ETH staking will become a new source of income for institutions. For them, holding ETH positions as reserves can also earn interest, providing another cash flow source. If the preferred choice is the largest scale Lido (there is also a chance it could be Coinbase or institutional-supported staking projects like Puffer), it will be a significant moment when the ceiling of the sector opens up. Of course, as the staking rate increases, the issuance rewards of ETH will also be compressed.

We also see that some in the DAO have proposed to initiate a revenue-sharing mechanism for staking LDO to enhance the token's utility and long-term value incentives. The problem is evident; a revenue-sharing mechanism would only further weaken the project's income, which is detrimental to long-term development. Another proposal mentioned in the DAO, the "excess surplus sharing mechanism," seems more reasonable.

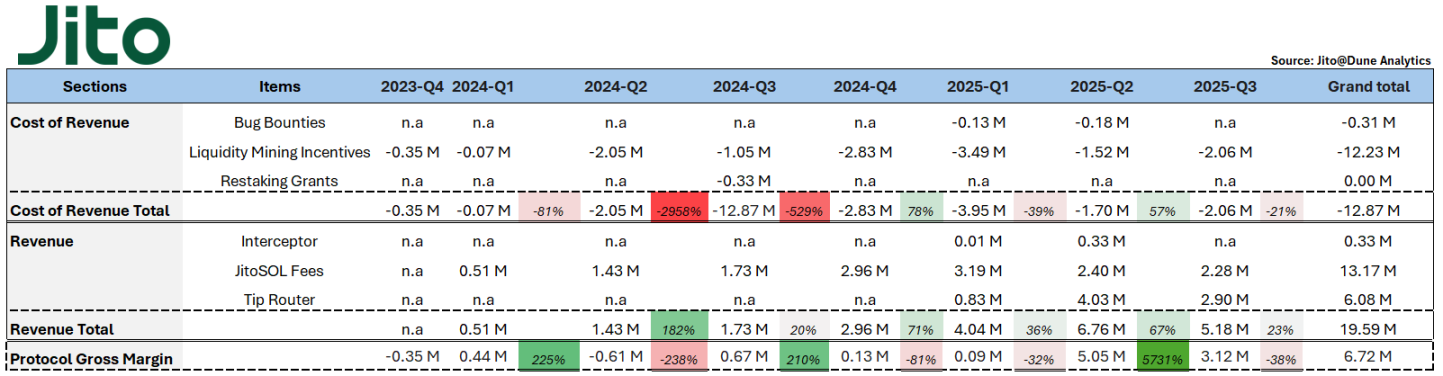

Jito's Unique Revenue Model - MEV Tips

@jito_sol, as the leader in the SOL staking sector, has at least a much better financial performance in "surface business" compared to Lido analyzed yesterday. Jito currently has a staking scale of ~16m SOL (jitoSOL), accounting for about ~23% of the entire network.

The ceiling of the sector - the staking rate of SOL is already relatively high among L1s (67.18%). Notably, Jito began providing underlying infrastructure services for liquidity re-staking in October last year, which has led to various re-staking services, with providers of VRT (Vault Receipt Tokens) operating on its infrastructure (such as @fragmetric140, @RenzoProtocol).

I personally believe that liquidity re-staking will be the main avenue for Jito to expand its business and increase revenue in the future. Currently, only about ~1.1m SOL has been re-staked, which is approximately ~6% of Jito's staked SOL and ~2% of the total staked SOL in the network. In contrast, the re-staking/staking ratio of ETH is about ~26%, indicating that there is still substantial room for growth for SOL, which is a share that Jito needs to capture.

Returning to Jito's financial report, let's first explain the project's various expenditures and revenues:

Bug Bounties: Expenditures used to encourage the discovery and reporting of protocol vulnerabilities. Valid vulnerabilities submitted by white-hat hackers can earn rewards.

Liquidity Mining Incentives: Used to reward users providing liquidity for JitoSOL or VRT trading pairs on DeFi platforms (such as Orca, Jupiter).

Restaking Grants: Issued to developers in the Node Consensus Network (NCN) ecosystem to support the development, deployment, and operation of restaking infrastructure.

Interceptor Fees: A mechanism to prevent holders of other liquidity staking protocols from maliciously short-term arbitraging JitoSOL. The JitoSOL held will be temporarily frozen for 10 hours, and if users wish to withdraw early, they can choose to pay a 10% fee.

JitoSOL Fees: JitoSOL charges a 4% management fee from staking rewards and MEV earnings (after deducting validator commissions). This translates to an annual management cost of about ~0.3% on the SOL deposited by users (7% APY * 4%).

Tip Routers: MEV accumulates as tips in each epoch and is distributed through the TipRouter, extracting 3% as protocol fees from MEV transaction tips, of which 2.7% goes to the DAO treasury, 0.15% rewards JTO stakers, and 0.15% rewards JitoSOL users.

So… what strategies can be observed in Jito's financial statements?

First, let's dissect the expenditure part. Liquidity Incentives have always been Jito's largest expenditure item, with costs surging since Q2 2024, currently maintaining wash fees of around $1M - $3M per quarter.

This primarily stems from the foundation's implementation of proposals JIP-2 + JIP-13, using $JTO for incentives in various DeFi applications (mainly at @KaminoFinance). It is evident that since Q2 2024, JitoSOL's revenue has indeed seen a significant increase, which I interpret as the benefits of using JitoSOL for DeFi-looping improving -> increasing willingness to stake SOL for JitoSOL -> more JitoSOL -> more staking income.

Starting in 2025, the foundation also proposed to continue investing 14M JTO (~$24M) into incentive measures, especially for re-staked assets and their corresponding DeFi operations, hoping to enhance the adoption rate of VRT.

As of Q3 2025, approximately ~7.7m JTO has been distributed as incentives. The effects are also quite significant, as Jito's revenue in 2025 has risen quarterly by 36%, 67%, and 23%, with the increase being higher than the distribution of incentives, proving this is a positive EV proposal.

In terms of revenue, it can be seen that JitoSOL fees + Tip Router are the two main sources of income for Jito. Since Q4 2024, benefiting from the meme craze in the Solana ecosystem, network transaction volume suddenly surged, and Jito naturally became the primary beneficiary.

At that time, the extent was so exaggerated that Jito's tips accounted for a full 41.6% to 66% of Solana's REV (Real Economic Value), and since Q2 2025, the profits from the Tip Router have also surpassed those from JitoSOL fees. This indicates that Jito's technical barrier is the MEV infrastructure, where users/arbitrageurs on Solana are willing to pay tips to increase transaction priority, a unique economic system that is rare among other public chains.

The rise in Solana's network transaction volume + the operational capabilities of MEV infrastructure + JitoSOL's leading position + the future development of re-staking applications on Jito have propelled the project's net profit to a peak in Q2 2025, rising 57 times to ~$5M. Although the current meme craze is not as frenzied as the 2024 pump.fun surge, I personally believe that if the re-staking sector of SOL matures, it will be the next catalyst for Jito.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。