Author: The DeFi Investor

Compiled by: Tim, PANews

2025 has been a very friendly year for DeFi so far.

Our regulatory environment has shifted from the hostile stance taken by the SEC under Gary Gensler to a more crypto-friendly situation today. And from almost all indicators, the adoption rate of DeFi is continuously increasing.

So I think it's time to take a closer look at 7 charts related to the current state of DeFi.

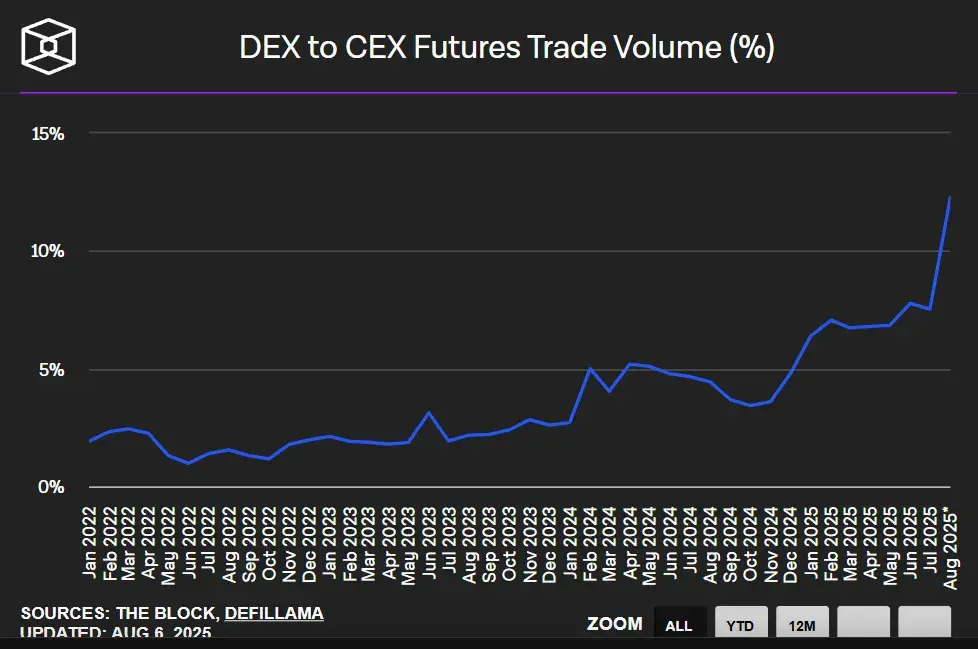

Trading Volume from Decentralized Exchanges to Centralized Exchanges Continues to Hit New Highs

Source: The Block

Although the process is slow, the trend is clear: decentralized exchanges are steadily eating into the market share of centralized exchanges.

In June 2022, the market share of perpetual DEX in the derivatives space was only 0.98%. Three years later, this figure has grown 11 times.

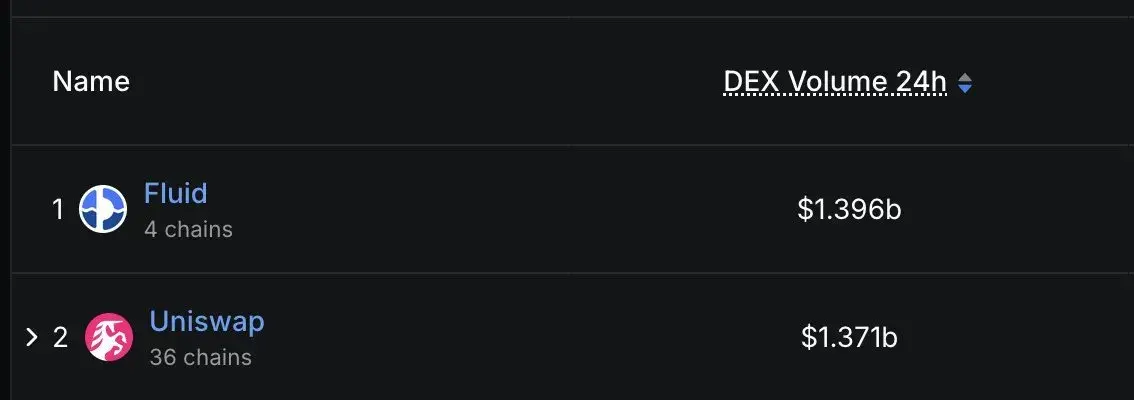

Fluid is the Fastest Growing DEX

Source: DeFiLlama

Reportedly, Fluid surpassed the leading DEX Uniswap on Ethereum in daily trading volume within less than a year of its launch.

Fluid DEX V2 is set to launch soon, and I wouldn't be surprised if Fluid ultimately wins the DEX battle on Ethereum.

In terms of capital efficiency, V2 is expected to be far superior to V1.

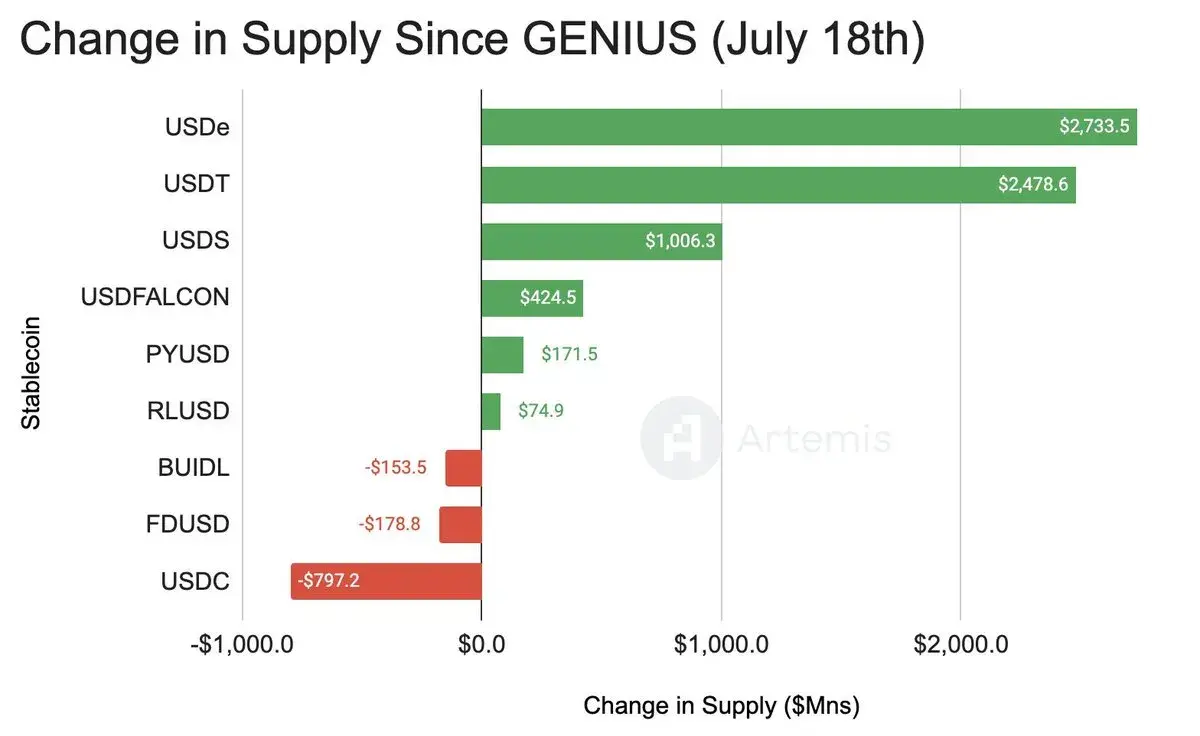

Yield-Generating Stablecoins Top Fund Inflow Charts for the First Time

Source: Artemis

Recently, the stablecoin USDe from Ethena surpassed the mainstream stablecoins USDT and USDC in net inflows over a two-week period for the first time.

Why is this change so significant?

USDT and USDC have long led the market in the stablecoin space, and now crypto-native solutions are emerging to challenge their dominance.

My prediction is that Resolv, Ethena, and Falcon Finance will continue to see exponential growth in the coming months.

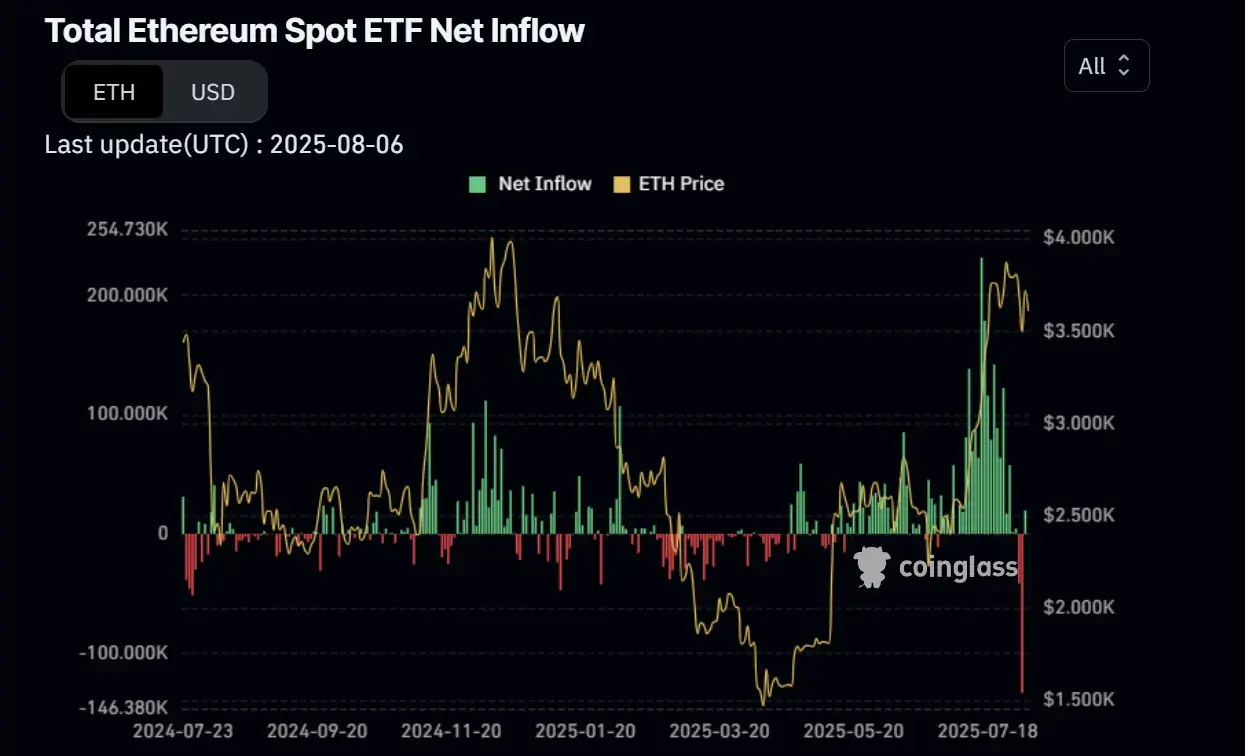

Spot Ethereum ETFs Perform Well, But Growth is Slowing

Source: Coinglass

After several weeks of setting new historical highs for daily inflows, Ethereum spot ETFs recently recorded the largest single-day outflow on record.

The reason may be that some traditional financial giants have taken profits.

However, from a macro perspective, the past two months have been the best-performing phase for spot Ethereum ETFs to date.

DeFi is Approaching AI's Share of Mind

Source: Kaito

For over a year, AI has dominated the share of mind.

But this situation is changing, as DeFi's attention has more than doubled in the past few months. Meanwhile, the attention on Meme coins has significantly decreased.

Fundamentals are becoming important again.

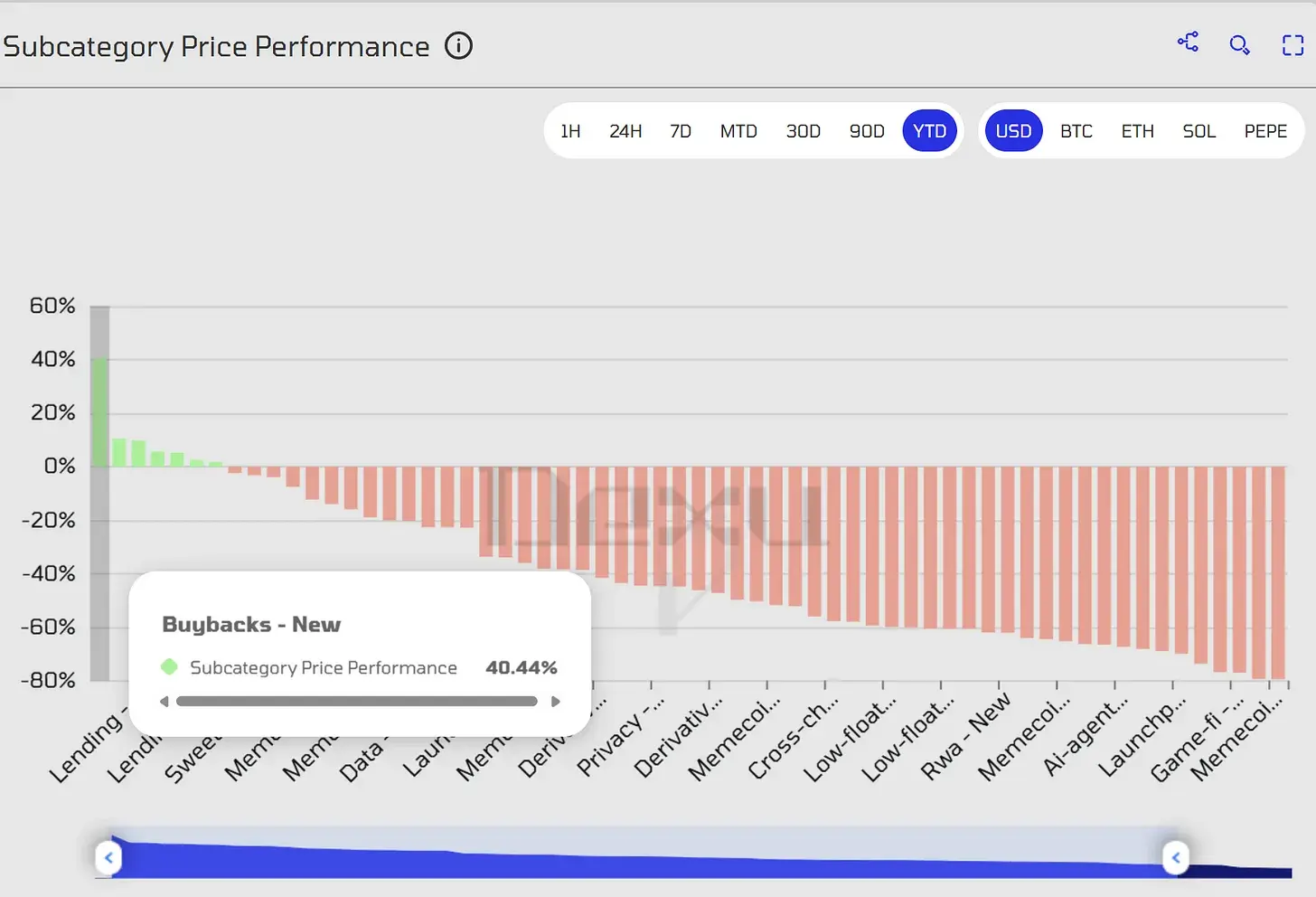

Projects with Token Buyback Plans Perform the Best in 2025

Source: Dexu AI

This marks a shift in the market's preference for fundamentally sound tokens. The subcategories of protocols conducting token buybacks include projects like Hyperliquid, PumpFun, Maple, EtherFi, Kaito, AAVE, and others.

Exchange BTC Reserves Continue to Decline

Source: Crypto Quant

Since February 2024 (shortly after the launch of the first Bitcoin spot ETFs in the U.S.), exchange BTC reserves have been continuously decreasing, which is in stark contrast to previous bull markets.

During this cycle, the inflows into Bitcoin ETFs and the purchasing demand generated by crypto asset reserve companies have had a significant positive impact on BTC prices.

In summary, these are all the data charts to present in this issue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。