Written by: BlockSec

In May 2025, the Hong Kong police dismantled a virtual asset money laundering group worth 15 million USD (approximately 117 million HKD), with the gang primarily splitting and transferring funds through OTC channels located in Tsim Sha Tsui.

Earlier, in the sensational JPEX case that shocked Hong Kong, the Commercial Crime Bureau (CCB) revealed that a significant amount of the involved funds was exchanged and transferred through local OTC shops, becoming an important link in the fraud chain.

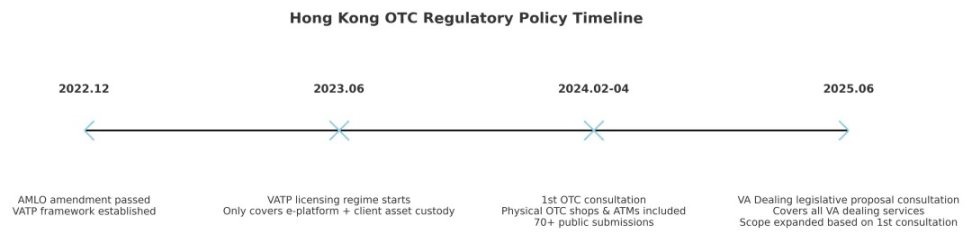

In June 2025, the Hong Kong government released a public consultation document titled "Legislative Proposal to Regulate Dealing in Virtual Assets," suggesting that all virtual asset trading services, including OTC, be included in a unified licensing regulatory framework. Although the proposal is still in the consultation stage and has not yet formed regulations, it outlines a clear blueprint for the next steps in Hong Kong's virtual asset regulation—from the early licensing of VATP platforms to the management of coin shops, and finally to comprehensive coverage of VA Dealing services.

In summary: In three years, Hong Kong's regulation has moved from the "vacuum zone" of OTC to comprehensive management.

Phase One (2023) VATP Included in Regulation, OTC Becomes "Overlooked"

At the end of 2022, Hong Kong passed the "Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance," implementing a licensing system for virtual asset trading platforms (VATP) starting in June 2023, regulated by the Securities and Futures Commission (SFC).

VA Dealing Consultation Paper, 1.3

"In December 2022, … a licensing regime for VA trading platforms (VATPs) … commenced operation in June 2023 … must be licensed by the SFC unless otherwise permitted by the law." VADEALING_consultation_…

According to the definition of VA exchange:

- Facilitating the trading of virtual assets between buyers and sellers through electronic means;

- Involves customer assets (holding, controlling, or arranging custody)

Therefore, the system at that time only targeted "electronic platform + customer asset involvement," and physical coin shops, counters, ATMs, and other OTC scenarios were not included, leading to a regulatory vacuum.

Phase Two (2024) Customs Licensing, Cryptocurrency OTC Also Requires Licensing

From February to April 2024, the Financial Services and the Treasury Bureau (FSTB) launched the first round of consultations on the "Virtual Asset Over-the-Counter Trading Service Licensing System," officially including physical OTC in regulation.

Main content:

- Anyone operating virtual asset spot trading (physical or online) in Hong Kong must be licensed;

- Licensing is handled by the Hong Kong Customs and Excise (CCE);

- Covers fiat currency exchanges and transfers such as USDT, BTC;

VA Dealing Consultation Paper, 1.6(a)-(b):

"Scope and coverage: Any person … services of spot trade of any VAs … would have to be licensed by the Commissioner of Customs and Excise (CCE). Eligibility: A licensee would be required to be a locally incorporated company …"

Phase Three (2025) OTC Incorporated into the VASP Family, Unified Regulation by SFC

In June 2025, Hong Kong released the second round of the "Legislative Proposal to Regulate Dealing in Virtual Assets," upgrading both the scope and depth of regulation:

- Expanded scope: Covers complex services such as block trading, brokerage, settlement, and asset management;

- Regulatory agency adjustment: Licensing by SFC, with HKMA regulating banking/SVF businesses;

- Principle continuation: Same business, same risk, same rules;

- Exemption arrangement: Only issuers that issue/redeem stablecoins in the primary market and have obtained HKMA permission can be exempted.

VA Dealing Consultation Paper, 1.10:

"Under the proposed regime, any person … providing the VA service of dealing in any VAs in Hong Kong is required to be licensed by or registered with the SFC… including conversion, brokerage, block trading…"

Reason for the changes: This round of proposals was formulated based on over 70 written opinions received during the first round of consultations. The government stated in the document that the feedback concentrated on issues such as the high-risk nature of OTC, cross-border money laundering loopholes, and insufficient regulatory coverage, thus expanding the original OTC regulatory proposal into a broader "VA Dealing" framework.

VA Dealing Consultation Paper, 1.8:

"Following the conclusion of the first round of consultation, we received over 70 written submissions from various stakeholders… We have refined our proposal to expand the scope to VA dealing services to better address AML/CFT risks."

Important note: The content of this phase is still in the public consultation stage and has not been formally legislated; final details may be adjusted during the legislative process.

Driving Forces Behind Policy Changes

The three evolutions of Hong Kong's OTC regulatory policy did not occur in isolation but were driven by multiple overlapping factors, with at least three core drivers behind them:

Driver One: Frequent Major Cases Expose Regulatory Vacuum

In the 15 million USD money laundering case in May 2025, the involved gang utilized OTC to split funds and bypass bank monitoring, completing multiple cross-border transfers in a short time. In the JPEX case, the CCB found that many investors' defrauded funds were exchanged for cash or stablecoins through local OTC shops, quickly flowing to overseas wallets.

These cases exposed a problem: even if platform regulation tightens, the anonymity and instant settlement characteristics of offline OTC can still bypass regulation, becoming a "last mile" risk channel.

Driver Two: International Regulatory Pressure and FATF Standards

Since the FATF (Financial Action Task Force) updated Recommendation 15 in 2019, it has explicitly required jurisdictions to fully include virtual asset service providers (VASPs) in their anti-money laundering/counter-terrorist financing (AML/CFT) frameworks. When Hong Kong first introduced VATP licensing, it met some FATF requirements, but the "overlooked" status of OTC business was repeatedly pointed out by international assessment agencies and partners. To maintain Hong Kong's reputation as an international financial center, regulatory agencies must fill this gap and ensure that "same business, same risk, same rules" is implemented.

To become an international virtual asset center, Hong Kong must address AML/CFT risks.

Driver Three: Local Public Opinion Drives Policy Upgrade

In the first round of OTC consultations in 2024, the government received over 70 written public opinions from banks, compliance agencies, crypto companies, law enforcement, and others. Most opinions reflected that OTC's anonymous trading poses high risks; cross-border fund flows are difficult to trace; and OTC plays an important intermediary role in fraud and money laundering cases.

The government explicitly stated in the 2025 "VA Dealing" legislative proposal that it was based on this feedback that the regulatory scope originally covering only OTC exchanges was expanded to a more complete VA Dealing full-chain business.

VA Dealing Consultation Paper, 1.8:

"Following the conclusion of the first round of consultation, we received over 70 written submissions from various stakeholders… We have refined our proposal to expand the scope to VA dealing services to better address AML/CFT risks."

Conclusion

OTC was once the "underground waterway" of Hong Kong's cryptocurrency market, and now it is being brought into the light. From platform regulation in 2023 to the management of coin shops in 2024, and to the proposed comprehensive "VA Dealing" framework in 2025, Hong Kong's virtual asset regulation is moving towards systematization and internationalization. The latest chapter of all this is currently in the public consultation period, awaiting the final draft of legislation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。