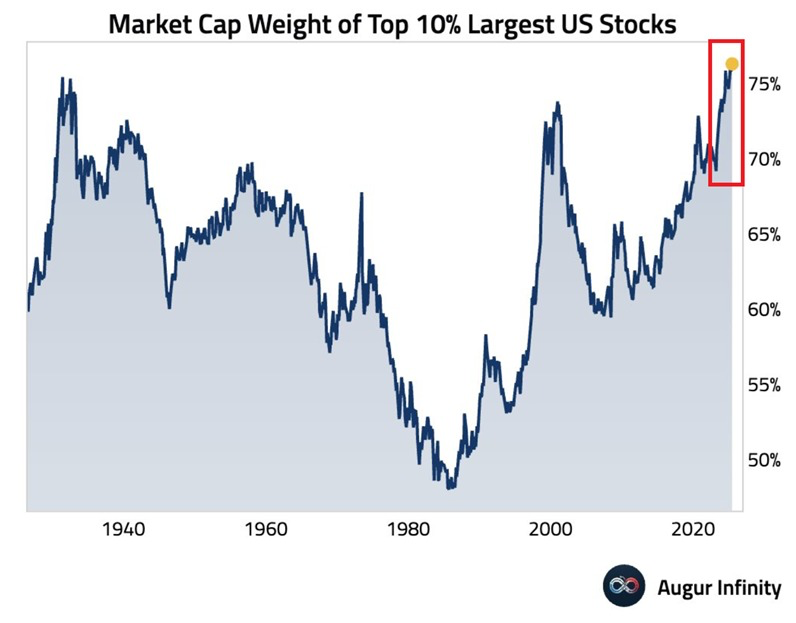

A few days ago, I saw a report from UBS. Today, I noticed that the top 10% of stocks by market capitalization in the U.S. currently account for about 76% of the U.S. stock market, reaching a historic high, which is worth noting.

Historically, this moment has occurred three times. The first time was after World War II, in the 1940s, when those large companies were the absolute main players in the market, holding a very high share. At that time, the U.S. economy was just recovering from the war, and some traditional industry giants, like automotive and steel, truly held significant power.

However, as time went on, by the 60s and 70s, this share gradually decreased. Why? Because the economy began to diversify, many small and medium-sized enterprises emerged, and various new technologies and models appeared, creating a vibrant market where everyone had opportunities. Thus, the prominence of those large companies was diluted.

Later, in the late 80s and early 90s, this trend reversed again. The most obvious example was around the year 2000, during what is commonly referred to as the "dot-com bubble." At that time, tech giants like Cisco and Microsoft were in the spotlight, with their market values skyrocketing. As a result, when the bubble burst, you could see that sharp peak, which was a reflection of that time, followed by a steep decline.

Now, here comes the key point. Looking at the far right, the area I’ve circled in red. In recent years, this share has started to soar again, surpassing any historical high! What does this indicate? It indicates that the current U.S. stock market has an unprecedented strong head effect.

In simpler terms, most of the money and attention in the entire U.S. stock market are concentrated on a small group of super giants. These companies are what we commonly refer to as the "Magnificent Seven," such as Apple, Microsoft, Nvidia, Google, Amazon, Meta, and Tesla. When you open the news, aren’t these companies being discussed every day? When their stock prices rise, the index follows; when they fall, the market generally declines as well!

In fact, the issues currently facing the U.S. stock market have been highlighted in the UBS report, which is worth our deep reflection:

Concentration of risk: This is like putting all your eggs in one basket. If one or several of these giants encounter problems, such as failing to meet performance expectations or facing regulatory troubles, the entire market will be significantly impacted. We small investors might suffer as a result.

Narrowing market breadth: This phenomenon indicates that many small and medium-sized enterprises, or those not in the spotlight, may be overlooked by the market. The entire market seems to lack the vibrant scene of flourishing diversity seen in the past.

Value misallocation: Sometimes, I wonder if the valuations of these giants are too high. Can their growth stories really support such high market values? This is a question I often ponder.

In short, caution is the key to long-term success! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。