Source: DeFi Investor

Translation: AIMan@Golden Finance

So far, 2025 is shaping up to be a great year for DeFi.

We have transitioned from a hostile regulatory environment under Gary Gensler's SEC to a more crypto-friendly one. Moreover, DeFi adoption is thriving by almost all metrics.

Therefore, I believe it is a good time to closely examine some charts that can illustrate the current market conditions and industry trends.

The following seven charts reveal the state of DeFi:

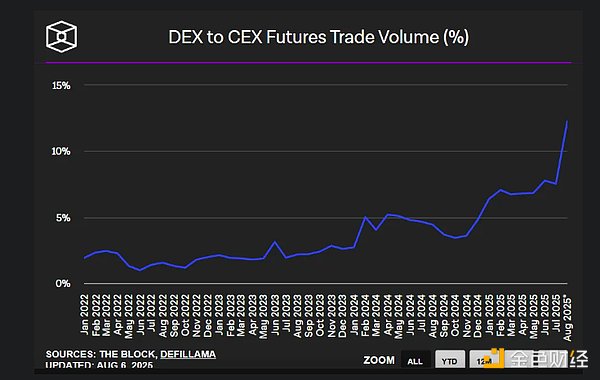

1. DEX Trading Volume Continues to Hit New Highs Compared to CEX

Data Source: The Block

DEX is slowly but steadily capturing market share from CEX.

In June 2022, the market share of perpetual contract DEX in the derivatives space was only 0.98%. Three years later, that number has grown elevenfold.

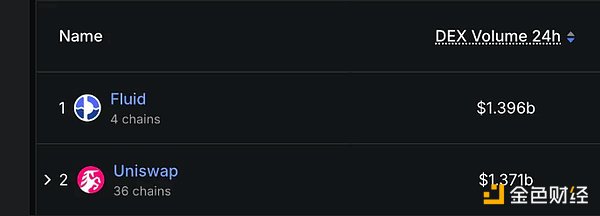

2. Fluid is the Fastest Growing DEX

Source: DeFiLlama

Fluid DEX briefly surpassed Uniswap in daily trading volume on Ethereum, and this was less than a year after its launch.

With Fluid DEX V2 on the horizon, I wouldn't be surprised if Fluid ultimately wins the DEX war on Ethereum.

In terms of capital efficiency, DEX V2 is expected to be more efficient than V1.

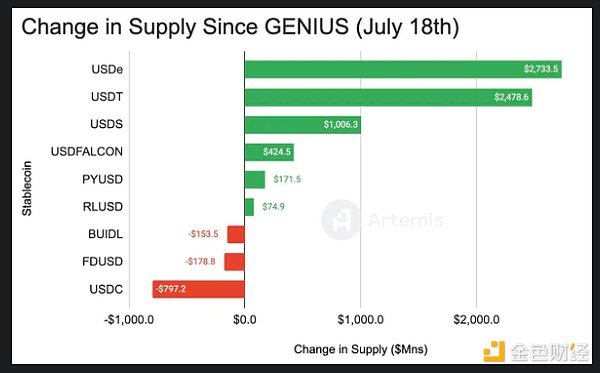

3. Yield-bearing Stablecoins Lead Inflows for the First Time

Source: Artemis

A few days ago, Ethena's stablecoin USDe surpassed USDT and USDC in net inflows for the first time over a two-week period. What does this mean?

Because USDT and USDC have long been leaders in stablecoin adoption. Now, crypto-native solutions are finally starting to challenge their dominance.

I predict that Resolv, Ethena, and Falcon Finance will continue to see exponential growth in the coming months.

4. Spot ETH ETF Performs Well but is Slowing Down

Data Source: Coinglass

After weeks of hitting new inflow highs, the spot Ethereum ETF recently recorded the largest single-day outflow in history.

The reason may be that some TradFi whales have taken profits.

However, looking at the overall picture, the past two months have been the best-performing months for the spot Ethereum ETF so far.

5. DeFi is About to Surpass AI in Mindshare

Data Source: Kaito

For over a year, AI has been in the lead.

However, this situation is beginning to change. In the past few months, DeFi's attention has more than doubled. Meanwhile, the attention on Meme has sharply declined.

Fundamentals are starting to matter again.

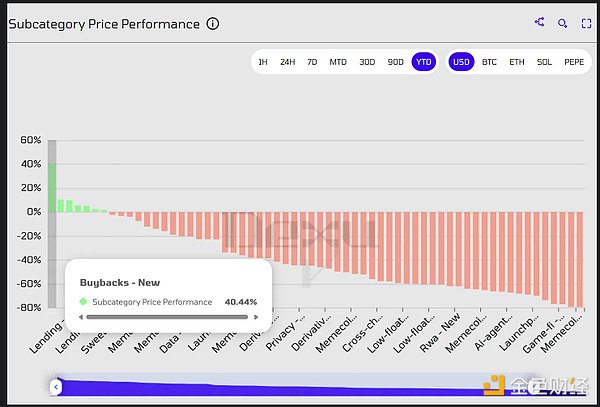

6. Protocols with Buyback Programs Perform Best in 2025

Source: Dexu AI

This indicates that the market is beginning to reward tokens with solid fundamentals.

The subcategory of protocols conducting token buybacks includes projects like Hyperliquid, Pump Fun, Maple, EtherFi, Kaito, AAVE, and others.

7. BTC Exchange Reserves Continue to Decline

Source: Crypto Quant

Since February 2024 (shortly after the U.S. launched its first spot Bitcoin ETF), BTC exchange reserves have been declining.

In previous bull markets, the opposite typically occurred.

However, in this cycle, the buying pressure generated by BTC ETFs and cryptocurrency fund companies has had a significant positive impact on BTC prices.

That said, these are all the charts I wanted to showcase in this newsletter.

Overall, I am very excited about the current market conditions.

As you can see above, fundamentals are becoming increasingly important. I am pleased to see more and more projects starting to buy back their tokens.

I hope that the prices in the coming months will reflect all the recent progress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。