Geoffrey Kendrick, head of digital assets research at London-based Standard Chartered Bank, delivered a nugget of alpha that many may have missed last week, ether treasury companies are probably a better buy than spot ether ETFs. The reason, which may be obvious to some, is that spot ETH funds don’t currently offer staking rewards, but treasury companies do.

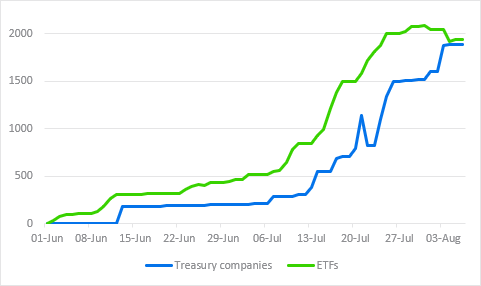

Kendrick and his team published a research note last Tuesday, showing how ether treasury companies such as Sharplink, have purchased the cryptocurrency at double the rate of spot ETFs. In a follow-up note yesterday, Kendrick said that since June, both treasury firms and ETFs each bought roughly 1.6% of all ether in circulation.

( ETH holding companies and ETFs are neck-and-neck when it comes to amount of ETH bought since June / Standard Chartered Research)

And now, given the already rapid pace of acquisition shown by treasury entities, the additional benefit of compounded staking rewards, and the fact that holding companies face fewer regulatory hurdles than ether ETFs, Kendrick and team see ETH treasury firms as having more growth potential than their fund counterparts or even their bitcoin treasury cousins.

“We think ETH treasury companies have even more growth potential than BTC ones from a regulatory arbitrage perspective,” Kendrick and team explain. “We think they may eventually end up owning 10% of all ETH, a 10x increase from current holdings.”

The team also expects ether treasury companies to help buoy the cryptocurrency past the $4,000 threshold. Ether, which floundered in the first quarter of 2025, reached its all-time high of $4,891.70 nearly four years ago in November 2021. The digital asset was trading at $3,816.40 at the time of reporting, up 3.81% over 24 hours, according to Coinmarketcap.

“If the flows can continue, ETH may be able to break above the key USD 4,000 level (our current end-2025 forecast),” Kendrick and team said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。