Trump Tariff Targets India’s Russian Oil Imports, But Spares China

On July 30, 2025, American President Donald Trump announced a 25% tariff on a broad group of Indian products, doubling the overall import duty to 50%.

Source: X (Previously Twitter)

He said the action was taken in retaliation against India's continued buying of Russian oil and military equipment, and India's "unfair trade practices" and high tariffs against US products. This was the justification for doubling the Trump Tariff on India

Though this is one of the toughest sanctions leveled against a United States trading partner, many are questioning what the real motives are behind it.

Why Not China?

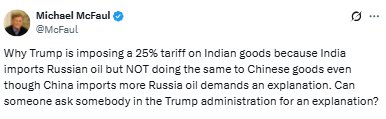

Although China is buying more Russian oil than India, the president has not levied similar penalties against Beijing. This has caused confusion and criticism. The Trump Tariff move appears less about oil and more about politics and personal grievances.

There has been speculation that Trump's move might also indicate frustration with India for failing to publicly acknowledge him for aiding in holding up the previous India-Pakistan war.

The US President does not believe that China is vulnerable enough to attack directly, particularly due to China's control of rare earth elements, which are crucial to numerous U.S. industries.

Is Russian Oil Really the Reason?

Some experts feel the Trump Tariff has nothing to do with India's energy agreements. They argue that the U.S. itself is still engaged in trade with Russia, hence would be hypocritical to sanction India based on this.

The Trump Tariff is more of a symbolic move, a way for the president to show strength while avoiding confrontation with China. As one observer put it, “He tried to pick a fight with China, failed, and is now going after an easier target.”

India’s Refusal to Open Key Markets

India's insistence on safeguarding its agriculture, dairy, and fishing industries has long been a source of tension with America.

The U.S. president has targeted India for refusing to allow American businesses into these sectors, and the tariff could be an attempt to put pressure on.

Still, it is uncertain whether the action will have any effect or simply worsen the U.S.-India trade relations.

Market Reactions and Global Impact

The news of the Trump Tariffs has disturbed the world markets. Investors are keenly observing if India will retaliate or if this might escalate into a greater trade war.

Experts are also worried that such a move at short notice might translate into increased prices for American consumers, particularly for goods imported from India.

The Trump Tariffs shook financial and crypto markets, with investors worried about increased trade tensions and higher import costs. Stocks related to U.S.-India trade fell, and crypto experienced volatility as global economic uncertainty increased.

Conclusion

The Trump Tariff on Indian products , presented as a retaliation for purchasing Russian oil, appears to be motivated by much deeper political and personal factors.

With China untouched even though it did more with Russia and U.S. business continued to engage in trade with Russia, the tariff looks more like a strategic or emotional gesture rather than a fair-minded policy.

Their long-term impact on the U.S.-India relationship, and indeed on world commerce, has yet to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。