Bitcoin ETFs Red Streak Hits Day 4 As Ether ETFs Turn Green with Solid Inflows

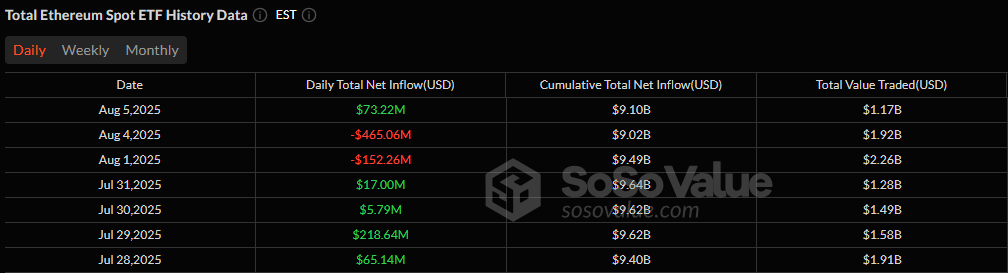

The split in investor behavior between bitcoin and ether ETFs widened on Tuesday, August 5, as funds tracking the two largest cryptocurrencies moved in opposite directions. Bitcoin ETFs saw a 4th straight day of outflows, losing $196.18 million, while ether ETFs posted a $73.22 million inflow, signaling renewed demand for ethereum exposure despite market volatility.

The bulk of bitcoin’s outflows came from Fidelity’s FBTC, which shed $99.11 million, followed by Blackrock’s IBIT with $77.42 million. Grayscale’s GBTC rounded out the losses with $19.65 million exiting the fund. Trading activity remained elevated at $2.66 billion, with total bitcoin ETF net assets settling at $146.18 billion, down significantly from last week’s highs.

Source: Sosovalue

Ether ETFs, on the other hand, rebounded strongly. Blackrock’s ETHA dominated inflows with a robust $88.77 million entry, while Vaneck’s ETHV added $5.24 million and 21Shares’ CETH contributed $3.57 million.

However, the green run was slightly offset by redemptions from Grayscale’s Ether Mini Trust and ETHE, which lost $13.45 million and $10.91 million, respectively. Ether ETF trading volume stood at $1.17 billion, pushing net assets to $19.99 billion.

The contrasting flows highlight a growing narrative: while bitcoin faces sustained selling pressure, ethereum’s institutional products continue to attract interest, perhaps tied to optimism around ETH’s DeFi and staking ecosystem. Whether this divergence holds or narrows will be a key theme as the week unfolds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。