Where is the main support for the risk market currently?

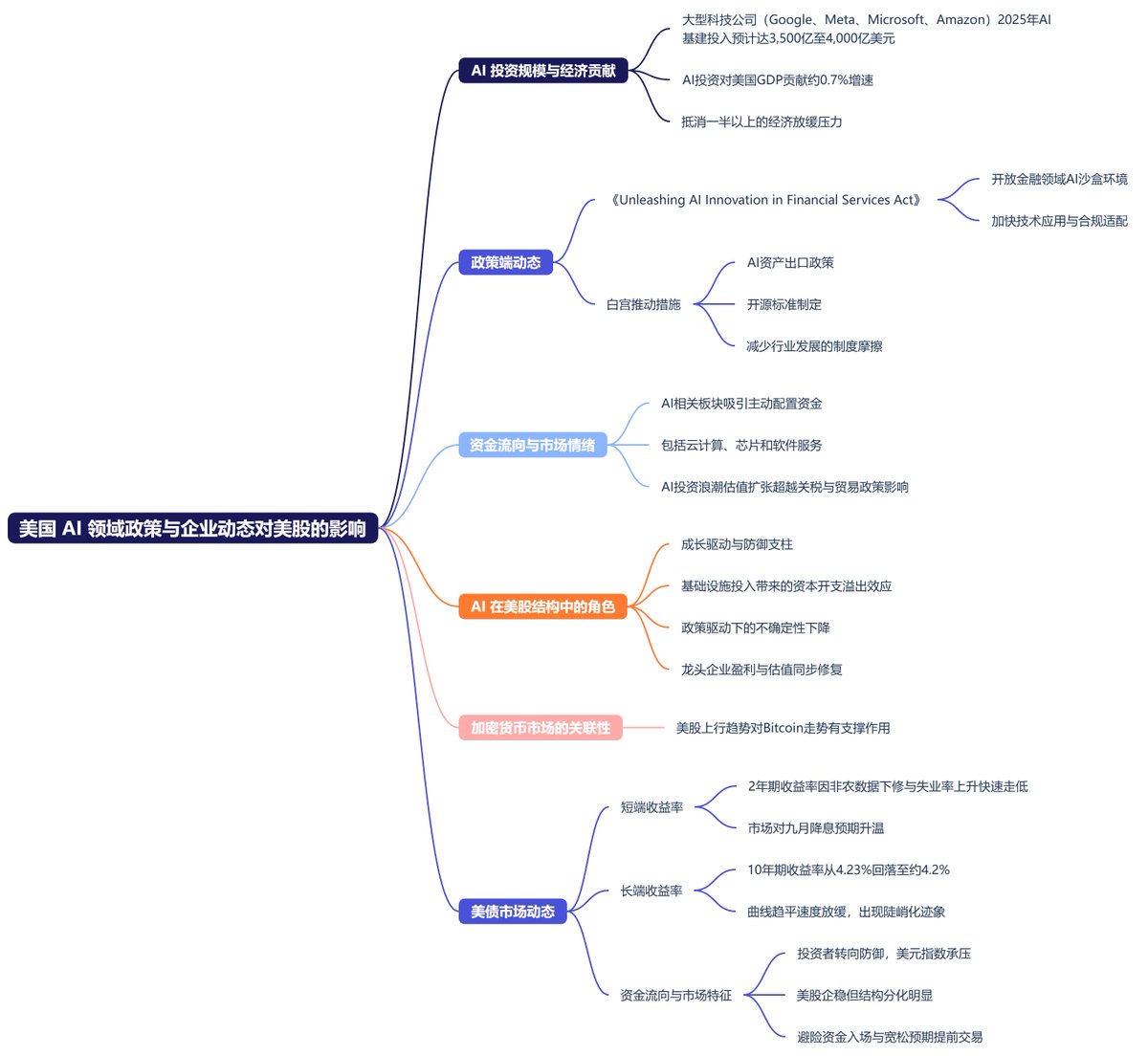

In the past week, U.S. policies and corporate dynamics in the AI sector have provided significant support for U.S. stocks, especially against the backdrop of increasing macro uncertainty. AI has become one of the few sectors capable of providing structural upward momentum. Major tech companies, including Google, Meta, Microsoft, and Amazon, have confirmed in their earnings reports and investment plans that AI infrastructure investments will exceed $350 billion by 2025, potentially approaching $400 billion.

This does not include the investments that the U.S. government and overseas institutions are preparing to make in the U.S. AI sector. Such scale means that even if economic data comes under pressure, AI investments alone could contribute nearly 0.7% growth to U.S. GDP, effectively offsetting more than half of the potential slowdown pressure.

On the policy front, the U.S. Congress has once again proposed the "Unleashing AI Innovation in Financial Services Act," which aims to open an AI sandbox environment in the financial sector, accelerating technology application and compliance adaptation. The White House is also promoting AI asset exports and the establishment of open-source standards to reduce institutional friction in industry development.

In terms of capital flow, AI and its related sectors, including cloud computing, chips, and software services, continue to attract a significant amount of actively allocated funds, creating an independent support effect that diverges from overall market sentiment. The market generally believes that the valuation expansion brought about by the AI investment wave has even surpassed the direct impact of tariffs and trade policies on U.S. stocks.

The capital expenditure spillover effect from this infrastructure investment, combined with the reduction of uncertainty driven by policy, as well as the synchronous recovery of leading companies' profits and valuations, has allowed AI to play a role in the current U.S. stock structure as both a growth driver and a defensive pillar.

Since cryptocurrencies are highly correlated with U.S. stocks, if the overall U.S. stock market can maintain an upward trend due to AI's momentum, then at the very least, Bitcoin's performance should not be too poor.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。