September may see a rebound, followed by a liquidity-driven pullback.

Written by: arndxt

Translated by: AididiaoJP, Foresight News

Welcome to the era of hyper-speculative capitalism.

Please pay close attention to the M2 money supply in mid-September.

In the current irrational economic environment, hyper-speculation has become a natural response.

Fiscal and monetary policies were once tools to anchor the market in a stable state, but now that stability has begun to crack:

The U.S. is running a 7% GDP deficit, occurring during a time of full employment.

Interest rates remain at 5%, yet Bitcoin is approaching historical highs.

Monetary policy has been replaced by fiscal dominance, with stimulus measures continuing even during "prosperous times."

The market no longer reflects fundamentals; it reflects liquidity.

The Madness of Bitcoin: Is it Rational in a Chaotic World?

Bitcoin no longer requires a weak economy or interest rate cuts. In fact, the best macro environment may be one without new shocks, with liquidity conditions continuing to improve.

And liquidity is surging:

Global M2 money supply remains high and may have peaked.

If Bitcoin rises by 10%, over $13 billion in short positions will be liquidated, indicating that the market still has ample funds to drive its parabolic rise.

Bitcoin typically peaks 525 to 530 days after a halving, suggesting that late September 2025 could be a key time point.

@MintedMacro provides a clear roadmap based on historical halving cycles:

Liquidity-driven cycles: When M2 grows, Bitcoin performs strongly. Currently, M2 has formed a double top pattern, with the second peak lower than the first.

Top timing predictions:

2013: 525 days post-halving

2017: 530 days post-halving

2021: 518 days post-halving

2025: Around September 21

Expected top range:

Bitcoin could reach $135,000 to $150,000

But the upside may be limited by macro tightening policies.

Key conclusion:

September may see a rebound, followed by a liquidity-driven pullback.

In a context where fundamentals are distorted and liquidity is the dominant force, market participants are adapting.

Macro Analysis Updated to August 3, 2025, covering the following topics:

This week's macro events

Bitcoin heat indicators

Market overview

Key economic indicators

Focus on India

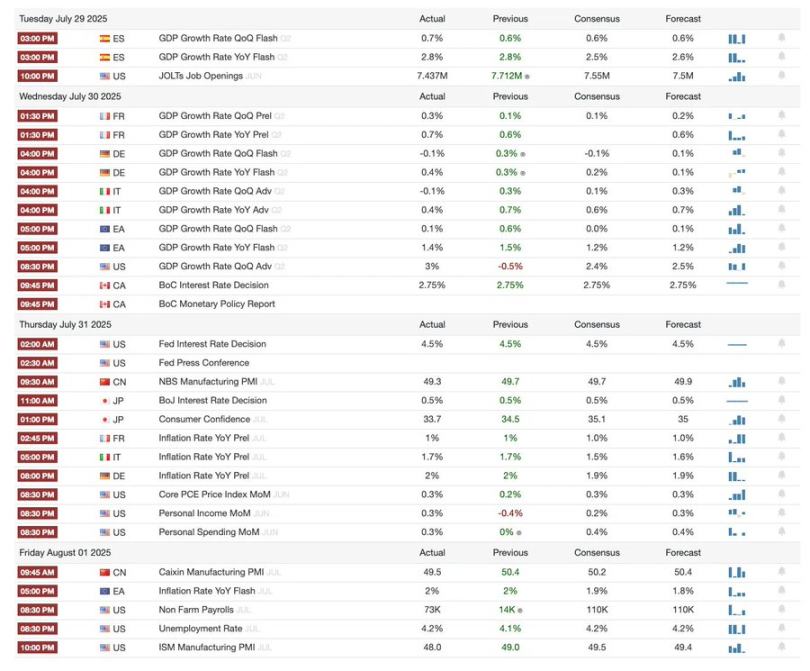

Summary of This Week's Macro Events

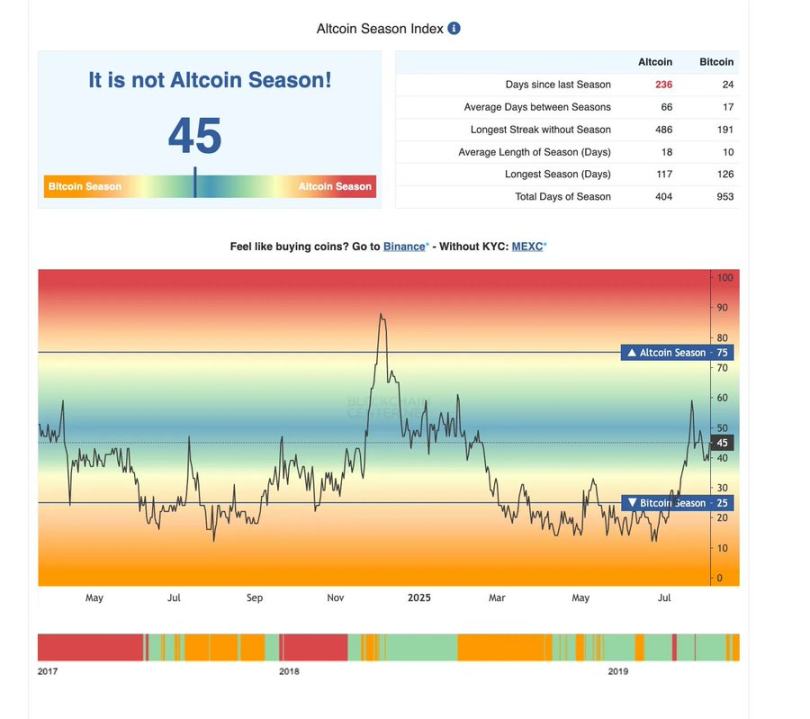

Bitcoin Heat Indicators

Bank and Regulatory Dynamics:

The U.S. Securities and Exchange Commission (SEC) has launched a "crypto initiative" aimed at strengthening regulation and enhancing the U.S.'s leadership in the digital finance space.

PayPal has introduced a "crypto payment" feature, allowing U.S. businesses to accept 100 types of cryptocurrencies.

Visa is expanding its stablecoin settlement capabilities, adding supported tokens and blockchains.

BNB has reached an all-time high, driven by institutional demand and corporate capital inflows.

Institutional Investment and Project Development:

Tron Inc. has submitted a $1 billion securities declaration, becoming the largest holder of TRX.

Strategy Inc. has acquired $739.8 million in Bitcoin, expanding its holdings to $43 billion and launching a preferred stock IPO.

Tether reported a second-quarter profit of $4.9 billion, with strong demand for Bitcoin and gold.

SharpLink Gaming has acquired $295 million in Ethereum, becoming the second-largest holder with 438,017 ETH.

Syntetika Hub has launched: a center for learning, contribution, and rewards within the ecosystem.

NFT and Digital Collectibles Market:

NFT sales surged to $574 million in July, the second highest for 2025, driven by demand from large whale assets.

CryptoPunks' floor price reached $208,000, a three-year high, driven by the rise in Ethereum.

Market Overview

U.S. Economy: Broader Signs of Slowdown

This week's economic data conveys a clear and consistent signal: U.S. economic growth momentum has sharply slowed in the first half of this year.

Consumer behavior is changing; despite healthier household balance sheets, credit card usage is tightening, reflecting rising uncertainty rather than optimism.

Housing affordability has hit a historic low: even with slight declines in home prices, mortgage rates and holding costs (taxes, insurance, maintenance) have surged. The Atlanta Fed reports that owning a median-priced home now consumes 53% of middle-class income, the highest on record, highlighting structural barriers to homeownership.

Global Central Banks: Diverging Policy Paths

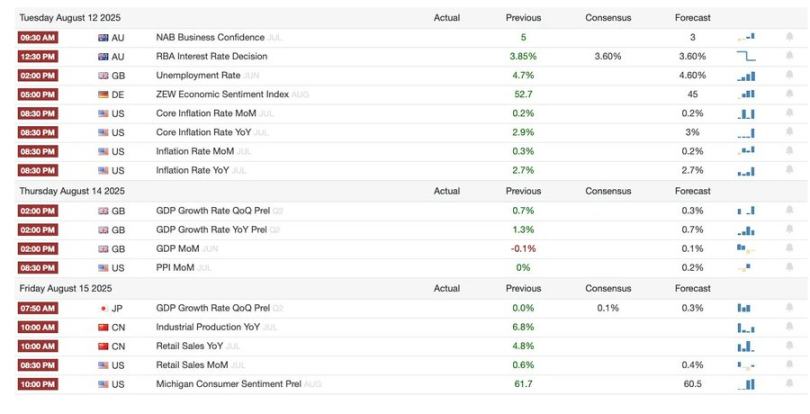

Policy divergences are emerging: central banks in Japan, Canada, Brazil, Colombia, and Singapore are holding rates steady, while Chile and South Africa have preemptively cut rates by 25 basis points due to slowing inflation and economic weakness.

Eurozone GDP for the second quarter slightly exceeded expectations, growing 0.1% quarter-on-quarter, but core inflation remains stable at 2.3% year-on-year, indicating that the European Central Bank will remain cautious.

China's July PMI softened, indicating that its economic recovery momentum is fading faster than expected, which may drag down regional demand and supply chains.

Federal Reserve: The Data-Dependent Dilemma

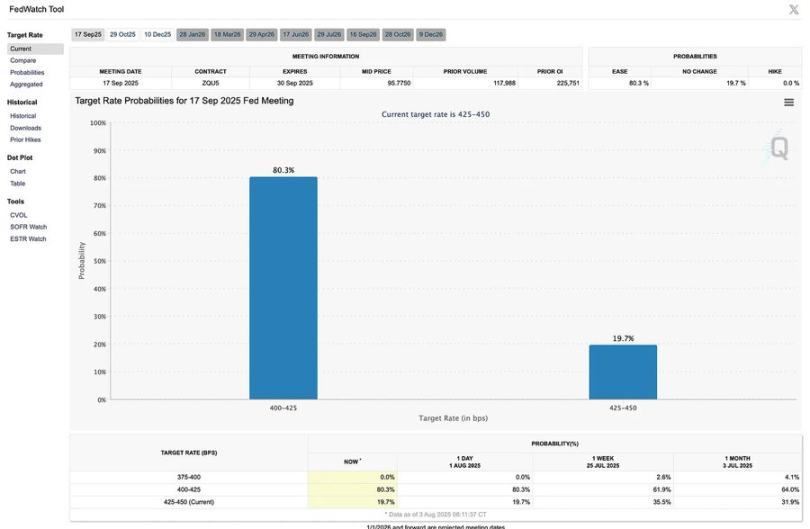

The Federal Reserve has maintained interest rates at 4.25%–4.50% for the fifth consecutive meeting, reinforcing its cautious stance amid mixed signals.

The September meeting may still adjust rates, but a rate cut is not certain; Fed officials have clearly stated the need to wait for clearer evidence from the labor market, inflation, and consumer data.

The outlook depends on the depth of the economic slowdown and whether inflation continues to ease without triggering a recession.

Key Economic Indicators

U.S.-Japan Agreement:

New Tariff Agreement: Below Threat but Still High

The U.S. has announced a 15% tariff on all Japanese imports, up from the previous 10% and far above the 2.5% at the beginning of the year.

Tariffs on cars and parts, previously at 27.5%, are now unified at 15%, boosting Japanese auto stocks and the stock market.

Inflation Risks from Rising Import Prices

Although an extreme 25% tax rate was avoided, the 15% tariff will still raise consumer prices for Japanese goods, increasing inflationary pressures and weakening U.S. household purchasing power.

A broader shift in trade policy may further raise import costs from other regions.

Japan's $550 Billion Investment Commitment: Terms Unclear

Trump stated that Japan would invest $550 billion in the U.S., with 90% of the profits going to the U.S., calling it a "signing bonus."

However, Japanese negotiators indicated that this figure is a ceiling rather than a guaranteed amount, expecting the U.S. to share risks and financing.

The lack of a written agreement raises questions about enforceability, laying the groundwork for future disputes.

U.S. Manufacturing Push Faces Labor Constraints

The agreement aims to shift more manufacturing activity to the U.S., but it remains unclear how to fill positions amid labor shortages and tightening immigration policies.

This contradiction undermines the strategy of reducing trade deficits through reshoring.

Auto Industry Rebound: Unfair Competition

U.S. automakers face higher costs than Japanese importers due to:

25% tariffs on imported parts.

50% tariffs on imported steel and aluminum.

Complex rebate processes under the North American Free Trade Agreement (NAFTA/USMCA).

Industry leaders warn that the agreement favors Japan over U.S. manufacturers and workers, raising concerns that it sets a precedent for future trade agreements.

Agreement in Doubt: Negotiation Rather than Contract Signing

No formal treaty has been signed; both sides have already diverged on the interpretation of terms.

This raises widespread concerns about U.S. reliance on non-binding trade commitments, which may erode trust and stability in future negotiations.

Job Market:

New Graduates Face Unprecedented Recruitment Slump

The unemployment rate for recent college graduates has hit a ten-year high, just one percentage point lower than all young workers, with an unusually narrow gap.

Historically, college graduates have had far better employment prospects than their peers, and this convergence is a warning sign for white-collar employment trends.

AI Not the Main Cause, at Least for Now

Although generative AI has been blamed for eliminating entry-level jobs, its impact remains limited to specific industries (such as technology).

Broader measures are still insufficient to explain the widespread weakness in graduate recruitment.

Policy Uncertainty Cools the Market

Uncertainty regarding trade policy, the direction of Federal Reserve interest rates, and immigration restrictions may hinder corporate hiring, especially for tech positions.

This uncertainty also affects employee behavior, with low turnover rates reflecting hesitance to change jobs in an unstable market.

Reduced turnover = fewer job vacancies, leading to a slowdown in labor market mobility.

Shortage of Skilled Workers Eases

The long-standing shortage of college graduates, which was a key driver of high wage premiums, is weakening.

As more workers enter the tech labor pool, wage premiums are flattening or declining, potentially further stifling creativity in traditional high-growth industries.

Focus on India

UK-India Trade Agreement: A Major Non-U.S. Shift

The UK and India have reached a landmark trade agreement that cuts tariffs on over 90% of UK exports to India.

The UK expects exports to India to grow by 60% by 2040, benefiting from rapidly growing market access in India.

Big Winners in the Automotive Industry

India is reducing its import tariff on cars from 100% to 10%, a dramatic change that could reshape the automotive market.

However, quotas limit the total volume of imports, suppressing short-term business gains for UK car manufacturers.

Significant Benefits for India

While the news focuses on the growth of UK exports, India benefits more from its own tariff reductions:

Lower consumer prices

Increased domestic competition

Enhanced global competitiveness of Indian businesses

These structural advantages may boost India's long-term export capacity and productivity.

50% of Indian Export Goods to the UK Tax-Free

About 50% of Indian export goods that previously faced tariffs of 4%–16% will enter the UK tax-free, benefiting Indian textile, pharmaceutical, and food exporters.

Strategic Trade Restructuring

The agreement reflects a global trend: as U.S. tariffs disrupt existing trade patterns, countries are attempting to diversify partnerships.

India is actively seeking trade liberalization with the EU, ASEAN, and even the U.S., positioning itself as a key player in the post-globalization reset.

Summary

The core characteristics of the era of hyper-speculative capitalism are liquidity-driven dynamics, fiscal dominance, and a market divergence from traditional economic logic. The madness of Bitcoin, the restructuring of trade patterns, and the evolution of the labor market are all reflections of this era. Investors and policymakers must adapt to this new reality, flexibly responding to the challenges posed by liquidity fluctuations and policy uncertainties.

A notable feature of the current global economy is liquidity-driven market behavior. Traditional economic theory posits that asset prices should reflect their intrinsic value or the present value of future cash flows. However, in the era of hyper-speculative capitalism, the abundance of available funds has become the core factor driving market prices.

Take Bitcoin as an example; its price volatility is highly correlated with the growth of global M2 money supply. When central banks inject large amounts of money into the market through quantitative easing or other means, these funds often flow into high-risk, high-return assets like cryptocurrencies. This phenomenon is particularly evident in 2025, where, despite the Federal Reserve maintaining high interest rates, Bitcoin continues to rise, reflecting the market's dependence on liquidity over traditional economic indicators.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。