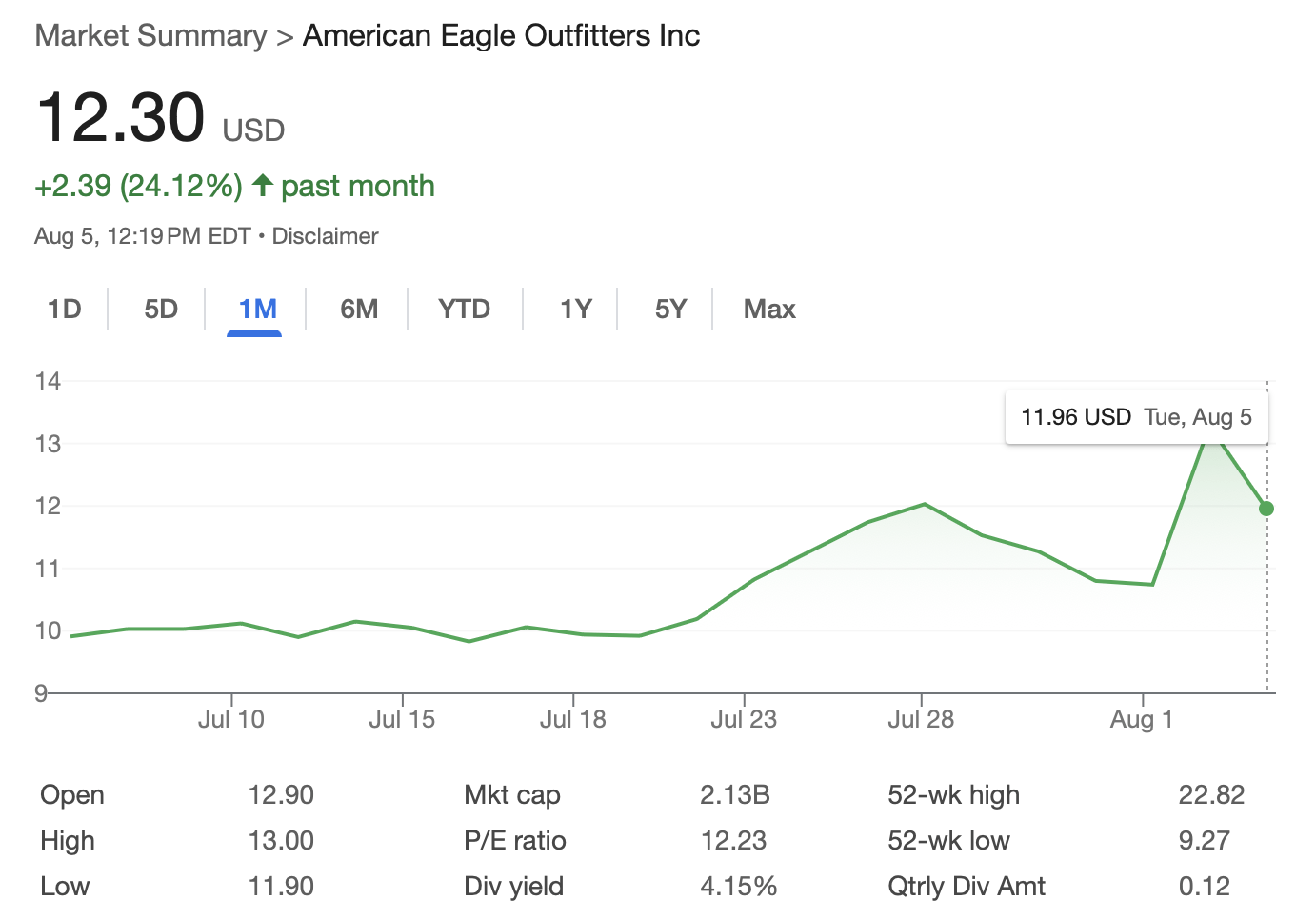

Sydney Sweeney’s denim ads made waves, sending American Eagle Outfitters stock soaring from under $10 to a $12.03 high on July 28, just four days after the campaign dropped. But by Aug. 1, the buzz had cooled down a hair, with shares closing at $10.74—right before President Trump chimed in with his own post about American Eagle and Sweeney’s ad.

“Sydney Sweeney, a registered Republican, has the ‘HOTTEST’ ad out there,” Trump exclaimed. “It’s for American Eagle, and the jeans are ‘flying off the shelves.’ Go get ‘em Sydney! On the other side of the ledger, Jaguar did a stupid, and seriously WOKE advertisement, THAT IS A TOTAL DISASTER! The CEO just resigned in disgrace, and the company is in absolute turmoil. Who wants to buy a Jaguar after looking at that disgraceful ad.”

Trump’s statement took another swipe at what he calls “woke” culture, arguing it’s a recipe for failure. He cited Bud Light as an example, claiming its collaboration with influencer Dylan Mulvaney sparked backlash that hit the company’s bottom line. He also brought up Taylor Swift, suggesting that after he publicly criticized her, she lost favor and even drew boos at the Super Bowl. Shortly after Trump’s Truth Social post, AEO futures ticked higher.

By 12:20 p.m. Eastern time, shares were trading at $12.30 apiece, after touching an intraday peak of $13.28. This marks a sharp turnaround from the company’s sluggish 2025 performance, with Sweeney’s denim campaign and Trump’s commentary injecting fresh momentum. For some, it serves as a cautionary tale against a trend of progressive cultural shifts.

The episode reflects a clear 2025 trend: Trump’s comments—no matter the topic—often spark swift market reactions. American Eagle’s rebound shows just how quickly his words can sway investor sentiment and brand fortunes across multiple industries.

The truth is, Trump moves markets. His vocal support for cryptocurrencies—highlighted by creating a Strategic Bitcoin Reserve (SBR) and signing pro-crypto laws—has boosted investor confidence and helped lift digital asset values since his election.

His bold tariff announcements and threats have also sent Wall Street on a roller coaster, with investors reacting sharply to trade policy uncertainty. Each new tariff stance has triggered big swings in equities, keeping markets on edge and highly responsive to policy signals from the White House.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。