Author: Richard Chen

Compiled by: Tim, PANews

It is now 2025, and cryptocurrency is going mainstream. The "GENIUS Act" has been officially signed into law, and we finally have a clear regulatory framework for stablecoins. Traditional financial institutions are embracing cryptocurrency. Cryptocurrency has triumphed!

As cryptocurrency crosses the chasm, this trend means for early-stage venture capitalists: we see crypto-related projects gradually surpassing crypto-native projects. The so-called "crypto-native projects" refer to projects built by crypto experts for the crypto space; while "crypto-related projects" refer to the application of crypto technology in other mainstream industries. This is the first time in my career that I have witnessed such a transformation, and this article aims to delve into the core differences between building crypto-native projects and crypto-related projects.

Building for Crypto Native

So far, the most successful cryptocurrency products have almost all been built for crypto-native users: Hyperliquid, Uniswap, Ethena, Aave, etc. Like any niche cultural movement, cryptocurrency technology is so ahead of its time that ordinary users outside the crypto circle find it difficult to "understand its essence," let alone become enthusiastic daily active users. Only those crypto-native players who have been on the front lines of the industry possess enough risk tolerance and are willing to invest time testing every new product, surviving various risks such as hacking and project failures.

Traditional Silicon Valley venture capitalists once refused to invest in crypto-native projects because they believed the overall effective market was too small. This is understandable, as the crypto space was indeed in a very early stage at that time. On-chain applications were few and far between, and the term DeFi was not coined until October 2018 in a group chat in San Francisco. However, you had to bet on faith and pray for macro dividends to arrive, allowing the market size of crypto-native projects to leap forward. Indeed, with the liquidity mining craze of the summer of 2020 and the dual boost of the zero-interest-rate policy in 2021, the crypto-native market achieved exponential expansion. In an instant, all Silicon Valley venture capitalists rushed to enter the crypto space, asking me for advice to make up for their four-year cognitive gap.

As of now, the total addressable market size of crypto-native users is still limited compared to traditional non-crypto markets. I estimate that the number of Twitter users in the crypto space is at most only tens of thousands. Therefore, to achieve a nine-figure (hundred million dollar) annual recurring revenue (ARR), the average revenue per user (ARPU) must remain at an extremely high level. This leads to the following key conclusion:

Crypto-native projects are built entirely for experts.

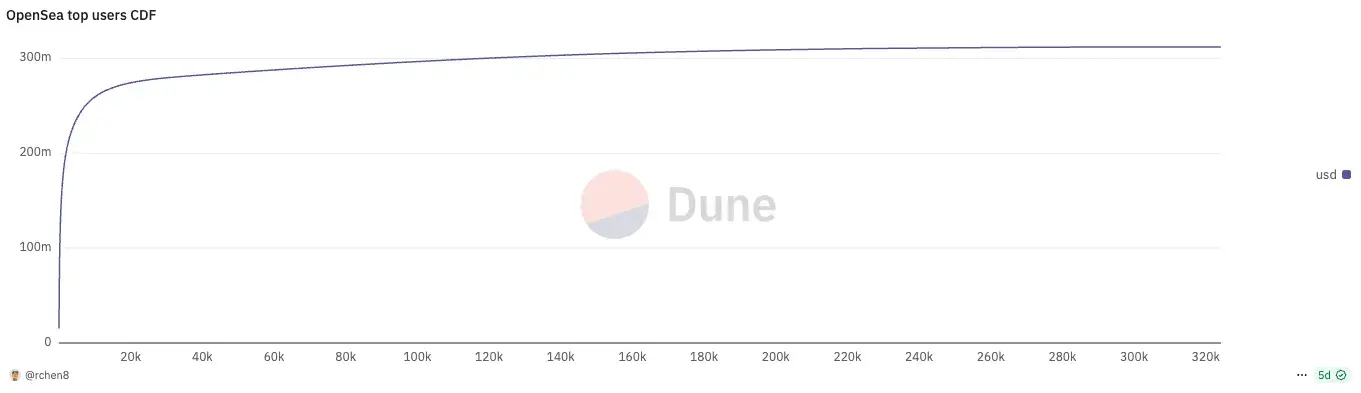

Every successful crypto-native product follows an extreme power-law distribution of user usage patterns. Last month, the top 737 users on the OpenSea platform (only 0.2%) contributed half of the total transaction volume; similarly, the top 196 users on the Polymarket platform (only 0.06%) accounted for 50% of the platform's transaction volume!

As a founder of a crypto project, what should truly keep you awake at night is how to retain top core users, rather than blindly pursuing user growth, which is in stark contrast to Silicon Valley's traditional philosophy of "daily active users first."

User retention in the crypto space has always been a challenge. Top users are often profit-driven and can easily be lured away by incentive mechanisms. This allows emerging competitors to simply poach a few core users and emerge from nowhere, eating into your market share, as seen in the competition between Blur and OpenSea, Axiom and Photon, LetsBonk and Pump.fun, and so on.

In short, compared to Web2, the ramparts of crypto projects are much shallower, and with all code being open-source and projects easily forked, native crypto projects often have a fleeting existence, with lifecycles rarely exceeding a market cycle, sometimes lasting only a few months. Those founders who became wealthy after the TGE often choose to "lie flat" and retreat, turning to angel investing as a retirement side job.

To retain core users, the only way is to continuously drive product innovation and always stay one step ahead of competitors. The reason Uniswap has been able to stand firm amid seven years of fierce competition lies in its continuous introduction of groundbreaking features from 0 to 1, such as concentrated liquidity in V3, UniswapX, Unichain, and V4 hook design, which continuously meet the needs of core users. This is particularly commendable, as the decentralized exchange track it has deeply cultivated is arguably the most fiercely contested field among all red ocean markets.

Building for Crypto Related

There have been many attempts to apply blockchain technology to broader real-world markets, such as supply chain management or interbank payments, but they all failed due to being ahead of their time. Fortune 500 companies have experimented with blockchain technology in their R&D innovation labs, but they have not seriously scaled it for practical production. Remember those buzzwords from back in the day? "We want blockchain, not Bitcoin," "distributed ledger technology," and so on.

Currently, we see a complete shift in the attitude of many traditional institutions towards cryptocurrency. Major banks and large corporations are launching their own stablecoins, and the regulatory clarity during the Trump administration has opened up policy space for the mainstreaming of cryptocurrency. Cryptocurrency is no longer a financial wilderness lacking regulation.

In my career, I am beginning to see more and more crypto-related projects rather than crypto-native projects. There is ample reason for this, as the biggest success stories in the coming years are likely to be crypto-related projects rather than crypto-native ones. The scale of IPOs is expanding to hundreds of billions, while the scale of TGEs is usually limited to hundreds of millions to billions. Examples of crypto-related projects include:

- Fintech companies using stablecoins for cross-border payments

- Robotics companies using DePIN incentives for data collection

- Consumer companies using zkTLS to authenticate private data

The common pattern here is: crypto is just a feature, not the product itself.

For industries that heavily rely on crypto technology, professional users remain crucial, but their extreme tendencies have eased. When cryptocurrency exists merely as a function, the key to success rarely depends on the crypto technology itself, but more on whether practitioners possess deep expertise in the crypto-related field and understand the core elements of the industry. This is evident in the fintech sector.

The core of fintech lies in achieving user acquisition with good unit economics (customer acquisition cost/customer lifetime value). Today, emerging crypto fintech startups are constantly fearful, worried that established non-crypto fintech giants with larger user bases can easily crush them by simply adding cryptocurrency as a functional module, or raise customer acquisition costs in the industry, making them lose competitiveness. Unlike pure crypto projects, these startups cannot sustain operations by issuing market-favored tokens.

Ironically, the cryptocurrency payment sector has long been a neglected track; I mentioned this during my speech at the 2023 Permissionless conference! But before 2023 was the golden period for founding crypto fintech companies, seizing the opportunity to build distribution networks. Now, with Stripe acquiring Bridge, founders in the crypto-native space are shifting from DeFi to payments, but they will ultimately be crushed by former Revolut employees who are well-versed in fintech strategies.

What does "crypto-related" mean for crypto venture capital? The key is to avoid reverse screening founders who have been rejected by non-professional venture capitalists, and not to let crypto venture capital become a backstop due to unfamiliarity with related fields. A lot of reverse screening comes from choosing native crypto founders who have recently transitioned from other fields to "crypto-related." A harsh reality is that, generally speaking, founders in the crypto space are often the disillusioned from the Web2 realm (though the top 10% of founders are different).

Crypto venture capital firms have always had a quality value gap, discovering potential founders outside the Silicon Valley network. They do not have impressive elite resumes (like Stanford degrees or Stripe work experience), nor are they good at pitching projects to venture capital firms, but they deeply understand the essence of crypto-native culture and know how to build passionate online communities. When Hayden Adams was laid off from his mechanical engineering job at Siemens, his initial intention in writing Uniswap was merely to learn the programming language Vyper; Stani Kulechov had already begun creating Aave (formerly ETHLend) just before graduating with a law degree in Finland.

Successful founders of crypto-related projects will sharply contrast with successful founders of crypto-native projects. They will no longer be the wild west financial cowboys who deeply understand the psychology of speculators and can build personal charisma around their token networks. Instead, they will be more mature and seasoned founders with business acumen, typically coming from crypto-related fields and possessing unique market entry strategies for user coverage. As the crypto industry gradually matures and develops steadily, a new generation of successful founders will emerge.

Conclusion

The Telegram ICO incident in early 2018 vividly showcased the cognitive chasm between Silicon Valley venture capital firms and crypto-native venture capital firms. Firms like Andreessen Horowitz, Benchmark, Sequoia Capital, Lightspeed Venture Partners, and Redpoint Ventures all invested because they believed Telegram had the user base and distribution channels to become a dominant application platform. Almost all crypto-native venture capital firms chose to forgo investment.

My contrarian view of the crypto industry is that consumer applications are not lacking. In fact, the vast majority of consumer projects cannot secure venture capital support because their revenue-generating capabilities are unstable. Entrepreneurs of such projects should not seek venture capital but should be self-sufficient and profitable, quickly cashing in on the current consumer boom. They must seize the time window of these few months before the trend shifts to complete their original accumulation.

The reason Brazil's Nubank holds an unfair competitive advantage is that it pioneered this category before the concept of "fintech" became mainstream. More importantly, in its early days, it only had to compete for users against traditional banking giants in Brazil, without facing competition from emerging fintech startups. As the Brazilian public's patience with existing banks reached its limit, they collectively turned to Nubank after its product launch, allowing the company to achieve an exceptionally low customer acquisition cost and perfect product-market fit.

If you want to build a stablecoin digital bank for emerging markets, why are you still in San Francisco or New York? You need to engage deeply with local users. Surprisingly, this has become the primary criterion for screening entrepreneurial projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。