The Philippine Securities and Exchange Commission (SEC) published an advisory on Aug. 4, alerting investors about unregistered offshore crypto platforms that continue to serve Filipino users. The regulator warned that a number of digital asset service providers are operating in the country without proper authorization. These platforms, the Philippine SEC stated, are offering crypto trading services in violation of newly implemented compliance requirements. The advisory stressed:

These rules apply to any person or entity that offers, promotes, or facilitates access to crypto-asset trading venues or intermediation services such as buying, selling, and derivatives trading of crypto-assets.

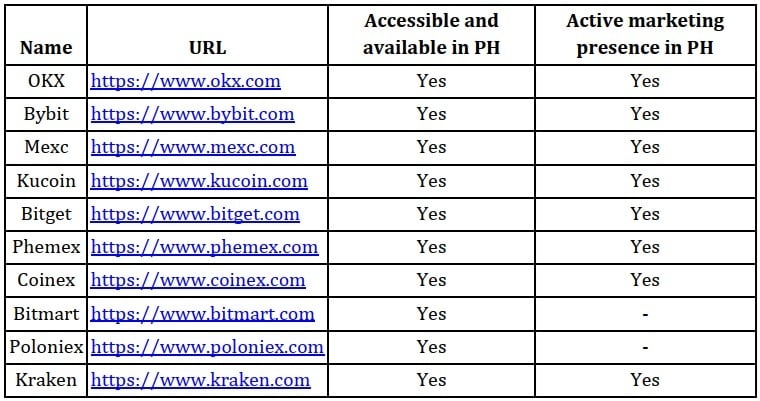

The advisory identified 10 exchanges currently violating domestic securities regulations: OKX, Bybit, Mexc, Kucoin, Bitget, Phemex, Coinex, Bitmart, Poloniex, and Kraken. All are either actively promoting services or remain fully accessible to users within the Philippines despite lacking any SEC-issued license under Memorandum Circulars No. 4 and No. 5, which took effect in July 2025.

The regulator additionally said other cryptocurrency exchanges may also be in violation, noting: “This list is not exhaustive. Other platforms offering similar services to the Philippine public without registration or SEC approval are likewise considered to be operating in violation of Philippine securities laws.”

List of unlicensed crypto exchanges flagged by the Philippines’ SEC. Source: Philippine SEC

Following the earlier geo-blocking of Binance, the Philippine SEC disclosed that several other platforms remain accessible and are engaging in unauthorized marketing activities directed at Philippine residents. The regulator emphasized:

They continue to offer or market crypto-asset services to the Philippine public without the required registration or license.

Beyond investor protection concerns, the Philippine SEC underscored the broader national risks posed by unregulated crypto activity. Because these entities operate outside the scope of the Anti-Money Laundering Act (AMLA), they are not subject to compliance controls such as customer due diligence, recordkeeping, or suspicious transaction reporting. The SEC warned that this lack of oversight may enable cross-border illicit finance and heighten the country’s vulnerability to gray-listing. Enforcement actions may include cease and desist orders, criminal proceedings, and coordination with tech firms to curb exposure. In response, some crypto proponents have urged regulators to adopt a more collaborative compliance approach to encourage innovation and safer engagement in the digital asset sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。