Author: Les Barclays

Translation: Shaw Golden Finance

In this article, I will analyze what I believe to be one of the most important financial developments currently taking place… new stablecoin legislation and its potential role in helping the United States manage national debt, maintain the dominance of the dollar, and exert pressure in global markets. In my view, this is not just about cryptocurrency regulation; it is closely related to the bond market, yield curves, macroeconomic strategies, and the broader geopolitical games being played behind the scenes.

If stablecoins are incorporated into the U.S. fiscal and monetary policy framework, their impact will be significant not only for the cryptocurrency space but also for global trade, manufacturing, debt issuance, and monetary policy. This could allow the U.S. to rebuild domestically at a lower cost while increasing financial pressure on competitors and drawing funds back into the U.S. system.

What is the GENIUS Act (and why is it being introduced now)

Stablecoins can be seen as digital dollars that always hold a value of exactly 1 dollar. Currently, there are no clear rules regarding who can issue stablecoins and how they should operate, which raises concerns about their safety.

The GENIUS Act (Senate version): This legislation establishes a regulatory framework for payment stablecoins (digital assets that must be redeemed by the issuer at a fixed monetary value). According to the Act, only licensed issuers will be allowed to issue payment stablecoins. You can think of it as requiring a special license to print digital currency.

Key Differences

Who is in charge: The Senate version centralizes regulatory authority in the Treasury Department, while the House distributes power among the Federal Reserve, the Office of the Comptroller of the Currency, and other agencies.

Rule-making: Under the Senate's GENIUS Act, only the Office of the Comptroller of the Currency (OCC) has the authority to issue these rules. The House's STABLE Act would impose more requirements, with multiple agencies collaborating.

Both aim to:

Safety first: Only approved companies can issue stablecoins, similar to how only licensed banks can hold your funds.

Consumer protection: The legislation will limit the issuance of payment stablecoins in the U.S. to "approved payment stablecoin issuers."

Market clarity: It aims to regulate the approximately $238 billion stablecoin market, creating a clearer framework for banks, companies, and other entities to issue digital currencies.

Current status: The GENIUS Act passed with a vote of 308 in favor and 122 against. The U.S. House of Representatives passed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (referred to as the "GENIUS Act") on July 17, 2025, and submitted this landmark legislation for President Trump’s signature. Thus, the Senate version (GENIUS Act) ultimately prevailed and officially became law, marking the first cryptocurrency legislation approved by both houses of Congress.

Essentially, both pieces of legislation seek to establish "traffic rules" for the digital dollar, but there are disagreements over which government agencies will act as the "traffic police."

The House's STABLE Act and the Senate's GENIUS Act are two opposing bills but share a common goal: to bring stablecoin issuers under regulatory oversight and clarify how much capital, liquidity, and risk management is deemed sufficient. They also aim to clarify which federal or state agencies will act as referees. But there is another less conspicuous potential subplot: how the widespread acceptance of stablecoins by global traditional institutions will impact the $28 trillion U.S. Treasury market.

How Stablecoins Become Implicit Demand for Treasuries

Here's the thing: Treasuries are the backbone of stablecoin reserves because, in terms of safety and liquidity, few other assets can compare. If you provide a digital dollar, you need to back it with assets that are as close to risk-free as possible. This sounds a lot like the hundreds of money market mutual funds issued by giants like BlackRock, Fidelity, and Vanguard, which hold over $6 trillion in assets, most of which are U.S. Treasuries. However, unlike the money market funds issued by Fidelity that may offer a 4% annual yield, most stablecoin issuers have so far refused to provide any yield or income to their holders. This is also why the largest stablecoin issuer, Tether, has extremely high profit margins and reported over $1 billion in operating profit in the first quarter of 2025. It has indeed set many standards for reserves, audits, disclosures, and anti-money laundering (AML) compliance because it wants to address many concerns about illegal activities. It also involves restrictions on marketing stablecoins as legal tender while prohibiting the payment of yields or interest to individuals holding stablecoins, as this would significantly undermine the banking sector.

One thing I have been paying attention to for a while (but unfortunately haven't discussed with anyone) is the relationship between stablecoins, U.S. Treasuries, and the Treasury Department. And I believe I understand why the government would push for stablecoins first rather than other things.

In the chart below, there is one thing I want to emphasize:

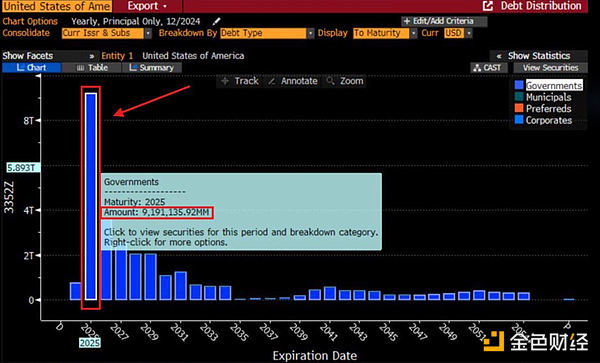

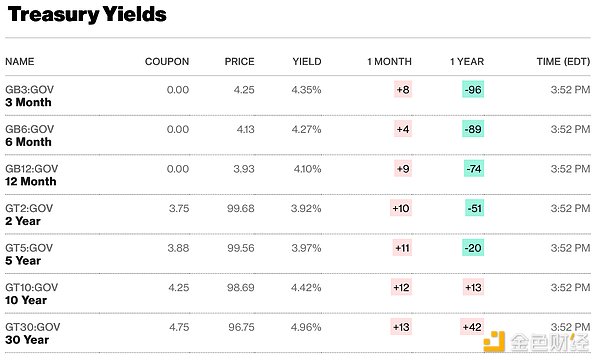

The reason I emphasize this now is that stablecoins could be one of the largest buyers of U.S. Treasuries, which would lower bond yields. In short, through stablecoins, you can normalize the yield curve, which I believe is exactly what the Trump administration wants to implement, as both Trump and Besant (whom I will discuss later) are concerned about national debt and the amount that needs to be refinanced by the end of the year.

Treasury Perspective

I think this is an interesting way to reduce the interest payments on the aforementioned debt, and the reason it is extremely compelling is that it would allow the U.S. to refinance its Treasuries at lower yields, ultimately making it much easier to finance the debt.

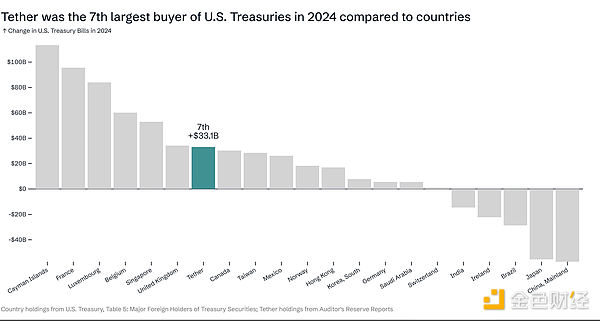

Now let's talk about the situation of stablecoins relative to other countries. In 2024, Tether was the seventh-largest buyer of U.S. Treasuries, comparable to other countries purchasing U.S. Treasuries. Imagine how much U.S. Treasuries Tether (or Circle or other entities) could purchase within this framework. There are some concerns surrounding stablecoins and central bank digital currencies, and other bills or proposals are being drafted and passed regarding the U.S. not supporting central bank digital currencies. You could speculate that Tether or Circle might be disguised as a central bank digital currency, but that is a completely different topic that I won't delve into. What I want to emphasize is the impact of stablecoins on national debt.

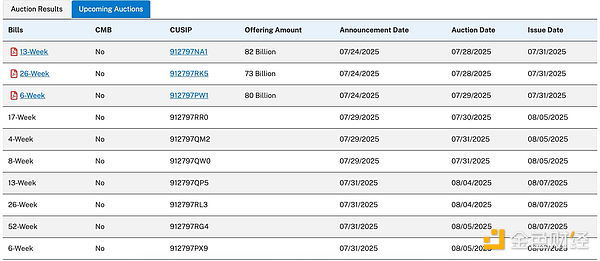

The Federal Reserve currently holds about 40% of Treasuries, which need to be rolled over at the new interest rate levels. These Treasuries are maturing in 2025 and 2026. Below, I will attach a chart of U.S. short-term Treasury yields for reference.

Currently, depending on the term in question, our debt rate is approximately between 4% and 5%. If this is short- to medium-term debt and is rolled over at the aforementioned rates, it will become very unsustainable, leading to a debt spiral. If stablecoins become one of the largest buyers of U.S. Treasuries, they can lower yields, and they will do so, especially in the short term. This is why I believe short-term demand, particularly for short-term Treasuries, is very noteworthy, as it means they will essentially become one of the largest buyers of short-term Treasuries and significantly alleviate the pressure of the massive U.S. national debt.

U.S. Treasury Secretary Scott Besant mentioned in an interview that the U.S. wants to be a leader in the digital asset space and use this as a means to exert pressure in global markets.

Clearly, Besant is a supporter of stablecoins. A few months ago, it was not possible to discuss this; you wouldn't want to showcase your action plan to your adversaries. I am glad he is one of the few who has figured out what the adoption of stablecoins in the U.S. could mean—considering his background, it is not surprising for him and those working in finance. I believe he has a very forward-thinking understanding of what stablecoins could be or what they mean for the U.S. Treasury market.

The U.S. Treasury is issuing different types of bonds, and on July 21, they auctioned $82 billion in 3-month Treasuries, which had a very favorable auction outcome. These are things that everyone involved in finance or investment should pay attention to.

These auctions are very important because they reflect investor interest (including domestic and foreign investors) in purchasing U.S. Treasuries. I also believe that Powell's current approach of not lowering interest rates too quickly is correct, not only because economic data suggests so but also because when interest rates remain high—especially since the U.S. is the driving force of the global economy—it undermines the stability of many other economies, primarily those in Asia, Europe, and South America. I say this because when interest rates are high, it actually attracts liquidity back to the dollar as investors seek safe havens. I believe the current situation is that they want to force other currencies to realign with the dollar. So they can take action in the bond market by keeping interest rates high. This could severely weaken the economies and/or currencies of those countries from a financing perspective, as the capital cost of non-dollar-denominated currencies becomes higher, making it more difficult to borrow. Therefore, those other countries will have to liquidate a large number of assets to fund themselves and stabilize their economies.

When a country finds itself in fiscal distress—regardless of how it got there—it will be forced to sell assets to stabilize its economy, and I am sure the Trump administration is aware of this and is leveraging this fact.

Scott and the entire U.S. government seem to be dissatisfied with Europe. They could have forced many countries to align with U.S. policies and everything proposed through means such as tariffs and the bond market, but the bond market is extremely important.

Financial Stability or Digital Vulnerability?

Now, if the U.S. pushes for stablecoin legislation while engaging in tariff negotiations and trade agreements, I believe many factors will converge, leading to significant domestic pressure in Europe and Asia, potentially triggering some form of credit event that would essentially cause stock markets to decline, prompting everyone to flock back to U.S. Treasuries. It depends on how quickly and on what scale stablecoins can develop, because if they grow too fast and too much, we might encounter some liquidity event (like the money market fund runs from 2008 to 2009, or even the brief decoupling of Tether from the dollar in 2022), and there could even be a liquidity downward spiral/run dynamic, such as stablecoin redemptions forcing the sale of short-term Treasuries.

In my view, some type of event does need to occur. It's like a compressed spring or even a ball underwater. The deeper you push the ball down, the more it wants to float to the surface. This is similar to what we see with Japanese government bonds and the UK debt market, among others.

An article written by a friend at Barclays explores several key adoption risks associated with stablecoins. Stablecoins are digital assets designed to maintain a stable value relative to a reference asset. The main adoption risks highlighted in the article include:

Regulatory Uncertainty: Stablecoins face significant regulatory scrutiny as regulators attempt to address issues surrounding their use, investor protection, and risks to financial stability. In the absence of a clear regulatory framework, issuers, users, and financial institutions seeking to incorporate stablecoins into their operations face ongoing uncertainty.

Operational Resilience: The underlying technological infrastructure of stablecoins, including smart contracts and supporting blockchains, must demonstrate strong stability, scalability, and security. Operational risks from disruptions, technical failures, and cyberattacks could undermine trust and usage.

Consumer Protection and Trust: Users must trust that the tokens are fully backed by reserves and can be redeemed at the promised value. Insufficient transparency or poor reserve management could erode confidence, leading to value loss for holders or other issues.

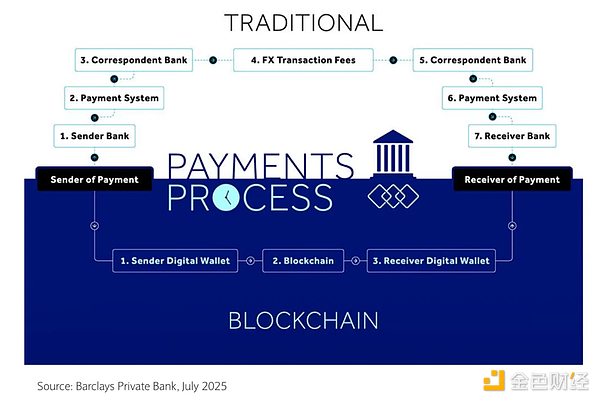

Integration with Existing Systems: The adoption of stablecoins may be hindered by the challenges of integrating new digital assets with traditional payment, banking, and financial market infrastructures. To realize the advantages of stablecoins at scale, seamless interoperability is required.

Systemic Risk: If poorly designed or inadequately regulated stablecoins are widely adopted, they could introduce new systemic risks to the broader financial system, especially if they occupy a significant share in payments or deposits.

These risks indicate that, despite the promising outlook for stablecoins, their widespread application depends on clear regulatory standards, robust technology, transparent reserve management, and successful integration with the existing financial ecosystem.

The Politics of Quiet Monetization

Shashank Rai describes a phenomenon that can be termed "quiet monetization"—how stablecoins create a significant increase in demand for U.S. Treasuries without expanding traditional government debt. Here’s how it works:

Stablecoin issuers must fully back their tokens with liquid assets (the vast majority being short-term U.S. Treasuries). As of early 2025, stablecoin issuers held over $120 billion in U.S. Treasuries, and this figure is expected to rise to $1 trillion or more by 2028. This creates what they call "a structural and sustained source of demand for short-term U.S. Treasuries, even as the market becomes increasingly cautious about U.S. fiscal policy and long-term debt."

The UK has been slow to establish the necessary regulatory certainty around stablecoins. Stablecoins are an expensive form of currency. They are costly because they limit the monetary transmission mechanism (thereby reducing economic growth). They are costly because they increase the volatility of government debt (and the dollar) and raise term premiums. They are costly because they dilute liquidity. They are costly because most of their yields are lower than those of money market funds. They are costly also because the transaction costs on blockchain are an order of magnitude higher than those of domestic payment systems.

Stablecoins represent a higher-risk form of currency. The risk lies in their adoption of an atomic swap model rather than a currency-to-currency model. The risk also lies in their KYC processes being subject to much less regulation. Additionally, there is a concentration risk surrounding miners in the blockchain.

As a competitive form of currency, they should receive regulatory certainty and be brought under regulatory oversight (which differs from the EU's approach, where excessive regulation has repeated its mistakes in the retail forex market, driving that market offshore). However, the structure of stablecoins should not undermine the stability of the banking system or erode public confidence in currency (as seen in the U.S.). Properly regulated stablecoins operating within a regulatory framework will be able to interoperate fully with cash. In a capital market environment, this will ultimately eliminate most stablecoins. Efficient markets, efficient liquidity, and programmable money do not require blockchain-based stablecoins.

A good regulatory framework for stablecoins needs:

Real-time reporting of redemptions/liquidity - daily net asset value reports

Regulatory capital based on RWA models (like money market funds or banks)

Minimum short-term liquidity ratios (24 hours).

Regular requirements for transparent internal audits (systems and processes) - senior personnel systems (key decision-makers must be qualified).

CRO's duty of care to regulators.

Stablecoin issuers should be able to access the central bank's real-time full payment system, repo market, and obtain central bank funding just like banks during periods of market stress. However, there should be no regulations on the asset composition of stablecoins (beyond meeting short-term liquidity needs). Transparency should be maintained, allowing the market to decide.

The "Offshore Quantitative Easing" Effect

The concept of "offshore quantitative easing" refers to how stablecoins effectively create demand for the dollar globally without the Federal Reserve needing to print more money:

Because stablecoins are market-driven, users tend to choose the most stable and widely accepted stablecoins, naturally favoring strong currencies (primarily the dollar) while potentially excluding weaker national currencies. As stablecoins become more prevalent, especially in emerging markets, the process of dollarization may further accelerate.

The author believes this will create "a new game of dollarization," where "the rapid and low-cost flow of stablecoins may marginalize weaker currencies, further solidifying the dollar's dominance and reshaping the international financial landscape by making the dollar more accessible and liquid in cross-border transactions."

Unlike traditional quantitative easing (QE), where central banks openly expand the money supply, this operation is achieved through private market forces—stablecoin companies automatically purchase Treasuries to back their tokens, thereby creating demand for Treasuries without government intervention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。