来源:bitcoinist

编译:区块链骑士

最新链上研究显示,美国在比特币持有量上遥遥领先。各国和企业纷纷增持比特币,投资者与分析师正密切关注这一趋势。美国持有的比特币规模之巨,正重塑加密货币领域关于稀缺性与价值的讨论。

根据 Fred Krueger 的分析,在全球近 2000 万枚流通比特币中,美国持有近 800 万枚,占现有总量的 40%。

报告显示,若每枚比特币估值为 12 万美元,美国持有的比特币总价值约为 9360 亿美元。与此同时,美国比特币 ETF 在 7 月录得 60 亿美元净流入,这是该类产品历史上第三强劲的月份,仅次于 2024 年 2 月和 11 月。

美国以外的比特币持有量远低。印度以 100 万枚比特币位居第二,占总量的 5%,按相同价格计算价值约 1200 亿美元。欧洲紧随其后,持有 90 万枚(4.6%),价值 1080 亿美元。

我国持有约 19.4 万枚比特币(1%),主要来自查封,价值约 233 亿美元。拉丁美洲和亚洲其他地区各持有约 40 万枚(2%),各价值 480 亿美元。非洲及其他地区合计持有 30 万枚(1.5%)。

有报道披露,美国上市公司是比特币市场的核心参与者。Strategy 以账面上 628,791 枚比特币遥遥领先。马拉松数字控股公司(Marathon Digital Holdings,MARA)紧随其后,持有 50,000 枚;XXI Capital 持有 43,514 枚。

比特币标准储备公司(Bitcoin Standard Treasury Company)持有 30,021 枚,Riot Platforms 持有 19,225 枚。美国前总统唐纳德・特朗普旗下的特朗普媒体与科技集团(Donald Trump Media&Technology Group Corp.)也榜上有名,持有 18,430 枚。这些企业涵盖矿企、金融服务等多个领域,凸显企业对加密货币的兴趣已多元化。

数据显示,尽管监管环境不明朗,印度的加密货币持有量仍在激增。该国大多数持有者为小额零售投资者,但庞大的用户基数使其超越欧洲。

在欧洲,零售与机构投资者共同推动加密货币的普及。不过,欧洲的增长较为平稳,而印度 2018 至 2023 年的复合年增长率(CAGR)接近 100%,远高于传统支付领域的约 8%。这种差异凸显了加密货币对印度用户的独特吸引力。

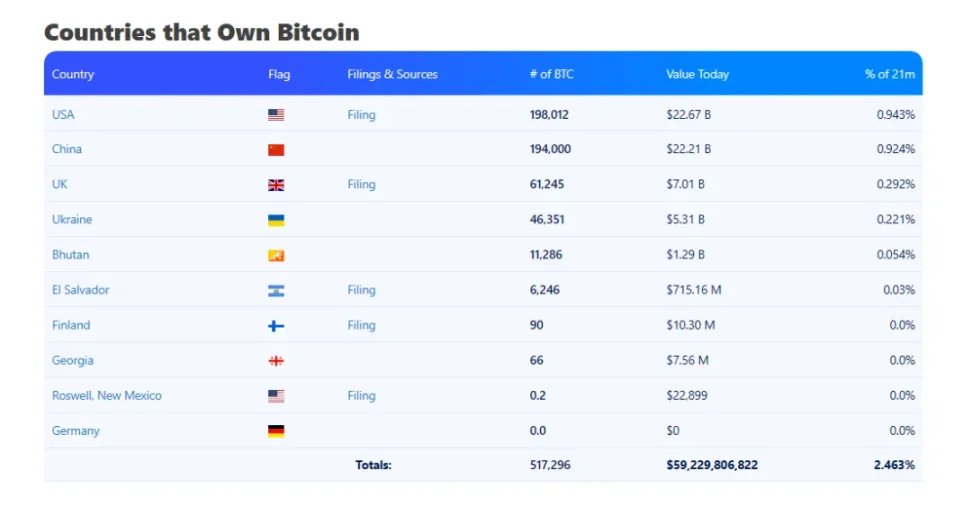

此外,Bitbo 近期图表也揭示了各国储备情况。图表显示,与美国相关的比特币储备超过 20 万枚,中国也持有类似数量的比特币。

英国以 6.1 万枚位居第三,乌克兰以 4.6 万枚位居第四。不丹、萨尔瓦多、芬兰等较小经济体持有 5000 至 10,000 枚比特币。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。