Author: xparadigms

Translation: Block unicorn

Key Points

According to Executive Order No. 14178, a working group today released a 166-page report outlining how the United States is leading the blockchain industry and ushering in the "golden age of cryptocurrency."

The key information in the report can be summarized into four main demands: (i) a universal classification framework for the digital asset market, (ii) the interconnection of the banking and blockchain industries, (iii) accelerating the adoption of stablecoins, and (iv) guidelines for illegal finance and taxation.

In the real world, the momentum for change is increasingly evident, as collaborations between traditional financial institutions (such as JPMorgan) and blockchain-based platforms (such as Coinbase and Robinhood) indicate a significant shift towards actual financial innovation.

1. Countries Recognizing Blockchain Potential Are Leading

In the United States, the government actively acknowledges the potential of blockchain and digital assets and is moving forward. On January 23, 2025, President Trump issued Executive Order No. 14178, "Strengthening America's Leadership in Digital Financial Technology," which clarified regulatory guidelines and encouraged innovation in the field. In accordance with this order, a cross-departmental working group recently released a 166-page report outlining how the United States is leading the blockchain industry and ushering in the "golden age of cryptocurrency."

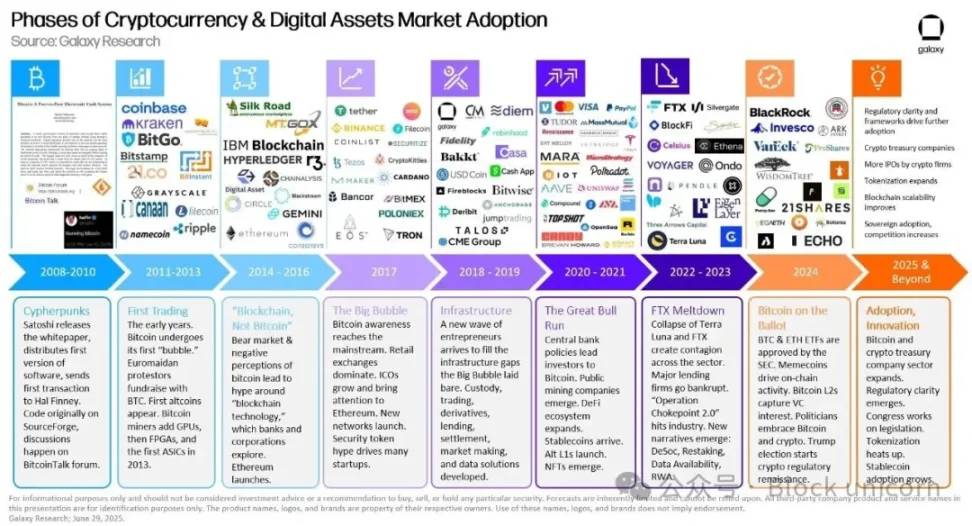

The report reviews America's long-standing tradition of technological innovation and assesses the potential of blockchain and digital assets (cryptocurrencies) to fundamentally change the financial system and asset ownership structure. It also points out that overly stringent measures, such as the previous government's so-called "Operation Choke Point 2.0," excluded legitimate crypto companies from the banking system and suggests that the government should actively support business activities related to these innovative technologies in the future rather than suppress them.

In the spirit of Executive Order No. 14178, the report emphasizes that U.S. regulators should promote innovation through clear and consistent rules and attract crypto companies to operate domestically. The report urges agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to collaborate in establishing clear standards and a common classification framework to eliminate regulatory gaps. It also suggests adopting a technology-neutral and flexible regulatory approach for new areas such as decentralized finance (DeFi) to ensure that innovation is not hindered by outdated rules.

Meanwhile, Hong Kong is also responding rapidly and following suit. In June 2023, the Hong Kong government introduced a formal licensing system for virtual asset exchanges, allowing limited participation from retail investors while regulating crypto trading. In May 2025, Hong Kong passed the most progressive "Stablecoin Act" in Asia, establishing licensing requirements for institutions issuing fiat-pegged stablecoins, effective from August 1. With this "regulated but innovation-friendly" approach, Hong Kong is expected to stimulate blockchain development and become one of Asia's leading digital asset centers.

2. Key Information from the Report "Strengthening America's Leadership in Digital Financial Technology"

Since the Trump administration took office, the sentiment towards cryptocurrencies in the United States has changed. As of June 2025, a survey found that 72% of crypto investors support President Trump's policies, and more than one-fifth of Americans now own some form of cryptocurrency. Among these investors, 64% indicated that the government's supportive stance on cryptocurrencies made them more inclined to invest in them than before. This optimistic sentiment has also spread among institutional investors: a poll found that 83% of institutional investors plan to increase their allocation to digital assets in 2025.

These data suggest that a more favorable regulatory environment is invigorating the industry. Under the banner of "supporting responsible innovation and growth," the report repeatedly emphasizes that by implementing policies that support cryptocurrencies and a clear regulatory environment, the United States can take a leading position in the upcoming blockchain revolution.

The key information in the report can be summarized into four main points. Let's explore them one by one.

2.1 A Universal Classification Framework for the Digital Asset Market Must Be Established

This section discusses the legal and regulatory classification of digital assets and ways to improve market structure. Currently, in the United States, there are no clear guidelines to determine whether a particular cryptocurrency is a security or a commodity. This ambiguity has led to jurisdictional conflicts between regulators (such as the SEC and CFTC) and left gaps in regulatory overlap. The report criticizes, "The lack of a comprehensive classification framework has resulted in a chaotic array of interpretations, leaving well-meaning participants trying to comply with regulations feeling as if they are walking through a minefield," emphasizing the urgent need to establish a clear and consensus-based classification law for digital assets.

For example, digital tokens used for fundraising may be considered securities (investment contracts) at the time of sale, but once they become sufficiently decentralized, some argue they should no longer be regarded as securities. Currently, there is no standard that can explain this dynamic change throughout the project lifecycle. This creates significant uncertainty for projects, as they find it difficult to predict which laws will apply over time.

In this context, the report views positively the passage of the "Digital Asset Market Clear Act (CLARITY Act)" in the U.S. House of Representatives with bipartisan support in 2025. This act categorizes digital assets into security tokens and non-security (commodity) tokens, clearly granting the SEC jurisdiction over the former and the CFTC jurisdiction over the latter and the crypto spot market. The act also includes provisions to protect Americans' rights to self-custody assets and engage in peer-to-peer transactions, recognizing the value of decentralized governance and decentralized finance (DeFi).

The report points out that the Digital Asset Market Clear Act will lay a solid foundation for "the structure of the U.S. digital asset market," but also suggests some improvements during the legislative process. First, the report emphasizes the need to clarify the legal status of fully decentralized protocols and provides factors for legislators to consider, such as:

- Whether the given software protocol exerts any actual "control" over user assets;

- Whether the protocol can technically be changed or upgraded;

- Whether there are centralized operators or governance structures;

- Whether current regulatory obligations can be technically enforced against it.

Based on these criteria, truly decentralized projects cannot be regulated in the traditional intermediary manner, thus requiring a new approach. Regulators should develop a flexible framework that achieves policy goals without stifling innovation.

The report hopes that the Digital Asset Market Clear Act can provide this foundation and urges Congress to pass the act swiftly. At the same time, the report suggests that regulators take immediate action using existing authority during the transition period to increase regulatory clarity for market participants.

2.2 The Banking and Blockchain Industries Should Be Interconnected

This section discusses the integration of the banking and crypto industries, proposing policy recommendations for U.S. banks to expand their participation in digital assets under prudent regulation. The report mentions the previous government's attempt to cut off banking services to crypto companies—known as the "Operation Choke Point 2.0" policy—and criticizes it as a misguided attempt to stifle a legitimate industry by pushing it out of the banking system.

The report points out that this top-down pressure has led many U.S. crypto companies to face issues such as bank account closures, resulting in consumer harm and the unintended growth of unregulated "shadow" markets. The report emphasizes that banks can gain significant efficiency and cost savings by leveraging blockchain. For example, integrating distributed ledger technology into payment and settlement systems can enable real-time payments and atomic settlements around the clock, eliminating business hour restrictions and reducing costs associated with central clearinghouses. Some major banks have already taken steps in this direction, testing their digital dollar tokens or blockchain platforms for bond settlements.

Recommendations in this section include:

- Clarifying the crypto-related activities allowed for banks and restoring initiatives such as the Office of Innovation to guide banks' actions in this area.

- Increasing transparency in the bank chartering and Federal Reserve account processes to facilitate new entrants and not unfairly prevent existing banks from serving crypto clients.

- Linking bank capital requirements to actual risk and developing regulatory guidelines for new risk exposures such as tokenized assets.

2.3 Stablecoins Should Be Viewed as Innovative Digital Tools and Actively Promoted

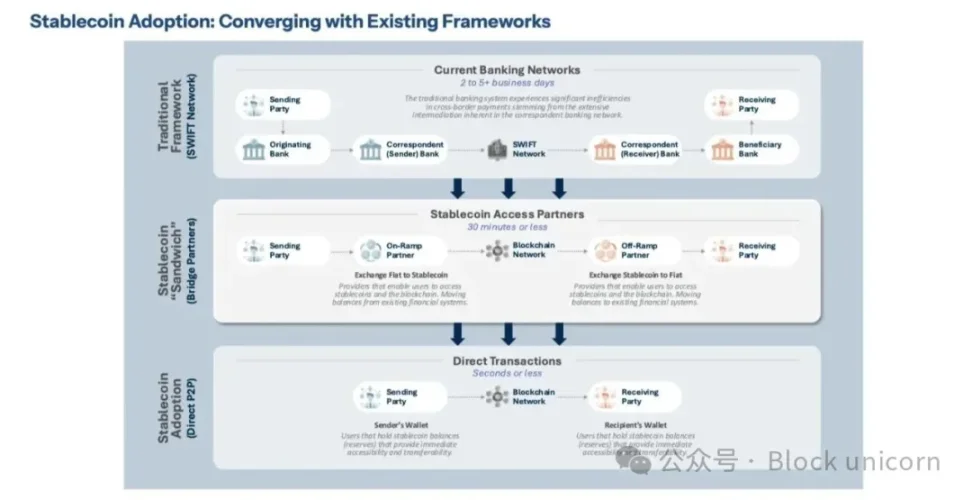

This section focuses on the role of stablecoins in digital payment innovation and reinforcing the dollar's dominance. Stablecoins are crypto assets with stable value, designed to maintain a 1:1 peg with fiat currencies like the dollar. Due to their price stability, they effectively serve as digital cash within the crypto ecosystem.

The report assesses that the widespread use of dollar-pegged stablecoins can modernize payment infrastructure, helping the U.S. move away from outdated traditional payment networks. For example, using stablecoins for international remittances or securities settlements can achieve near-instant processing without intermediary banks, significantly reducing costs. This will also enhance the international influence of the dollar. Currently, dollar-pegged stablecoins account for a significant share of global crypto trading volume, with a circulating value in the hundreds of billions. The report emphasizes that to lead this trend, the U.S. must establish a clear federal regulatory framework for stablecoins.

In this context, the report highlights the "Guidance and Establishment of the U.S. Stablecoin Innovation Act" (referred to as the GENIUS Act) passed by Congress this year. This act (i) establishes a system for private dollar stablecoin issuers that is approved and regulated by the Federal Reserve, and (ii) prohibits the Federal Reserve from developing a central bank digital currency (CBDC), thereby confirming a preference for private sector-led digital dollar innovation. The report praises the GENIUS Act for "incorporating an innovation-friendly framework into federal law" and strongly urges the Treasury and other relevant agencies to faithfully and promptly implement the act.

The report also notes that while establishing stablecoin rules, it is necessary to address tax issues. Under current U.S. tax law, the definition of stablecoins is unclear, and their tax treatment may vary depending on whether they are viewed as currency or property. The report argues that this ambiguity burdens participants, and therefore, once a federal regulatory system for stablecoins is established, tax laws should be updated to clarify the classification of stablecoins and eliminate uncertainty.

The core message of this section can be summarized as: "Actively promote stablecoins as a means of digital dollar innovation, firmly oppose central bank digital currencies, as they threaten American freedom and financial stability." Regarding stablecoins, the report urges the implementation of the newly passed GENIUS Act and suggests that additional legislation may be introduced if necessary to enhance privacy protection and consumer safeguards.

The report also emphasizes that the U.S. should take the lead in establishing global standards for stablecoins and promoting cross-border payment innovation.

2.4 Guidelines for Illegal Finance and Taxation Must Be Established

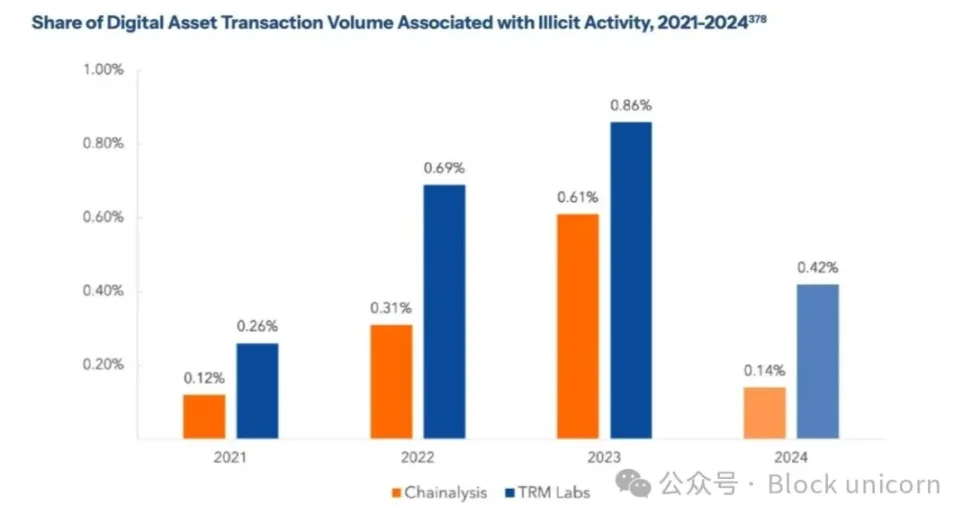

This section discusses the illegal financial risks associated with cryptocurrencies (money laundering, terrorism financing, tax evasion, etc.) and the measures to address them. The report states, "To embrace innovation while ensuring national security, we must modernize anti-money laundering (AML) regulations," and analyzes the shortcomings of the current system.

Due to the anonymous, borderless, and real-time nature of crypto transactions, the report acknowledges that enforcing laws designed for traditional banking, such as the Bank Secrecy Act (BSA) or the "travel rule," is challenging. For example, criminals may use decentralized exchanges or mixers to repeatedly swap or split funds, making transactions difficult to trace. The report cites specific cases—such as the misuse of decentralized finance (DeFi) by North Korean hacker groups in 2022 and ransomware attackers demanding cryptocurrency payments—to illustrate the need for updates to the current AML system to address these new strategies.

At the same time, the report repeatedly emphasizes that AML/Counter-Terrorism Financing (CFT) enforcement should not be abused in a way that deviates from the intent of the law. If AML regulations are used for political purposes or to stifle specific industries, it will only erode trust in the financial system. Therefore, regulatory agencies themselves should operate under democratic oversight and transparency, and clearly establish guidelines to avoid unfairly restricting legitimate businesses and users.

The final part of this section presents recommendations to address the ambiguity and uncertainty surrounding digital asset taxation. The report points out that while the Internal Revenue Service (IRS) generally classifies cryptocurrencies as property, specific tax guidelines for new activities such as staking, mining, airdrops, or token wrapping have yet to be established, creating significant confusion for taxpayers. The report urges the IRS and the Treasury to issue clearer and more practical tax guidance and suggests considering a minimum tax exemption for small crypto transactions to avoid penalizing users for everyday payments made with cryptocurrencies.

3. More People Should Better Understand Cryptocurrencies

Many countries and companies—led by the United States—are racing to announce and implement blockchain strategies, not merely to follow trends, but because they foresee the trajectory of the market and are preparing in advance. In the U.S., companies like Messari, Delphi, Galaxy Research, and rwa.xyz continuously provide high-quality research to help institutions formulate forward-looking strategies for blockchain and digital assets. Protocols like Ondo Finance and Morpho have built secure on-chain financial services, while companies like BitGo and Coinbase provide reliable infrastructure for institutions to invest in crypto assets.

In contrast, South Korea's fundamental understanding and preparation for the blockchain industry—especially stablecoins—remain insufficient. Discussions about stablecoins still tend to focus on the failure of Terra or debates about why stablecoins do not work, with arguments revolving around issuance rather than real-world applications. However, stablecoins have demonstrated various use cases globally, and South Korea should not only focus on issuance but also develop products that integrate them into daily life. Achieving this first requires policy support and a clear regulatory environment.

Since the blockchain industry (especially stablecoins) is still in its early stages, it is indeed challenging to point to specific success stories that justify their adoption. However, this is precisely why maintaining an open attitude—essentially saying, "Let's take a serious look and try to understand this"—is so important. Only by starting to understand now can we hope to keep pace with the rapidly changing landscape.

4. Everything is Now Ready

The boundaries between finance and the blockchain industry have begun to blur, and leaders from both sides are starting to collaborate. A typical example is the partnership between JPMorgan, the largest bank in the U.S., and the crypto exchange Coinbase. JPMorgan announced that its credit card customers can convert reward points into USDC on Coinbase's Base blockchain. The bank will also link customer accounts directly to the Coinbase platform, enabling seamless, near-instant exchanges between fiat and cryptocurrencies. This marks a milestone integration between traditional banks and crypto exchanges, indicating that major financial institutions now recognize digital assets as a legitimate component of their financial services.

This trend is not limited to banks and exchanges. Coinbase has also partnered with Morpho to expand into on-chain finance—specifically the decentralized finance (DeFi) space. Through this collaboration, users can deposit their held Bitcoin via the Coinbase app and use it as collateral to borrow USDC for everyday spending. This demonstrates an asset utilization strategy that traditional finance cannot achieve. In fact, investors can manage their daily cash flow while continuing to hold Bitcoin, indicating that blockchain-based financial innovation has entered a practical phase.

Another development is occurring in the fintech sector. The popular trading platform Robinhood is launching its own Layer-2 blockchain to provide infrastructure for on-chain issuance and trading of listed and private stocks. The Robinhood chain will ultimately connect with the Ethereum ecosystem. This means that fintech platforms are no longer just providing brokerage services but can utilize their own blockchain to handle a broader range of on-chain financial assets. In short, a new trend is emerging where traditional fintech platforms are adopting blockchain to achieve asset ownership and liquidity in unprecedented ways.

Unfortunately, unlike these global financial innovation cases, South Korea is still lagging behind. There have yet to be specific collaborations or mergers between South Korean banks, exchanges, fintech startups, and DeFi projects. South Korean institutions may need to at least experiment with a private blockchain platform (such as JPMorgan's private Kinexis network) to gain practical experience. Major countries and financial institutions worldwide are already sketching out blockchain-driven financial blueprints and actively engaging in collaboration. If South Korea continues to remain inactive, all domestic discussions will inevitably remain at the theoretical stage, never translating into practice.

Of course, implementing blockchain is not easy, and it is understandable to remain cautious while its market impact is not yet clear. However, avoiding issues due to uncertainty or delaying action indefinitely is not the best choice. The transformation of the financial system driven by blockchain has already begun, and leaders are learning and accelerating their development rapidly. The only remaining question is when and how other countries will decide to join this wave.

The momentum for change is becoming increasingly clear, and now that the puzzle pieces have come together, it is fundamentally time to deepen our understanding of the blockchain industry and to seriously consider and take action to adopt it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。