The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and reject any market smoke screens!

The other day, I mentioned that the cryptocurrency circle and stablecoins are two different markets. Many friends voiced their opposition, and after our discussion, it became clear that everyone indeed needs to deepen their financial fundamentals. The article repeatedly emphasizes that once stablecoins choose to operate in the Hong Kong region, they will not be developed in the mainland. This is not difficult to understand. Our stablecoin system is not implemented for the same purpose as that of the United States. The stability in Hong Kong is merely a preparation for domestic enterprises to open up foreign markets, not a wedding dress for outflow. Our ideology is completely opposite to that of the United States; socialism and capitalism are fundamentally different concepts. Moreover, the financial infrastructure built by the United States is vastly different from ours. The U.S. relies on the financial market to achieve the return of dollars, while we are the world's largest industrial country, which means we are the source of exports. It is surprising that some friends discuss with Lao Cui that opening the financial market would elevate domestic capital. How could that possibly be open?

Those clamoring to open the financial market either lack financial fundamentals or are domestic traitors. Lao Cui does not deny that once the market is opened, many manufacturing industries, including top domestic companies, will indeed rise to a higher level. However, all of this comes at a certain cost; everyone must sacrifice all industrial chains. The prosperity of the stock market cannot hide the core issue: the U.S. only needs to print money to obtain a complete industrial chain. Isn't that a dead end? Many users will say that opening the market will better lead to the internationalization of the RMB, and more countries will use our currency. Everyone should be clear about where the difficulty of RMB internationalization lies. To have others recognize your national currency, you must maintain imports greater than exports; otherwise, holding RMB has no value. We are the largest exporting country; how can we reverse this to maintain import data? Stablecoins are not a part of our path to internationalization; they merely open a channel for inflow, as evidenced by VIVO's capital return from India. The use of stablecoins is to break down currency barriers and achieve cross-border transactions. Outflows will be strictly controlled, and those interested can take a closer look at the relevant strategies in Hong Kong.

You can compare the data between China and the U.S., but Lao Cui needs to remind everyone to consider the aspect of purchasing power while comparing data. After a detailed comparison, Lao Cui concludes that while the U.S. may have certain advantages above the middle class, the lower class may not be as glamorous as you think. Lao Cui hopes that those who believe the grass is greener abroad can face this issue. The U.S. consumption capacity is indeed three times higher than ours in terms of data. You can also compare detailed data: in 2024, U.S. personal consumption is $19.83 trillion, with goods consumption at $6.24 trillion (31.49%) and service consumption at $13.58 trillion (68.51%). Service consumption mainly includes healthcare, housing and public services, entertainment and dining, finance and insurance (12%), education (8%), etc. You don't need to think too much about service consumption; it is basically not significantly related to the world economy and can only drive domestic circulation. And service consumption is precisely the most important part for them.

Goods consumption is undoubtedly strong. Our export data to the U.S. in 2024 is as follows: Total exports: $524.656 billion, a year-on-year increase of 4.9%. Total imports: $163.624 billion, almost flat compared to last year. Trade surplus: $361 billion. Main export products: Electromechanical products account for 41.45% of total exports. Everyone should be clear that this is still a growth state under tariff pressure. Listing these data is to hope that everyone can objectively recognize that the U.S. and we are almost in a symbiotic relationship. Their stablecoin system also cannot avoid our sector; stablecoins are a means for them to absorb global resources. These data are all calculated based on the dollar and have not yet been understood from the perspective of purchasing power, which means there will be exchange rate differences. By listing multiple data points, you can understand that last year we consumed 30 million cars, while the U.S. consumed 15 million cars, noting that the U.S. consumption market includes 5 million used cars, while China does not include used cars: the mobile phone consumption market in China is 2.6 times that of the U.S.; in almost all consumption categories, China's total exceeds that of the U.S. by several times, and the per capita difference is not significant. China accounts for 54% of the world's pork consumption, half of the world's vegetable consumption, 40% of fruit consumption, 70% of freshwater fish consumption, and 38% of seafood consumption.

The subsequent data relates to our agriculture and marine products, and it is understandable that you think this is a geographical advantage. Listing this series of data is merely to tell everyone that in terms of equivalent currency, we actually pay more attention to the experience of essential products. There are indeed shortcomings in many areas, but we are continuously improving. Everyone should not always think that the domestic situation is inferior to that of foreign countries. In the cryptocurrency market, we simply do not participate, so we cannot talk about opening up in this regard. What everyone understands about the cryptocurrency market being fair is even more absurd; absolute fairness is impossible if there is no benefit flowing into your hands. After reviewing the above data, we can discuss the differences between stablecoins and the cryptocurrency market, making it easier to understand. The U.S. promotes stablecoins to harvest the middle class of various countries and the global black and gray industries, thereby alleviating the U.S. debt itself. We are merely trying to protect ourselves; perhaps by closely following U.S. strategies, we can also share in the profits.

The inherent contradictions of stablecoins are very obvious, which is also a significant reason for the delay in the Hong Kong license on August 2. It can be seen that domestic stablecoins are more based on the issuance of the Ethereum public chain. Once this channel is opened, how to control capital outflow becomes the biggest issue. If it is not based on public chain issuance, it becomes a closed-door operation. This has become the viewpoint of most users: as long as it is data on the chain, it will definitely promote the market value of the cryptocurrency market. Lao Cui agrees with this viewpoint; as long as on-chain transactions occur, there will be value flowing out, and block packaging will generate transaction fees. Will these giants' stablecoins flow into the cryptocurrency market? I believe there will definitely be corresponding measures because once they flow into the cryptocurrency market, these coins will become uncontrollable. This also involves the exchange of Hong Kong stablecoins for USDC and similar issues, which will pose significant hidden dangers. Until the problems are resolved, we will generally remain conservative.

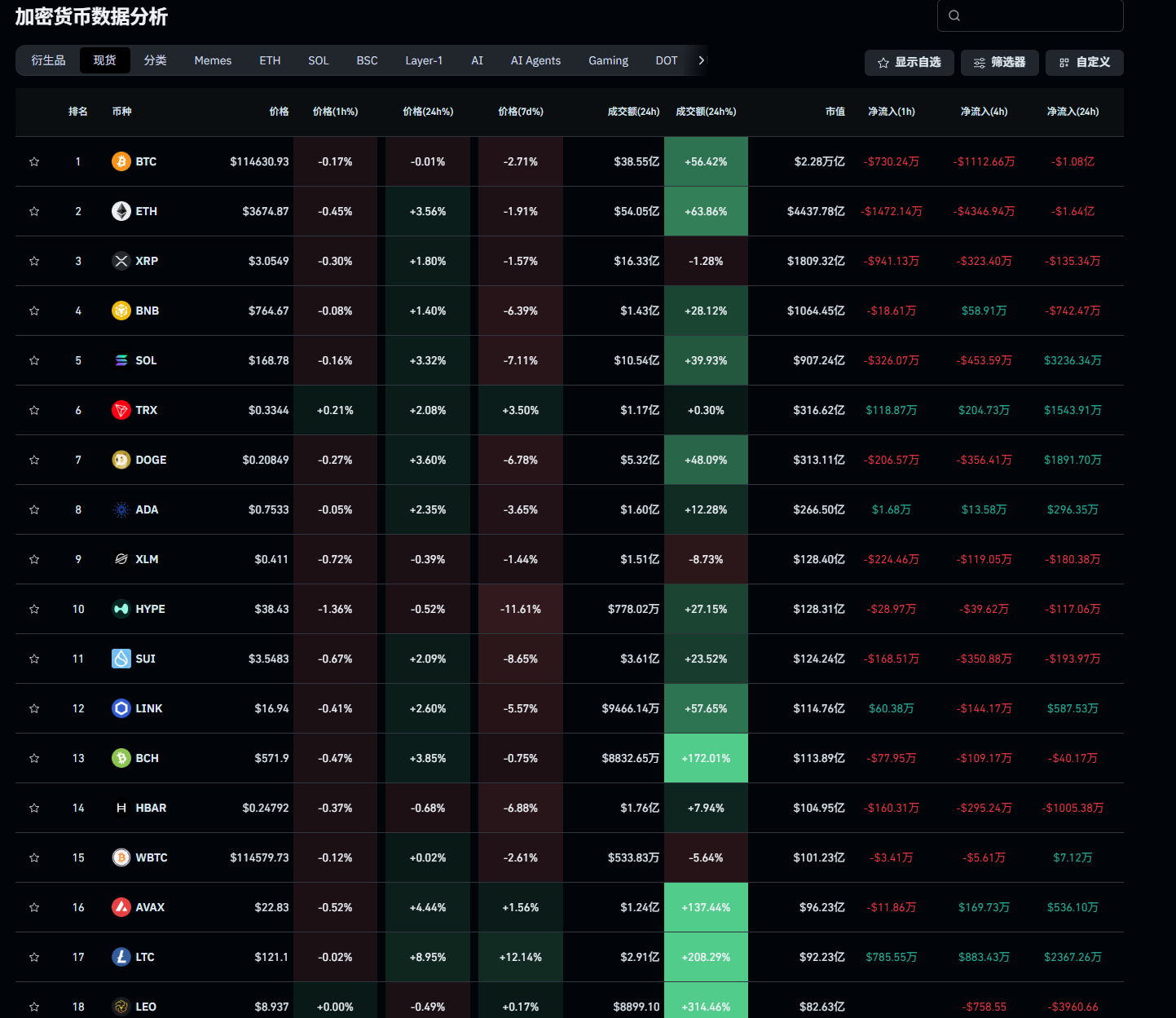

Lao Cui summarizes: Simply put, our stablecoins will hardly be linked to the cryptocurrency market and will definitely be strictly controlled from flowing into the cryptocurrency market. However, the U.S. stablecoins may not be the case. Currently, the cryptocurrency market has a market value of up to three trillion, but the U.S. market occupies almost half of it. Even if it flows in, it is beneficial for them. Once the market value of U.S. stablecoins circulates and expands, it will inevitably push up the value of other coins, especially those issued using their own public chain. This is also the main reason for Ethereum's recent surge, as most stablecoins are leveraging the Ethereum public chain. Another piece of news almost corroborates Lao Cui's viewpoint, which is that the issue of capital gains tax in overseas stock markets has basically been resolved. This indicates our attitude, so do not expect domestic capital to intervene. However, looking at recent trends, the involvement of Asian capital is very evident, and you should understand the weight of this statement. Ultimately, the new high position of this bull market may exceed many people's expectations, which is why Lao Cui has always emphasized that you must enter the market. The high point you see now may, by the end of the year, become the entry point after a significant drop. Do not miss this bull market; perhaps this is your opportunity to cross classes!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and ends up frequently trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。