The weekend market has been a bit concerning, with Bitcoin and Ethereum both experiencing a pullback. Looking at the daily chart, this pullback has just hit the Fibonacci 23.6% retracement level. Although it is slowly rebounding now, the momentum is not strong.

You can see that the OBV and MAOBV are still entangled without a clear direction, which means the trading volume has not given a definitive signal yet. Looking at the large orders, the main players are currently engaged in back-and-forth trading, with a noticeably higher number of sell orders in the overall market.

Therefore, for BTC in the short term, pay attention to the resistance range of 115000~115300, while support is seen around 114000~113700. For ETH, there is a dense wall of sell orders below the current price, and it is likely to fluctuate between 3495~3590 in the short term. It might be better to wait for a clear breakout before making plans. Fortunately, there is a lot of support from chips hidden below the daily line, which is reassuring.

Today, I want to share three tips for selecting coins to help you find potential strong coins in advance.

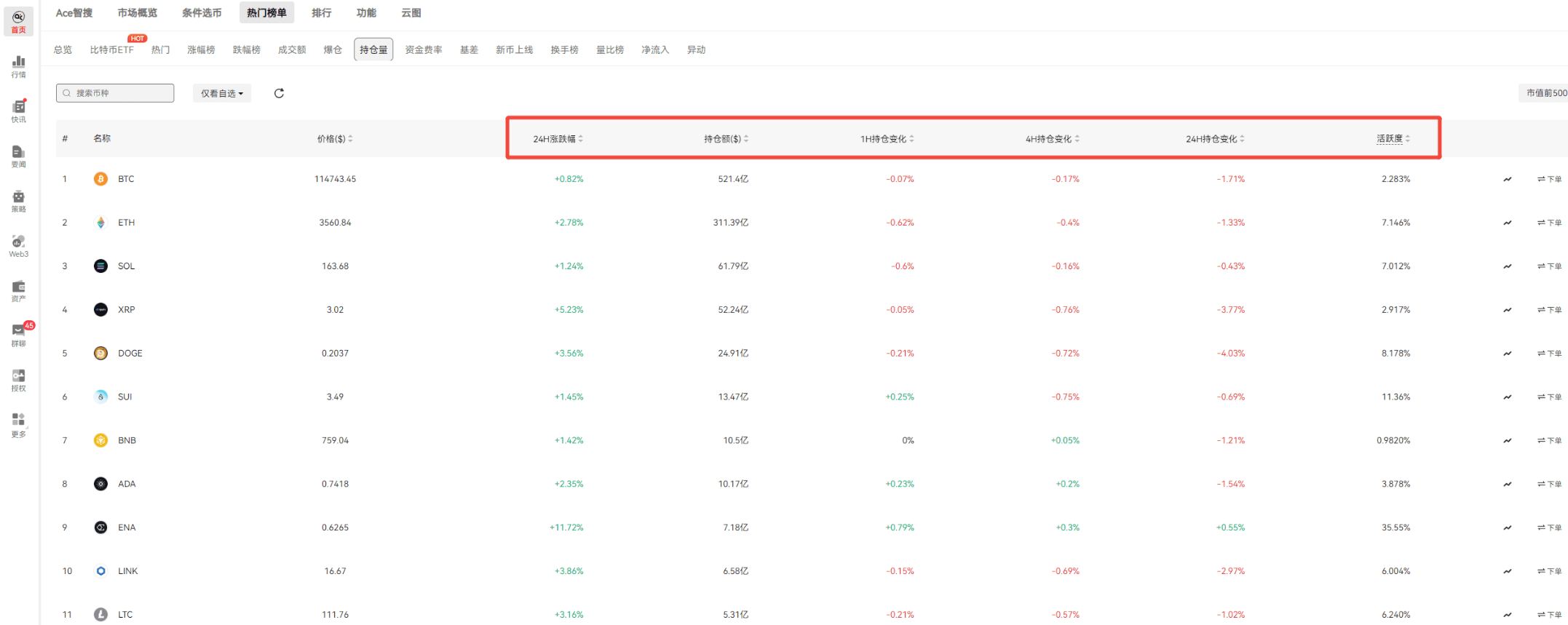

The first is the contract open interest method for selecting coins.

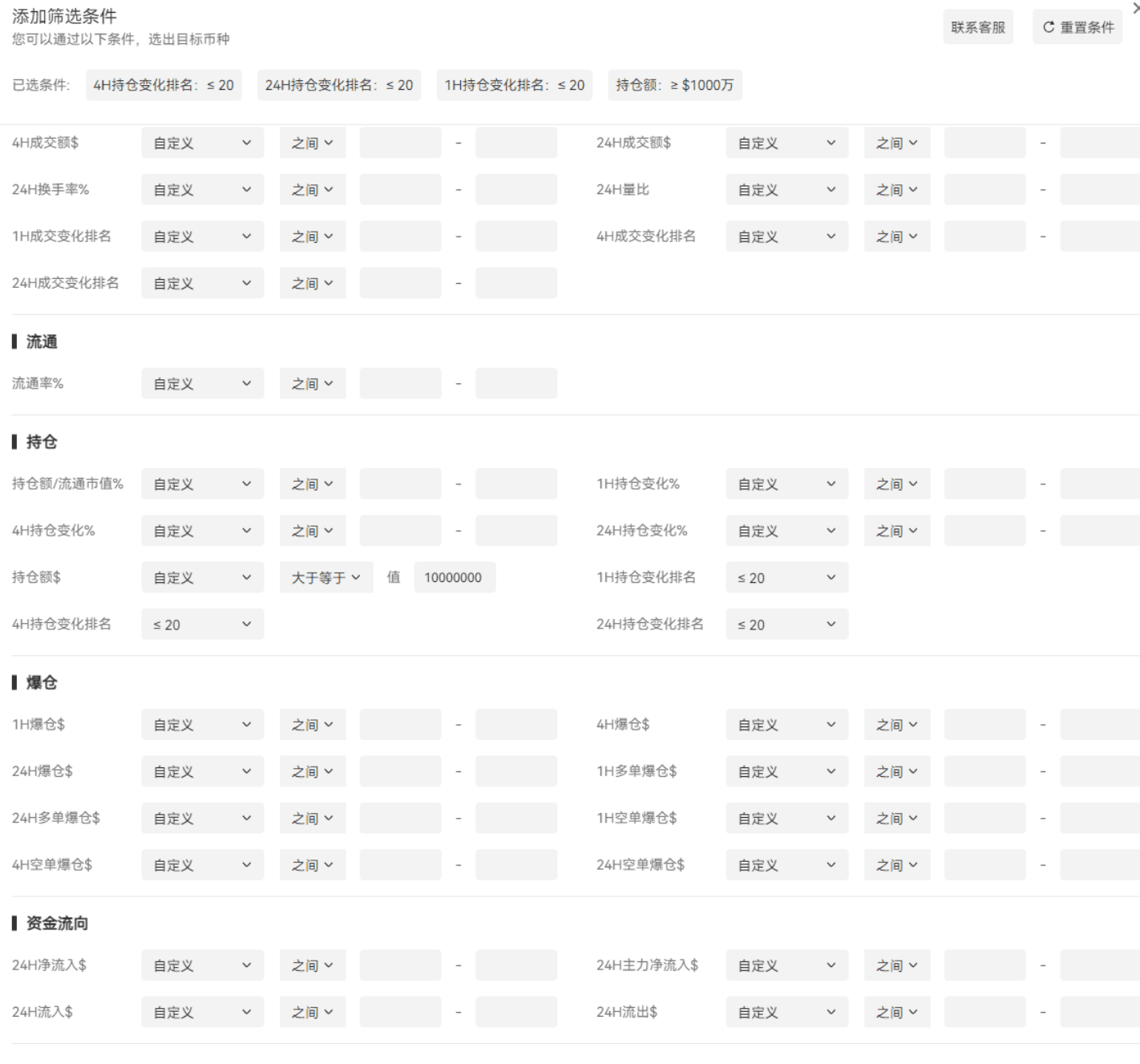

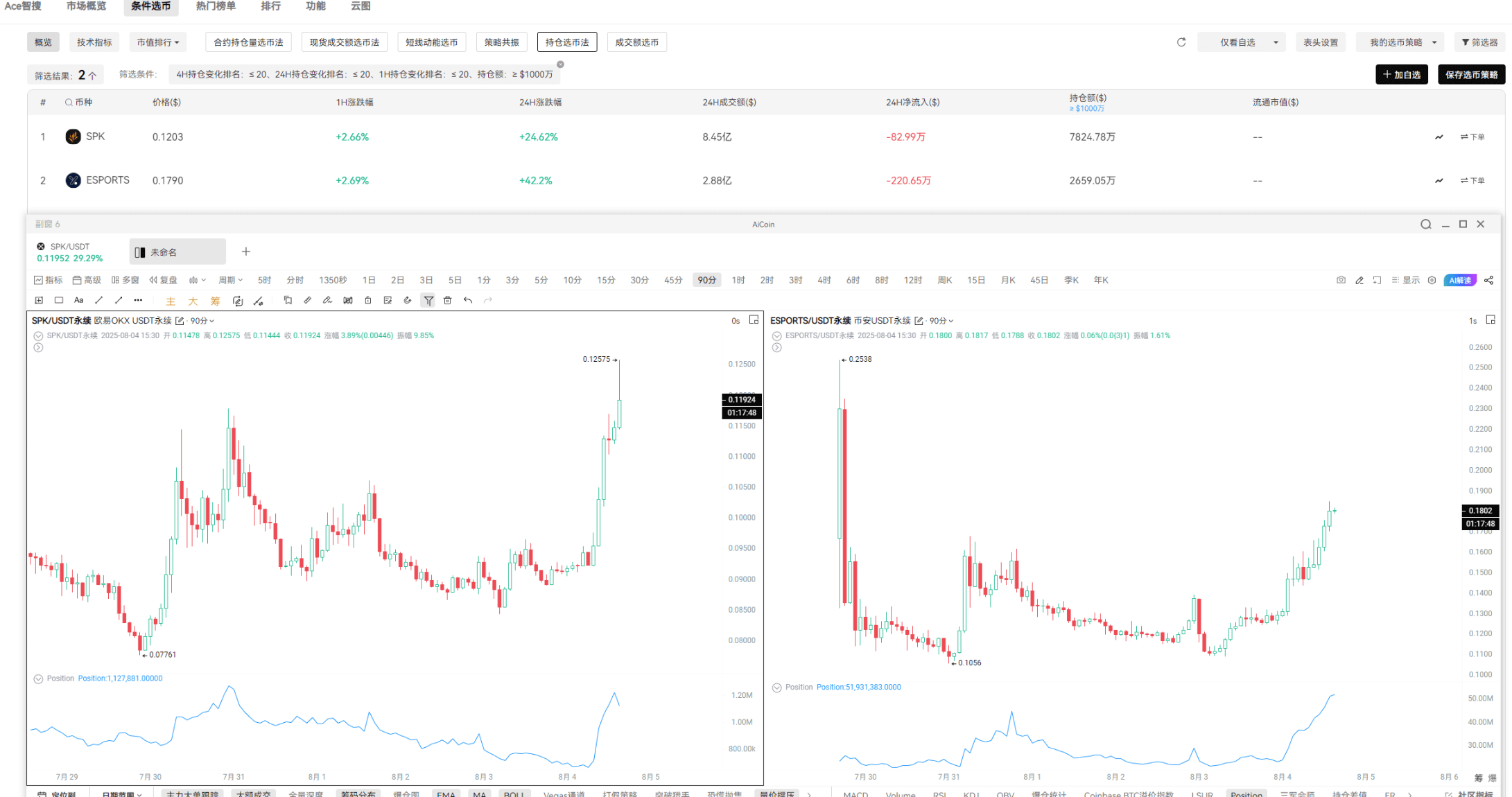

The core of looking at open interest is to determine whether "smart money" has quietly built positions in advance, which essentially involves observing the flow of funds in contracts. Specifically, you need to check these conditions: the changes in open interest over 1 hour, 4 hours, and 24 hours must rank in the top ten; the open interest must reach at least 10 million dollars, though you can relax this a bit based on the situation, mainly to filter out those small and zombie coins; the price increase should not exceed 10%, indicating that the main players have not started to push the price; and the higher the activity level, the better, as you can see if the funds are consistently in the market, with turnover rate helping you assess this. Previously, we would slowly filter through the open interest leaderboard, which is this page.

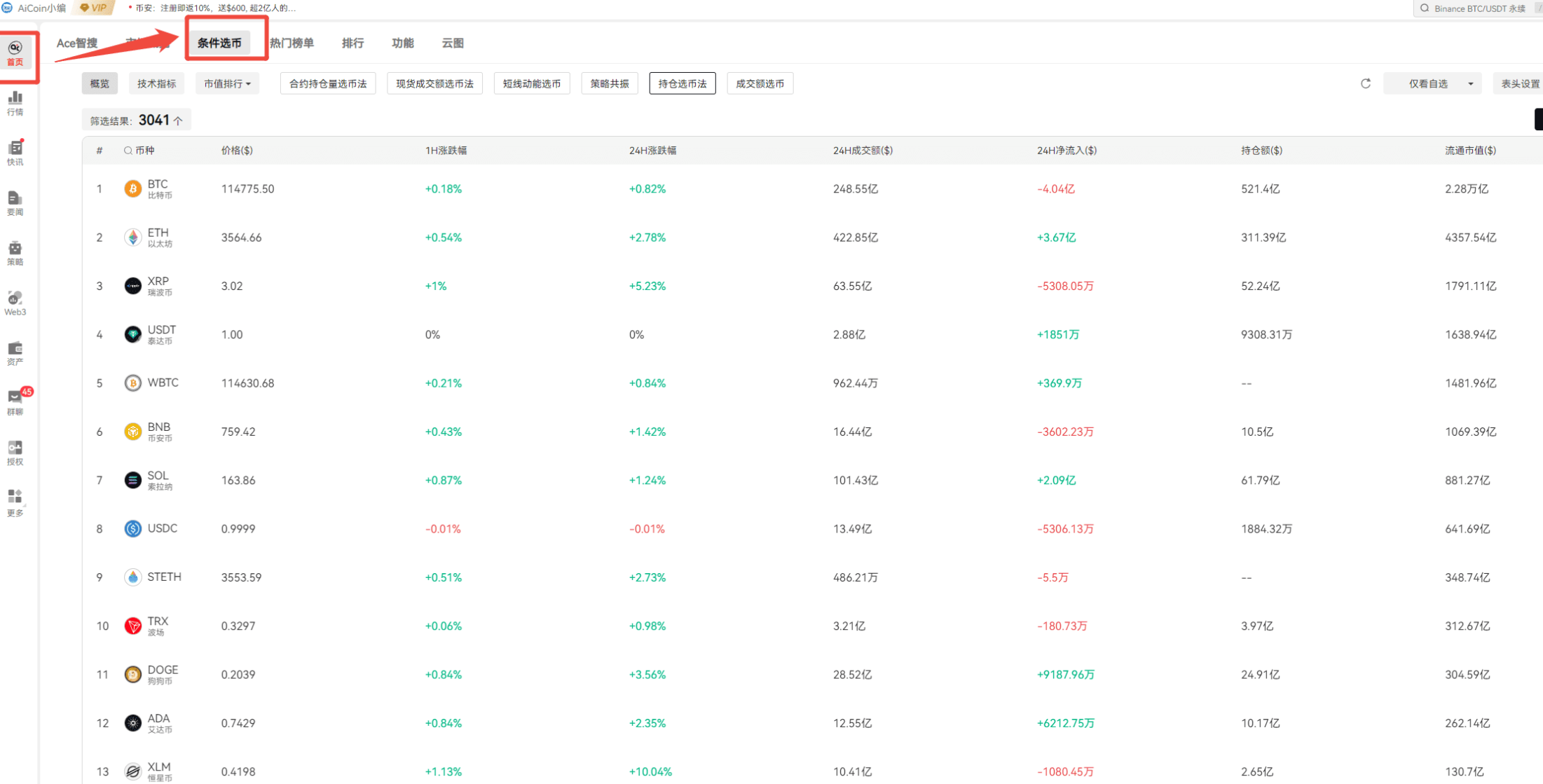

However, there is now a simpler way — using the conditional coin selection feature.

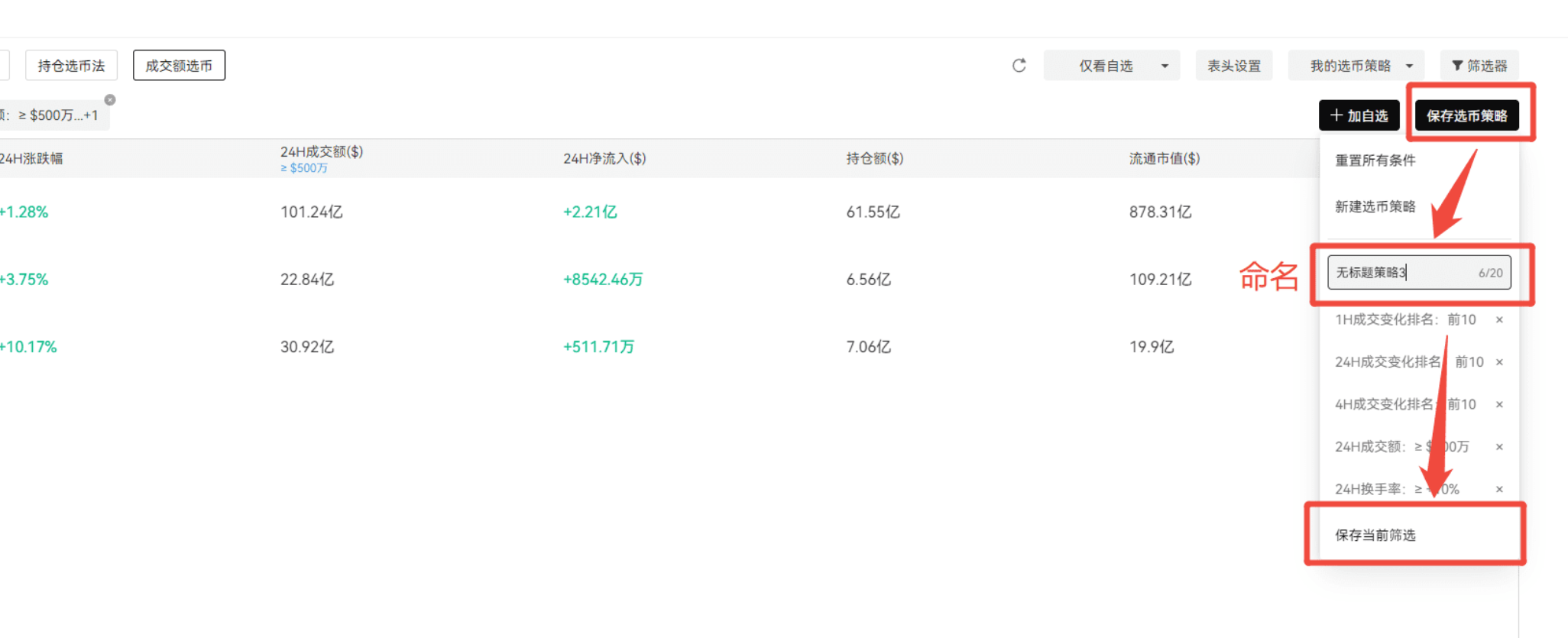

You can follow along to set it up, first opening the filter.

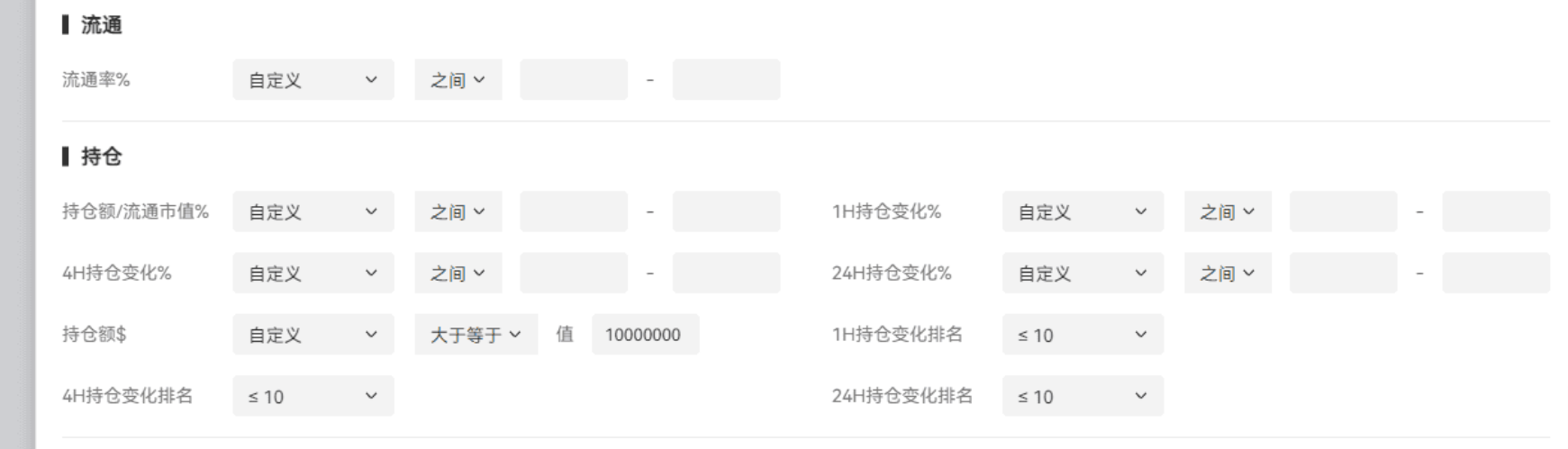

Find the [Open Interest] section and fill in the conditions one by one. If you don't find any coins that meet the criteria for now, you can relax the requirements a bit, such as looking at the top 20 changes. This is a screenshot I took around 3 PM. In fact, I usually combine open interest with the LUSR indicator to get a clearer picture of what the main players are doing.

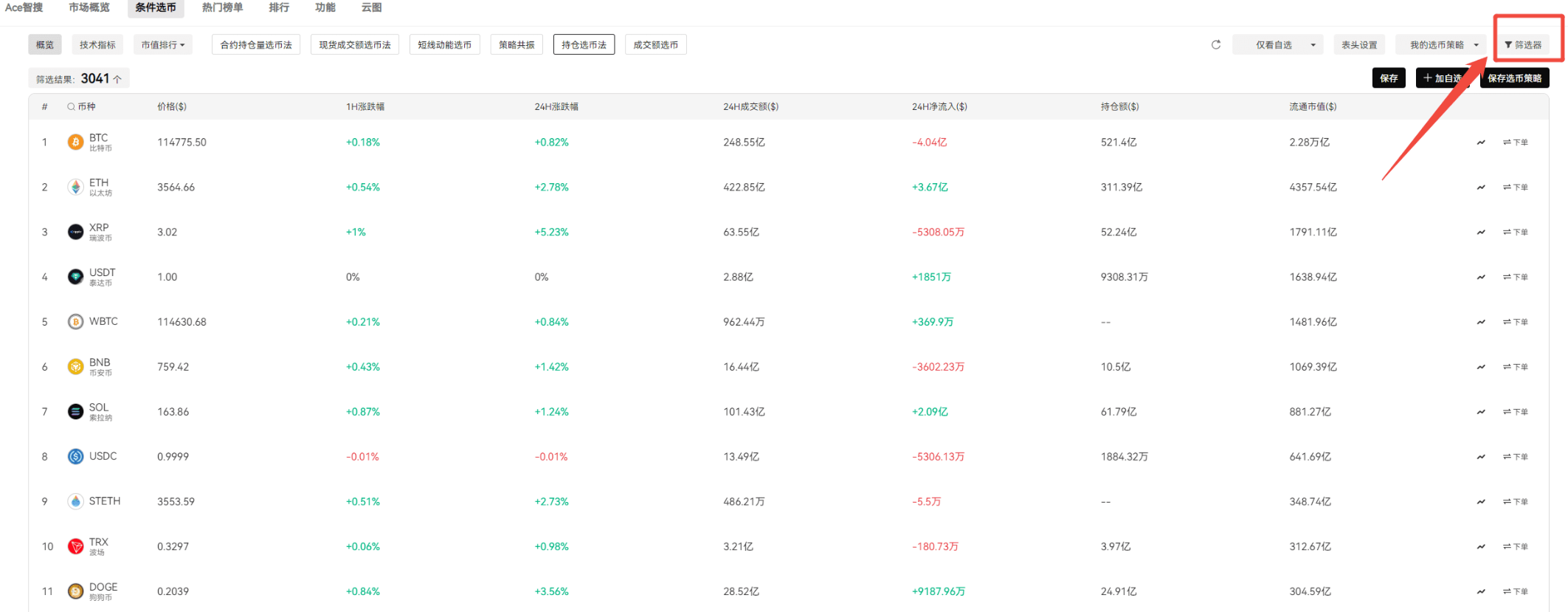

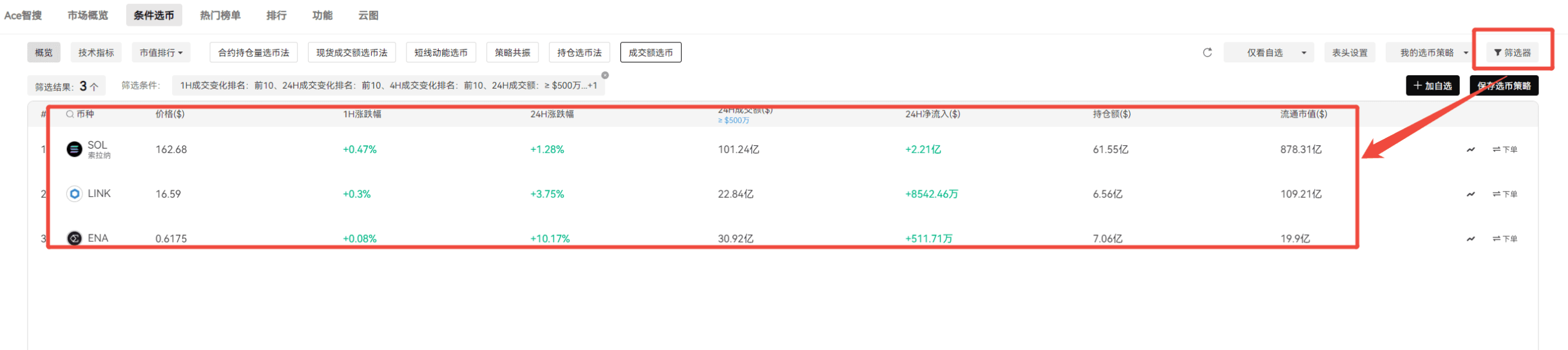

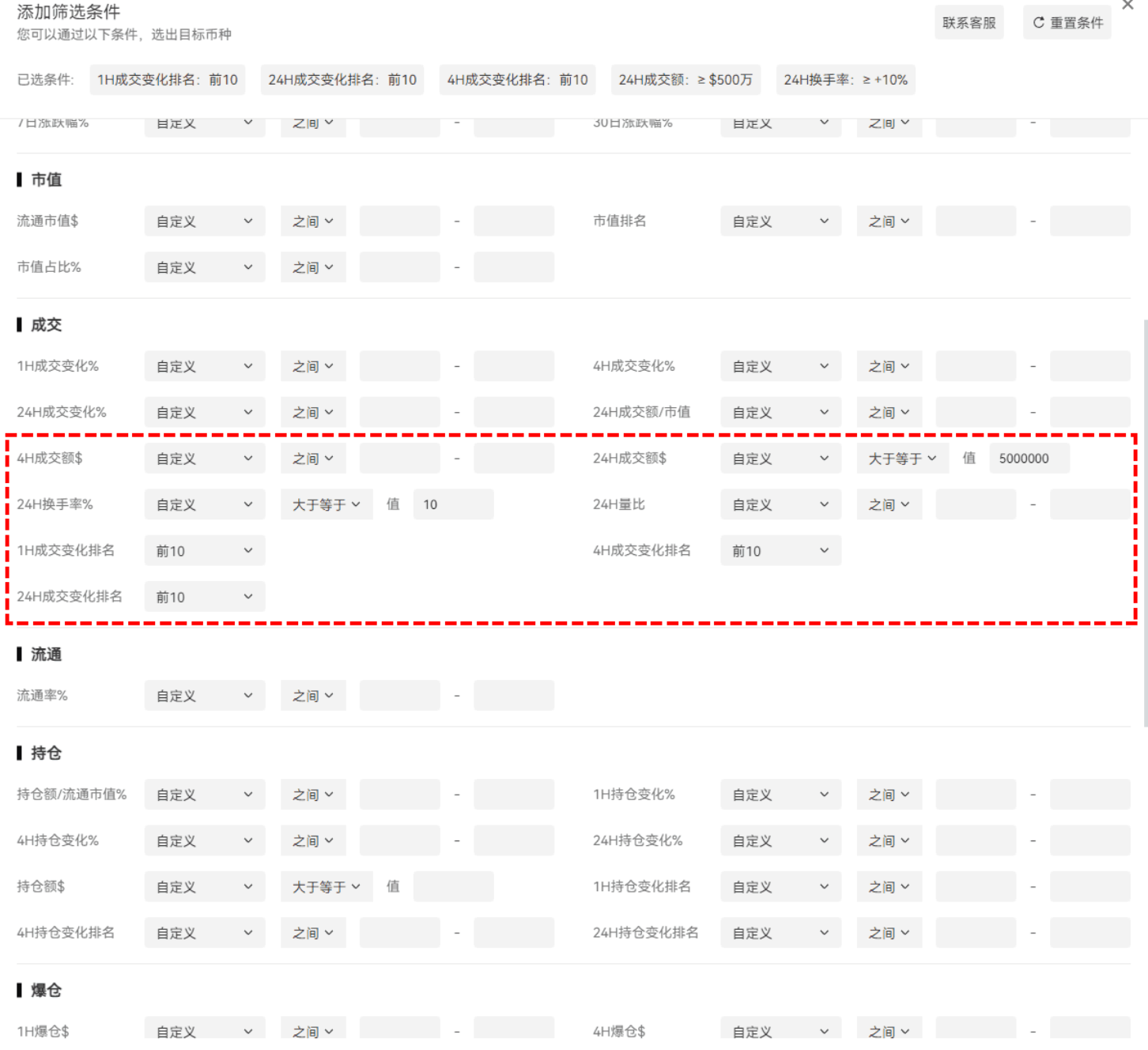

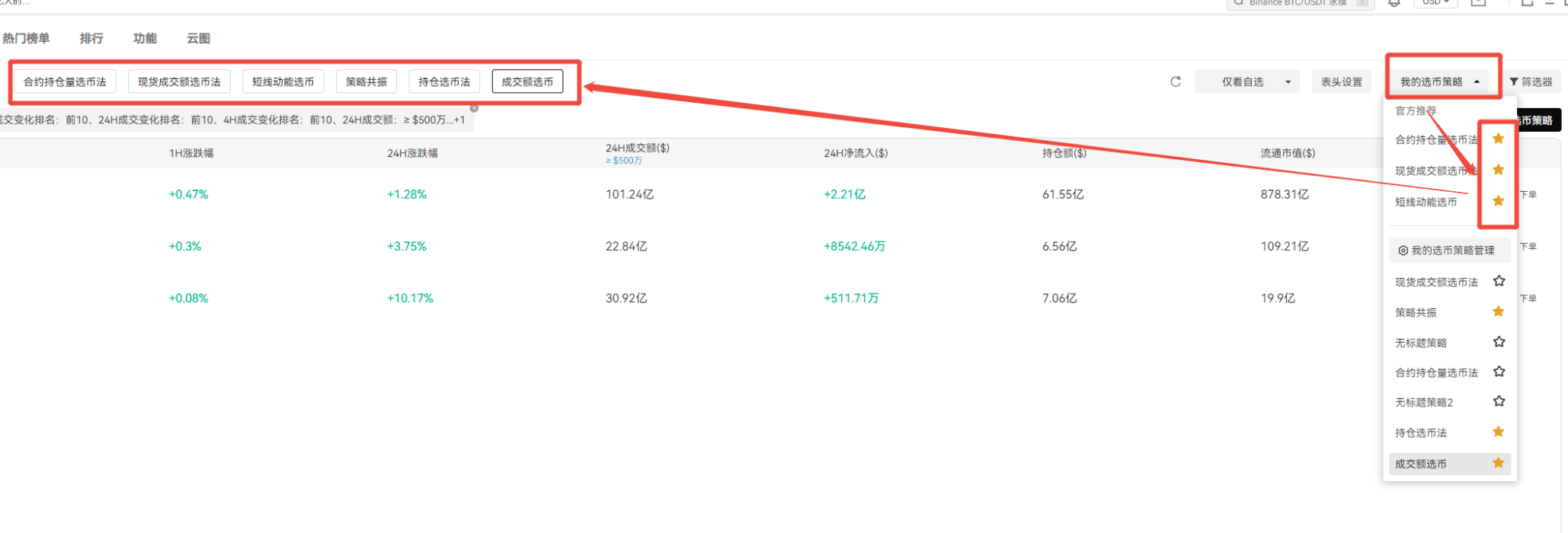

The second tip is the trading volume method for selecting coins, which is particularly useful in a rising market and can also be operated using the conditional coin selection tool.

The screening logic is as follows: the changes in trading volume over 1 hour, 4 hours, and 24 hours must be among the top, ensuring that the trend can continue; the 24-hour trading volume must be at least 5 million dollars, indicating that main players are participating; the price increase should be controlled within 10%; and the turnover rate should also be high, meaning that funds are active and chips are continuously rotating. The operation is also simple; just find the corresponding conditions in the [Trading] section and fill them in, and you will quickly get the results.

Here’s a little tip: if you don’t want to reset the conditions every time, you can save the strategy. Once saved, the coin selection strategy can be added to favorites, allowing you to see it directly in the header.

To determine whether a coin is strong enough, look at two points:

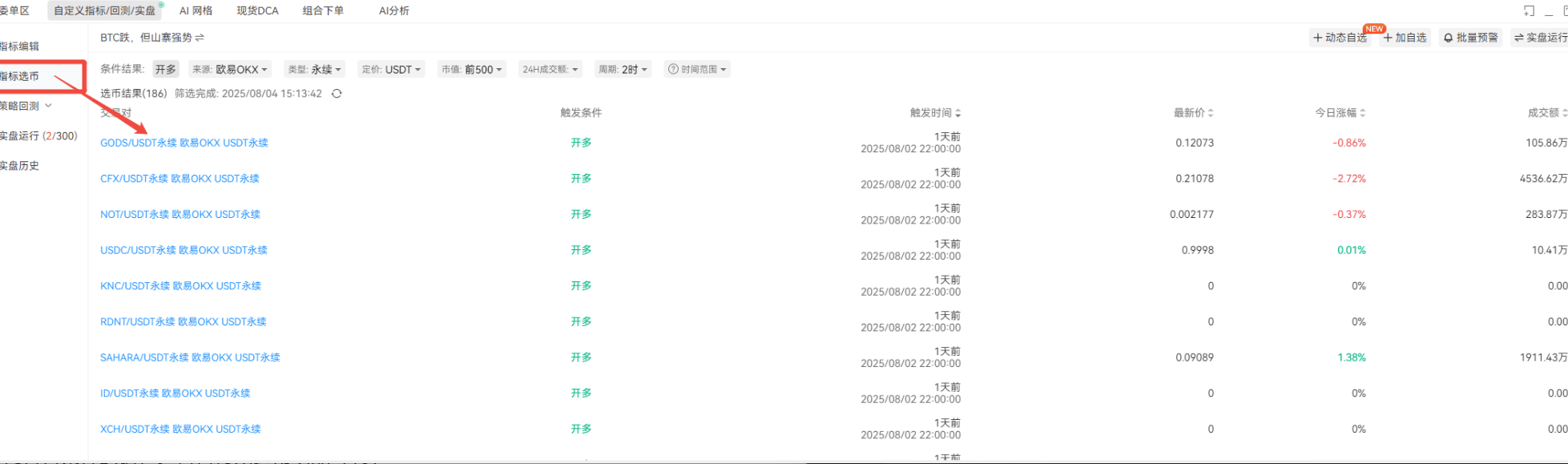

First, it should drop less than BTC when it falls, and second, it should be able to quickly recover its losses after a drop. The most obvious cases are those where BTC is falling, but the coin is rising against the trend. This method cannot be filtered using the previous conditional coin selection feature, but don’t worry, I’ve created an indicator that integrates all the conditions mentioned earlier, allowing you to quickly find strong coins using the custom indicator's coin selection feature. However, currently, BTC does not meet the conditions, so I will pull up Ethereum's historical signal performance for your reference.

Looking at these images, they all show situations where BTC fell but the coin price did not drop significantly. Once BTC meets the conditions, you can directly use the coin selection feature.

By the way, all three tips discussed in this live session are free! Only the large orders and chip distribution shown in the screenshots during the market analysis are member features. Remember to lock in every Monday and Thursday, where you can enjoy a 10% discount and also receive a strategy cloud membership worth 60U. If you’re lucky, it’s also possible to win a free PRO membership and exclusive merchandise!

Additionally, we at AiCoin and Binance have brought you this exclusive benefit worth $600 (AiCoin Exclusive), which is currently only available through AiCoin. For more details, feel free to visit http://lt.gt/BNB168.

This article only represents the author's personal views and does not reflect the position or views of this platform. This article is for information sharing only and does not constitute any investment advice for anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。