BTC Suffers Historic Outflows as ETH Momentum Slows Down After 20-Day Run

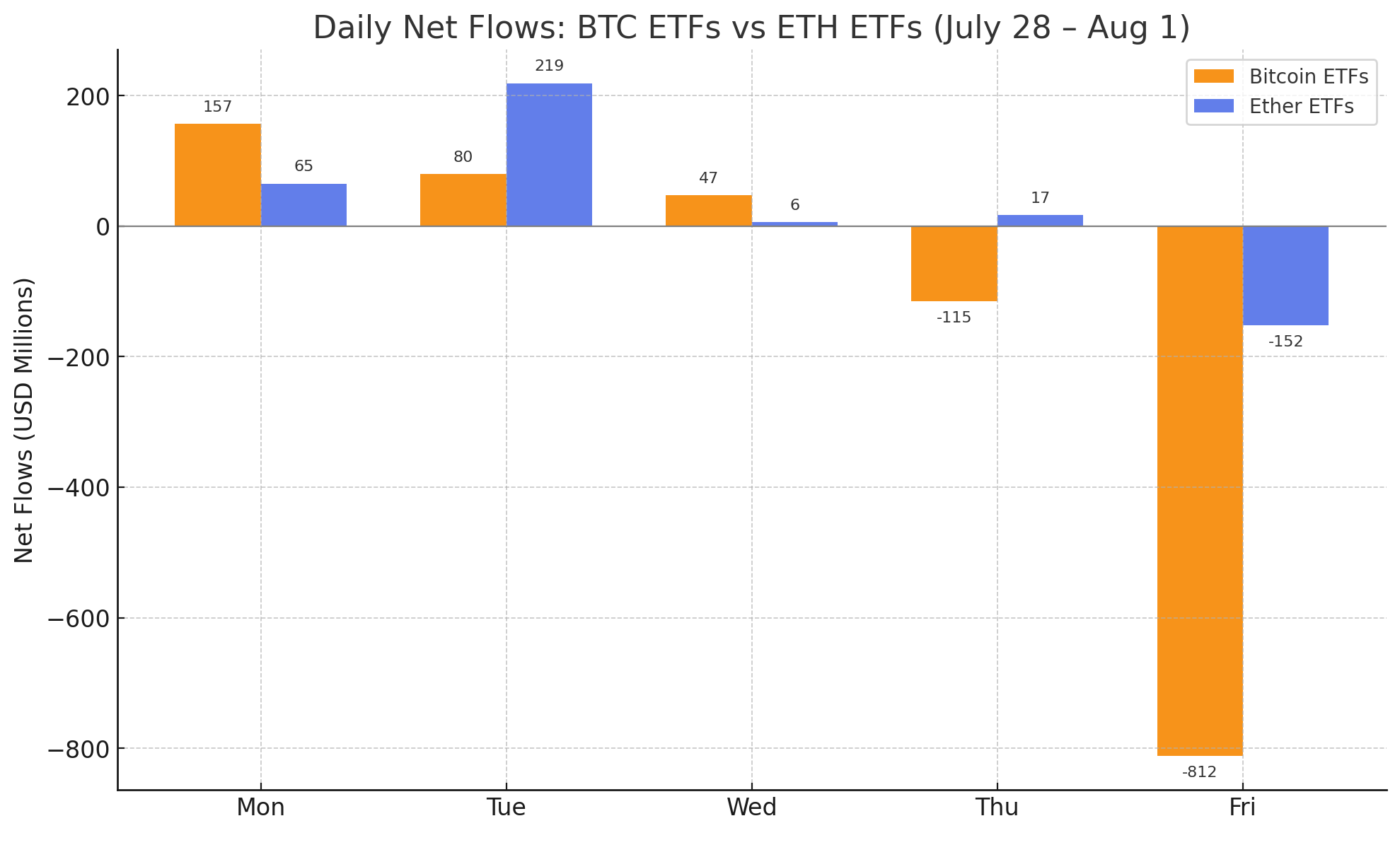

The crypto ETF market experienced a week of extremes. What began with steady inflows for both bitcoin and ether ended in one of the most dramatic outflow days of 2025, sending shockwaves through institutional circles.

Bitcoin ETFs, after a modest start, collapsed under selling pressure on Friday, logging $812 million in outflows, the second-largest daily loss ever recorded. For the week, BTC ETFs closed with a net outflow of $644 million, breaking a seven-week inflow streak.

Blackrock’s IBIT remained relatively resilient (+$355.34 million added over the week) along with Vaneck’s HODL (+$9.13 million) but was overshadowed by massive exits from Fidelity’s FBTC (-$354.17 million) and Ark 21shares’ ARKB (-$443.50 million).

Other exits for the week were seen across Grayscale’s GBTC (-$124.94 million), Bitwise’s BITB (-$66.58 million), and Grayscale Bitcoin Mini Trust(-$16.93 million).

Cumulative weekly totals: BTC ETFs: -$643 million and ETH ETFs: +$154 million

Ether ETFs painted a different picture. Riding a 20-day inflow streak, they piled on $241 million by Thursday, but Friday’s $152 million outflow trimmed the final weekly gain to $154.32 million.

Blackrock’s ETHA dominated the inflows (+$394.15 million), while Fidelity’s FETH (-$72.05 million), Grayscale’s ETHE (-$53.80 million), Grayscale’s Ethereum Mini Trust (-$47.68 million), and Bitwise’s ETHW (-$40.30 million) led the way for the losses.

Trading volumes hit new highs, with BTC ETFs recording $6.14 billion on Friday alone, and ETH ETFs surging to $2.26 billion. Despite the outflows, net assets remain robust at $146.48 billion for BTC and $20.11 billion for ETH, signaling continued institutional engagement, even amid volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。