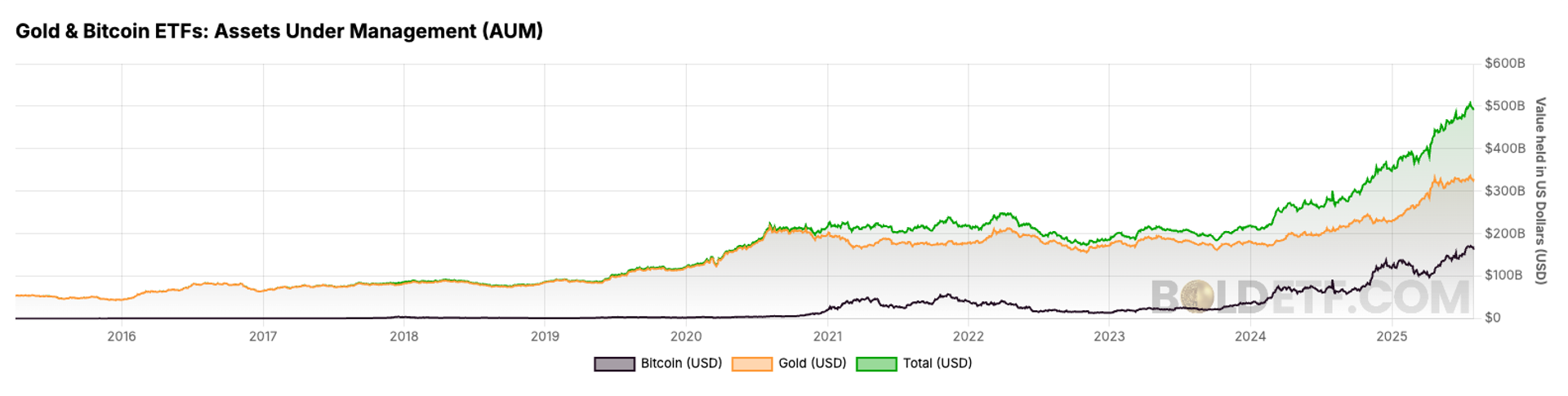

The combined assets under management (AUM) of gold and bitcoin (BTC) exchange traded funds (ETFs) have crossed the $500 billion mark for the first time, according to the latest data from the Bold Report.

As of early August 2025, gold ETFs represent approximately $325 billion, while bitcoin ETFs have surged to $162 billion.

Gold has long been a staple in ETF markets, consistently increasing in size each year. However, bitcoin has been rapidly gaining ground, particularly following the launch of US spot bitcoin ETFs.

Prior to their approval, global bitcoin ETF AUM was around $20 billion. In the months since, that figure has grown more than eightfold, marking a major shift in institutional demand. In the same period, gold ETFs have also expanded, nearly doubling from $170 billion.

The chart tracking AUM growth over the past five years illustrates this transformation. While gold ETFs have followed a steady upward trend, bitcoin ETFs show a sharper, more recent acceleration.

Price movements have mirrored this divergence. Since the US bitcoin ETF launch, bitcoin’s price has climbed approximately 175%, compared to a 66% rise in gold. This reflects both increasing investor interest in bitcoin and its higher volatility profile.

Read more: Bitcoin Still on Track for $140K This Year, But 2026 Will Be Painful: Elliott Wave Expert

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。