Written by: Prathik Desai

Translated by: Block unicorn

In the 20th century, Augusta National Golf Club was criticized for its blatant elitism. As the host of the Masters Tournament, the club has only 300 members, with an extremely strict admission process that does not even allow potential members to apply directly. Membership must be obtained through invitation. Another way is to be nominated by someone and then patiently wait.

Critics called it the ultimate "men's club," which it indeed was until 2012. Worse still, for decades, the club prohibited African Americans from becoming members. Sports journalists questioned why the most prestigious event in golf would take place at a venue that excluded 99.9% of humanity. Public opinion was very poor: a small group of wealthy white men controlled the opportunity that millions yearned to experience.

The club prides itself on having some notable members, including four-time Masters champion Arnold Palmer, business magnates Warren Buffett and Bill Gates, and the 34th President of the United States, Dwight D. Eisenhower.

Clearly, this is not the most democratic way to operate a club.

But why does Augusta National Golf Club pursue the popularization of world-class golf courses? Open access rarely creates a high-end brand. The club seeks excellence. With only 300 members and almost no external players, the course remains pristine throughout the year. Every detail is managed with precision.

For example, it can afford the rigorous maintenance required for the legendary Augusta National Golf Club brand. Think about it: hand-trimming fairways with scissors, coloring pine needles, and moving entire groves of trees to achieve the perfect television angle. Fewer stakeholders mean higher precision. When access is controlled, quality can reach perfection.

The same logic explains one of the most misunderstood trends in today's cryptocurrency space: why real-world asset (RWA) tokens—digital representations of everything from government bonds to real estate—are predominantly held by a small number of wallets.

But the exclusivity here is not based on gender or race.

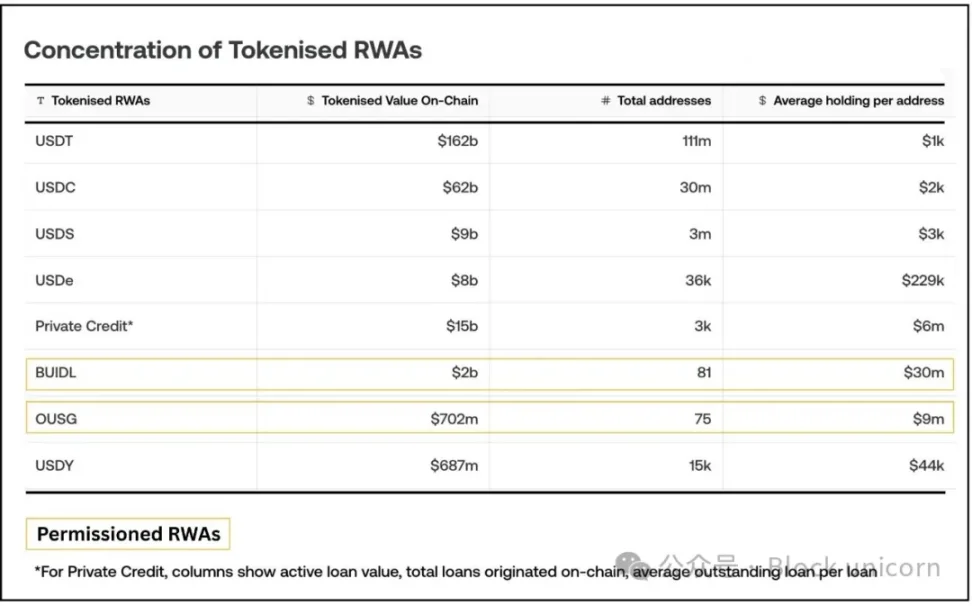

BlackRock's tokenized money market fund BUIDL (BlackRock US Dollar Institutional Digital Liquidity Fund) is an asset of about $2.4 billion, but as of July 31, 2025, it had only 81 holders.

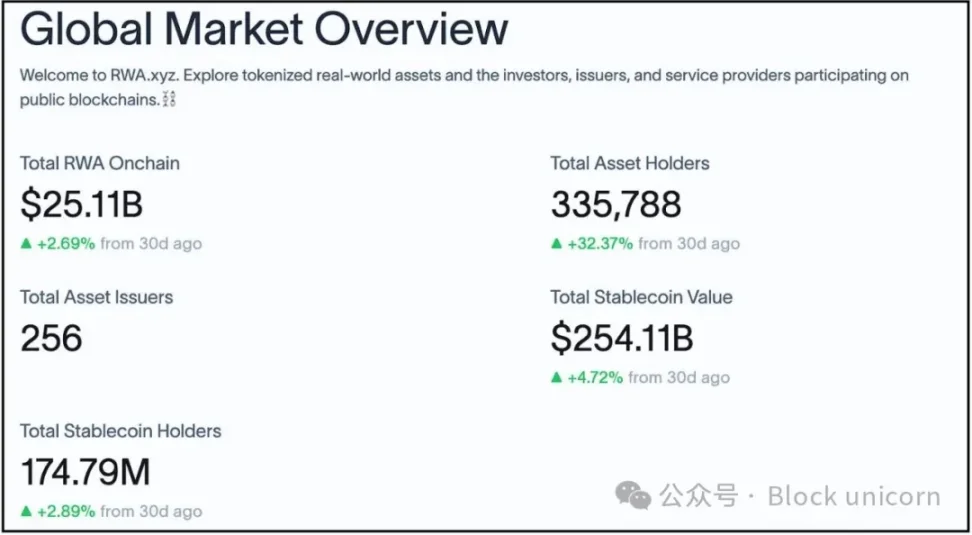

Similarly, Ondo Finance's US Treasury fund OUSG (Ondo Short-Term US Government Bond Fund) shows only 75 holders on-chain. In contrast, major stablecoins like USDT/USDC are held by millions of addresses (approximately 175 million stablecoin holders across networks).

At first glance, these digital dollar assets seem to embody all the problems that blockchain was supposed to solve: centralization, gatekeeping, exclusivity. Since you can copy and paste wallet addresses, why can't you purchase these yield-generating tokens like other crypto assets?

The answer lies in the same operational logic that allows Augusta National Golf Club to maintain its exclusivity. These tokens are designed to be centralized.

Regulatory Reality

The history of financial exclusivity is often a story about maintaining privilege through exclusion. But in these cases, exclusivity serves a different purpose: to keep the system compliant, efficient, and sustainable.

Most RWA tokens represent securities or funds that cannot be freely offered to the public without registration. Instead, issuers use private or limited offerings regulated by the U.S. Securities and Exchange Commission (SEC), such as Regulation D in the U.S. or Reg S overseas, restricting tokens to qualified or compliant investors.

BUIDL (BlackRock) offered through Securitize is only open to U.S. qualified purchasers (a subset of accredited investors, with a minimum investment of about $5 million).

Similarly, Ondo's OUSG (tokenized Treasury fund) requires investors to be both qualified investors and qualified purchasers.

These are not arbitrary barriers. They are requirements verified by the SEC under Regulation D 506(c), determining who can legally own certain types of financial instruments.

When we observe tokens designed for different regulatory frameworks, the contrast becomes more apparent. Ondo's USDY is only available to non-U.S. investors (sold overseas under Reg S). By circumventing U.S. restrictions, it achieves broader distribution, allowing non-U.S. individuals who complete KYC to purchase USDY. The number of USDY holders is 15,000, which, while not large, far exceeds the 75 holders of OUSG.

The same company, the same tokenized asset, just under different regulatory frameworks. The result is a distribution difference of up to 200 times.

This is where the comparison between Augusta National Golf Club and RWA becomes precise. To achieve the aforementioned goals, RWA token platforms integrate compliance into the token code or surrounding infrastructure. Unlike freely tradable ERC-20 tokens, these tokens are often subject to transfer restrictions at the smart contract level.

Most security tokens adopt a whitelist/blacklist model (through standards like ERC-1404 or ERC-3643), where only pre-approved wallet addresses can receive or send tokens. If an address is not on the issuer's whitelist, the token's smart contract will prevent any transfer to that address.

It's like a guest list enforced by code. You can't just show up at the door with a wallet address and demand entry. Someone must verify your identity, check your accredited investor status, and add you to the approved list. Only then will the smart contract allow you to receive tokens.

Backed Finance's tokens come in two forms—unrestricted versions and wrapped "compliant" tokens. Wrapped tokens "only allow whitelisted addresses to interact with the tokens," and Backed will automatically add users to the whitelist after they complete KYC.

Efficiency Argument

From the outside, this system appears exclusive. From the inside, it appears efficient. Why? From the issuer's perspective, given their business model and constraints, a centralized holder base is often a rational or even intentional choice.

Every additional token holder represents a potential compliance risk and additional costs, whether on-chain or off-chain. Despite these upfront compliance costs, on-chain rails bring long-term operational efficiency, particularly in terms of automatically updating net asset values (NAV), instant settlement compared to traditional market T+2, and programmability (such as automatic interest distribution).

By implementing tokenization and deploying distributed ledger technology (DLT), asset managers can reduce operational costs by 23%, equivalent to 0.13% of assets under management (AUM), as stated in a white paper by global fund network Calastone.

It predicts that tokenization can help each fund improve its profit and loss statement by an additional $3.1 million to $7.9 million, including an increase of $1.4 million to $4.2 million in revenue through more competitive total expense ratios (TER).

The entire asset management industry can achieve total savings of $135.3 billion in UCITS, UK, and US (40 Act) funds.

By limiting distribution to known and vetted participants, issuers find it easier to ensure that each holder meets the requirements (accredited investor status, jurisdiction checks, etc.) and reduce the risk of tokens accidentally falling into the hands of bad actors.

Mathematically, it also makes sense. By targeting a small number of large investors rather than a large number of small investors, issuers can save on onboarding costs, investor relations, and ongoing compliance monitoring. For a $500 million fund, reaching capacity with five investors each contributing $100 million is more commercially viable than with 50,000 investors each contributing $10,000. The former is also much simpler to manage. While on-chain transfers settle automatically, the compliance layer involving KYC, accredited certification, and whitelisting remains off-chain and scales linearly with the number of investors.

Many RWA token projects explicitly target institutional or corporate investors rather than retail. Their value proposition often revolves around providing crypto-native yield channels for fund managers, fintech platforms, or crypto funds with large cash balances.

When Franklin Templeton launched its tokenized money market fund, they did not intend to replace your bank checking account. They aimed to provide a way for CFOs of Fortune 500 companies to earn yield on their idle corporate cash reserves.

Stablecoin Exception

Meanwhile, comparisons with stablecoins are not entirely fair, as stablecoins address regulatory challenges in different ways. USDC and USDT are not securities themselves, designed as digital representations of the dollar rather than investment contracts. This classification is achieved through careful legal structuring and regulatory engagement, allowing them to circulate freely without investor restrictions.

But even stablecoins require significant infrastructure investment and regulatory clarity to achieve their current distribution scale. Circle spent years building compliance systems, working with regulators, and establishing banking relationships. The "permissionless" experience users enjoy today is built on a highly permissioned foundation.

RWA tokens face different challenges: they represent actual securities with real investment returns and are therefore subject to securities laws. Until there is a clearer regulatory framework for tokenized securities (the recently passed GENIUS Act begins to address this), issuers must operate within existing restrictions.

Future Outlook

The current centralization of RWA tokens is, after all, the closest manifestation of traditional financial operations. Consider traditional private equity funds or bond issuances restricted to qualified institutional buyers, where participants are typically limited to a small number of investors.

The difference lies in transparency. In traditional finance, you do not know how many investors hold a particular fund or bond—this information is private. Only large holders need to make regulatory disclosures. On-chain, every wallet address is visible, making centralization apparent.

Moreover, exclusivity is not a characteristic of on-chain tokenized assets. It has always been the case. The value of RWA tokenization lies in making these funds easier for issuers to manage.

Figure's Digital Asset Registration Technology (DART) reduces loan due diligence costs from $500 per loan to $15, while shortening settlement times from weeks to days. Goldman Sachs and Jefferies can now purchase loan pools as easily as trading tokens. Meanwhile, tokenized Treasuries like BUIDL suddenly become programmable, allowing you to use these ordinary government bonds as collateral to trade Bitcoin derivatives on Deribit.

Ultimately, the noble goal of democratizing access can be achieved through regulatory frameworks. Exclusivity is a temporary regulatory friction. Programmability is a permanent infrastructure upgrade that makes traditional assets more flexible and tradable.

Returning to Augusta National Golf Club, their controlled membership model makes golf tournaments the perfect epitome. A limited number of members means that every detail can be managed with precision. Exclusivity creates conditions for excellence, but paradoxically, it also makes it more cost-effective. To provide the same level of precision and hospitality to a broader, more inclusive audience, costs would multiply.

A controlled holder base also creates convenience for fund issuers to ensure compliance, efficiency, and sustainability.

But the barriers on-chain are gradually lowering. As regulatory frameworks evolve, packaged products emerge, and infrastructure matures, more people will gain access to these yields. In some cases, this access may be achieved through intermediaries and products designed for broader distribution (such as Backed Finance's unrestricted version) rather than through direct ownership of the underlying tokens.

The story is still in its early stages, but understanding why things look the way they do today is key to grasping the transformations that are about to happen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。