Written by: BitPush

July 2025 is a festive month in the crypto world. Bitcoin surged past the $120,000 mark; Ethereum led the market with an astonishing increase of over 49%, with its spot ETF attracting more than $5 billion in just one month, cumulatively nearing $10 billion. Market confidence soared, and bullish sentiment reached unprecedented heights, seemingly signaling an unstoppable bull market on the horizon.

However, this upward trend faced headwinds in early August, as a "triple black swan" event caused the market to swiftly switch from a "risk-on" mode to a risk-averse state, with the CME Bitcoin futures premium turning negative and significant capital fleeing high-risk assets.

Negative "Triple Hit": The Trigger for Market Panic

The recent market crash was not coincidental but resulted from a series of high-level macro events that erupted in a very short time. These events collectively fostered a "risk-averse" sentiment among investors.

1. New Tariff Policy: Reigniting the Global Trade War

On July 31, U.S. President Trump signed an executive order announcing new reciprocal tariffs on imports from several countries, with rates ranging from 10% to 41%. This policy quickly sparked market concerns about escalating global inflation. Investors generally believed that tariff barriers would drive up commodity prices, potentially forcing the Federal Reserve to maintain a tough stance on interest rate cuts, which is undoubtedly a significant negative for risk assets reliant on loose liquidity.

2. Poor Employment Data and Political Turmoil

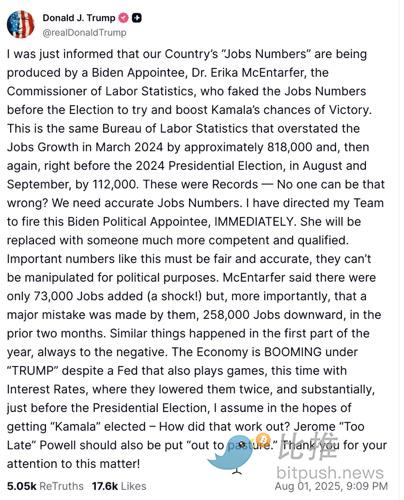

Shortly after the tariff policy was announced, the U.S. Department of Labor released employment data that fell far short of market expectations. This weak economic signal was enough to unsettle investors. More dramatically, President Trump expressed extreme dissatisfaction with this data and fired the head of the U.S. Labor Bureau, Erika McEntarfer, just hours after the report was released.

This politically charged action further amplified market panic, casting a heavy layer of uncertainty over the economic outlook.

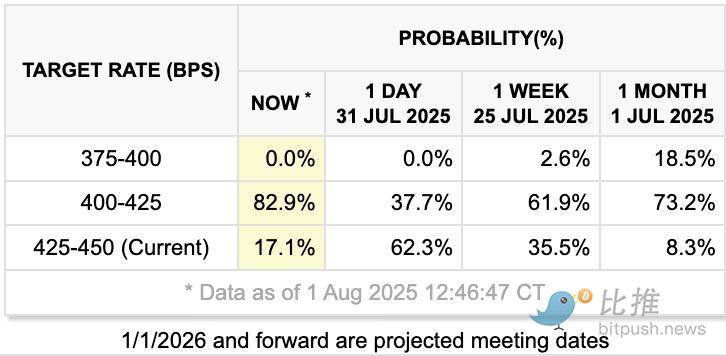

Traders reacted to the employment report by significantly increasing bets on a rate cut in September: as of the time of writing, CME FedWatch data indicated an almost 83% probability that the Federal Reserve would lower the target rate to 4.00-4.25%, up from the previous day's 37.7%.

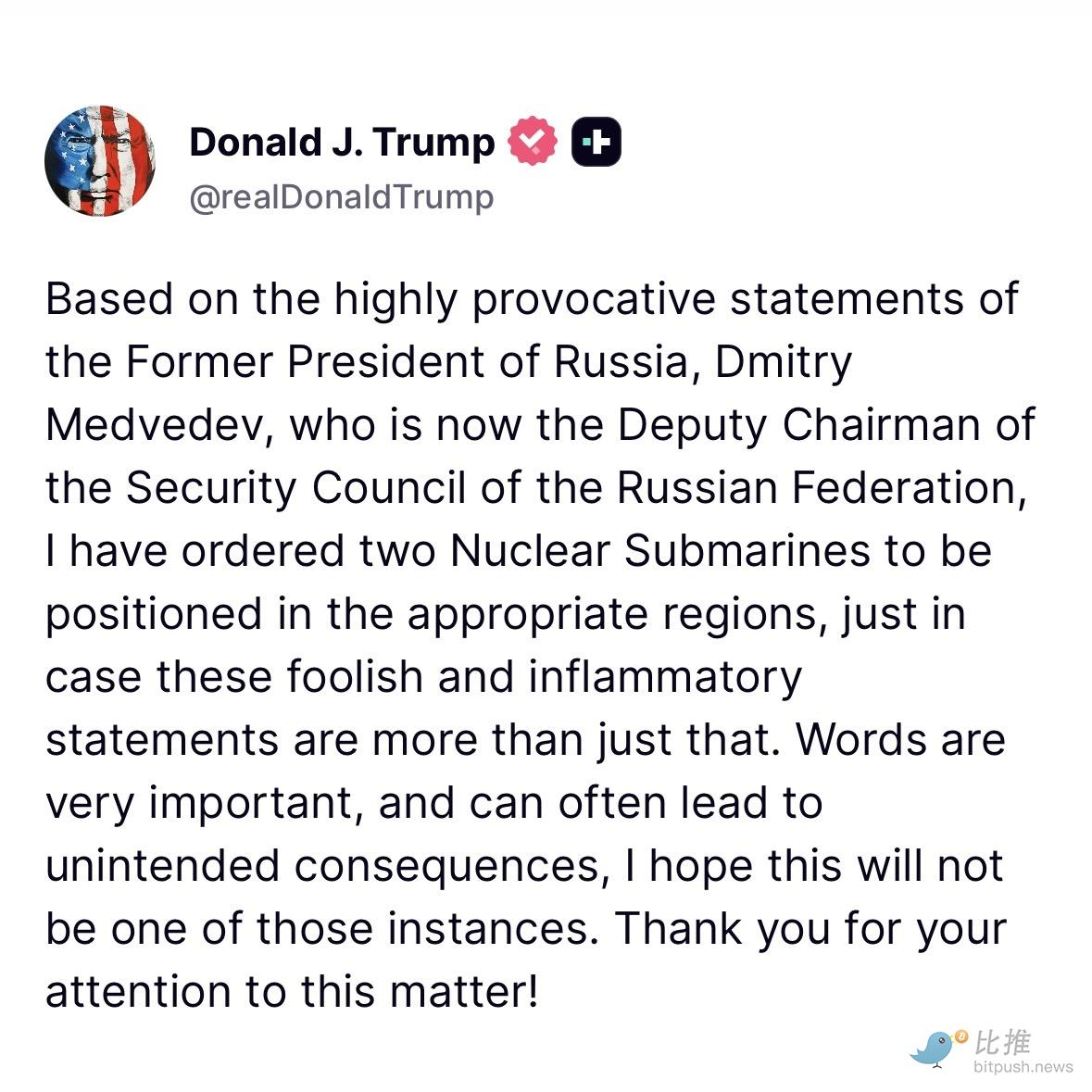

3. Nuclear Submarine Deployment: Geopolitical Tensions

On the geopolitical front, Trump ordered the deployment of two nuclear submarines to areas near Russia. This aggressive military action was a direct response to "provocative remarks" made by a senior Russian official.

In the shadow of the Russia-Ukraine conflict, this level of geopolitical tension escalated, causing global investors to feel uneasy. Seeking safe havens became a priority, and cryptocurrencies, as high-volatility assets, naturally became targets for sell-offs.

Liquidation Storm

Under the barrage of negative news, cryptocurrency prices plummeted, triggering a chain reaction. Bitcoin fell over 3% in a single day, dipping to $113,231; Ethereum and Solana suffered even more severe declines, dropping 6% and 5%, respectively. XRP was not spared, with a decline exceeding 10%.

The sharp price drop quickly triggered a "domino effect" in the derivatives market. According to CoinGlass data, over $940 million in long positions were forcibly liquidated in the past 24 hours, with long liquidations accounting for the vast majority, reaching $860 million.

Crypto-related stocks faced even more severe blows, with declines exceeding those of the crypto assets themselves. This revealed the market's dual concerns during risk-averse periods: worries about the macro economy and concerns about the fundamental business of these companies.

- Coinbase: After reporting second-quarter earnings that fell short of expectations, its stock price plummeted 16%. Despite its core trading business performing poorly, the significant drop in its stock price also reflected collective panic among investors in the face of market uncertainty.

- Strategy: As a well-known "proxy stock" for Bitcoin, its stock price fell 8.7%, highlighting the market's vulnerability to such high-leverage assets.

Other crypto companies like Circle and Galaxy Digital also suffered heavy losses, indicating that any tremor in the crypto market could be magnified through the stock prices of publicly listed companies, transmitting to traditional financial markets. The yield on 10-year U.S. Treasury bonds fell 14 basis points to 4.22%, while gold prices rose 1.5% to $3,400 per ounce, returning to historical highs.

Is it a "Healthy Correction" or a "Risk Warning"?

In the face of the market downturn, analysts' opinions diverged.

Ben Kurland, CEO of the crypto research platform DYOR, held an optimistic view, defining the recent drop as a "healthy and strategically significant cooling-off period." He pointed out that after the "red-hot" July, the market is undergoing a "planned pause," with funds flowing from the most speculative and unstable asset classes to safer havens. In his view, this is not a "crisis," but a rational response to the "lack of new crises."

However, some analysts expressed caution. They believe that the macro drivers behind this drop are complex and unpredictable. Some analysts predict that considering historical patterns and current macro uncertainties, Bitcoin prices may continue to face pressure in August and September, potentially dropping to $80,000, with a turnaround possibly occurring only in the fourth quarter.

Glassnode analysts predict that if Bitcoin prices fall below $110,000 after a recent surge, it could trigger accelerated sell-offs.

Except for halving years, August is typically one of the more subdued months in Bitcoin's history. The exuberance of July ultimately requires the calm of August to digest. Is this severe market fluctuation a healthy profit-taking, or a warning of a larger storm? Perhaps only after digesting all the negative news can the market find a new direction amid the volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。