Crypto News: What Happened in the Crypto Market on August 2, 2025

Crypto New s Today: Market Dips, Trump Shakes the Fed, and Big Ethereum & Bitcoin Bets

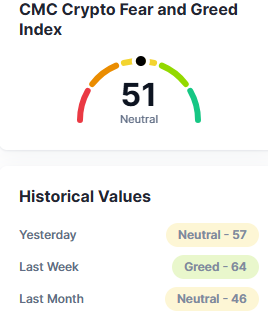

In Crypto News Highlights: The global currency market saw a drop of 5.4% today, with the total market cap now at $3.76 trillion. Trading volume over the last 24 hours hit $160 billion. Bitcoin still leads with 60.2% dominance, followed by Ethereum at 11.2%. Meanwhile, the Fear and Greed Index has cooled off, falling from 57 to 51, showing a more cautious mood among investors.

Source: CoinMarketCap

Here’s a full breakdown of the top Crypto News stories shaping the market today.

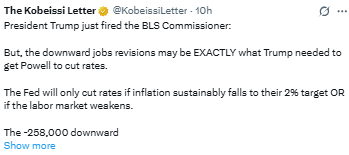

Trump Fires BLS Chief, Fed Pressure Builds

U.S. President Donald Trump fired the Commissioner of the Bureau of Labor Statistics (BLS) just hours after new job data showed weaker results than expected . The revised numbers revealed 258,000 fewer jobs than earlier reported, with July’s hiring also coming in soft.

This weak as per the Crypto News and data plays into Trump’s demand for interest rate cuts. The Federal Reserve has said it will only lower rates if inflation falls or the labor market slows. Now, markets are betting there’s an 80% chance of a rate cut in the next meeting.

Right after the firing, Fed Governor Adriana Kugler resigned early from her term. Trump cheered the exit and now has a chance to pick a replacement who may support looser money policies. With growing tension between Trump and Fed Chair Jerome Powell, many wonder if he’s trying to remake the Fed from the inside.

Source: X

SEC’s Project Crypto: New Rules for the Digital Age

In a huge step for regulation, SEC Chairman Paul Atkins has announced Project Crypto , a bold move to update how the U.S. handles digital assets.

The plan includes: Easier registration for digital assest companies. Clear definitions of tokens (commodity vs. security). A new “regulatory sandbox” to let startups test ideas and the support for tokenization of real-world assets

Under this new setup, Bitcoin and Ethereum will be classified as commodities, with the CFTC taking charge. This should end years of confusion for digital coin builders in the U.S.

Atkins said most old rules were written for an “industrial age” and not built for digital tech. Now, this Crypto News signals that the SEC wants to make the U.S. a hub for blockchain innovation.

Source: X

SharpLink Buys 464K ETH, Stakes for Income

One of the major Crypto News highlight is, Digital asset firm SharpLink has been making huge Ethereum moves . In just seven hours, the company converted $108 million in USDC into 14,933 ETH at an average price of $3,550. This latest buy pushed their total ETH holdings to 464,000 coins, worth around $1.62 billion today.

But SharpLink isn’t just holding ETH- it’s staking large amounts to earn passive income from network rewards. With yields around 3.5%–4.5%, the company is blending long-term investing with cash flow strategy.

Many now compare this to MicroStrategy’s Bitcoin model, but with more utility, as Ethereum’s staking function adds value beyond just price gains.

Source: Wu Blockchain

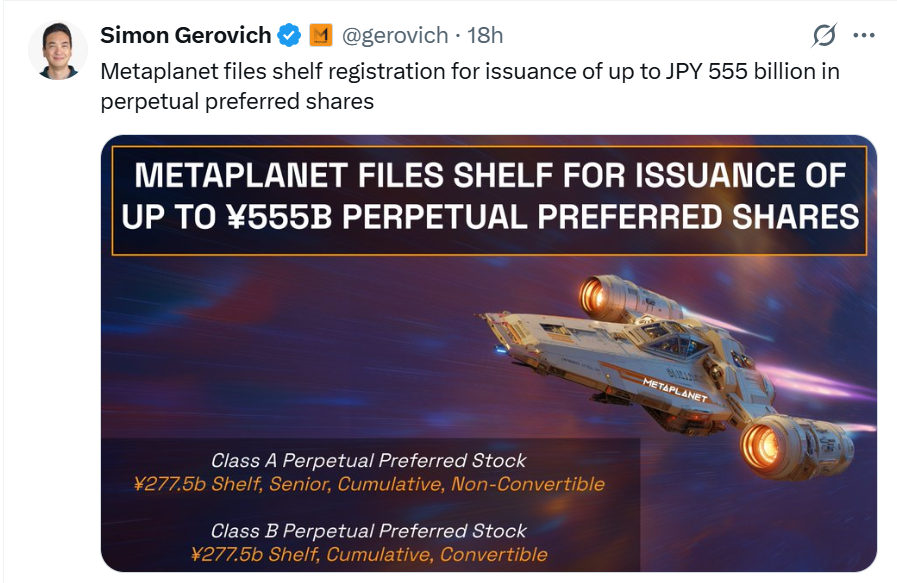

Crypto News: Metaplanet Files $3.7B to Stack 210K BTC

Japanese Web3 firm Metaplanet has filed a plan to raise $3.7 billion through a shelf offering to fund its Bitcoin buying spree . The company wants to buy 210,000 BTC by 2027.

The filing includes a vote to increase its share count and create two preferred stock classes, offering up to 6% dividends. If approved at the September 1 EGM, this could massively boost its BTC purchases.

Since April 2024, Metaplanet has already bought 17,132 BTC, worth about $1.95 billion. The latest buy of 780 BTC on July 28 shows the company is not slowing down. If the full plan goes through, Metaplanet could become one of the world’s biggest corporate Bitcoin holders.

Source: X

Final Thought: From government moves to billion-dollar bets, today’s Crypto News proves the market is full of energy, risk, and change. Institutions like SharpLink and Metaplanet are doubling down, while the U.S. begins rewriting its rules for the digital future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。