On July 31, Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), announced a groundbreaking new policy—"Project Crypto." This chain reform initiative led by the SEC has a clear goal: to completely rewrite the regulatory logic of the United States in the era of crypto assets, allowing financial markets to "move on-chain" and realize the grand vision outlined by the Trump administration—to make the U.S. the "world's crypto capital."

The previous model of "enforcement over regulation" not only drove innovative companies in the crypto space to relocate to Singapore and Dubai but also missed the opportunity for the U.S. to lead the next generation of financial infrastructure. The launch of "Project Crypto," however, differs from the regulatory suppression tone of the past few years, undoubtedly sending a strong signal to the entire industry: the on-chain era in the U.S. starts now.

Regulatory Easing: DeFi Protocols like Uniswap and Aave Welcome a Golden Window

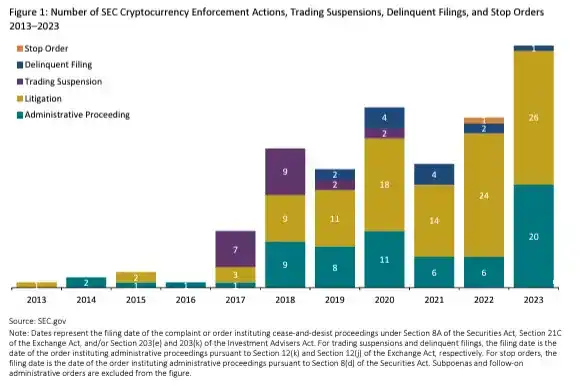

The attitudes of past SEC chairpersons towards crypto assets and their derivatives—especially DeFi (Decentralized Finance)—have often determined the temperature and activity level of the U.S. market. During Gary Gensler's tenure, the SEC's regulatory strategy was centered on "security definition first" and "enforcement as the guideline," emphasizing the comprehensive inclusion of token trading within the traditional securities framework. Over his term, more than 125 enforcement actions related to crypto were initiated, involving numerous DeFi projects, including subpoenas for Uniswap and lawsuits against Coinbase, nearly pushing the compliance threshold for on-chain products to a historical high.

However, after the new chairman Paul Atkins took office in April 2025, the SEC's regulatory style underwent a fundamental shift. He quickly initiated a roundtable discussion titled "DeFi and the American Spirit," aimed at easing regulations on DeFi.

In Project Crypto, Atkins clearly stated that the original intention of U.S. federal securities law is to protect investors and ensure market fairness, rather than to stifle technology architectures that do not require intermediaries. He believes that decentralized financial systems, such as automated market makers (AMMs), can essentially facilitate non-intermediated financial market activities and should be granted legitimate status at the institutional level. Developers who "only write code" should be provided with clear protections and exemptions; meanwhile, intermediary institutions wishing to provide services based on these protocols should be given clear and enforceable compliance pathways.

This shift in policy thinking undoubtedly releases positive signals for the entire DeFi ecosystem. In particular, protocols like Lido, Uniswap, and Aave, which have already formed on-chain network effects and possess highly autonomous designs, will gain institutional recognition and development space under a non-intermediated regulatory logic. Tokens of protocols long troubled by the "securities shadow" are also expected to reshape their valuation logic against the backdrop of regulatory easing and the return of market participants, potentially becoming "mainstream assets" in the eyes of investors.

Building the Next Generation of Financial Gateways: Super-App Will Reshape the Competitive Landscape of Trading Platforms

In his speech, Paul Atkins proposed the concept of "Super-App," which is highly practical and transformative. Atkins believes that current securities intermediaries face cumbersome compliance structures and redundant licensing barriers when providing traditional securities, crypto assets, and on-chain services, which directly hinders product innovation and user experience upgrades. He suggested that future trading platforms should be able to integrate various services—including non-security crypto assets (like $DOGE), security crypto assets (like tokenized stocks), traditional securities (like U.S. stocks), as well as staking and lending—under a single license. This is not only a compliance innovation that simplifies processes but also the core of future competitive strength for trading platform companies.

The regulatory body will promote the real implementation of this super application framework. Atkins has clearly indicated that the SEC will draft a regulatory framework allowing crypto assets to coexist and trade on SEC-registered platforms, regardless of whether they constitute securities. At the same time, the SEC is also evaluating how to utilize existing authority to relax certain asset listing conditions on non-registered exchanges (such as platforms holding only state licenses). Even derivatives platforms regulated by the CFTC may be expected to incorporate some leverage functions to release greater trading liquidity. The overall direction of regulatory reform is to break the binary boundary between securities and non-securities, allowing platforms to flexibly allocate assets based on product nature and user needs, rather than being shackled by compliance structures.

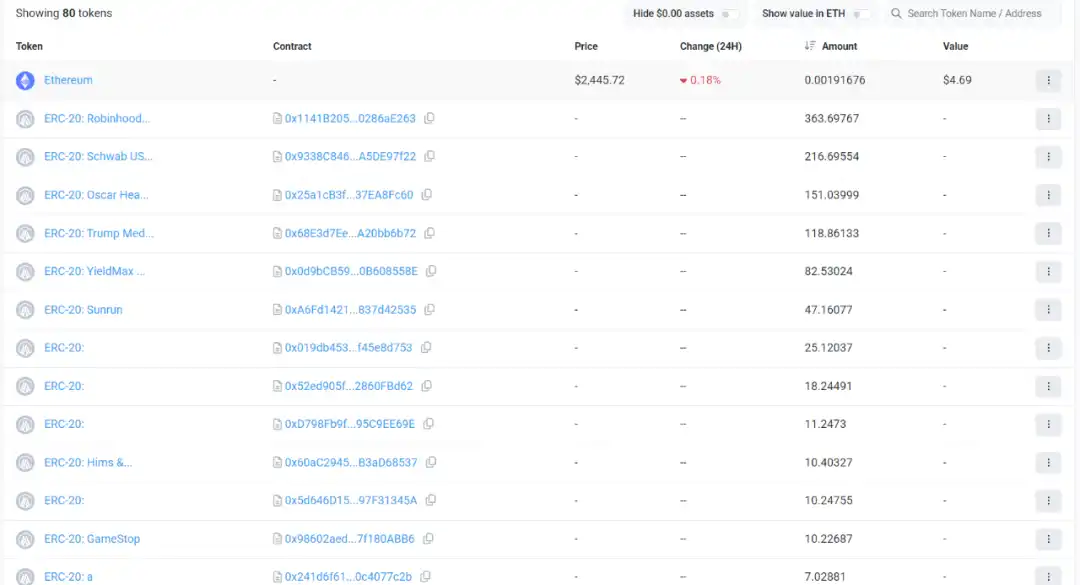

The most direct beneficiaries of this transformation are undoubtedly Coinbase and Robinhood. These two companies have long established diversified trading structures that cover mainstream crypto assets, operate traditional securities trading, and provide lending and wallet services. Encouraged by Project Crypto, they are expected to be among the first platforms to reap policy dividends—achieving one-stop services and bridging on-chain products with traditional user bases. Notably, Robinhood has completed the acquisition of Bitstamp this year and officially launched tokenized stock trading, listing U.S. stocks like Apple, Nvidia, and Tesla in ERC-20 format. This move is precisely a rehearsal of the Super-App model: providing traditional stock trading experiences through on-chain protocols without disrupting the familiar user experience.

On the Coinbase side, they are advancing the developer ecosystem through the Base chain, attempting to integrate exchange, wallet, social, and application layer services. If they can integrate traditional securities and on-chain assets at the compliance level in the future, Coinbase is likely to evolve into a "on-chain version of Charles Schwab" or "next-generation Morgan Stanley"—not just an asset gateway, but a complete platform for financial tool distribution and operation.

It is foreseeable that once the Super-App framework is fully released, it will become the core battleground for competition among trading platforms. Whoever can first achieve compliant "multi-asset aggregated trading" will occupy a leading position in the next round of financial infrastructure upgrades. The regulatory attitude has become increasingly clear, and platforms are already accelerating their entry into the market. For users, this means a smoother trading experience, a richer product selection, and a financial world that is closer to the future.

ERC-3643: From Technical Protocol to Policy Template, the Compliance Bridge for RWA Track

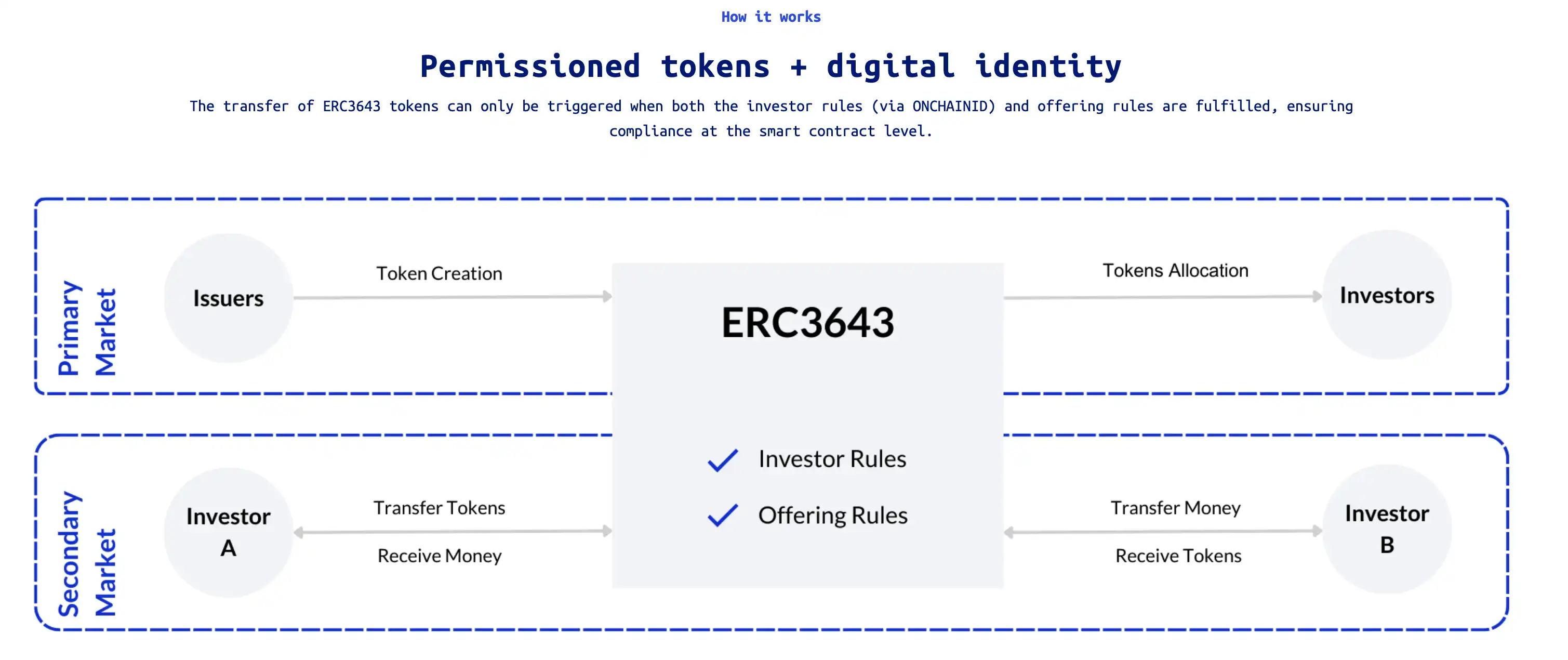

Regarding RWA, Paul Atkins explicitly stated in his speech that he would promote the tokenization of traditional assets and specifically named ERC-3643 as a token standard worth referencing in the regulatory framework. This is the only token standard publicly mentioned during the entire speech, indicating that ERC-3643 has elevated from a technical protocol to a policy-level reference model, underscoring its significance.

Paul emphasized that when designing an innovative exemption framework, the SEC will prioritize token systems that "embed compliance capabilities," and the smart contracts of ERC-3643 integrate mechanisms such as permission control, identity verification, and transaction restrictions, which can directly meet the current securities regulations' requirements for KYC, AML, and accredited investors.

The most notable feature of ERC-3643 is its design philosophy of "compliance as code." It incorporates a decentralized identity framework called ONCHAINID, requiring all token holders to undergo identity verification and comply with preset rules before completing holding or transfer operations. Regardless of which public chain the token is deployed on, only users who meet KYC or accredited investor standards can truly own these assets. The compliance determination is completed at the smart contract level, eliminating reliance on centralized audits, manual records, or off-chain protocols.

This is fundamentally different from ERC-20, which was born in a completely open, permissionless on-chain native context, where any wallet address can freely receive and transfer tokens, making it a fully "fungible tool." In contrast, ERC-3643 targets high-value, heavily regulated asset categories such as securities, funds, and bonds, emphasizing "who can hold" and "whether it is compliant," making it a "permissioned token standard." In other words, ERC-20 is the free currency of the crypto world, while ERC-3643 is the compliant container for on-chain finance.

Currently, ERC-3643 has been adopted by multiple countries and financial institutions worldwide. The European digital securities platform Tokeny has been expanding the ERC-3643 standard into the private market for securitization in recent years. In June of this year, Tokeny announced a partnership with the digital securities platform Kerdo, planning to build a blockchain-based private investment infrastructure through ERC-3643, covering asset types such as real estate, private equity, hedge funds, and private debt.

From real estate to art collections, from private equity to supply chain notes, ERC-3643 provides the underlying support for the fragmentation, digitization, and global circulation of various assets. It is currently the only public chain token standard that combines programmable compliance, on-chain identity verification, cross-border legal compatibility, and the ability to interface with existing financial architectures.

As Paul Atkins stated in his speech, the future securities market must not only "operate on-chain" but also "comply on-chain." In this new era, ERC-3643 may become the key bridge connecting the SEC with Ethereum, linking TradFi with DeFi.

Entrepreneurs Returning to the U.S.: The Primary Market Will Take Off Again from On-Chain

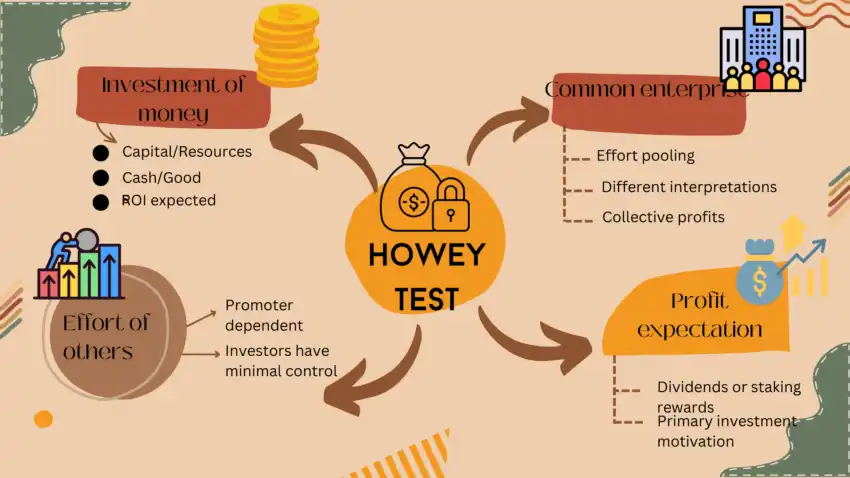

For a long time, the "Howey Test" has been the primary basis for the SEC to determine whether an asset constitutes a security. Specifically, it includes four elements: whether there is a monetary investment, whether the investment is in a common enterprise, whether there is reliance on the efforts of others to generate profits, and whether there is an expectation of profits. If a project meets all four criteria, it will be classified as a security, thus subjecting it to a series of securities law frameworks, including pre-issue prospectus, information disclosure, and regulatory filing.

It is precisely because the test standard is vague and enforcement scales vary that many projects in recent years have chosen to sacrifice the U.S. market to avoid potential regulatory risks, even deliberately "blocking" U.S. users and not opening airdrops and incentives.

In the latest release of the Project Crypto policy, SEC Chairman Paul Atkins explicitly stated for the first time that a reclassification standard for crypto assets will be established, providing clear disclosure norms, exemption conditions, and safe harbor mechanisms for common on-chain economic activities such as airdrops, ICOs, and staking. The SEC will no longer default to "issuing tokens = securities," but will reasonably categorize assets based on their economic attributes into different categories such as digital commodities (like Bitcoin), digital collectibles (like NFTs), stablecoins, or security tokens, and provide appropriate legal pathways.

This represents a critical turning point: project teams will no longer need to "pretend not to issue tokens," nor will they need to use roundabout structures like foundations or DAOs to conceal incentive mechanisms, and they will no longer have to register projects in the Cayman Islands. Instead, teams that genuinely focus on code and have technology as their core driving force will receive institutional recognition.

As emerging sectors like AI, DePIN, and SocialFi rapidly rise and the market's demand for early-stage financing surges, this regulatory framework based on substantive classification and encouragement of innovation is expected to spark a wave of projects returning to the U.S. The U.S. will no longer be a market that crypto entrepreneurs avoid, but may once again become their first choice for token issuance and fundraising.

Summary

"Project Crypto" is not a single piece of legislation but a comprehensive set of systemic reforms. It envisions a future where decentralized software, token economies, and capital market compliance are integrated. Paul Atkins' stance is also very clear: "Regulation should no longer stifle innovation but pave the way for it."

For the market, this is also a clear signal of policy shift. From DeFi to RWA, from Super App to token issuance and fundraising, who can take off in this round of policy dividends depends on who can respond first to this U.S.-led "on-chain capital market revolution."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。