Trump Pushes Fed for Rate Cut—Will It Shake Up the 2025 Crypto Market?

U.S. President Donald Trump is continuously pushing current Fed Chair Jerome Powell to reduce interest rates from the current 4.25%–4.50% all the way down to 1%. Trump claims this will help the economy and create more investment opportunities, especially in crypto.

But the latest Fed rate decision from the July 29–30, 2025 meeting shows that the central bank is not planning any cuts for now. The FOMC is staying cautious due to ongoing inflation risks. The US President says that rate cuts could boost the crypto market and unlock new money flow. But many experts don’t agree—including economist Peter Schiff.

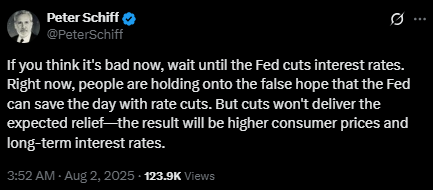

Peter Schiff Slams Trump’s Fed Pressure—Says It's a Dangerous Move

Peter Schiff , a well-known financial strategist and longtime gold supporter, is clearly against Trump’s pressure on the Fed. He recently tweeted that a Fed rate cut won’t solve problems—instead, it could create bigger ones.

Source: X

He believes that rate cuts impact inflation negatively. If FOMC lowers rates now, it may weaken the U.S. dollar and increase consumer spending. That can bring back inflation. And when inflation rises, long-term interest rates also go up because bond investors demand more returns.

Schiff added that people are still hoping for relief from the FOMC. But in reality, any Fed rate cuts 2025 might lead to higher prices, higher borrowing costs, and weak economic growth. He also warned that premature cuts—just like in the 1970s—can cause stagflation .

In his view, this isn’t good for crypto either. While short-term gains may come, long-term damage is likely. Schiff said clearly that this will not just hurt the dollar but also Bitcoin , tech stocks, and the broader market. This matches his earlier Peter Schiff Bitcoin prediction , where he said gold would benefit while assets would struggle.

Interestingly, he even advised Powell not to resign or let Trump fire Jerome Powell , because if Trump gets full control, he could misuse it for his own political and financial interests.

Trump's Crypto Moves: Supportive Vision or a Dictator's Power Play?

Trump’s recent actions have raised eyebrows. His support for memecoins, connections to controversial projects like Wlfi, and fast decisions like tariff hikes without proper planning show he might be more focused on his own power than economic stability.

Many feel his crypto-friendly image is just a mask for his real intentions. Behind the slogans like “Make America Great Again,” Trump might just be playing a business game. His moves seem less about innovation and more about control. The Jerome Powell resign controversy is part of this bigger power push.

Even Peter Schiff, a known digital asset critic, is now warning that Trump's behavior may be harmful not just for fiat money but also for digital assets like Bitcoin and Ethereum.

Fed Rate Cut or Not—What It Means for Bitcoin and Crypto Traders

So what does this all mean for crypto investors?

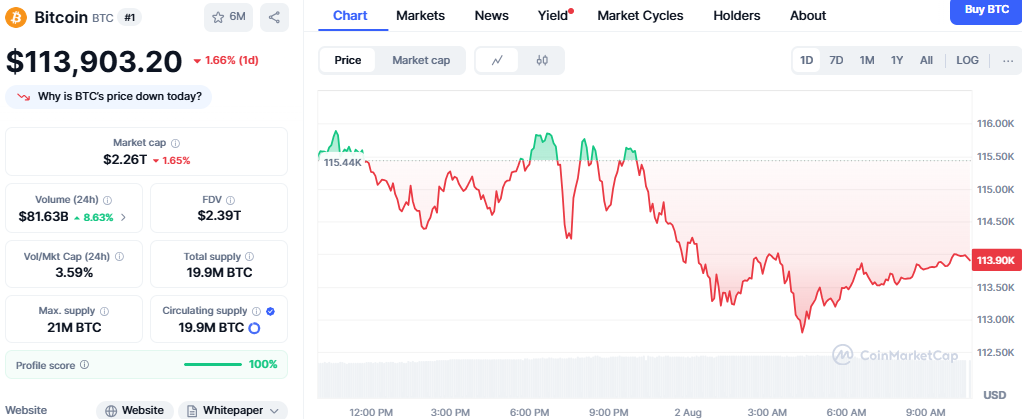

At the time of writing, the crypto market crash es upto 1.73% in the past 24 hours shows nervousness. The global market cap is down to $3.71 trillion. Bitcoin price today is $113,919 after a 1.65% drop.

Source: CoinMarketCap

A rate cut impact on crypto could bring short-term benefits, like more liquidity and investor activity. But long-term risks remain. If the economy suffers, the Fed may have to raise interest rates even higher later—possibly above 4.50%. That could hurt the market more than help.

Also, due to the lack of strong crypto regulations , any external market shock or policy shift hits digital asset prices faster than traditional assets.

For now, traders must stay alert. Schiff’s warning and the Fed’s cautious stance should not be ignored. The rate cut probability might be low for now—but the market will keep watching every word from Powell and Trump closely.

Conclusion

While Trump pushes for a big Fed rate cut , experts like Peter Schiff believe this could harm both the economy and the crypto market. Short-term gains may tempt investors, but long-term risks are real. traders should focus on facts, not just headlines.

Disclaimer : This article is for informational purposes only. It does not offer financial or investment advice. Always do your own research before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。