Bitcoin ETFs End Positive Streak With $115 Million Outflow As Ether Stays Green

A shift in market sentiment hit bitcoin ETFs on Thursday, July 31, snapping their recent positive run with $114.83 million in outflows. The day opened strong for a few funds. Blackrock’s IBIT added $18.62 million, while Franklin’s EZBC, Grayscale’s Bitcoin Mini Trust, and Invesco’s BTCO collectively contributed nearly $16 million. Vaneck’s HODL chipped in another $3.31 million.

But the outflows told a bigger story. Ark 21shares’ ARKB bled $89.92 million, followed by Fidelity’s FBTC losing $53.63 million and Grayscale’s GBTC shedding $9.18 million. The imbalance tipped the scales deep into the red despite 5 ETFs recording inflows. Total trading volume remained fairly strong at $3.56 billion, with net assets holding at $152.01 billion.

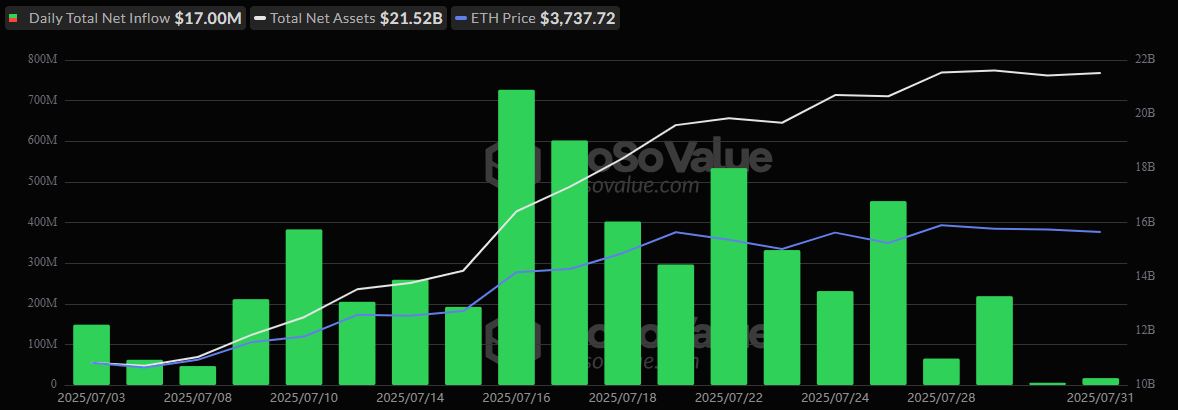

Ether ETFs’ 20-day streak. Source: Sosovalue

Ether ETFs, on the other hand, continued their relentless march forward. The asset class logged its 20th consecutive day of inflows, adding $17 million. Blackrock’s ETHA dominated again with $18.18 million, while Fidelity’s FETH pitched in $5.62 million.

Grayscale’s ETHE dragged slightly with a $6.80 million outflow, but it wasn’t enough to break the green streak. Ether ETF trading hit $1.28 billion, and net assets climbed to $21.52 billion, reinforcing ether’s growing institutional appeal.

Two clear narratives are emerging: bitcoin ETFs are facing resistance after heavy institutional moves earlier this month, while ether ETFs, though smaller in magnitude, maintain consistency, a sign that investor conviction in ETH remains strong.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。