MicroStrategy News: Bitcoin Stuck at $112K–$125K as Saylor Plan 7% BTC

A bold Microstrategy news that’s rocking the crypto world, Saylor CNBC interview today revealed its potential plan to acquire 1.5 million Bitcoin, which would represent a staggering 7% of the total supply. This revelation arrives as the cryptocurrency trades in a tight range, caught between support at $112K and prediction near $125K—raising the stakes for both bulls and bears.

Let’s dive into how Michael’s ambitions are affecting sentiment and what’s next for the king of crypto.

Saylor CNBC Interview Today: Aiming for 1.5M $BTC

Live on CNBC, Michael dropped a bombshell—revealing that his company’s ultimate target could be 1.5 million tokens. This would translate to roughly 7% of the 21 million supply.

Source: Bitcoin Magazine

Speaking confidently, he compared Strategy’s ambition to that of BlackRock, which now owns over 740,896 coins through the iShares Bitcoin Trust (IBIT).

This came just days after the company announced the purchase of 21,021 coins worth $2.46 billion, funded through its fourth preferred stock offering — a $2.5 billion capital raise, selling 28 million shares at $90 apiece.

That move pushed MicroStrategy BTC holdings to 628,791 tokens, now valued at over $71.91 billion.

BTC Monopoly? MicroStrategy 7% Bitcoin Acquisition Too Much

While critics worry about Bitcoin centralization, he doesn’t see anything outrageous about aiming for a 7% share of total supply. After all, BlackRock’s growing position proves the institutional race is on.

This MicroStrategy news not only sets a bar for other firms but also tightens available supply—potentially sparking the next price impact. Saylor btc news today emphasized crypto king's long-term nature, calling it a “50-year asset” designed for generational wealth building.

Bitcoin Price Impact: Stuck Between $112K and $125K

At the time of writing, it is trading at $115,066.71, showing a daily drop of 2.71%. TradingView technical indicators are giving mixed signals:

-

MACD: Bearish crossover – momentum fading

-

RSI: 46.94 – neutral, sliding downward

-

Support: $112,000

-

Resistance: $120,000

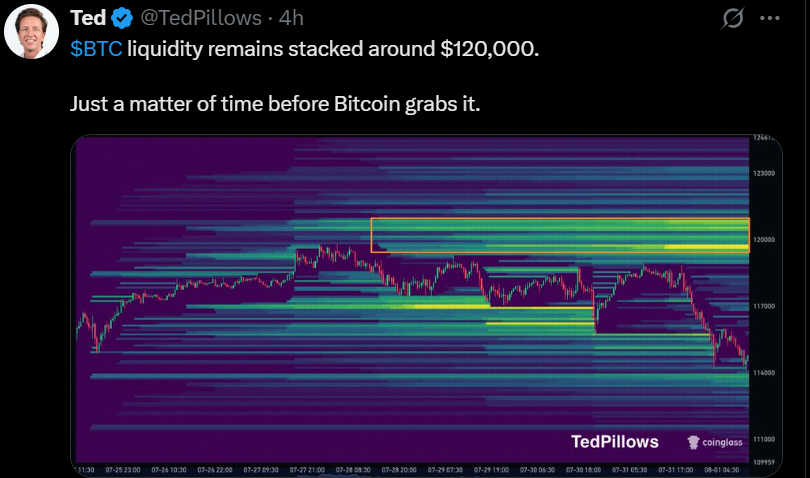

Analysts like Ted , a known OKX partner, highlighted that liquidity remains clustered around $120K, making it a zone of interest for price discovery. It’s a matter of “when,” not “if,” token retests this level.

Bullish Price Prediction $125K and Bearish Scenario

| Scenario | Levels / Conditions |

|---|---|

| Bullish Scenario | Support: $112,000 First Target: $118,000 Breakout Point: $120,000 Extended Target: $125,000+ Indicators: MACD flips bullish, RSI climbs above 50 Pattern: Inverse Head and Shoulders breakout (per BitBull) Sentiment: Reinforced by Saylor’s CNBC statement |

| Bearish Scenario | Breakdown Level: Below $112,000 Short-term Target: $108,000 Major Support: $105,000 Correction Range: $98,000–$100,000 Indicators: RSI drops below 40, continued MACD weakness Sentiment: Could trigger renewed crash fears |

Conclusion: Is Saylor Starting a BTC Supply War?

The most compelling takeaway from the Saylor CNBC interview today is his long-term vision in the latest Microstrategy news today . With nearly $72 billion in tokens already secured, and ambitions to own 1.5 million coins, he is reshaping corporate treasury models.

With price hovering between $112K and $125K, all eyes are now on price action. The Michael Saylor Bitcoin buying strategy isn’t just bullish—it’s becoming a blueprint, so keep a close watch on any Microstrategy news now.

Also read: Spur Protocol Daily Quiz Answer 02 August 2025: Earn Free Rewards免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。