On July 31, 2025, the Federal Reserve announced that it would maintain the federal funds rate at 4.25%-4.50%, marking the fifth pause in interest rate cuts since the easing cycle began in September 2024. However, this Federal Open Market Committee (FOMC) meeting set a record for the first time in 30 years with two board members casting dissenting votes—Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller, both appointed by President Trump, advocated for an immediate 25 basis point rate cut. Fed Chair Jerome Powell displayed a hawkish stance at the post-meeting press conference, emphasizing optimism about the labor market and ongoing concerns about inflation, which significantly cooled market expectations for a rate cut in September. Powell clearly stated, "It is too early to assert whether there will be a rate cut in September; we will reference economic data before the next meeting."

Division Within the Federal Reserve

One of the highlights of this FOMC meeting was the dissenting votes from the two board members, marking the first significant division since 1995. Bowman's and Waller's dovish positions reflect concerns among some officials about the economic slowdown, particularly the potential impact of the Trump administration's high tariff policies on employment and consumption. Both advocated for a 25 basis point rate cut to support the labor market and alleviate economic uncertainty. However, Powell downplayed the internal division at the press conference, emphasizing that FOMC decisions are based on "data-driven and risk-balanced" approaches, and reiterated that the Fed's independence is not influenced by political pressure.

Non-Farm Payroll Data Preview

The non-farm payroll data for July, to be released tonight, is highly anticipated. The market expects an addition of 110,000 jobs, down from 147,000 in June, with the unemployment rate expected to rise slightly from 4.1% to 4.2%. This data is below the average levels of the previous months, indicating that the labor market may be slowing, which could alleviate the Fed's concerns about wage inflation. However, if the data is unexpectedly weak, it may further raise expectations for a rate cut in September, leading to a quick rebound in BTC; conversely, if it remains strong, the pause in rate cuts may extend to October or December.

Bitcoin Trends

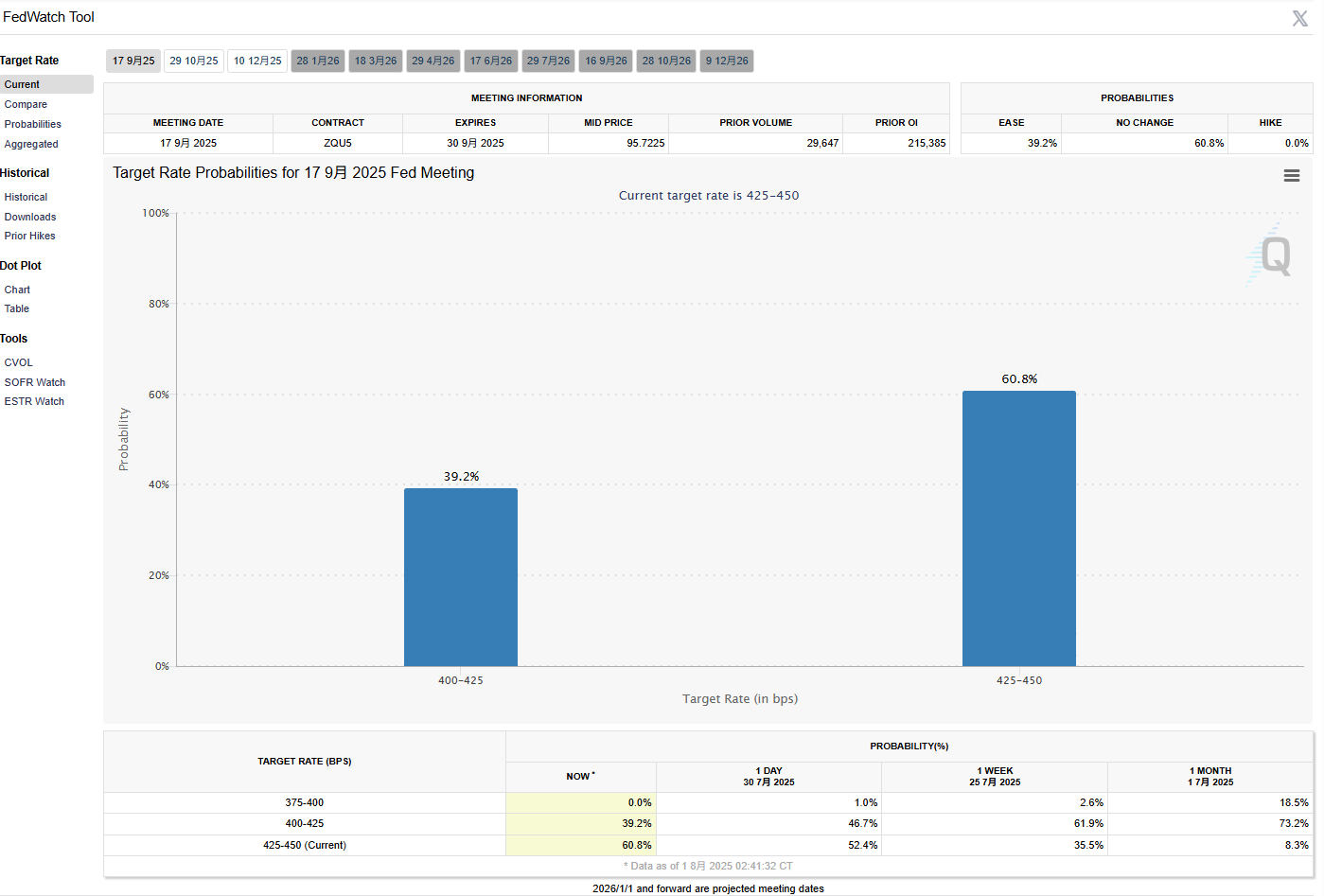

The hawkish tone of the Fed's July decision has put pressure on Bitcoin prices. Following the announcement, Bitcoin's price fell, reflecting market concerns about the high interest rate environment. Wall Street Journal reporter Nick Timiraos noted that the FOMC statement included new wording regarding "magnitude and timing," suggesting a slowdown in the pace of rate cuts, which reduced the probability of a 25 basis point cut in September from 65% to 60.8%. The dollar index has risen, putting further downward pressure on crypto assets.

Tonight's non-farm data will provide a new catalyst for Bitcoin trends:

New Jobs: Expected at 110,000; if significantly below expectations, it may increase the probability of a rate cut, pushing Bitcoin prices higher; if above expectations, it may strengthen the pause in rate cut expectations, leading the dollar and yields to rise further, potentially causing Bitcoin to break below the support level of $116,000 and test the $110,000 mark.

Unemployment Rate: Expected at 4.2%; if it rises to 4.3% or higher, it may trigger market concerns about economic slowdown, increasing rate cut expectations.

Additionally, the short-term effects of Trump's tariff policies have not yet fully manifested. Powell noted that tariffs could lead to a "one-time price shock," but their long-term impact needs further confirmation from August and September data. If the tariff effects are mild, the Fed may lean towards a rate cut; if they raise inflation, the pause in rate cuts may extend into 2026.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。