Author: White55, Mars Finance

Within 48 hours after the Federal Reserve's July meeting, the market experienced a dramatic reconfiguration of expectations. When Chairman Powell's hawkish remarks pierced through the trading hall during the press conference, the interest rate swap market reacted instantly—the probability of a rate cut in September plummeted from 68% before the meeting to 40%, while the probability for October dropped from a "done deal" to 80%. Behind this collapse of expectations was the historic division within the Federal Reserve, with two governors (Waller and Bowman) casting dissenting votes against the decision to maintain interest rates for the first time since 1993, as well as the increasingly tense relationship between the White House and monetary policymakers.

Federal Reserve's July Decision: Hawkish Signals Penetrate the Market

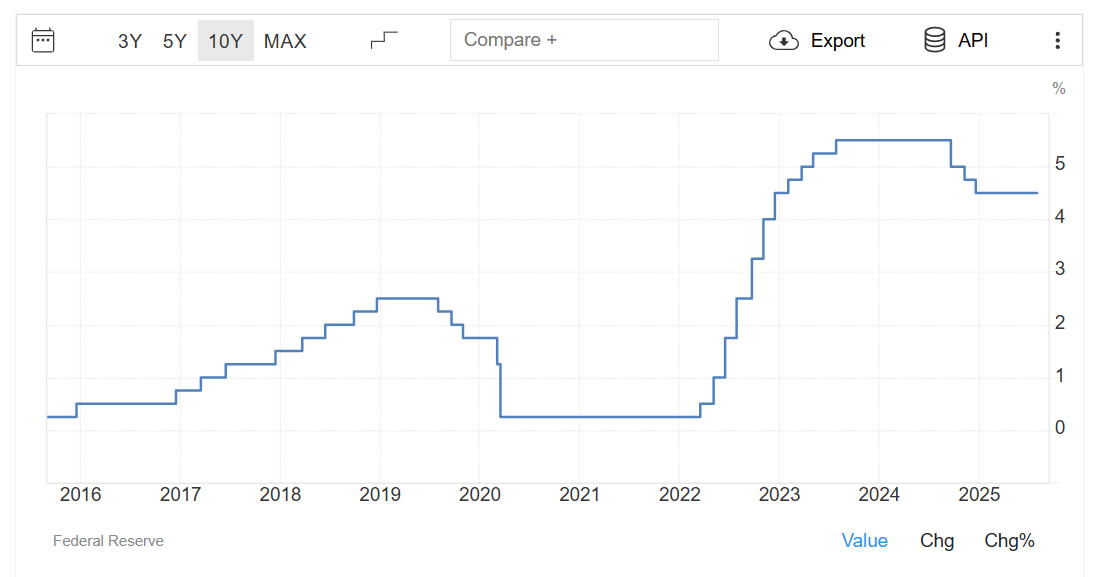

_The U.S. interest rates remain close to their highest levels in over a decade. Source: _Trading Economics

The decision from the Federal Reserve headquarters in Washington, D.C. on July 31 superficially continued the market's general expectations: the federal funds rate was maintained in the range of 4.25%-4.50%, continuing the tightening stance since 2024.

However, beneath the surface, undercurrents were stirring—Governors Waller and Bowman unusually voted in favor of an immediate 25 basis point rate cut, breaking the Federal Reserve's record of not having dual dissenting votes in thirty years. This division highlighted the cracks within the Federal Reserve regarding the assessment of the economic outlook: doves see risks of slowing growth, while hawks focus on the threat of inflation rebounding.

Powell's statements during the press conference further reinforced the hawkish tone. When pressed by reporters about the possibility of a rate cut in September, he repeatedly emphasized: "We have not made any decisions yet; it will depend on the overall evidence obtained from now until the September meeting." He specifically pointed out that the surge in prices of goods such as furniture and clothing had pushed the June CPI to a five-month high, and the impact of Trump's tariff policy "will be fully evident by the end of summer." This cautious stance directly extinguished market expectations for short-term easing.

Dramatic Drop in Rate Cut Probability: A Dual Game of Data and Power

The sharp adjustment in market expectations stemmed from multiple overlapping signals:

- The Ghost of Inflation Reappears: The overall inflation rate in June climbed to 2.7%, rising for four consecutive months, moving further away from the Federal Reserve's 2% target. The transmission effects of tariffs are fermenting, and the Beige Book indicates that businesses are planning to pass on cost pressures by the end of summer.

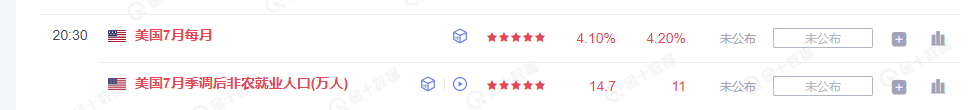

- Resilience in the Job Market: Although non-farm employment has cooled, the addition of over 100,000 jobs and a 4.1% unemployment rate still approach full employment levels, diminishing the urgency for a rate cut.

- Escalating Political Pressure: Trump publicly claimed before the decision that "I get the impression that Powell is ready to cut rates," attempting to influence the decision. However, Powell's emphasis on "the independence of the Federal Reserve" was seen as a subtle rebuttal to political interference.

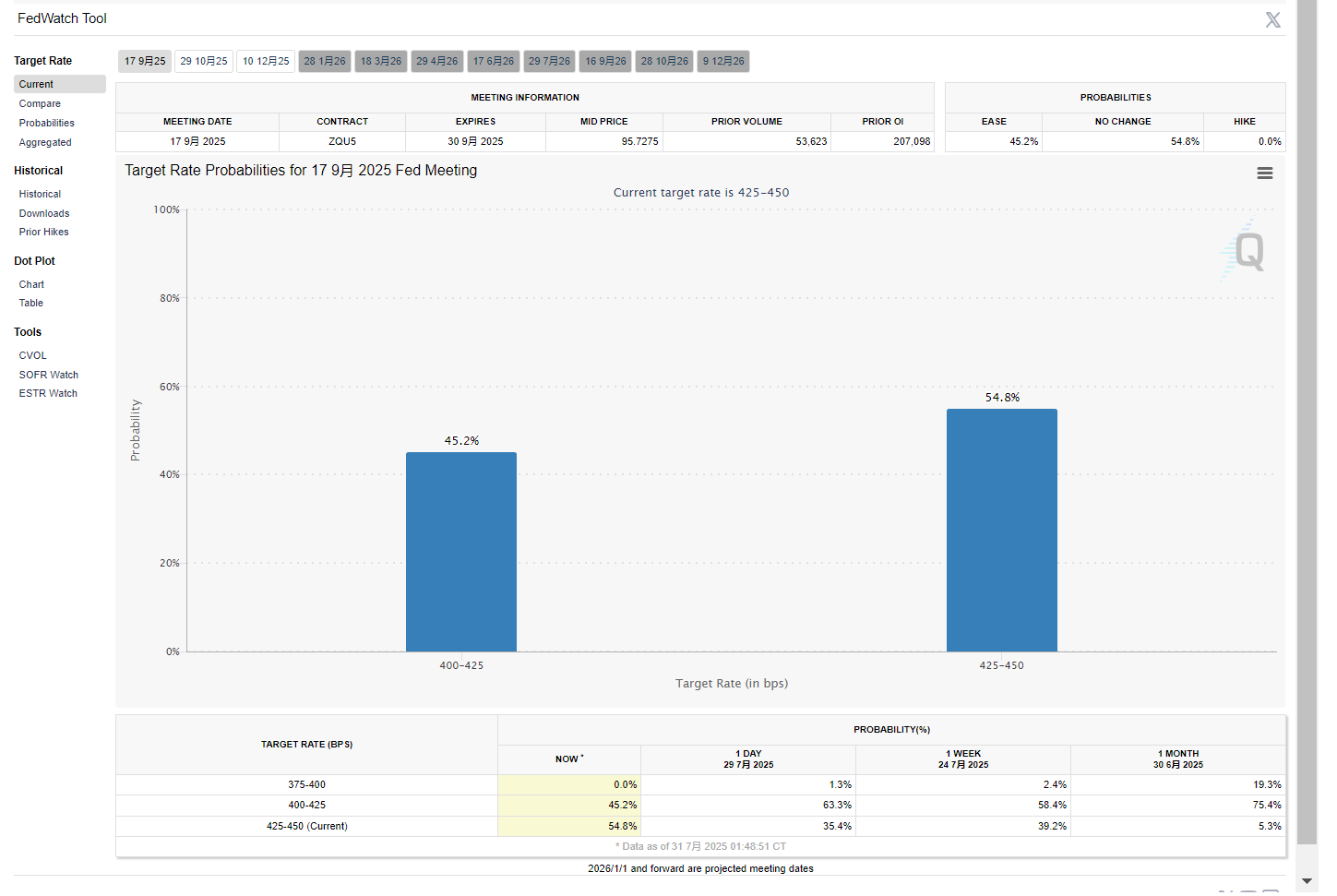

The CME FedWatch tool captured the dramatic shift in expectations: the probability of maintaining rates in September surged from 32% to 54.8%, while the probability of a 25 basis point cut plummeted from 68% to 45.2%. The interest rate market further adjusted its expectations for rate cuts before the end of the year down to 37 basis points, indicating that the commitment to two rate cuts has shrunk to nearly a "fifty-fifty" gamble.

Response of the Crypto Market: Short-term Volatility and Structural Support

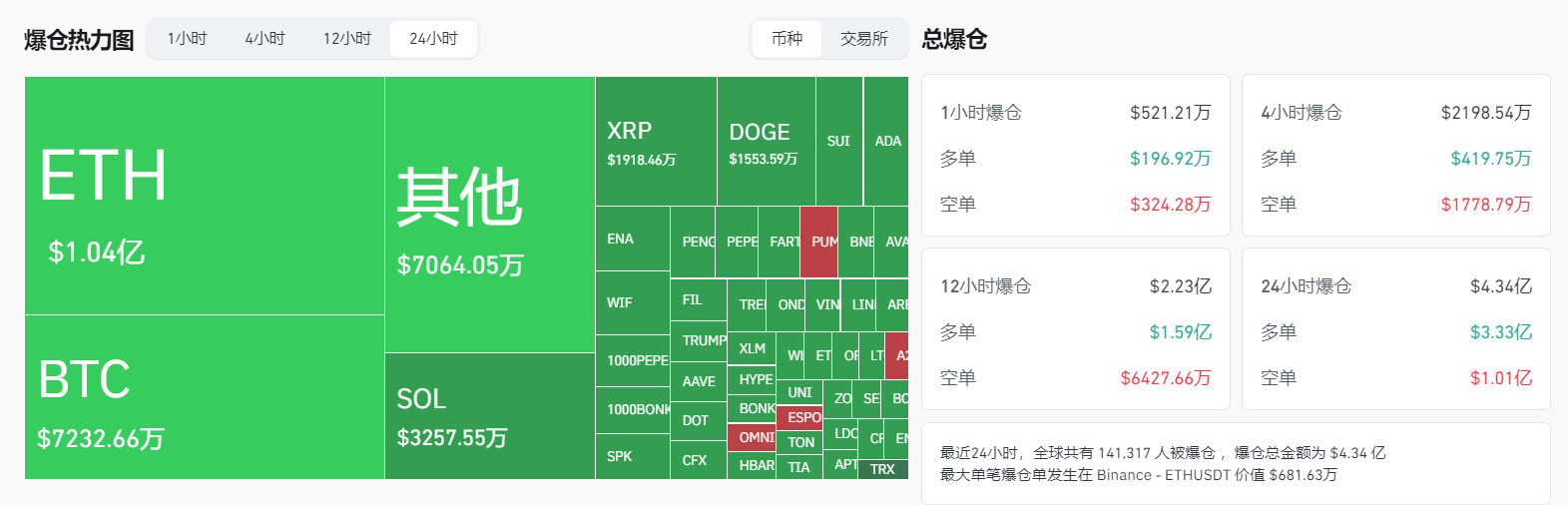

Within an hour of the announcement, Bitcoin fell below $116,000, and Ethereum dipped to a low of $3,680. However, this pullback was as brief as a seasonal strong wind—Bitcoin quickly rebounded above $118,600, and Ethereum robustly reclaimed the $3,870 mark, demonstrating the resilience of crypto assets.

This resilience is supported by three factors:

- Liquidity Buffer: Despite the delay in rate cuts, the Federal Reserve's balance sheet continues to expand, providing a safety net for risk assets. Bitfinex analysts noted that if the economy shows no signs of recession, a 25 basis point cut could still act as a catalyst for a bull market.

- Diminishing Selling Pressure: The Bitcoin sell-off from Mt. Gox and various governments has largely ended, and part of the $14.5 billion distribution funds for FTX creditors may flow back into the crypto market.

- Seasonal Patterns: Historical data shows that while September is the weakest month for Bitcoin, the subsequent October ("Uptober") has averaged a 1,449% increase (based on statistics from 2019 to present).

Reconstructing the Bull Market Trajectory: Slowdown or Acceleration?

As the expectations for a September rate cut collapse, has the fuel for the bull market run out? The market presents a divided judgment:

- Short-term Momentum Weakens: Nick Ruck, head of LVRG Research, admitted: "If the Federal Reserve remains cautious, the pace of the bull market may slow down." Leveraged traders are the first to be affected—over the past 24 hours, $434 million in cryptocurrency futures were liquidated, with long positions accounting for 82%.

- Long-term Narrative Unchanged: Henrik Andersson, Chief Investment Officer of Apollo Capital, emphasized: "The market has digested the expectations of delayed rate cuts; the key is whether the risk of recession materializes." If the economy achieves a soft landing, liquidity will eventually flow into risk assets.

A more complex picture emerges in the race between policy and economic data: if employment data deteriorates in the next two months (e.g., unemployment rate exceeds 4.5%), rate cuts may come earlier; however, if tariffs push CPI above 3%, the Federal Reserve may even restart discussions on rate hikes. Within the observation window set by Powell, two sets of CPI and employment reports will be released in August and September, with each data point potentially serving as a trigger for volatility.

Calm in the Eye of the Storm: The Accumulation Logic of the Crypto Market

The current relative calm in the market reflects investors' strategic patience. In the wake of the halving of the September rate cut probability, the S&P 500 index only slightly fell by 0.4%, indicating resilience that can be interpreted in two ways:

- The Effect of Bad News Being Priced In: Some investors view the hawkish statements as the last dip, especially when the Federal Reserve acknowledges that "rates should have been cut if not for tariffs," making the long-term direction of policy clear.

- The Rise of Alternative Narratives: The tax cuts and deregulation plans accelerated by the Trump administration are injecting new expectations for corporate profits. If fiscal policy takes over from monetary policy, risk assets may gain a new engine.

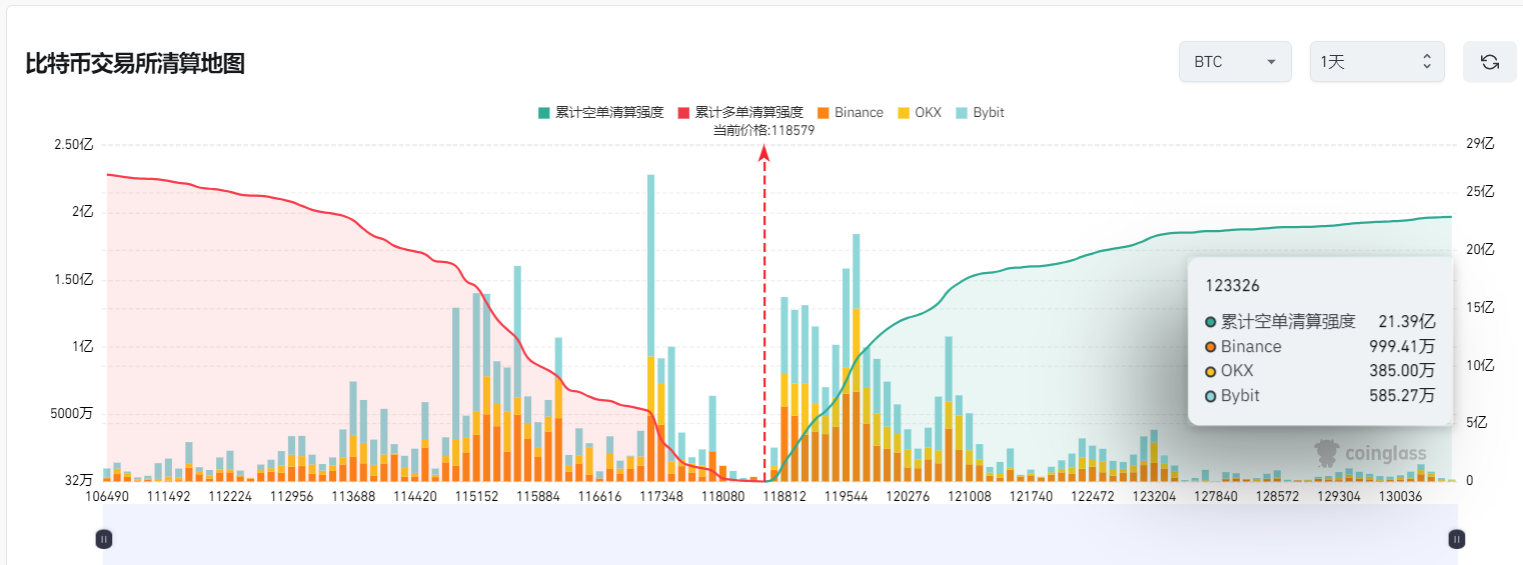

For the crypto market, the compression of short-term volatility may brew a larger breakthrough. CoinGlass's liquidation heatmap shows that Bitcoin has accumulated a large number of short liquidation positions around $120,000, and a breakout could trigger a chain reaction. Meanwhile, QCP Capital observed that institutional investors are positioning for an upward trend in the fourth quarter through the options market, with implied volatility premiums indicating that bullish sentiment remains unchanged.

The Art of Balance in the Fog of Policy: The Crypto Market

As the September FOMC meeting becomes a key battleground for determining the direction of monetary policy, crypto investors need to seek certainty amid multiple uncertainties:

- Increased Sensitivity to Economic Data: The non-farm data on August 1 and the CPI on August 13 will become catalysts for market volatility, necessitating caution regarding short-term leverage risks.

- Strategic Value of Seasonal Patterns: If panic selling occurs in September, historical data shows that "buying the dip for the fourth quarter" is the statistically optimal strategy.

- Increased Weight of Political Variables: Trump's threat to appoint a "more moderate chair" when Powell's term ends in 2026 may force a policy shift due to political pressure.

As Wall Street traders turn their attention to the September FOMC meeting, the cryptocurrency market is undergoing a silent buildup. The delay in rate cut expectations may temporarily suppress the rhythm of the bull market, but it is also accumulating stronger momentum for a final breakthrough.

Much like the script following the emergency rate cuts in March 2020—initial market doubts were ultimately swallowed by a surge of liquidity, and this time, the institutional funding pipeline brought by Bitcoin ETFs may allow the transmission of easing policies to be more rapid than at any point in history.

The Federal Reserve's hawkish statements are like pouring a handful of sand into the engine of a bull market, but the true mechanics understand: when the monetary policy of the world's largest central bank is set to shift, a brief slowdown in speed is merely a moment of breath before the storm arrives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。