Author: Nancy, PANews

The U.S. crypto ETF has received a regulatory "green light," and the market may welcome a new wave of listing enthusiasm. On one hand, the U.S. SEC has officially allowed the physical subscription and redemption mechanism for crypto ETFs, significantly enhancing trading efficiency and market liquidity; on the other hand, a universal listing standard for crypto ETPs is on the horizon, which will open a fast track for crypto assets to enter the ETF market.

SEC Officially Approves Physical Subscription and Redemption for Crypto ETPs

Crypto regulation is reaching an important turning point. On July 30, the SEC cast a significant vote, allowing authorized participants to conduct physical subscriptions and redemptions for crypto ETPs.

Both crypto ETPs and ETFs are financial instruments that list cryptocurrencies (such as Bitcoin, Ethereum, etc.) in a securitized form on traditional stock exchanges, aiming to provide investors with a convenient and compliant investment channel for crypto assets. Both allow investors to trade like buying and selling stocks without directly dealing with crypto wallets or private key management, offering high liquidity and transparency, and must be approved by the financial regulatory authorities of their respective countries or regions. However, there are significant differences in structure and regulation between the two. Crypto ETFs belong to a fund structure, typically being physically-backed products with stricter disclosure requirements and higher asset security, making it more challenging to obtain approval in strictly regulated markets (like the U.S.); crypto ETPs, on the other hand, are a broader concept and may not necessarily be funds, potentially carrying issuer credit risk, but are easier to launch and more flexible in markets like Europe.

As is well known, the Bitcoin and Ethereum spot ETFs use a cash subscription and redemption mechanism. In this model, authorized participants must first deliver cash to the ETF issuer, which then purchases an equivalent amount of Bitcoin or Ethereum in the spot market to support the newly issued ETF shares; the redemption process operates in reverse.

However, this indirect operation model leads to high trading costs, settlement delays, and significant market slippage risks, limiting the product's attractiveness and primary market liquidity.

With the opening of the physical subscription and redemption mechanism, authorized participants can now directly deliver Bitcoin or Ethereum to the ETF issuer to create or redeem ETF shares. The further integration of on-chain assets and traditional financial products not only enhances operational efficiency but also opens new channels for the compliant liquidity of crypto assets, potentially attracting more ETF participants.

"This marks the beginning of a new chapter in SEC regulation. As a key goal during my chairmanship, I am committed to establishing a regulatory framework for the crypto market that aligns with market realities. This approval will reduce product costs, enhance operational efficiency, and ultimately benefit investors. It will further promote the construction of a rational and clear crypto regulatory system," said SEC Chairman Paul S. Atkins.

Bloomberg analyst James Seyffart believes that the physical subscription/redemption mechanism for Bitcoin and Ethereum spot ETFs has already been approved. It is expected that the soon-to-be-approved altcoin ETFs will likely also allow physical subscriptions and redemptions from the start. This is another step in the right direction.

Probability of Approval for 12 Altcoin ETFs

Additionally, the SEC has approved other proposals to promote the development of the crypto asset market, including applications for the listing of hybrid spot Bitcoin and Ethereum ETPs, options trading for specific Bitcoin spot ETPs, flexible exchange (FLEX) options trading, and increasing the position limit for specific Bitcoin ETP options to 250,000 contracts, enriching market tools and enhancing flexibility.

Opening the listing channel, the universal standard for crypto ETPs may be launched within 60 days.

In addition to the critical step forward in the operational model of crypto ETPs, their listing channel has also seen significant optimization.

Recently, Cboe BZX submitted a milestone rule amendment proposal to the U.S. SEC. The core of this proposal is a systematic revision of Rule 14.11 (e)(4) to establish a universal listing standard for Commodity-Based Trust Shares (CBTS).

As early as 2013, BZX established a listing system for CBTS based on Rule 14.11 (e), but this rule was essentially designed for traditional commodity ETFs, primarily targeting trust structures supported by single commodities (such as gold or oil). As the market evolved, such as the rise of crypto assets and the emergence of composite investment portfolios, the shortcomings of the original rule gradually became apparent, including limited asset types, cumbersome approval processes, and low innovation efficiency.

The Bitcoin and Ethereum spot ETFs are typical cases, having undergone years of modifications and negotiations before finally being approved. In fact, under the existing rules, each crypto ETF must submit a separate 19b-4 application document, with an approval cycle that can last up to 240 days. This model consumes regulatory resources and undermines market confidence.

The core logic of the new proposal is to institutionalize and standardize the "one coin, one review" ETF listing process, allowing any CBTS product that meets specific conditions to be listed directly.

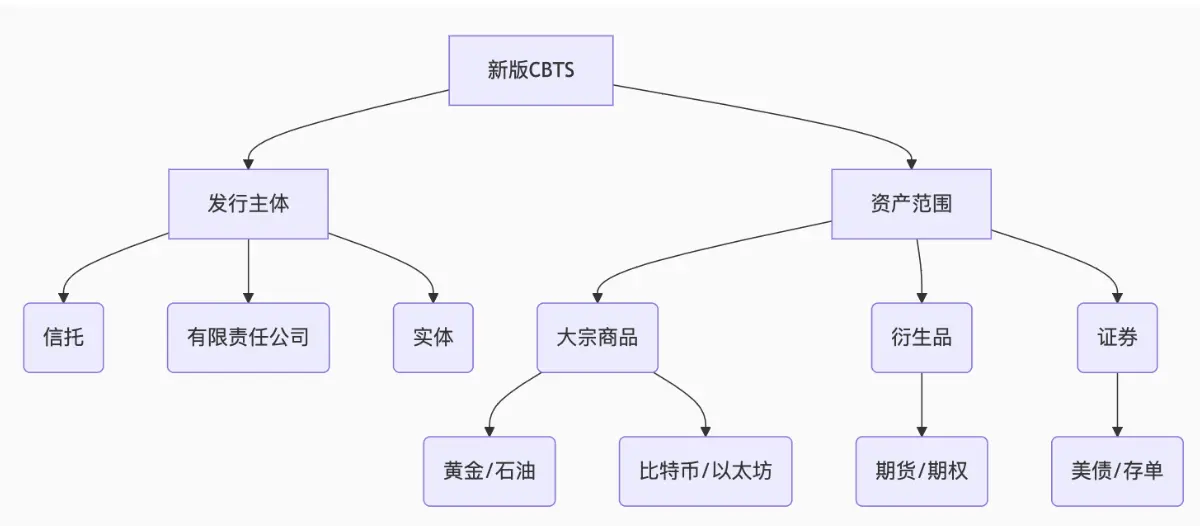

This amendment comprehensively upgrades the definition of CBTS, breaking the original limitation of single commodities. The new rules clarify that trust shares can be issued by trusts, limited liability companies, or other similar entities, significantly enhancing flexibility. The asset scope is also allowed to hold multiple commodities (such as gold, oil, Bitcoin, Ethereum, etc.), commodity-based assets (including futures, options, swaps, etc.), securities, cash, and cash equivalents (such as U.S. government bonds, certificates of deposit).

At the same time, the proposal specifies three paths for directly listing underlying assets: (1) ISG market trading: commodities traded in markets of members of the Intermarket Surveillance Group (ISG), allowing exchanges to access trading information and ensure regulatory visibility; (2) DCM (Coinbase Derivatives Exchange) trading for 6 months: futures contracts based on the commodity traded continuously for at least 6 months in a CFTC-regulated designated contract market (such as CME), with monitoring agreements; (3) ETF net asset value accounting for 40%: the commodity accounts for more than 40% of the net asset value (NAV) in an already listed ETF, and that ETF is traded on a national securities exchange. These three paths effectively anchor the liquidity, compliance, and regulatory visibility of the assets, forming a unified and transparent "listing equals admission" mechanism, avoiding duplicate reviews and regulatory arbitrage.

Additionally, the proposal strengthens market transparency and investor protection requirements, stipulating that CBTS issuers must disclose the following core information daily for free on a public website, including daily holdings, net asset value (NAV) and market price, historical data, and trading volume, significantly enhancing the readability and verifiability of ETF products, helping investors reasonably assess the fair value and trading efficiency of ETFs.

It is worth mentioning that the proposal supports the crypto staking mechanism. According to Rule 14.11 (e)(4)(G), if the proportion of redeemable assets in the ETF is less than 85%, a liquidity risk management policy and procedures must be established; if assets are staked, isolated, re-staked, restricted, or otherwise limited in liquidity, making T+1 redemption impossible, it is considered "not redeemable at any time"; if staked assets exceed 15% of total assets, a special liquidity management mechanism must be activated. This means that as long as the ETF can ensure sufficient liquidity or establish a robust staking risk control system, the staking mechanism can be legally introduced into the structure of crypto ETF products, providing more possibilities for product design and revenue models.

Currently, the proposal has not yet been formally implemented. According to Greg Xethalis, General Counsel of Multicoin Capital, this regulation still needs to undergo public comment and review, with the comment period likely ending within 21 days after publication in the Federal Register, meaning the rule could likely be finalized in less than 60 days. Once approved, it will open an efficient and transparent listing channel for commodity-type ETPs, including crypto assets.

New Rules on the Horizon, Who Will Be the Biggest Winner?

The universal listing standard for crypto ETPs is on the verge of being established, and Coinbase, CFTC, and altcoin ETFs may become the biggest beneficiaries.

As mentioned earlier, under the new regulatory framework, as long as a certain asset's futures have a compliance trading record of over 6 months in the Coinbase DCM contract market, it qualifies for universal listing. This means Coinbase may become the "certification center" for altcoins to enter ETFs. Moreover, since the new proposal supports the staking mechanism, related institutions will also benefit, and Coinbase Custody is currently a recognized mainstream custodian and staking service provider in the U.S., also serving as the custodian for many Bitcoin and Ethereum spot ETFs.

The proposal clearly states that the issuing entity of CBTS products is not registered as an investment company under the Investment Company Act of 1940 but must operate under the regulatory framework of the Commodity Futures Trading Commission (CFTC). This means that which crypto assets can enter ETFs will be controlled by the CFTC regarding whether their futures can be listed, thereby indirectly affecting ETF entry qualifications. The regulatory trend is clear: the product path for crypto ETFs is determined by the SEC, while asset qualifications are pre-reviewed by the CFTC.

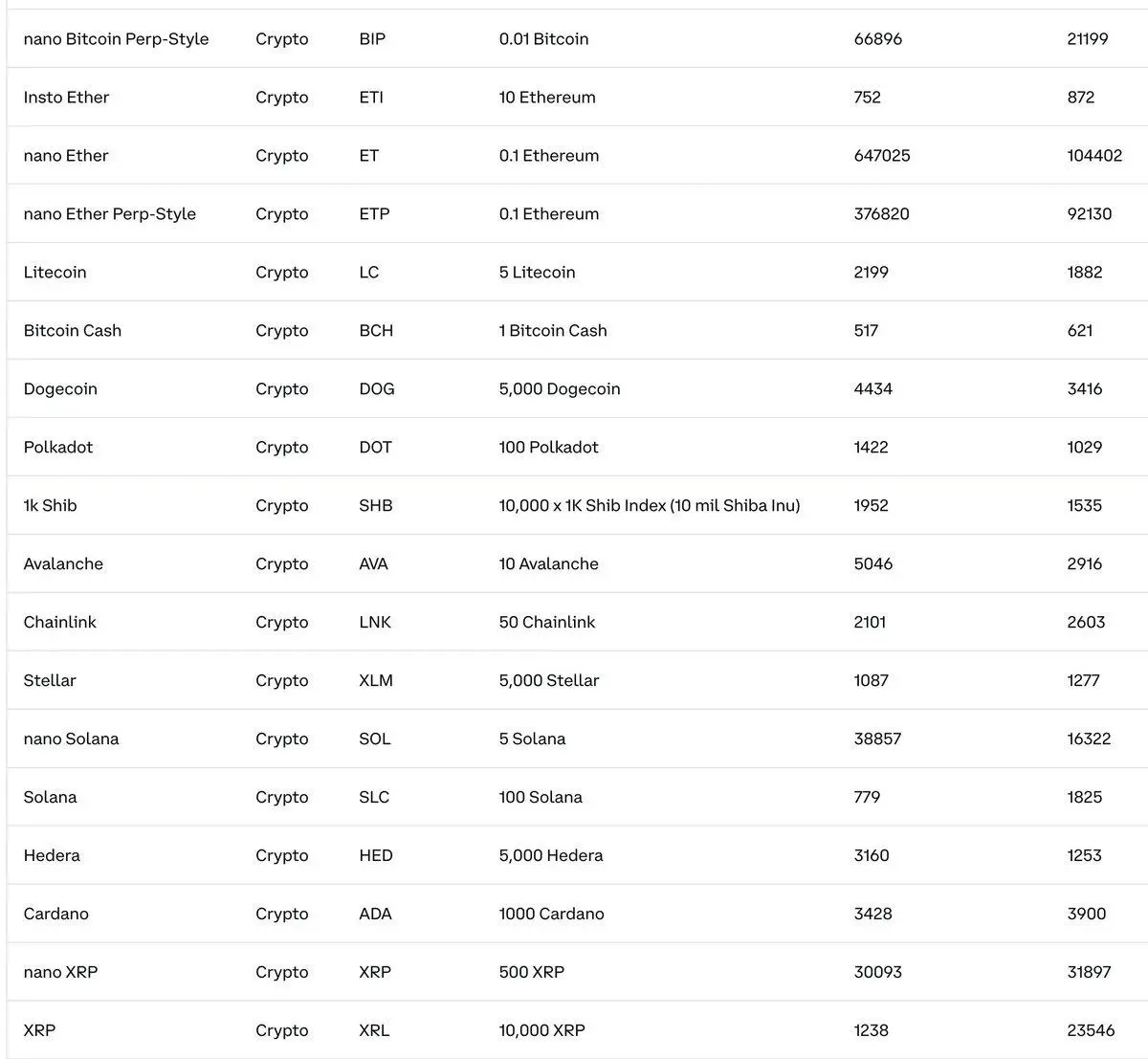

At the same time, the new rules will also promote the rapid approval and listing of more altcoin ETF products. According to Bloomberg senior ETF analyst Eric Balchunas, based on the standards, cryptocurrencies with over 6 months of futures trading tracking records on the Coinbase Derivatives Exchange will be allowed to be included in ETPs. Currently, there are about a dozen crypto assets that meet the criteria, aligning with the previous market expectations of over 85% approval probability for mainstream cryptocurrencies. Regarding the specific approval timeline, Balchunas indicated it could be in September or October of this year.

Crypto Projects on Coinbase Derivatives Exchange for Over 6 Months

Greg Xethalis also indicated that the New York Stock Exchange and Nasdaq are expected to follow suit soon. There are also pending ETP applications, including ETPs for Solana and XRP. The SEC can choose to take action on these ETP 19b-4 applications before the October 10 deadline for Solana or the later deadline for XRP, or they may also be included in the new listing standard (GLS) process for approval. Both are expected to launch in the fourth quarter, including physical delivery and SOL staking yields.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。