Ether ETFs Extend Streak to 19 Days Despite Heavy Outflow; Bitcoin ETFs Add $47 Million

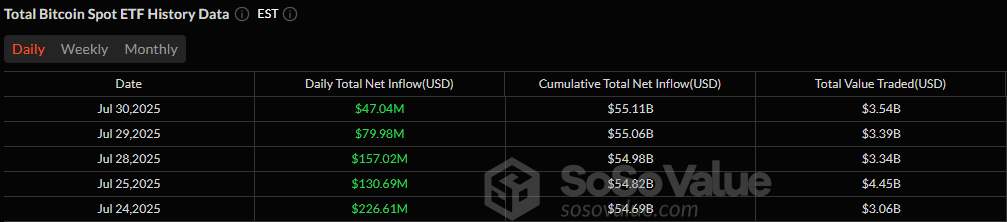

Momentum in the crypto ETF market showed contrasting tones on Wednesday, July 30. Bitcoin ETFs posted a decent $47.04 million inflow, thanks to Blackrock and Bitwise shouldering the load.

Blackrock’s IBIT led with $34.37 million, and Bitwise’s BITB contributed $12.66 million, while the rest of the field sat idle. No outflows were recorded, a rare sight in recent weeks. Trading activity remained strong with $3.54 billion changing hands, keeping net assets steady at $151.36 billion.

Bitcoin ETFs sustain inflow momentum. Source: Sosovalue

Ether ETFs, meanwhile, barely clung to the green. The asset class registered $5.79 million in net inflows, marking the 19th consecutive positive day, but it was close. Blackrock’s ETHA pushed $20.27 million, and Grayscale’s ETHE chipped in $7.77 million, yet a massive $22.27 million exit from Fidelity’s FETH nearly erased the day’s gains.

With $1.49 billion in trades, ether ETF net assets now stand at $21.43 billion, reinforcing its growing influence despite uneven flows.

The divergence underscores two narratives: BTC inflows are steady and institutionally anchored, while ETH continues to capture interest, though its streak is becoming harder to sustain as volatility in individual funds grows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。