The cryptocurrency-stock strategy is just the prologue; a deeper integration of capital and the evolution of governance models have only just begun.

1. Global Macro Variables Reshape Asset Pricing Paths: Inflation, the Dollar, and a New Round of Capital Games

In the second half of 2025, global financial markets entered a new era dominated by macro variables. Over the past decade, liquidity easing, global collaboration, and technological dividends formed the three pillars of traditional asset pricing. However, as we enter this cycle, these conditions are undergoing a systematic reversal, and the pricing logic of capital markets is being profoundly reshaped. Cryptocurrency assets, as a frontier reflection of global liquidity and risk appetite, are seeing their price trends, funding structures, and asset weights driven by new variables. The three core variables are the stickiness of structural inflation, the structural weakening of dollar credit, and the institutional differentiation of global capital flows.

First, inflation is no longer a short-term volatility issue that can be quickly suppressed; it is beginning to exhibit stronger "stickiness" characteristics. In developed economies represented by the United States, core inflation levels have consistently remained above 3%, far exceeding the Federal Reserve's target of 2%. The core reason for this phenomenon lies not in simple monetary expansion but in the continuous solidification and self-amplification of structural cost-push factors. Although energy prices have retreated to a relatively stable range, the surge in capital expenditures brought about by artificial intelligence and automation technologies, the price increase effects of upstream rare metals during the green energy transition, and rising labor costs due to manufacturing reshoring have all become sources of endogenous inflation. At the end of July, the Trump team confirmed that starting August 1, high tariffs on bulk industrial and technology products from countries such as China, Mexico, and Vietnam would be fully restored. This decision not only signals the continuation of geopolitical games but also indicates that the U.S. government views inflation as an acceptable "strategic cost." Against this backdrop, the costs of raw materials and intermediate products faced by U.S. companies will continue to rise, pushing consumer prices into a second round of increases, forming a "policy-driven cost inflation" pattern. This is not traditional overheating inflation but rather policy-driven embedded inflation, whose persistence and penetration into asset pricing will far exceed that of 2022.

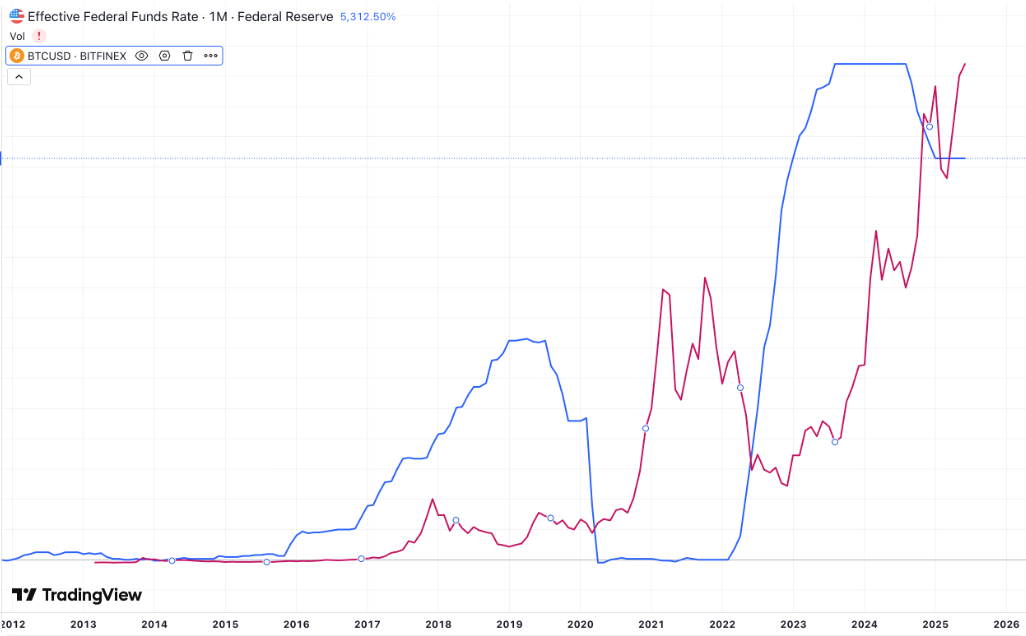

Secondly, against the backdrop of persistently high inflation, the Federal Reserve's interest rate policy is unlikely to loosen quickly, with the federal funds rate expected to remain above 5% at least until mid-2026. This creates a "suppressive pricing" effect on traditional stock and bond markets: the yield curve in the bond market is inverted, long-duration products are severely impacted, and the stock market faces a continuous increase in discount factors in valuation models. In contrast, cryptocurrency assets, especially Bitcoin and Ethereum, have valuation logic more based on a "growth expectation-scarcity-consensus anchor" overlapping model, which is not directly constrained by traditional interest rate tools. Instead, in a high-interest-rate environment, their scarcity and decentralized characteristics attract more funding attention, exhibiting "anti-monetary cycle" pricing behavior. This characteristic allows Bitcoin to gradually transform from a "high-volatility speculative asset" to an "emerging alternative value reserve asset."

More profoundly, the dollar's "anchoring" position globally is facing structural weakening. The U.S. fiscal deficit continues to expand, with the federal deficit surpassing $2.1 trillion in the second quarter of 2025, an 18% year-on-year increase, setting a historical high for the same period. Meanwhile, the U.S.'s status as a global settlement center is facing decentralization challenges. Countries like Saudi Arabia, the UAE, and India are actively promoting local currency settlement mechanisms, including cross-border payment systems such as the renminbi-dirham and rupee-dinar, which are beginning to replace some dollar settlements. Behind this trend is not only the cyclical damage caused by dollar policies to non-U.S. economies but also these countries' proactive attempts to decouple from a "single currency anchor." In this environment, digital assets have become a neutral, programmable, and de-sovereignized alternative value medium. For example, stablecoins like USDC and DAI are rapidly expanding in OTC trading and B2B cross-border payments in Asian and African markets, becoming a digital extension of the "emerging countries' underground dollar system," while Bitcoin has become a tool for capital flight and a safe haven against local currency depreciation. In countries like Argentina, Nigeria, and Turkey, the purchasing power premium for BTC has exceeded 15%, reflecting genuine capital hedging demand.

It is noteworthy that as the trend of de-dollarization accelerates, the internal credit system of the dollar itself is also showing signs of fatigue. Moody's and Fitch simultaneously downgraded the outlook for the U.S. long-term sovereign credit rating to "negative" in June 2025, primarily citing "structural irreversibility of long-term fiscal deficits" and "political polarization affecting budget execution." The systematic warning from rating agencies regarding U.S. Treasury bonds triggered increased volatility in the U.S. bond market, leading risk-averse funds to seek diversified reserve forms. The purchase volume of gold and Bitcoin ETFs rose rapidly during the same period, indicating a preference among institutional funds for reallocating to non-sovereign assets. This behavior reflects not only liquidity demand but also a "valuation escape" from the traditional asset system, as global capital seeks alternative anchors to rebalance the "systemic security" of their investment portfolios amid gradually overdrawn valuations of U.S. stocks and bonds.

Finally, the institutional differences in global capital flows are reconstructing the boundaries of asset markets. Within the traditional financial system, issues such as tightening regulation, valuation bottlenecks, and rising compliance costs are limiting the expansion space for institutional funds. In the cryptocurrency field, especially influenced by the relaxation of ETF access and auditing systems, cryptocurrency assets are gradually entering a stage of "compliance legitimacy." In the first half of 2025, several asset management companies received approval from the U.S. SEC to launch themed ETFs including SOL, ETH, and AI-related cryptocurrencies, allowing funds to indirectly enter the blockchain through financial channels, reshaping the funding distribution pattern among assets. Behind this phenomenon is the increasing dominant role of institutional frameworks in guiding funding behavior paths.

Therefore, we can see a clearer trend: changes in traditional macro variables—including the institutionalization of inflation, the dulling of dollar credit, the long-term high positioning of interest rates, and the policy-driven diversion of global capital—are collectively driving the onset of a new pricing era. In this era, value anchors, credit boundaries, and risk assessment mechanisms are being redefined. Cryptocurrency assets, particularly Bitcoin and Ethereum, are gradually transitioning from a liquidity bubble phase to a stage of institutional value acceptance, becoming direct beneficiaries under the reconstruction of the macro monetary system's margins. This also provides a foundation for understanding the "main logic" of asset price movements in the coming years. For investors, updating cognitive structures is far more critical than short-term market judgments; future asset allocation will no longer merely reflect risk preferences but will also be a reflection of the depth of understanding of institutional signals, monetary structures, and the global value system.

2. From MicroStrategy to Public Company Financial Reports: The Institutional Logic and Diffusion Trend of Cryptocurrency-Stock Strategies

In this cycle of 2025, the most structurally transformative force in the cryptocurrency market comes from the rise of the "cryptocurrency-stock strategy." From MicroStrategy's early attempts to use Bitcoin as a corporate financial reserve asset to an increasing number of public companies actively disclosing their cryptocurrency asset allocation details, this model is no longer an isolated financial decision but is gradually evolving into a corporate strategic behavior with institutional embeddedness. The cryptocurrency-stock strategy not only opens up a flow channel between capital markets and on-chain assets but also gives rise to new paradigms in corporate financial reports, equity pricing, financing structures, and even valuation logic. Its diffusion trend and capital effects have profoundly reshaped the funding structure and pricing models of cryptocurrency assets.

Historically, MicroStrategy's Bitcoin strategy was seen as a "high-stakes" high-volatility gamble, especially during the significant downturn of cryptocurrency assets between 2022 and 2023, when the company's stock price faced considerable skepticism. However, entering 2024, as Bitcoin prices broke historical highs, MicroStrategy successfully reconstructed its financing logic and valuation model through a "cryptocurrency-stock linkage" structured strategy. The core lies in the synergistic drive of a three-fold flywheel mechanism: the first layer is the "stock-cryptocurrency resonance" mechanism, where the BTC assets held by the company amplify the net value of cryptocurrency assets on the financial statements through rising coin prices, thereby boosting stock prices, which in turn significantly reduces the cost of subsequent financing (including equity issuance and bonds); the second layer is the "stock-bond synergy" mechanism, which introduces diverse funding through issuing convertible bonds and preferred stocks while leveraging the market premium effect of BTC to lower overall financing costs; the third layer is the "cryptocurrency-bond arbitrage" mechanism, which combines traditional fiat currency liability structures with cryptocurrency appreciation logic to form cross-cycle capital transfers in a time dimension. After this mechanism was successfully validated by MicroStrategy, it was quickly imitated and structurally transformed by the capital market.

Entering 2025, the cryptocurrency-stock strategy is no longer limited to experimental allocations by individual companies but has spread to a broader range of public companies as a financial structure that combines strategic and accounting advantages. According to incomplete statistics, as of the end of July, more than 35 public companies globally have explicitly included Bitcoin in their balance sheets, with 13 also allocating ETH, and another 5 experimenting with allocations of mainstream altcoins such as SOL, AVAX, and FET. The common characteristic of this structural allocation is that, on one hand, it constructs a financing closed loop through capital market mechanisms, and on the other hand, it enhances the book value and shareholder expectations of the company through cryptocurrency assets, thereby boosting valuation and equity expansion capabilities, forming positive feedback.

Supporting this diffusion trend is, first and foremost, changes in the institutional environment. The "GENIUS Act" and "CLARITY Act," which officially took effect in July 2025, provide clear compliance pathways for public companies to allocate cryptocurrency assets. Among them, the "mature blockchain system" certification mechanism established by the "CLARITY Act" directly incorporates core cryptocurrency assets like Bitcoin and Ethereum into commodity property regulation, stripping the SEC of its securities regulatory authority over them, thus creating legal legitimacy for companies to allocate these assets in their financial reports. This means that public companies no longer need to classify their cryptocurrency assets as "financial derivatives" under risk categories but can account for them as "digital commodities" under long-term assets or cash equivalents, and even participate in depreciation or impairment provisions in certain scenarios, thereby reducing accounting volatility risks. This shift allows cryptocurrency assets to be placed alongside traditional reserve assets like gold and foreign currency reserves, entering the mainstream financial reporting system.

Secondly, from the perspective of capital structure, the cryptocurrency-stock strategy creates unprecedented financing flexibility. In a high-interest-rate environment set by the Federal Reserve, traditional corporate financing costs remain high, making it particularly difficult for small and medium-sized growth companies to achieve leveraged expansion through low-cost debt. In contrast, companies allocating cryptocurrency assets can leverage the valuation premium brought about by rising stock prices to obtain higher price-to-sales and price-to-book ratios (PS and PB) in the capital market, and can also use cryptocurrency assets themselves as collateral to participate in on-chain lending, derivative hedging, cross-chain asset securitization, and other new financial operations, thus achieving a dual-track financing system: on-chain assets provide flexibility and yield, while off-chain capital markets provide scale and stability. This system is particularly suitable for Web3 native enterprises and fintech companies, allowing them to gain far greater capital structure freedom than traditional paths within a compliance framework.

Moreover, the cryptocurrency-stock strategy has also triggered a shift in investor behavior patterns. After cryptocurrency assets were widely allocated to the balance sheets of public companies, the market began to reprice the valuation models of these companies. Traditionally, corporate valuation is based on indicators such as profitability, cash flow expectations, and market share. However, when large-scale cryptocurrency holdings appear in corporate financial reports, their stock prices begin to exhibit a high correlation with cryptocurrency prices. For example, the stock prices of companies like MicroStrategy, Coinbase, and Hut8 have significantly outperformed the industry average during Bitcoin's upward cycles, demonstrating a strong "gold content" premium associated with cryptocurrency assets. At the same time, an increasing number of hedge funds and structured products have begun to view these "high cryptocurrency-weighted" stocks as alternatives to ETFs or proxy tools for cryptocurrency exposure, thereby increasing their allocation in traditional investment portfolios. This behavior structurally promotes the financialization of cryptocurrency assets, allowing Bitcoin and Ethereum to not only exist as assets themselves but also to gain indirect circulation channels and derivative pricing functions in the capital market.

Furthermore, from a regulatory strategic perspective, the diffusion of the cryptocurrency-stock strategy is also seen as an extension tool for the U.S. to maintain its "dollar hegemony" in the global financial order. Against the backdrop of a global surge in CBDC (Central Bank Digital Currency) pilot programs, the continuous expansion of cross-border renminbi settlements, and the European Central Bank's push for digital euro testing, the U.S. government has not actively launched a federal-level CBDC but has chosen to shape a decentralized dollar network through stablecoin policies and a "regulatable cryptocurrency market." This strategy requires a compliant, high-frequency market entry with substantial funding capabilities, and public companies, as bridges connecting on-chain assets and traditional finance, are precisely fulfilling this function. Therefore, the cryptocurrency-stock strategy can also be understood as an institutional support for the U.S. financial strategy of "non-sovereign digital currencies replacing dollar circulation." From this perspective, the allocation of cryptocurrency assets by public companies is not merely a simple accounting decision but a participatory path in a national-level financial architecture adjustment.

The more profound impact lies in the global diffusion trend of capital structures. As more and more U.S. public companies adopt the cryptocurrency-stock strategy, listed companies in the Asia-Pacific, Europe, and emerging markets are also beginning to follow suit, attempting to secure compliance space through regional regulatory frameworks. Countries like Singapore, the UAE, and Switzerland are actively revising securities laws, accounting standards, and tax mechanisms to open institutional channels for domestic companies to allocate cryptocurrency assets, forming a competitive landscape for the global capital market's acceptance of cryptocurrency assets. It is foreseeable that the institutionalization, standardization, and globalization of the cryptocurrency-stock strategy will be an important evolutionary direction for corporate financial strategies in the next three years and will serve as a key bridge for the deep integration of cryptocurrency assets and traditional finance.

In summary, from MicroStrategy's breakthrough to the strategic diffusion among multiple public companies, and then to the normative evolution at the institutional level, the cryptocurrency-stock strategy has become a key channel connecting on-chain value and traditional capital markets. It is not only an update of asset allocation logic but also a reconstruction of corporate financing structures, as well as a result of the bidirectional game between institutions and capital. In this process, cryptocurrency assets have gained broader market acceptance and institutional security boundaries, completing a structural leap from speculative assets to strategic assets. For the entire cryptocurrency industry, the rise of the cryptocurrency-stock strategy marks the start of a new cycle: cryptocurrency assets are no longer just on-chain experiments but have truly entered the core of global balance sheets.

3. Compliance Trends and Financial Structure Transformation: Accelerating the Institutionalization of Cryptocurrency Assets

In 2025, the global cryptocurrency market is at a historical juncture where the wave of institutionalization is accelerating. Over the past decade, the focus of the cryptocurrency industry has gradually shifted from "innovation speed overwhelming regulatory pace" to "compliance frameworks driving industry growth." As we enter the current cycle, the core role of regulation has evolved from "enforcer" to "institutional designer" and "market guide," reflecting a renewed understanding of the structural influence of national governance systems on cryptocurrency assets. With the approval of Bitcoin ETFs, the implementation of stablecoin legislation, the initiation of accounting standard reforms, and the reshaping of capital market risk and value assessment mechanisms for digital assets, the compliance trend is no longer an external pressure on industry development but has become an endogenous driving force for financial structure transformation. Cryptocurrency assets are gradually embedding into the institutional network of the mainstream financial system, completing the transition from "gray financial innovation" to "compliant financial components."

The core of the institutionalization trend is first reflected in the clarification and gradual relaxation of regulatory frameworks. From the end of 2024 to mid-2025, the U.S. successively passed the "CLARITY Act," "GENIUS Act," and "FIT for the 21st Century Act," providing unprecedented clarity on commodity property recognition, token issuance exemption conditions, stablecoin custody requirements, KYC/AML details, and the applicable boundaries of accounting standards. Among these, the most structurally impactful is the classification system for "commodity property," which views foundational blockchain assets like Bitcoin and Ethereum as tradable commodities, explicitly excluding them from securities law regulation. This classification not only provides a legal basis for ETFs and spot markets but also creates a certain compliance pathway for institutions such as companies, funds, and banks to incorporate cryptocurrency assets. The establishment of this "legal label" is the first step toward institutionalization and lays the groundwork for subsequent tax treatment, custody standards, and financial product structure design.

At the same time, major global financial centers are competing to promote localized institutional reforms, forming a competitive landscape where "regulatory lowlands" transform into "regulatory highlands." The Monetary Authority of Singapore (MAS) and the Hong Kong Monetary Authority have both introduced multi-tiered licensing systems, incorporating exchanges, custodians, brokers, market makers, and asset managers into differentiated regulatory frameworks, establishing clear thresholds for institutional entry. Abu Dhabi, Switzerland, and the UK are also piloting on-chain securities, digital bonds, and combinable financial products at the capital market level, making cryptocurrency assets not only exist as an asset class but also gradually evolve into fundamental elements of financial infrastructure. This "policy experimentation" mechanism safeguards innovation vitality while promoting the digital transformation of the global financial governance system, providing new pathways for institutional upgrades and collaborative development in traditional finance.

Under the impetus of institutional changes, the internal logic of financial structures is also undergoing profound changes. First is the reconstruction of asset classes, with the proportion of cryptocurrency assets in large asset management institutions' allocation strategies increasing year by year, rising from less than 0.3% of global institutional allocations in 2022 to over 1.2% in 2025, with expectations to exceed 3% in 2026. This proportion may seem low, but the marginal flow it represents within a multi-trillion-dollar asset pool is sufficient to rewrite the liquidity and stability structure of the entire cryptocurrency market. Institutions like BlackRock, Fidelity, and Blackstone have not only launched BTC and ETH-related ETFs but have also incorporated cryptocurrency assets into their core asset allocation baskets through proprietary funds, fund of funds (FOF) products, and structured notes, gradually establishing their roles as risk hedging tools and growth engines.

Secondly, there is the standardization and diversification of financial products. In the past, the main trading methods for cryptocurrency assets were limited to spot and perpetual contracts, but under the push for compliance, the market has rapidly derived various product forms embedded in traditional financial structures. For example, cryptocurrency ETFs with volatility protection, bond-type products linked to stablecoin interest rates, ESG asset indices driven by on-chain data, and on-chain securitized funds with real-time settlement functions. These innovations not only enhance the risk management capabilities of cryptocurrency assets but also lower the participation threshold for institutions through standardized packaging, allowing traditional funds to effectively participate in on-chain markets through compliant channels.

The third layer of financial structure transformation is reflected in the clearing and custody models. Starting in 2025, the U.S. SEC and CFTC jointly recognized three "compliant on-chain custody" institutions, marking the formal establishment of a bridge between asset ownership, custody responsibilities, and legal accounting entities for on-chain assets. Compared to previous models based on centralized exchange wallets or cold wallet custody, compliant chain custody institutions achieve asset layered ownership, transaction permission isolation, and embedded on-chain risk control rules through verifiable on-chain technology, providing institutional investors with risk control capabilities close to those of traditional trust banks. This change in underlying custody structure is a key infrastructure building block for institutionalization, determining whether the entire on-chain finance can truly support complex structured operations such as cross-border settlement, collateralized lending, and contract delivery.

More importantly, the institutionalization of cryptocurrency assets is not only a process of regulation adapting to the market but also an attempt by sovereign credit systems to incorporate digital assets into macro-financial governance structures. As the daily trading volume of stablecoins exceeds $3 trillion and begins to assume actual payment and settlement functions in some emerging markets, central banks' attitudes toward cryptocurrency assets are becoming increasingly complex. On one hand, central banks are promoting CBDC development to strengthen their national currency sovereignty; on the other hand, they are adopting an "open management" approach with "neutral custody + strong KYC" for certain compliant stablecoins (such as USDC and PYUSD), effectively allowing them to undertake international settlement and payment clearing functions within a certain regulatory scope. This shift in attitude indicates that stablecoins are no longer adversaries of central banks but rather one of the institutional containers in the process of reconstructing the international monetary system.

This structural change ultimately reflects on the "institutional boundaries" of cryptocurrency assets. The market in 2025 is no longer segmented by a discontinuous logic of "crypto circle - chain circle - outside the circle," but is forming three continuous levels: "on-chain assets - compliant assets - financial assets." There are channels and mapping mechanisms between each level, which also means that each type of asset can enter the mainstream financial market through some institutional pathway. Bitcoin has transformed from an on-chain native asset to an ETF underlying asset, Ethereum has evolved from a smart contract platform asset to a token for general computing financial protocols, and even some governance tokens of DeFi protocols have entered fund of funds (FOF) pools as risk exposure tools after structured packaging. This flexible evolution of institutional boundaries allows the definition of "financial assets" to genuinely possess the potential for cross-chain, cross-national, and cross-institutional systems for the first time.

From a more macro perspective, the essence of the institutionalization of cryptocurrency assets is the adaptive response and evolution of the global financial structure under the digital wave. Unlike the "Bretton Woods system" and "petrodollar system" of the 20th century, the financial structure of the 21st century is being reconstructed in a more distributed, modular, and transparent manner, redefining the foundational logic of resource flow and capital pricing. Cryptocurrency assets, as a key variable in this structural evolution, are no longer outliers but are manageable, auditable, and tax-compliant digital resources. This process of institutionalization is not a sudden change in a specific policy but a systematic evolution of the collaborative interaction among regulation, market, enterprises, and technology.

Therefore, it is foreseeable that the process of institutionalization of cryptocurrency assets will further deepen, and in the next three years, three coexisting models will emerge in major global economies: one model is the "market openness + prudent regulation" model led by the U.S., with ETFs, stablecoins, and DAO governance as the institutional axis; another model is represented by China, Japan, and South Korea, characterized by "restricted access + policy guidance," emphasizing central bank control and licensing mechanisms; and the third model is represented by Singapore, the UAE, and Switzerland, functioning as "financial intermediary experimental zones," providing institutional mediation between global capital and on-chain assets. The future of cryptocurrency assets is no longer a struggle of technology against institutions but a reorganization and absorption of technology by institutions.

4. In Conclusion: From Bitcoin's Decade to Cryptocurrency-Stock Linkage, Welcoming a New Landscape for Cryptocurrency

In July 2025, Ethereum celebrated its tenth anniversary, and the cryptocurrency market has transitioned from early experimentation to institutional recognition. The widespread initiation of the cryptocurrency-stock strategy symbolizes the deep integration of traditional finance and cryptocurrency assets.

This cycle is not merely a market launch but a reconstruction of structure and logic: from macro monetary policy to corporate assets, from cryptocurrency infrastructure to financial governance models, cryptocurrency assets have truly entered the realm of institutional asset allocation for the first time.

We believe that in the next 2-3 years, the cryptocurrency market will evolve into a three-pronged structure of "on-chain native yield + compliant financial interfaces + stablecoin-driven" dynamics. The cryptocurrency-stock strategy is just the prologue; a deeper integration of capital and the evolution of governance models have only just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。