Coinbase may become the biggest winner.

Written by: 1912212.eth, Foresight News

On July 29, the U.S. Securities and Exchange Commission (SEC) announced the approval of a physical creation and redemption mechanism for cryptocurrency exchange-traded products (ETPs). Previously, cryptocurrency ETPs primarily used a cash creation and redemption model. This change significantly reduces trading costs and improves efficiency. In addition, the SEC also announced the listing standards for spot ETFs, with the new standards expected to take effect in September or October 2025, aimed at simplifying the ETF listing process and opening the doors of mainstream finance to more cryptocurrency assets.

Must be listed on major exchanges like Coinbase for at least 6 months

The SEC's new listing standards primarily focus on the qualification requirements and operational mechanisms for cryptocurrency ETPs. First, in-kind creations and redemptions are officially allowed, meaning authorized participants can exchange ETP shares for actual cryptocurrency assets instead of cash. This model can reduce tax burdens, decrease trading friction, and enhance ETF liquidity. The SEC chairman emphasized in a statement that this decision aims to provide cryptocurrency ETPs with treatment similar to traditional ETFs while maintaining market integrity. Previously, cryptocurrency ETPs were forced to use cash models, leading to higher operational costs and potential manipulation risks.

Additionally, the SEC has established "universal listing standards," requiring that cryptocurrency assets must be listed on major exchanges like Coinbase for at least 6 months. This regulation aims to ensure that assets have sufficient liquidity and market depth to avoid manipulation. According to documents cited by Phyrex, tokens without futures or newer altcoins like Meme coins (e.g., Bonk and Trump coins) will need to go through the 40 Act for ETF conversion.

Which projects may get ETF approval

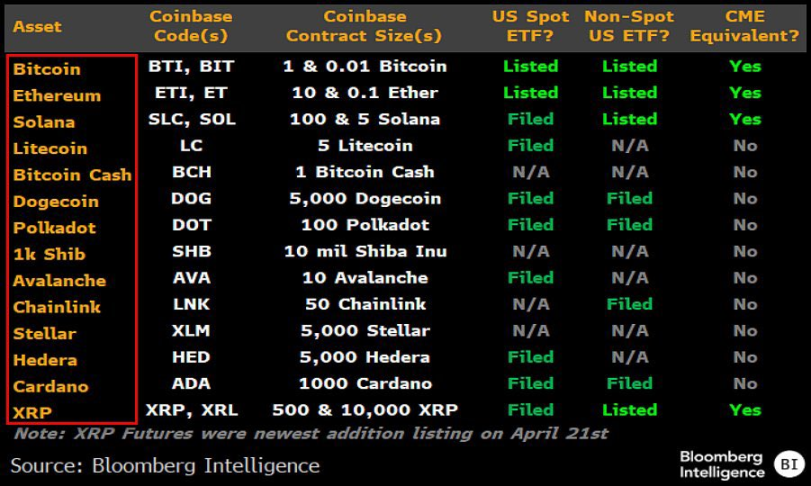

Spot ETFs for Bitcoin and Ethereum have been approved for 2024 and 2025, respectively, and these products will continue to benefit from the optimization of the physical mechanism.

According to SoSoValue data, as of July 31, 2025, the total net inflow for U.S. Bitcoin spot ETFs has reached $55.11 billion. The U.S. Ethereum spot ETF has achieved a total net inflow of $9.62 billion, with rapid growth after breaking out of a sluggish period. The approval of spot ETFs undoubtedly supports the price increase of these coins.

The new standards open the door for altcoins. Solana (SOL) and Ripple (XRP) are seen as the first beneficiaries. Cboe's proposal explicitly mentions that SOL and XRP ETPs are expected to launch in the fourth quarter of 2025, with active futures markets. XRP futures contracts officially launched on Coinbase on April 22 this year, and XRP's cross-border payment applications have also attracted institutional interest. Analysts predict a high probability of approval for these ETFs, potentially achieving this by the end of 2025.

Other potential projects include Chainlink, Polkadot, and Cardano, which meet the listing duration requirements and have emerging futures contracts supporting them. However, not all projects will pass: DOGE may be excluded due to a lack of futures history unless its market maturity improves. Overall, the new standards are expected to approve 10-15 new ETFs, covering the top 20 cryptocurrency assets by market capitalization, driving the industry from speculation to investment.

Coinbase may become the biggest beneficiary

On May 9, Coinbase's subsidiary Coinbase Derivatives launched the first CFTC-regulated Bitcoin and Ethereum leveraged futures trading service in the U.S., available 24/7 for retail and institutional users. This marks the first time the U.S. derivatives market has achieved round-the-clock trading, allowing users to hedge risks and seize market opportunities at any time. Coinbase also plans to introduce perpetual contracts, offering more compliant derivatives in the future.

As the largest cryptocurrency exchange in the U.S., Coinbase will significantly benefit from the SEC's new standards. First, the standards directly reference Coinbase as a qualification benchmark: assets traded on the platform for more than 6 months are eligible to apply for ETPs, reinforcing Coinbase's regulatory influence. This means that assets listed on Coinbase are more likely to be converted into ETF products, attracting more issuers to collaborate with them. For example, Coinbase has served as the custodian for several Bitcoin and Ethereum ETFs, with its custody business revenue growing by 30% in the first quarter of 2025.

Secondly, the new standards will increase Coinbase's trading volume and revenue. The physical redemption mechanism requires ETF issuers to hold actual cryptocurrency assets, which will drive institutions to conduct large trades through Coinbase. Bloomberg analysts estimate this could bring Coinbase an additional $1 billion in fee revenue annually. Furthermore, as more ETFs are approved, retail investors will turn to Coinbase to purchase underlying assets, creating a positive feedback loop.

On February 21 of this year, the SEC dropped its lawsuit against Coinbase without any fines. Policy-wise, there are no major obstacles for Coinbase. The new standards enhance Coinbase's legitimacy, shifting it from a regulatory adversary to a partner.

CFTC's authority over spot ETF approvals may be prioritized

The U.S. Commodity Futures Trading Commission (CFTC), as a commodity regulatory agency, is playing an increasingly important role in the field of spot ETFs. Cryptocurrency assets like Bitcoin are considered commodities, so the regulation of spot ETFs involves coordination between the SEC and CFTC. In 2025, a White House policy report called for both to strengthen cooperation, including establishing a "safe harbor" mechanism to avoid regulatory overlap. The leadership vacuum at the CFTC (with the chairman position vacant) has led to delays in decision-making, but this also provides opportunities for the cryptocurrency industry: the CFTC tends to favor a more lenient commodity framework, which may accelerate the innovation of spot ETF derivatives. If the CFTC further classifies more cryptocurrencies as commodities, the approval of spot ETFs will be faster, reducing the SEC's burden of securities review.

Currently, regulatory agencies seem to have found a balance. Twitter KOL qianbafrank commented that the SEC's new listing standards mean "the SEC's approval authority for cryptocurrency spot ETFs has been prioritized to the CFTC (Commodity and Futures Commission), as the CFTC is the main decision-making regulatory body for which assets can have futures contracts."

However, the CFTC's influence also brings challenges: if incidents of manipulation in the cryptocurrency futures market increase, the CFTC may strengthen scrutiny, indirectly dragging down spot ETFs. Reports indicate that in 2025, the CFTC has handled multiple cryptocurrency fraud cases, which may require ETF issuers to comply with stricter reporting standards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。