The mainstream chains of the future must serve real-world assets and users, and must also meet the requirements of regulatory agencies.

Written by: Bensha, CryptoMiao, Unai Yang, Zhao Qirui

Currently, there are two major trends in the cryptocurrency industry. First, the industry is gradually entering a period of regulatory convergence, reshaping the original pattern of "technology first, regulation lagging behind"; second, the integration of on-chain and traditional financial industries is becoming increasingly close. Whether it is the issuance of RWA (real-world assets) or the on-chain processing of stablecoins and financial derivatives, an irreversible trend has already formed.

In this context, "compliant public chains" have begun to become an important topic, and "the compliance capability of chains" is becoming a core factor for traditional institutions to assess their access value.

This article focuses on three questions: Why should public chains be compliant, what constitutes compliance, and how to achieve compliance? It also analyzes two highly compliant public chains: Base and Sui, and examines the potential Robinhood Chain that may be launched in the future, to provide readers with references for public chain selection, business integration, and business strategy judgment.

I. Reasons for Public Chain Compliance

As mentioned at the beginning, the necessity of public chain compliance comes from two aspects: first, regulatory requirements; second, user demands. So let's ask a few more questions: Why do regulators require public chains to be compliant? Who's interests are harmed by non-compliant public chains? Why do users want to use compliant public chains? What value can compliant public chains bring?

(1) Why do regulators require public chains to be compliant?

Regulatory agencies in various jurisdictions around the world have several top priorities, which are to prevent financial crimes (such as money laundering, fraud, and terrorist financing), maintain financial market stability, and protect consumers. These involve fundamental issues of trust and security in financial markets, and for the United States, they are also related to national security and its position of global hegemony.

Illegal funds can "cleanse" themselves on-chain and then flow into legitimate areas in a concealed manner; cryptocurrency-related fraud and frequent hacking attacks often lead to the evaporation of investors' wealth, causing market panic; if large cryptocurrency companies or platforms are hacked due to on-chain vulnerabilities or fined for violating relevant laws, they not only suffer massive financial losses but also directly affect the liquidity of the financial system.

In May 2022, the stablecoin UST on the Terra blockchain, which focuses on algorithmic stablecoins, was heavily sold off, leading to a de-pegging, and the governance token LUNA experienced a catastrophic price drop, with a market value evaporating by $40 billion, affecting millions of users. Following this, the famous crypto hedge fund Three Arrows Capital, which held a large amount of LUNA, saw its assets shrink significantly and ultimately declared bankruptcy, which in turn affected several trading platforms, triggering a systemic crisis in the industry. It is conceivable that if such an event occurs again in the future, it will not be limited to a scale of tens of billions of dollars; its harm could even be comparable to the financial crisis of 2008.

As the crypto world becomes increasingly interconnected with the traditional financial system, regulatory agencies must consider and mitigate the potential negative impacts. Especially as the crypto market continues to expand and integrate into mainstream financial markets, any losses due to regulatory missteps in the future could be catastrophic.

(2) Why do users want to use compliant public chains?

Users in the crypto market can be divided into ordinary retail investors and institutional users. Here, we mainly discuss the needs of institutional users. Institutional users refer to those who participate in the crypto market not as individuals, typically including financial institutions, corporate users, government and state-owned capital-backed institutions, and Web3 native institutions.

As the infrastructure of the entire crypto industry, the only viable path for institutional users to deploy on-chain businesses is through public chains: BlackRock launched the first tokenized fund BUIDL on Ethereum, VISA integrated USDC settlement service for merchant payments on Solana and Ethereum, Google provides RPC nodes for Solana, Ethereum, etc., and USDC and USDT are issued on multiple public chains. The first question that all Web3 startup teams must consider is which public chain ecosystem to join…

Just as banks would not choose to deploy on the dark web, institutions will not deploy their businesses on a chain that exists in a "legal gray area." Therefore, the premise of all this is compliance, credibility, and regulatory oversight; otherwise, they will never be able to "truly go on-chain," as regulatory agencies can easily crush years of efforts by a team with a single lawsuit.

In addition to the inevitable business choice and regulatory reasons, for institutional users, compliant public chains are nurturing a new round of growth "tickets."

If a chain can meet the compliance needs of institutions, it can undertake new businesses such as RWA, central bank digital currencies, and corporate financial applications, entering the multi-trillion-dollar asset market, which will directly bring in massive funds from traditional capital such as VCs, LPs, and banks, enlarging the collective pie. At the same time, modules such as "selective privacy," "on-chain identity," and "on-chain credit" will become new infrastructure layers as regulations become more detailed, and the Depin, SocialFi, and GameFi sectors above them will have a more solid development foundation. These areas, which have fluctuated without significant progress in the past, may break through in the future, achieving true mass adoption like stablecoins.

(3) What constitutes a truly compliant public chain?

The public chain sector has long lacked clear and unified regulatory standards. Regulatory agencies often judge projects based on the Securities Act and the Howey Test, which are not free from subjective factors from regulators. During the Biden administration, Ethereum, EOS, Ton, and others faced severe regulation, and even the compliance benchmark Coinbase received multiple subpoenas from the SEC.

With the passage of the three major crypto bills in the U.S. and the SEC's positive statements, "compliance" in the crypto industry is no longer a vague requirement of "feeling the way across the river." The same applies to public chains.

Although there is currently no unified standard specifically targeting "public chain" compliance in U.S. crypto regulation, multiple laws and bills are gradually forming a clearer regulatory framework. However, for public chains, if they wish for the behaviors within their ecosystems to be legal and compliant, they must possess the capability to meet these requirements. The strong compliance public chains mentioned in this article refer to those that proactively meet regulatory requirements from a technical perspective, "catering to their preferences and seriously transforming."

The regulatory requirements mainly come from the following: including the Bank Secrecy Act (BSA), the DAAMLA Digital Asset Anti-Money Laundering Act, the GENIUS Act, the CLARITY Act, cross-enforcement by the CFTC and SEC, and FinCEN guidance.

To meet these requirements, they must be embedded in the architecture at a technical level. For example, identity verification (KYC/KYB), transaction auditability, compliance controls in smart contracts. At the same time, they must allow on-chain applications to undergo testing and review in specific environments and permit authorized regulatory agencies to access necessary on-chain data, among other things.

Although the examiners have not specified standards, the answers are almost laid out on the table.

II. Current Status and Implementation Path of Strong Compliance Public Chains

Currently, representative projects that align with our definition of "strong compliance public chains" include Base, Sui, and the future Robinhood Chain. Next, we will look at the steps these three have taken towards compliance and how they have achieved it.

(1) Base

Coinbase, as a compliance representative platform in the U.S. market, launched the Base chain to establish a "regulatory-friendly" on-chain ecosystem, providing a compliant, secure, and controllable web3 environment for institutions and mainstream users. This complements its exchange business and is core to its expansion into a diverse compliance business landscape. In the future, its Web3 business in the three core scenarios of finance, identity, and asset issuance will all be conducted through the Base chain. Because of this, compliance has been at the core of Base's design from the beginning.

1. Technical Architecture

Since compliance is the core, various functions required by regulatory agencies must be considered, which requires the architecture of the public chain to have flexibility. Base's solution is to leverage existing technologies to achieve this.

Base is built on top of Optimism's OP Stack, a modular and pluggable blockchain development framework that provides diverse modules and components for each public chain built on the OP Stack.

Therefore, you can think of Base as a highway foundation that can flexibly equip "cameras, speed limiters, and identity recognition systems." For example, if certain compliance requirements need to be met, a compliance module can be customized and written into the execution layer.

Coinbase acts as the "toll booth + identity inspector," becoming a key bridge between off-chain compliance services and the on-chain world. Before entering the Base chain, users must first complete identity verification (KYC) and anti-money laundering review (AML) on the Coinbase platform. This compliance data will not be directly exposed on-chain but will be transmitted to the on-chain through a controlled interface. At that point, the user's wallet address (Ethereum address) will receive a label indicating that the user has passed the review, making all of the user's on-chain activities traceable, and the Base on-chain address will no longer have anonymity.

This off-chain identity and on-chain activity coordination effectively builds a "legal highway system." BASE itself is the infrastructure for running various Web3 applications—you can run DeFi protocols, deploy NFT markets, launch blockchain games, etc. Coinbase ensures that every "vehicle" (user or funds) entering this highway has undergone legal identity checks, preventing compliance risks such as money laundering and fraud.

By reusing a mature modular framework, Base lowers the technical threshold for implementing compliance functions and reserves space for adjustments to meet more complex regulatory requirements in the future.

2. Functional Design

Having solved the major issue of KYC/AML, there are other regulatory requirements to meet. Coinbase's approach is to develop corresponding compliance functions.

Smart contracts are still smart contracts, but Base has designed compliant channels that support the issuance of RWA and security tokens. Its smart contracts can support the entire process of asset creation, holding, transfer, and redemption supervision. In the future, it will also meet the directive response functions for fund freezing, destruction, and other instructions proposed in the GENIUS Act and other regulations. The on-chain deposit token JPMD, piloted by JPMorgan, has been launched on BASE, validating its institutional-level compliance capabilities.

Auditing remains auditing, but Base has a longer audit period and plans to provide standardized APIs or dedicated nodes for regulatory agencies to facilitate real-time access to on-chain data. These interfaces will work with regulatory technology (RegTech) tools like Chainalysis to achieve real-time risk control, abnormal transaction identification, and address tracking.

BASE also introduces blacklist and whitelist functionalities. The blacklist can automatically block sanctioned addresses, while the whitelist mechanism ensures that sensitive assets circulate only between addresses that have passed compliance checks. In the future, privacy-enhancing technologies (such as privacy pools + zero-knowledge proofs) may also be introduced to protect user privacy while ensuring compliance.

3. Acquisition Supplements

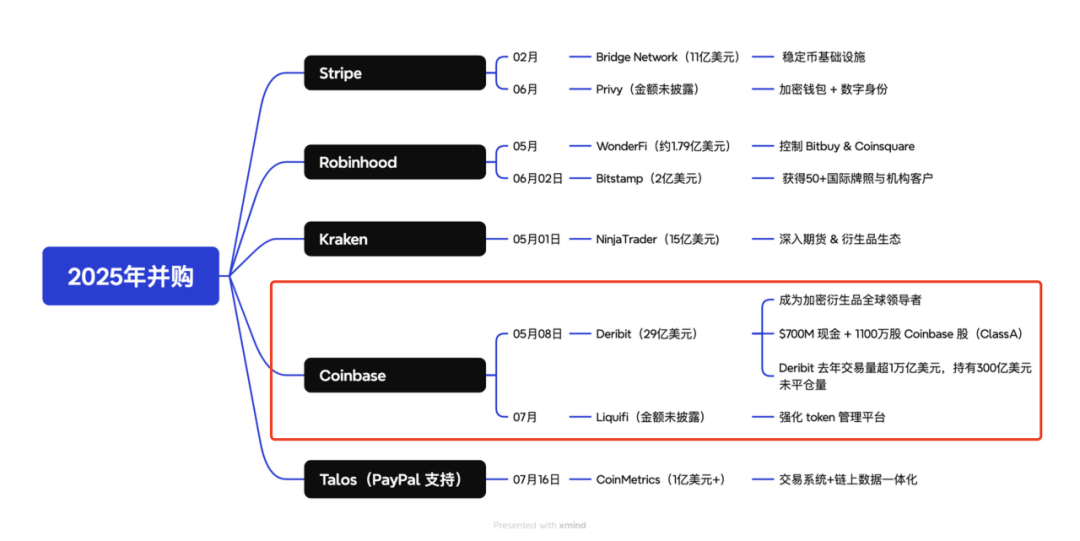

In addition, Coinbase has acquired several key teams and projects in recent years to strengthen BASE's on-chain compliance capabilities and data infrastructure:

Liquifi: Supports compliant asset issuance, completing the compliant issuance path for on-chain securities and stablecoins;

Spindl: Enhances user behavior tracking and advertising attribution capabilities;

Deribit equity stake: Controls key data in the derivatives market, strengthening risk monitoring.

Acquisition events in fintech companies over the past 25 years

This series of integrations covers the complete stack from enterprise services to protocol layers and data interfaces, providing BASE with a standardized, replicable compliance L2 construction template.

In short, BASE has embedded "compliance" into its system design rather than relying on external governance to make up for it afterward. From architectural choices to functional development to acquisition supplements, the entire chain meets the most basic compliance requirements in sequence. This design philosophy positions BASE as one of the public chains most aligned with mainstream compliance requirements in the future Web3 world.

(2) Sui

Sui, a public chain project launched in May 2023, has quickly emerged in the blockchain field due to its unique technical architecture and user-friendly design. Compared to many other public chain projects, Sui has demonstrated remarkable robustness in its nearly two years since launch, especially in terms of regulatory compliance and network security. As of now, Sui has not faced any lawsuits or accusations, highlighting the rigorous attitude of its development team towards technology and compliance, and earning trust and reputation in the competitive blockchain market.

At the same time, Sui's recent performance further proves its market potential. With the rapid development of the Sui chain ecosystem and the continued increase in community enthusiasm, Sui's market capitalization has soared to over $13 billion, ranking among the top 13 in the global virtual currency market capitalization leaderboard. This market cap not only reflects the market's high recognition of Sui's technological innovation and application prospects but also marks its important position in the competition within the public chain sector.

So, how has Sui managed to maintain compliance while rapidly growing and establishing a foothold in the fierce competition of public chains?

1. Language Advantage

While both meet compliance requirements and possess flexibility, Sui's flexibility advantage is "innate," unlike Base, which chose existing technical architectures.

Sui uses the Move programming language, emphasizing high transaction speed and low latency, prioritizing fast and secure transaction execution, especially suitable for real-time applications like gaming and finance. Compared to the more widely adopted EVM languages, Move has more advanced features that are better suited for current blockchain development.

The modular design of the Move language allows developers to organize code into reusable modules, sharing resources and functionalities, facilitating upgrades and combinations, giving it an advantage in developer experience.

Recently, Ethereum (ETH) founder Vitalik also suggested replacing the Ethereum Virtual Machine with RISC-V. RISC-V shares many similarities with the Move language, the most significant being modularity and scalability. Both RISC-V and Move emphasize modularity and scalability in their designs, supporting user-defined instruction extensions, making them adaptable to various application scenarios for use across different blockchain applications. This further highlights the technical superiority of the Move language.

This lays a solid foundation for Sui's compliance path.

2. Empowering Developers / Partnerships / Third-Party Integration

The Sui blockchain has taken several measures to ensure compliance with regulatory requirements.

First, compliance tools are made into "modules" for developers to call as needed. As a decentralized blockchain, Sui does not directly enforce AML or KYC, but it provides the necessary tools and infrastructure for projects built on the platform to meet regulatory standards. Through various tools, it helps developers self-regulate and ensure compliance, such as geographic restrictions. For example, Sui has partnered with Netki to launch DeFi Sentinel, a compliance oracle that provides developers with automated compliance tools, including real-time KYC/AML (Know Your Customer/Anti-Money Laundering), wallet screening, and financial transaction monitoring. These tools can help dApps verify users' locations, ensuring that only users in compliant regions can access services. For instance, the Doubleup gambling project is only open to users in compliant gambling regions.

Of course, in the face of potentially illegal projects or individuals that may slip through the cracks, Sui's terms of service explicitly state legal cooperation obligations: funds can be frozen or access restricted as required by law, providing a legal interface for compliance review. If $1.46 billion is stolen from Bybit on the Sui chain, the terms may allow for the freezing of the stolen funds.

Secondly, seeking support from partners. The decentralized nature of Sui makes it difficult to implement AML/KYC directly like traditional financial institutions, but by providing transparent transaction records and partner tools, it supports projects in meeting regulatory needs. For example, the Sui blockchain collaborates with Ant Digital to utilize its ZAN platform to provide KYC and AML tools to support the compliant tokenization of real-world assets (RWA). ZAN operates as an RPC node for Sui, integrating with Sui's infrastructure. This means ZAN's tools can seamlessly communicate with Sui's blockchain network, enhancing scalability and security.

Finally, introducing third parties. The Sui chain collaborates with third parties like Chainalysis through its community-driven Sui Guardian program to enhance compliance. Sui Guardian tracks scams and phishing sites, while Chainalysis's analytical tools can monitor and analyze on-chain transactions, identifying addresses or patterns associated with known illegal activities. By analyzing transaction patterns, Chainalysis can identify potential phishing attack victims, helping exchanges and users take preventive measures. This helps Sui comply with global AML and KYC regulatory requirements, such as the EU's Fifth Anti-Money Laundering Directive (5AMLD) and the U.S. Bank Secrecy Act (BSA).

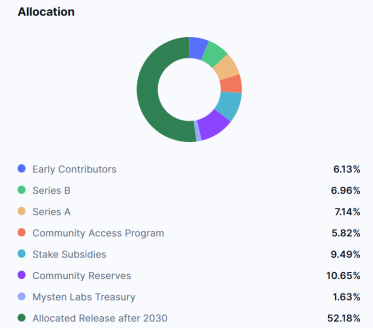

These three points can also be seen from community incentives. The distribution model of Sui tokens has three uses to support the construction of the Sui ecosystem community: Community Access Program: 5.82%; Stake Subsidies: 9.49%; Community Reserves: 10.65%. The proportion of tokens used to support the construction of the Sui ecosystem community is 26%, reaching 54.37% of the announced release plan (47.82% to be released by 2030), accounting for more than half of the total circulating tokens. The Community Access Program is used for project incentives to support on-chain projects. The Community Reserves, at 10.65%, focus more on the long-term construction of the Sui ecosystem, such as funding the development of DApps in the Move language, supporting community governance, or reserving funds for future expansion to guide compliance ecosystem construction.

In this way, Sui meets compliance requirements while achieving risk isolation.

In the blockchain ecosystem, public chains typically serve as the foundational layer, allowing users to interact with various DApps through smart contracts written by project parties, with stakeholders primarily being the project parties and users. Currently, most legal disputes and judicial cases involve project parties and their participants; unless a public chain has significant vulnerabilities that directly lead to user losses, public chains are rarely named as defendants.

For example, Sui recently announced a partnership with xMoney and xPortal to launch a digital Mastercard supporting SUI tokens in Europe. Sui itself, as a technology platform, is primarily responsible for building the infrastructure and asset ecosystem, while the payment side is handled by the licensed institution xMoney, and the application side user experience is managed by xPortal.

3. Data Compliance

Sui is one of the few public chains that has explicitly built GDPR (General Data Protection Regulation) compliance capabilities. Through three native technical tools, it has established a compliance system aimed at highly regulated markets like the EU:

Through this mechanism, Sui users can use Web2 login methods to access Web3 applications without exposing private keys or leaking identities—upgrading both experience and compliance simultaneously.

We can see that Sui's path also internalizes compliance as part of its architecture and product design, but compared to Base, Sui's solution finds a balance between compliance and decentralization.

From the outset, compliance has been integrated into the top-level architecture, not only meeting global regulatory requirements but also building a vibrant and robust ecosystem through community incentives, key project construction, and offline activities. Its specific measures for user compliance, partner support, and project levels, such as collaborating with third parties to provide KYC/AML tools and adopting innovative technologies to support GDPR compliance, demonstrate its foresight and execution in addressing regulatory challenges.

The layout of public chains should start from an overall perspective, adapting to future development directions from the underlying logic. As a public chain project, it should not plan development from a single project perspective but consider diverse application scenarios and development trends, making early arrangements. Governing a chain is like governing a country; only with a complete infrastructure on-chain, leading the development of high-investment projects, and reasonably distributing incentive measures can it attract more developers and users, gradually developing a rich on-chain ecosystem.

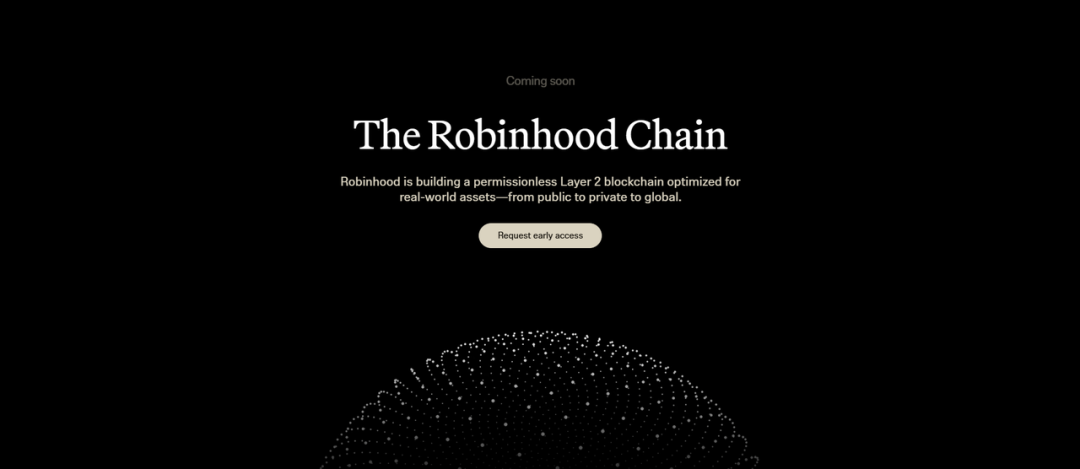

(3) Robinhood Chain

Robinhood, the internet brokerage firm, has pioneered the retail trading market and has actively followed up on crypto by listing multiple cryptocurrencies and developing its own wallet application. At the end of June, it announced the provision of tokenized U.S. stocks, gaining significant attention. However, Robinhood has also faced difficult situations: in 2020, it was fined up to $70 million due to "payment for order flow" issues—making it one of the largest fines ever imposed on a brokerage in U.S. history, which reinforced its awareness of embedding compliance frameworks deeply into product design. Thus, the essence of Robinhood today is that of a compliance-first fintech company, with its business model built on the foundation of "compliance innovation."

1. From Arbitrum to Robinhood Chain

The tokenized stocks launched by Robinhood at the end of June are issued on the Layer 2 public chain Arbitrum, which has lower gas fees and higher throughput compared to the Ethereum mainnet. However, Arbitrum itself does not meet our definition of a strongly compliant public chain, so this choice is more of a strategic expedient. Consequently, its tokenized U.S. stocks are only available to European users, rather than its home market—the United States.

As Web3 enters the stage of industry integration, Robinhood's next step is to launch its own compliant public chain, Robinhood Chain, as a platform for asset issuance, on-chain settlement, and data custody. The aim is to fully bring traditional financial assets (such as stocks and ETFs) on-chain, enabling 24/7 trading, decentralized circulation, and deep integration with DeFi infrastructure. This will be a key leap for Robinhood from a "Web2.5 compliant exchange" to "Web3 compliant financial infrastructure." Such an important strategic step will prioritize compliance in the U.S. market, and thus one of the key focuses of Robinhood Chain's development is the "compliance module."

2. Three Steps to Compliance

It must be noted that Robinhood has not yet disclosed the technical roadmap for its public chain. However, based on its official "Tokenization Memo" (hereinafter referred to as Memo) and the compliance letters submitted to the SEC, we speculate that the future Robinhood Chain is most likely to adopt the following compliance technologies:

First is "on-chain + off-chain identity binding." Like Base, Robinhood chooses "off-chain KYC + on-chain authorized address binding," which is explicitly mentioned in its compliance letter to the SEC. This means that all actions associated with the on-chain address bound to the Robinhood exchange will become traceable, while addresses not bound to off-chain accounts will be prohibited from transferring tokens.

Secondly, smart contracts. This step is also similar to Base. In addition to KYC, the Memo mentions mandatory trading management measures, rules from different jurisdictions, etc. The rules mentioned in the Memo can actually be transformed into smart contract logic judgments, which on a technical level consist of a series of if/else statements that can be added to transfer or mint functions to take effect. This means that the contract itself will enhance on-chain execution capabilities such as "regional restrictions," blacklists, and position limits, without relying on manual review.

Finally, compliance API support. In its letter to the U.S. SEC, Robinhood mentioned that in the future, its tokenized stocks, bonds, and other assets must be custodied by licensed brokers (such as Robinhood itself or regulated third parties) to ensure asset security and prevent theft or misuse. These brokers will be responsible for safeguarding users' private keys, recording transaction ledgers, and undergoing regular audits. Although these assets are on-chain, trading must still be allowed through traditional channels (such as over-the-counter trading (OTC) or automated trading systems (ATS)). At the same time, these on-chain transactions should also be able to connect with traditional financial systems (like the DTC clearing system) to ensure data consistency between on-chain and off-chain.

To support these, Robinhood Chain will build a standardized "regulatory interface," which is a technology module similar to an API. Through these interfaces, regulatory authorities can view transaction records, freeze addresses involved in risks, and retrieve a user's transaction history to ensure that on-chain activities comply with regulatory rules.

3. Future Possibilities

Robinhood's CEO Vlad Tenev has explicitly mentioned in a live broadcast that he respects Coinbase as a competitor. In the grand chessboard of Web3, Coinbase made the first move by launching the Base public chain, which provides a reference model for Robinhood to launch its own public chain. The future Robinhood Chain will follow a similar compliance path as Base, with both learning from each other and developing independently.

In terms of compliance path selection, Robinhood and Base are almost identical. A flexible underlying architecture, self-built compliance modules, and open API interfaces for regulators. This is also the most common operation we see for compliant public chains in the U.S. market.

### Compliance and Privacy-First Public Chains: Exploring the Middle Ground

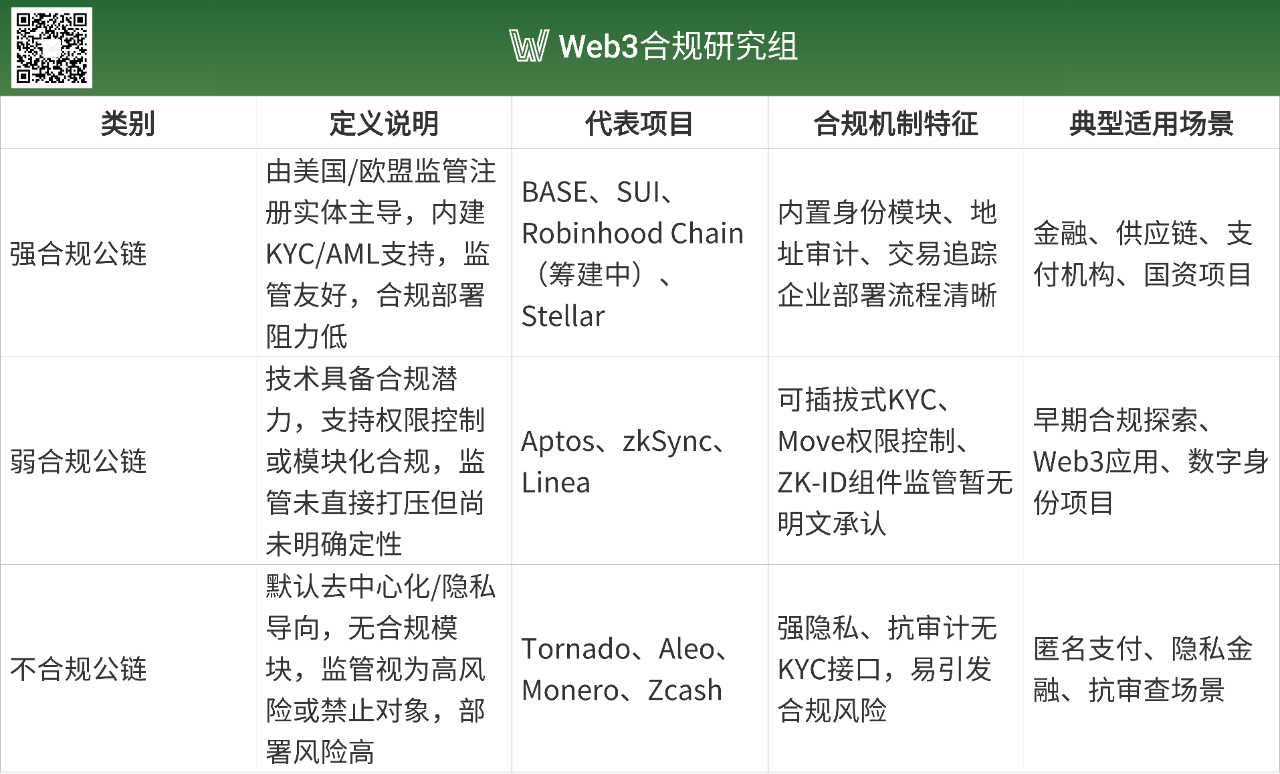

Base, Robinhood Chain, and Sui are public chains that considered legal compliance from the outset, making them suitable for promotion within traditional financial systems. In contrast, other public chains, such as ZKsync and Stellar, while also emphasizing compliance, still face some controversy regarding regulatory acceptance, falling into the "weak compliance" middle ground. There are also a number of public chains that are in direct conflict with regulatory agencies and are completely rejected by mainstream institutions.

(1) Weak Compliance Public Chains

Plasma is a Layer 2 public chain based on Ethereum, with its core feature being the use of USDT as its native asset. It is precisely because of its association with stablecoins like Tether (USDT) that its compliance has been widely questioned. Tether has faced scrutiny in recent years over compliance issues, such as insufficient transparency regarding its reserves and inadequate anti-money laundering (AML) measures. Although the Plasma team has actively adjusted its strategy, attempting to cater to regulators through technical means (such as improving data availability or introducing auditing mechanisms), it has yet to receive formal recognition from mainstream regulatory agencies.

ZKsync is an Ethereum ZK-rollup scaling solution that has garnered attention from traditional financial institutions in recent years. Deutsche Bank is developing its Project Dama 2 based on ZKsync, aiming to establish a compliant financial chain linked to Singapore's MAS and provide audit permissions to regulators. ZKsync is willing to compromise and proactively engage with projects in compliance scenarios, but its foundation remains an open, freely accessible protocol without built-in mandatory KYC or trading restriction mechanisms. As a result, it is still under regulatory investigation by the U.S. SEC and Treasury and has not yet received official regulatory approval.

Aztec is an Ethereum Layer 2 focused on privacy transactions and smart contracts, achieving a combination of anonymity and programmability. Its system is based on zero-knowledge proof (ZKP) technology and provides a dedicated Noir language for executing private smart contracts. While it promotes research directions that combine privacy and compliance in academic and technical communities, it has not been clearly defined or recognized by mainstream regulatory agencies. Although Aztec seeks a balance between compliance and privacy, its core positioning remains privacy-first, and its compliance relies on how the subsequent ecosystem adopts "optional compliance modules," while the protocol itself lacks mandatory KYC/AML interfaces.

(2) Non-Compliant Public Chains

If weak compliance public chains are those that do not do enough in terms of compliance but at least indicate a move towards compliance, then non-compliant public chains completely ignore regulatory requirements.

In January 2025, the U.S. SEC officially filed a lawsuit against Nova Labs, alleging that its issuance of three tokens—Helium Network Token (HNT), Helium Mobile Token (MOBILE), and Helium IoT Token (IoT)—constituted illegal sales of unregistered securities. The SEC also accused it of misleading investors by falsely claiming partnerships with major companies like Nestlé and Salesforce, without corresponding authorization or contracts.

Helium, as a typical DePIN (Decentralized Infrastructure Network), centers its project around IoT hotspot devices, completely bypassing KYC reviews and lacking any on-chain compliance modules. Its token circulation is highly public and operates anonymously, making it difficult for regulatory agencies to hold it accountable. The lawsuit is still in its early stages, with the project party fully denying the SEC's allegations and currently lacking any compliance support mechanisms, making it a typical representative of a "completely non-compliant" public chain.

Another classic example of complete non-compliance is Terra. The SEC has been suing its parent company Terraform Labs since 2023, accusing it of inducing investors to participate in unregistered securities sales through the issuance of the UST stablecoin and LUNA, using an algorithmic stabilization mechanism. Ultimately, the SEC's ability to find fault lies in the collapse event and the lack of basic KYC/AML mechanisms throughout the project, as well as the absence of any compliance modules such as fund freezing, address restrictions, on-chain audits, or regulatory interfaces. The project has been detached from regulatory pathways since its inception and is considered a typical violation of securities law rules.

### Trend Judgment: The Long-Term Evolution Logic of Compliant Public Chains

In recent years, many projects have been obsessed with "building their own public chains," but reality has proven that unless you can achieve excellence in performance, security, and ecosystem, the marginal benefits of building a chain are far less than the compatibility and compliance dividends brought by directly integrating with mainstream chains.

So the real questions become three:

Will different types of assets or data be massively brought on-chain?

How will the market landscape for compliant public chains evolve?

In a future where on-chain systems continue to evolve and regulatory environments change, what new technologies will emerge?

The answer to the first question is undoubtedly clear. BlackRock has not only tokenized government bond ETF shares on the Ethereum network but has also launched the first fully on-chain issued, settled, and managed private fund. Wall Street institutions like Goldman Sachs and Citigroup are also continuously exploring the pathways for bringing RWA (Real World Assets) on-chain. Notably, even trading data is gradually being "chainified"—companies like BlackRock and Fidelity are recording some fund operations on public chains like Ethereum. On the other side of the ocean, the Hong Kong SFC has officially licensed 41 virtual asset platforms, with Guotai Junan becoming the first licensed Chinese brokerage. This series of actions clearly signals that the intersection of compliant finance and on-chain assets has arrived.

At this point, choosing a public chain has become an inevitable part. What institutions truly need is not to "create another chain," but to find a structure that balances sovereign compliance, on-chain autonomy, cross-chain interoperability, and secure self-custody.

The future public chain architecture will show a trend of "modular compliance capabilities" being embedded. The new paradigm represented by Base and Robinhood Chain has already demonstrated a trend: through off-chain identity verification + on-chain behavior tracking, combined with standardized regulatory APIs, achieving synergy between compliance and an open ecosystem. This design model will be reused by more chains targeting the institutional market in the future. Another technical direction is "selective compliance," where developers or application layers can freely call compliance modules, connect to KYC service providers, and set asset management rules, as seen in chains like Sui and ZKsync.

We anticipate that compliance regulation will present a dual-track parallel structure: first, the compliance requirements for financial assets will become increasingly stringent, covering the entire process of compliance including KYC, AML, and regulatory data access; second, there will still be room for inclusivity regarding decentralized architecture and innovative exploration, especially in areas like smart contract logic, DAO governance, and ZK privacy computing.

As compliant public chains gradually mature, a batch of "native compliance" projects will emerge at the application layer. These projects will not only consider regulatory requirements during issuance and operation but may also directly provide "regulatory as a service" (RegTech-as-a-Service) capabilities. KYC, AML, risk control engines, identity custody, and contract auditing capabilities will form standardized interfaces, becoming public services in the on-chain ecosystem, further lowering the access threshold for traditional financial institutions.

For example, in terms of security, multi-signature architecture has become the standard answer. Taking NexVault as an example, its enterprise-level multi-signature wallet solution supports 12 main chains, focusing on asset self-custody, security auditing, permission management, and inheritance logic for enterprises, family offices, foundations, and DAOs, and has established a regulatory compliance pathway in Hong Kong and Singapore.

### Final Words

As the crypto industry gradually enters the era of compliance, the construction of public chains no longer purely pursues performance and cost but begins to regard "compliance" as a prerequisite for top-level design. From Coinbase to Robinhood, from Base to Sui, we can see a trend: the future mainstream chains must serve real-world assets and users, and must also meet the requirements of regulatory agencies.

The term "compliance" will no longer represent suppression and constraints but will become a new productivity tool.

By understanding regulatory logic, technical architecture, and user needs in a systematic way, it is entirely possible to create blockchain infrastructure that possesses both openness and compliance. The future Web3 world will not only be about anonymous transactions and DeFi arbitrage but will also be an ecosystem coexisting with diverse scenarios such as RWA issuance, identity credit, on-chain governance, and industrial finance. The role of public chains will also upgrade from "technology laboratories" to "new digital platforms."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。