You cannot control the market, but you can use an operational plan to make your company run more steadily and go further.

Written by: Emily Westerhold, Partner at a16z crypto

Translated by: Luffy, Foresight News

"If you fail to plan, you are planning to fail." Benjamin Franklin did not direct this statement at startup founders, but it is very applicable to them. Founders (especially in the cryptocurrency space) have too many uncontrollable factors: market volatility, constantly changing regulatory policies, and high external expectations.

For this reason, focusing on what you can control becomes particularly important, and that’s where an operational plan comes into play. An operational plan may not sound glamorous, but it is one of the most controllable and usable tools in your hands, helping you turn your vision into momentum without depleting funds or overwhelming your team.

Conceptually, an operational plan is simple. It covers everything the business is doing: What tasks are there? Who is responsible? What goals need to be achieved? What is the total cost? How will results be measured? However, the answers to these questions can be complex, making it crucial to organize them into a single plan.

Even if you have never created an operational plan for a business, you have certainly done something similar in your personal life. For example, if you want to run a marathon, you need a training plan to schedule your preparation in the months leading up to the race. How far do you run each time? When do you increase the distance, and by how much? What routes do you choose? How do you rest and recover? What do you do if you get injured? In the business world, your "marathon race day" might be a product launch, an IPO, or another significant goal. The principles are the same.

But do not confuse an operational plan with a strategic plan. A strategic plan outlines the macro blueprint of the business, the vision you sell to investors; whereas an operational plan is the concrete action plan that brings that vision to life, translating the strategic plan into executable details involving personnel, costs, and timelines. Both types of plans are essential for building a healthy and vibrant business.

Next, let’s delve into what an operational plan should include.

Creating an Operational Plan

First, focus on the four core elements of operations: People (who is responsible?), Time (when will each task be completed?), Cost (what is the budget?), and Metrics (how will progress be assessed?).

An operational plan is an iterative process, so there is no need to get overly fixated on the first draft. There are many best practices to reference, various frameworks, and expensive consultants you can hire. But the core task is to clearly articulate who is doing what in the company; you can write these down yourself and refine them later. For now, just ensure that the operational goals for a period are clear and organized.

Importantly, your plan must involve trade-offs. A business cannot do everything, so trade-offs are necessary. Moreover, these trade-offs should be difficult, prompting the leadership team to engage in thorough discussions about priorities and non-priorities. No matter how successful a business is, trade-offs will always be a perpetual topic; constraints can drive wiser decision-making.

Three Common Mistakes

When creating an operational plan, there are three common mistakes to watch out for.

1. Don’t be overly optimistic about timelines and expected outcomes. Information is constantly changing, so your plan needs to be flexible and adaptable. Be wary of dependencies: for example, "We need to launch Product A before we can launch Product B," "We must hire two engineers to develop that new feature," or "If we just hire one marketer, revenue will increase by this much."

Incorporating such factors into the operational plan may seem appealing, but failing to meet milestones can lead to problems due to these dependencies. If it takes a long time to hire those two engineers, you may risk missing the deadline for developing the new feature. Therefore, the operational plan can be optimistic, but it must also be pragmatic. Leave yourself room to adjust direction as circumstances change, and don’t forget to adjust subsequent timelines accordingly.

2. Don’t try to do too much at once. Founders often have many ideas for the business, but time and resources are limited, and pursuing all ideas can exacerbate cash burn and distract the team.

Instead, strategically arrange the order of activities. In other words, think about how different opportunities and capabilities can create conditions for other opportunities and capabilities. Perhaps launching a certain product can bring in new users, allowing you to leverage those users; or investing in a certain technology can open up new revenue streams. Consider how to prioritize business activities reasonably and allocate time and resources accordingly.

Of course, reality is often more complex than plans. As a founder, you are most aware of the series of opportunities related to the product. It’s easy to want to seize multiple opportunities, partly because you can see the vast market behind each opportunity, and also because the core product’s performance may not meet expectations or progress may be slow, prompting you to seek multiple paths to success. But the harsh reality is that small teams can usually only excel at one thing at a time. Diverting attention may seem tempting, but it often leads to the most important tasks not being executed properly.

To assess the focus of the business, you can ask yourself two questions: What is the current top priority of the business? What are employees spending most of their time on? If the answers are inconsistent, there may be a problem.

3. The business needs measurable success metrics. Even if your operational plan is excellent, unless you can monitor the operational status of the business, the entire plan may become mere talk. Why? Because if you don’t know how to measure success, you cannot measure (or even recognize) failure, which means you will struggle to cope with challenges and setbacks. Measurement metrics don’t have to be complex; even using red/yellow/green status indicators can work, but you must have measurement metrics.

Remember: what you incentivize will drive people’s behavior. Carefully consider whether your measurement metrics will yield the best results for the business. For example, you might want to tie people’s incentives to the outcomes they produce, rather than just looking at how many hours they worked.

Budgeting Key Points

The budget is a key component of any operational plan, and the operational plan must answer the question, "How much will all this cost?" Therefore, founders should be aware of some budgeting tips.

Most businesses spend the majority of their expenses on employees. This is not always the case, but it is a useful rule of thumb, especially since founders sometimes underestimate the total cost of adding new employees. You need to consider not only salaries, benefits, and payroll taxes but also hardware, software, licenses, travel expenses, and everything else employees need. Many expenses are directly related to the number of employees, so model your budget accordingly.

Related to this is the point that you should not forget to plan equity as you do cash. Equity management could itself be the subject of a separate article, but when creating hiring plans, you should also budget for the relevant equity you intend to grant. If your project issues tokens to employees, the same principle applies. In short, having a comprehensive and clear compensation philosophy is crucial. Early mistakes often amplify over time.

Distinguish between fixed costs and variable costs to understand budget flexibility. You need to know which parts of the budget can be adjusted and which cannot. Suppose you must cut costs by 30% next week; do you know where to start? Or suppose the company is growing, and you want to increase investment; do you know where it makes sense to increase investment? This can be challenging for startups, as there are fewer variables. But the more thoroughly you understand these budget adjustment factors, the more adept you will be at making decisions.

Additional tip: Negotiate with vendors and service providers whenever possible, and avoid signing long-term contracts to maintain flexibility.

Scenario planning is your friend. Any budget you create may have deviations, just varying in magnitude. This is true even for mature companies, as there are too many factors that budgets cannot cover. Therefore, do not fixate on a single ideal scenario for the future of the business; instead, use scenario planning to face various possible futures calmly and allocate corresponding probabilities and confidence intervals for each scenario. What factors might catch you off guard? What changes could disrupt the current model of the company? For example, if facing regulatory uncertainty, what different regulatory outcomes might look like for the business? Treat the budget as a learning and planning tool for discussing and organizing various opportunities and uncertainties.

Cash reserves should be sufficient to sustain operations for at least 6 months. Founders often feel caught off guard by cash burn issues. Suppose your company has two years of funding reserves but no operational plan to guide it. Perhaps by the end of the year, you realize you’ve hired 5 more people, and the product is 6 months behind schedule. Suddenly, your funds are only enough to sustain operations for 6 months. Unless you can monitor cash burn effectively, your focus will be entirely on fundraising or cutting costs. Even if you successfully secure new funding, completing the fundraising may take longer than you expect and incur legal fees. Not to mention, the closer you get to running out of funds, the less leverage you have in negotiations.

The key to avoiding cash flow issues is controlling the budget. As a founder, do not neglect this responsibility. While you can delegate the actual work to other team members, you should still communicate monthly to compare the expected cash burn for the month with the actual cash burn. Is there a significant difference between actual cash burn and expected cash burn? If so, what needs improvement or adjustment? Did you miscalculate costs? Or is this just a one-time issue?

A useful tool for founders is the "zero-based budgeting" method. Currently, many companies base their next year’s budget on the current budget, adjusting it by 10%. While this method is simpler than some others, it does not encourage deep thinking about the current needs of the business. Zero-based budgeting requires you to start from scratch and carefully consider the actual expenditures for the company in the coming year. The benefit is that you must find a reasonable justification for each expenditure rather than simply rolling over last year’s budget. This helps you target the budget precisely where the business currently needs it.

Regarding fund management, especially for founders in the cryptocurrency space: it is crucial to establish an investment policy that provides guiding principles for fund management. While your risk tolerance typically depends on your funding reserves, always remember that the top priority is to preserve capital.

What Operational Model is Your Business In?

There is no absolute correct or best framework for creating an operational plan. Whatever you choose, it should help you address the core questions of the plan: Who is doing what, when will it be completed, what is the cost, and how will it be measured.

However, before choosing a framework, you should first determine what operational model you are in, as the operational model dictates your priorities. You can determine this through a series of questions:

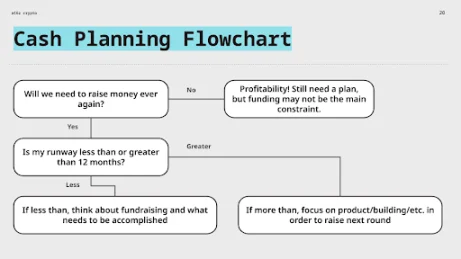

1. Does your business still need funding?

The answer is likely "yes," as most early-stage venture-backed companies will seek additional funding, but there are exceptions. If your business is already profitable, that’s great. You still need an operational plan, but funding may not be its primary constraint. If you are not yet profitable, continue to the next question.

2. Can your funding reserves sustain operations for more than 12 months?

The core idea is that if your funding reserves can sustain operations for more than 12 months, then this year's plan may not include fundraising. Your priorities might be to build the product or assemble the team. However, if the funding reserves are less than 12 months, the operational plan should include fundraising, cost-cutting, seeking strategic partnerships and investment opportunities, or all of the above. You may also need to closely examine expenditures and look for ways to improve.

3. If fundraising is needed, what goals do you need to achieve?

You must clarify what milestones need to be reached to persuade investors to participate in the next round of funding. The appropriate milestones depend on the business situation and the round of funding you wish to pursue, so it’s best to discuss this with your investors. For example, you might think that launching a product will attract more funding, but investors may want to see product-market fit first.

Next, consider what resources are needed to achieve these milestones. Look at what positions need to be filled, what other steps need to be taken, and how long you think it will take. List these costs in a spreadsheet; does the cash in your bank account cover these needs? If not, see which variables can be adjusted to achieve a balanced budget. Would adjusting the order of activities help? What about changing the current priorities of the business?

Once resources are identified, consider how long your funding reserves can last if you hire or invest in these resources. Then ask yourself: given the company’s current cash situation, are these funding reserves sufficient? If they are sufficient, then you have a solid foundation for creating the operational plan. If not, you need to revisit hiring, investment, or focus areas and iterate on the plan.

Finally, establish some metrics to monitor the operational plan to understand whether it is effective. Importantly, monitoring should have a fixed cycle to ensure it is done regularly.

Operational Goals Template

The worksheet below can help you outline operational goals initially. One approach is to first determine annual goals and then work backward to identify the tasks that need to be completed each quarter, by each department, or even by each individual. The key is to write down your ideas, as trying to keep the entire operational plan in your head is likely to lead to omissions.

Here is a simple measurement system example for tracking goal progress. With red/yellow/green indicators, you can briefly report on the goals that are progressing well and those that are concerning during weekly leadership team meetings. In this example, you might say that there are no issues with the product, there are minor concerns with marketing but nothing to worry about, and there are serious problems with engineering that need team discussion to resolve. Clearly, this system is not complex, and that is the key: find a way to monitor the operational plan while holding people accountable.

Creating an operational plan for the business is crucial, but there is no need to get overly fixated. Focus on substance rather than form, ensuring that you can answer some simple questions, such as who is doing what, when it will be completed, what the costs are, and how it will be measured. Once you achieve this, you will have a basis for measuring your performance and can keep track of whether the business's progress aligns with the plan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。