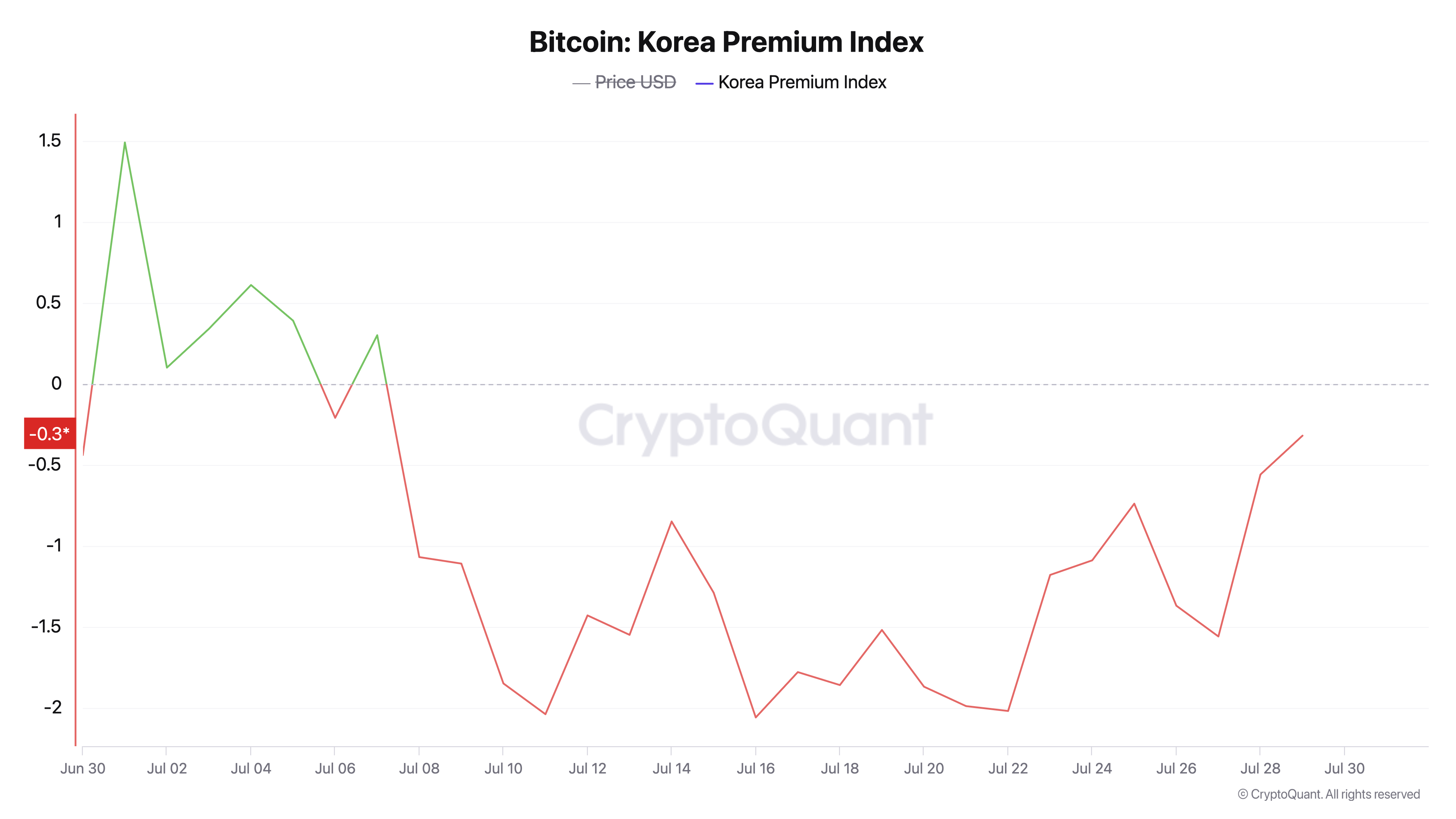

Bitcoin (BTC) usually fetches a premium in South Korea, but that trend flipped this month. According to data from cryptoquant.com, a discount has persisted for the past 22 days—starting on July 8, 2025.

Bitcoin.com News spotlighted this pricing gap nine days ago, and by the next day, July 22, bitcoin was trading 2.02% below the global weighted average. The day after saw a noticeable recovery, with BTC’s price gap in South Korean won narrowing to 1.18%—and the trend has kept moving in that direction.

Although it briefly widened to around 1.56% three days ago, it had tightened to just 0.32% by yesterday. As of 9:45 a.m. Eastern on Wednesday, July 30, the discount sits near 0.40%, with the global average at $117,677 per coin and South Korea’s price at $117,208.

The bitcoin price gap on South Korean exchanges likely reflects softer local demand. In this scenario, lighter buying or heavier selling within Korean shores has pushed bitcoin prices below the global average.

But with the gap closing, it appears arbitrage desks may have quietly stepped in through indirect routes—or domestic interest is slowly picking back up as sentiment steadies and traders move to take advantage of the lingering discount.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。