The Monetary Authority sets limits without quotas, "JCOIN" and "JOYCOIN" emerge.

Written by: ChandlerZ, Foresight News

Only a few days remain until the official implementation of Hong Kong's stablecoin licensing mechanism. The Hong Kong Monetary Authority has released documents such as the "Regulatory Guidelines for Licensed Stablecoin Issuers," "Guidelines for Anti-Money Laundering and Counter-Terrorist Financing (Applicable to Licensed Stablecoin Issuers)," "Summary of the Stablecoin Issuer Licensing System," and "Summary of Transitional Provisions for Existing Stablecoin Issuers."

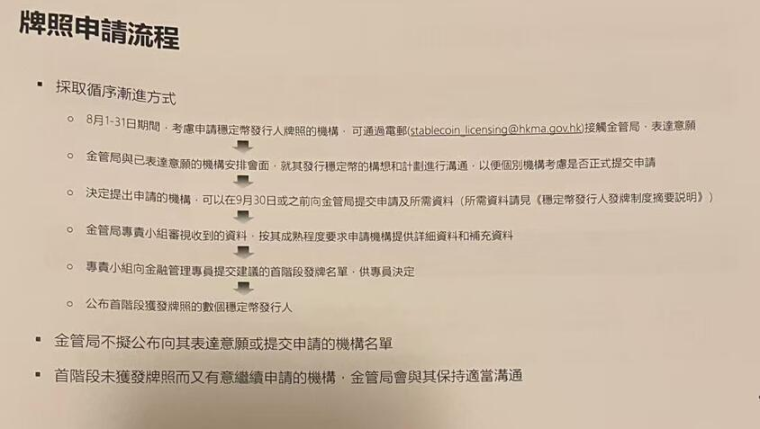

At the same time, the Monetary Authority held a technical briefing on the regulatory system for stablecoin issuers. According to the established timeline, interested applicants must contact the regulators by August 31 and submit formal applications by September 30. It is expected that only a single-digit number of licenses will be issued in the first batch, with the earliest possible issuance by the end of the year.

As the policy gradually takes shape, the market has also shown related movements. According to Ming Pao, JD.com's JD Coin Chain has registered the names "JCOIN" and "JOYCOIN," which the market speculates to be the names of its stablecoins. A consensus is forming that Hong Kong will officially enter the regulatory period for stablecoins. The definition of compliance is becoming clearer, and the intentions of participating institutions are beginning to emerge.

Number of licenses not confirmed, initial stablecoin holders must verify identity

In terms of the application process, the Hong Kong Monetary Authority encourages interested applicants to express their intentions by August 31, 2024, and submit formal application materials by September 30. Entering the "sandbox testing" does not automatically guarantee a license; non-participants can also apply, with the key being the maturity and compliance of the application plan. Regulatory requirements cover various aspects, including reserve asset management, risk control, corporate governance, issuance and redemption mechanisms, anti-money laundering, and counter-terrorist financing, and must adhere to international standards such as FATF's "Transfer Rules."

Image source: Daily Economic News

According to the latest statement from the Hong Kong Monetary Authority, there is currently no fixed number set for the issuance of stablecoin issuer licenses. Each application will be evaluated based on the maturity of the application materials, risk management capabilities, and business feasibility, without quota restrictions, and participation in sandbox testing will not be a priority for approval. Additionally, the Monetary Authority will not disclose the list of applying institutions, emphasizing that the licensing process will maintain a high level of prudence and confidentiality.

Regarding the currencies to which stablecoins are pegged, the Hong Kong Monetary Authority has expressed an open attitude, supporting pegging to a single fiat currency or a basket of fiat currencies. However, for currencies like the Renminbi, which are not fully convertible, careful evaluation will be based on specific usage scenarios and reserve mechanisms. To accommodate existing stablecoin issuers in Hong Kong, the regulatory system also includes "transitional arrangements," allowing qualified entities to continue operations with a temporary license for six months.

To accommodate stablecoin issuers that have already engaged in substantive business in Hong Kong before the regulations take effect, the Monetary Authority has established transitional arrangements. Relevant institutions can submit license applications within three months after the regulations come into effect, and upon confirming compliance capabilities, they will be allowed to operate with a temporary license for six months until final approval is completed.

Unlike the previously more lenient whitelist model, the new regulatory mechanism emphasizes strong regulation and high transparency. Licensed stablecoin issuers must implement real-name management, and the identities of holders must be verified by the issuer, regulated financial institutions, or trusted third parties. Furthermore, application materials must comprehensively cover reserve asset arrangements, compliance governance, anti-money laundering mechanisms, technical architecture, and risk control plans, with regulatory authorities imposing higher requirements on applicants' operational capabilities.

It is noteworthy that the Monetary Authority has repeatedly pointed out that the core judgment for whether to grant a license is not limited to the level of asset reserves but rather depends on whether the applicant's stablecoin business model has practical application scenarios and sustainability. In this regard, the regulatory body maintains a "strict first, lenient later" tone, cautiously maintaining the pace of licensing in the early stages of the system to prevent market bubbles and conceptual speculation, emphasizing the steady advancement of the long-term sustainable development of Hong Kong's digital asset ecosystem.

Regulatory framework clarified on the eve of the law's effectiveness

From the perspective of the regulatory framework, the "Regulatory Guidelines for Licensed Stablecoin Issuers" issued by the Hong Kong Monetary Authority constitutes the core of the entire system, setting high standards and detailed compliance requirements across seven major areas, including reserve asset management, issuance and redemption mechanisms, scope of business activities, financial resource requirements, risk management, corporate governance, and business ethics. The reserve asset management section explicitly requires stablecoins to implement 100% full backing and limits the types of reserve assets to highly liquid, low-risk cash management assets, such as cash, short-term bank deposits, high-rated short-term bonds, and overnight reverse repos, which must be isolated and managed through trust arrangements, with custodians also needing to meet minimum standards. Additionally, stablecoin issuers are prohibited from paying interest to users, must maintain internal accounts daily, disclose core data weekly, and undergo regular independent audits.

In terms of issuance and redemption, the regulatory guidelines require licensed stablecoin holders or their distribution partners to strictly adhere to customer suitability management rules, not providing services in prohibited areas, and must use identity verification, geolocation identification, and other technical means to prevent compliance risks. There are also detailed disclosure requirements for redemption policies, including clearly stating users' redemption rights, operational time limits, and fees, and requiring regular reviews of the reasonableness and effectiveness of the issuance and redemption mechanisms themselves.

Regarding financial resources, applicants must have a paid-in capital of no less than HKD 25 million, and net assets must not come from external borrowing, reflecting the Monetary Authority's high emphasis on the sustainability and risk tolerance of stablecoin businesses. If an applicant plans to issue multi-currency stablecoins, they must communicate with the Monetary Authority regarding the currency composition ratio and potential mismatch risks.

In terms of management and governance structure, the regulatory body clearly requires applicants to be corporate entities, with their directors, executives, and stablecoin managers needing relevant knowledge and experience, and core personnel must be based in Hong Kong. During the application phase, they may also need to undergo individual interviews with the Monetary Authority.

Combining the application process outlined in the "Summary of the Licensing System," the entire procedure includes five steps: preliminary intention communication, cross-border regulatory coordination (if applicable), material preparation, advisory committee review, and final approval, emphasizing prudence and information transparency. The document also lists a detailed checklist of application materials, including a business plan for more than three years, financial budgets for the next three years, and compliance plans.

JCOIN and JOYCOIN emerge

JD.com's JD Coin Chain has registered the names "JCOIN" and "JOYCOIN," which the market speculates to be the names of its stablecoins. Registration details indicate that related services include providing electronic fund transfers and cryptocurrency financial transactions through blockchain technology. JD Coin Chain is one of the participants in the Monetary Authority's stablecoin issuer sandbox program and previously collaborated with Tianxing Bank last July to test a stablecoin-based corporate cross-border payment solution.

JD Coin Chain Technology was registered in Hong Kong in March 2024 and became one of the first three institutions to enter the Hong Kong Monetary Authority's "Stablecoin Issuer Regulatory Sandbox" in July. In an interview with Bloomberg Businessweek, JD Coin Chain CEO Liu Peng stated that the company plans to launch payment-type stablecoins pegged to the Hong Kong dollar and other major fiat currencies, with plans to complete the license application, stablecoin issuance, and the launch of a compliant trading platform simultaneously in early Q4.

Unlike the asset attributes of cryptocurrencies, JD's stablecoin is positioned as a "payment tool," with its issuance based on a public chain architecture, emphasizing transparency, auditability, and regulatory compliance. Against the backdrop of the Hong Kong "Stablecoin Regulation" officially taking effect on August 1, JD Coin Chain is leveraging its parent company JD Group's full-chain resources in e-commerce, payments, and supply chains to conduct application testing in JD's global sales retail scenarios in Hong Kong and Macau, with plans to gradually expand to cross-border trade settlement and compliant investment trading scenarios.

On the technical side, JD's stablecoin transfers can achieve second-level processing, with costs significantly lower than traditional cross-border payment models. Preliminary tests show significant cost reduction and efficiency improvement advantages. Additionally, Liu Peng believes that while the current stablecoin market is dominated by USDT and USDC, compliant stablecoins serving traditional trade and payment enterprises, with Hong Kong as a hub and licensed institutions as carriers, have the potential to open up new battlegrounds. JD Coin Chain plans to use compliance as its core competitive advantage, aiming to provide on-chain payment and financing services for small and medium-sized enterprises through partnerships with compliant financial institutions, and to enhance the efficiency of fund settlement across different industries with customized scenario solutions.

Summary

As Hong Kong's stablecoin regulatory system enters the countdown, actions from various market participants have already unfolded, and the regulatory framework is becoming more complete. At a time when policies are clear and rules are being implemented, stablecoins are being separated from the narrative of cryptocurrencies, moving towards real scenarios of payment infrastructure and trade settlement. Although the first batch of licensed institutions has not been revealed, the regulatory authorities have clearly conveyed the message that they do not pursue quantity but focus on quality and sustainability. Those who can strike a balance between compliance, risk control, and practical application are likely to be the first to open the true interface between on-chain finance and the real economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。