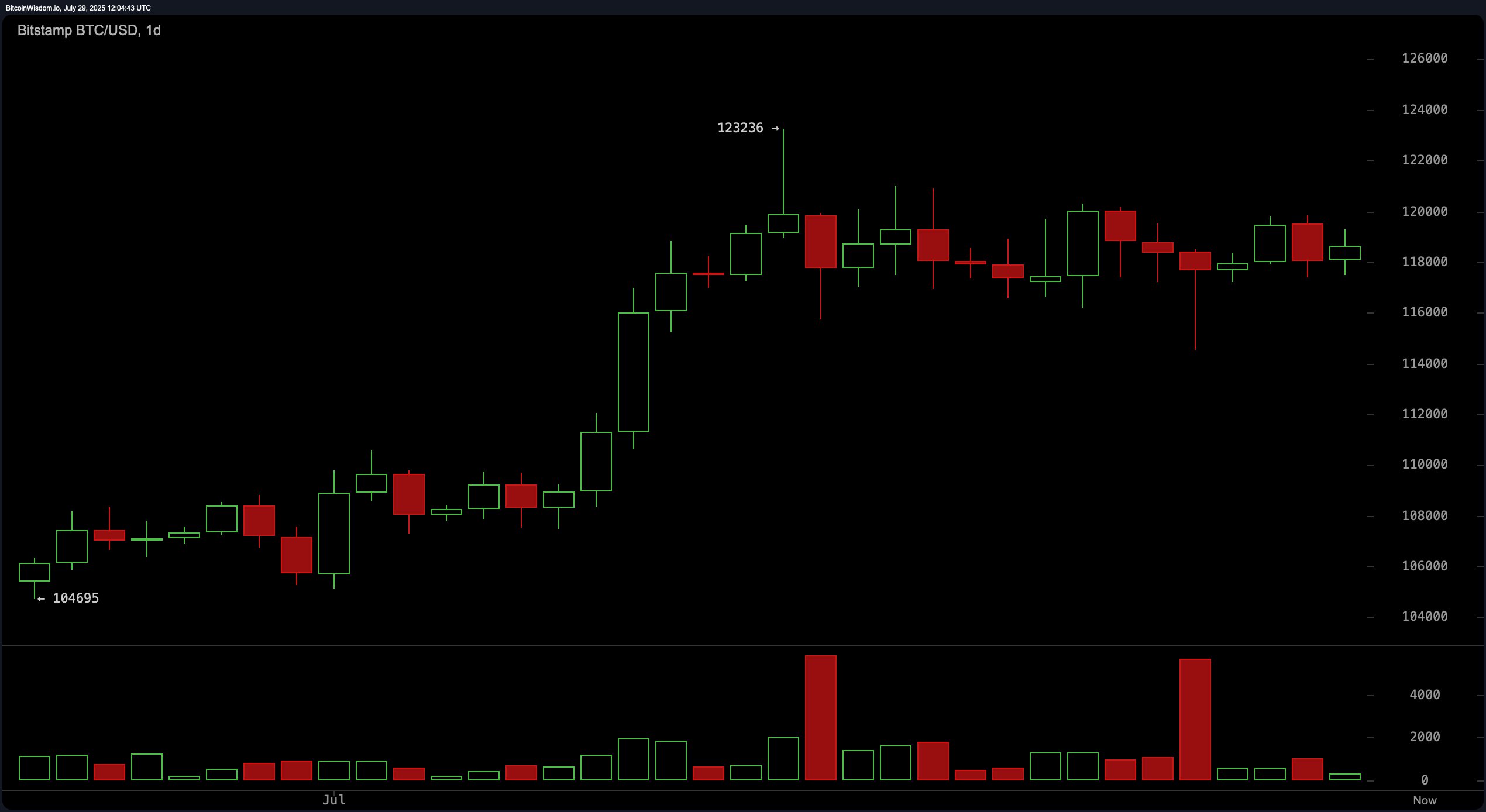

On the daily chart, bitcoin remains in a broader uptrend but is clearly transitioning into a consolidation phase following its peak near $123,236. Price action has stabilized between $118,000 and $120,000, accompanied by a notable red volume spike after the top, which may indicate distribution. While the price still trades above key moving averages such as the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, 30, 50, 100, and 200 periods, momentum is fading. A breakout above $120,500 supported by volume could confirm bullish continuation, while a drop below $116,000 would shift the bias to bearish.

BTC/USD daily chart via Bitstamp on July 29, 2025.

The 4-hour BTC/USD chart highlights a recent V-shaped recovery from $114,500 back to approximately $119,826, yet the bounce has shown weaker volume, implying lower conviction. Structurally, this timeframe suggests a developing lower high—typically a bearish signal—unless resistance at $119,826 is decisively breached. A close above $120,000 on rising volume could validate a bullish reversal. Conversely, a drop below $117,500 could signal renewed downside pressure, with support next seen near $114,500.

BTC/USD 4-hour chart via Bitstamp on July 29, 2025.

Looking at the 1-hour chart, the price reflects a choppy, indecisive pattern marked by lower highs and lows, followed by a modest recovery. Buyer activity was noted near the $117,400 zone, but conviction remains muted. The asset is currently ranging with a slight upward tilt. A short-term scalp opportunity may arise if bitcoin closes above $118,800 with volume confirmation, while a rejection near $119,200 or a breakdown under $117,500 would support short entries.

BTC/USD 1-hour chart via Bitstamp on July 29, 2025.

Oscillator readings underscore the current neutrality in momentum. The relative strength index (RSI) is at 60, the stochastic %K at 58, the commodity channel index (CCI) at 26, and the average directional index (ADX) at 25—all signaling neutral sentiment. Meanwhile, the awesome oscillator prints a 4,041 value, also neutral. Only the momentum oscillator indicates a bullish sign, while the moving average convergence divergence (MACD) level shows a bearish signal at 2,066, pointing to the current technical indecision in the market.

Moving averages paint a generally bullish picture across all major timeframes. All exponential and simple moving averages from 10 to 200 periods are flashing positive signals. Notably, the 10-period EMA and SMA stand at $118,260 and $118,373, respectively—just below the current price—providing short-term support. The consistency of bullish signals from these trend-following indicators adds weight to an optimistic bias, provided bitcoin can maintain its footing above key levels and break through near-term resistance.

Bull Verdict:

If bitcoin’s price can decisively break above the $120,500 resistance zone with accompanying volume, the broader uptrend remains intact, signaling renewed bullish momentum. The consistent buy signals across all major exponential and simple moving averages reinforce this outlook, pointing toward a potential retest of the $123,000 high and beyond.

Bear Verdict:

A confirmed breakdown below the $117,500 threshold, especially if followed by a close under $116,000, could negate the bullish setup and usher in a deeper correction. With weakening momentum on multiple timeframes and a bearish MACD divergence, a failure to hold key support levels could lead bitcoin toward the $114,500 zone or lower.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。