Barely a week after surpassing the $800 mark to set a new all-time high (ATH), BNB surged again late July 28, peaking just above $850. The digital asset’s rally of 7.4% within 24 hours saw its total market capitalization rise to more than $118.5 billion, cementing BNB’s place as the number five digital asset.

Data shows BNB reached $855.84 at 3:26 a.m. EST, a new ATH and more than $40 higher than its July 23 peak of $808. However, unlike then, BNB’s surges this time did not appear to be the result of capital rotation, as other prominent digital assets registered decent gains in the same period. For instance, XRP, which trended downward when BNB set a new ATH, was up by nearly 2% while ethereum ( ETH) continued its upward trend, rising 3.9%.

ETH’s price action, like BNB’s, appears detached from the rest of the crypto market as the digital asset has continued to notch new gains. At the time of writing, ETH was trading just above $3,934, and the number two asset appeared on course to breach the $4,000 mark for the first time since Dec. 8, 2024.

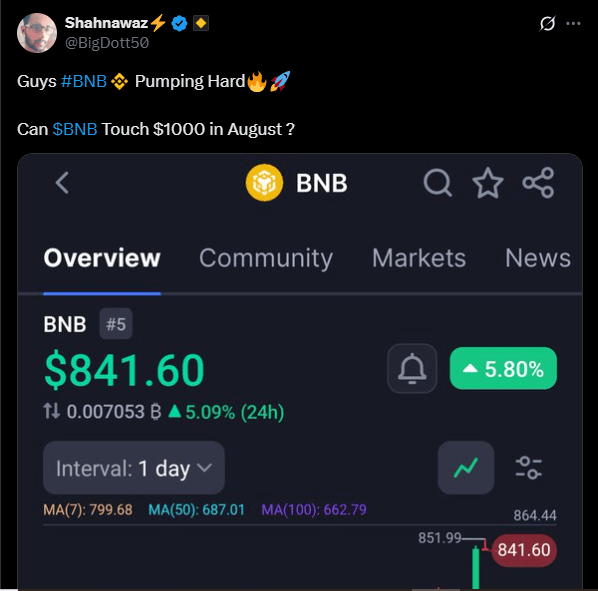

Meanwhile, BNB’s latest surge, which has brought its gains over 30 days to just over 30%, has sparked enthusiasm among the digital asset’s supporters, some of whom project it to breach the $1,000 mark in August. One social media user suggested that the $840–$880 range may act as resistance.

In a report released on July 23, shortly after BNB surged to $808, the Binance Research team attributed the digital asset’s rise to what it described as its pivot from a retail asset to an institutional-grade reserve. The report also showed that BNB stood out among other major assets over a five-year period, with a higher Sharpe ratio and a lower maximum drawdown. The report added:

“Its five-year Sharpe ratio reached 2.5, indicating that for every dollar of risk taken, the return was 2.5 dollars. This highlights BNB’s potential for strong returns alongside a comparatively stable risk profile.”

The report also said the BNB rally is robust because it’s driven by new, long-term capital entering the spot market, rather than speculative, leveraged trading. Unlike previous surges, the open interest in BNB futures hasn’t spiked proportionally, indicating genuine investor conviction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。